|

市場調查報告書

商品編碼

1698567

小型風力渦輪機市場機會、成長動力、產業趨勢分析及2025-2034年預測Small Wind Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

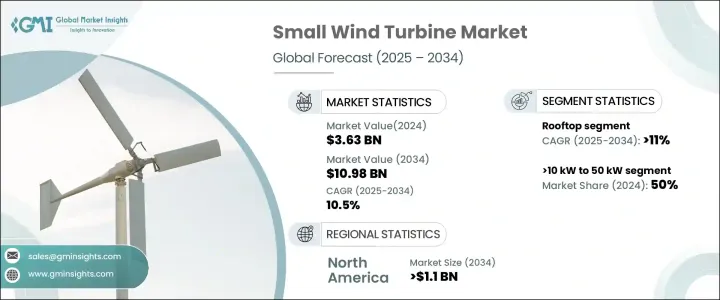

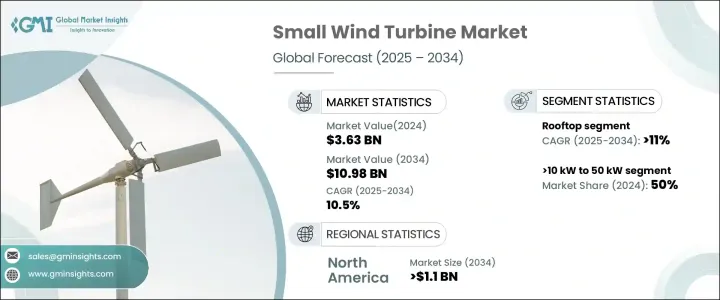

2024 年全球小型風力渦輪機市場價值為 36.3 億美元,預計 2025 年至 2034 年期間的複合年成長率為 10.5%。由於風力渦輪機技術的不斷進步,包括改進的基礎設計、增強的渦輪葉片和最佳化的旋轉機制,市場正在經歷顯著成長。這些創新使小型風力發電系統更有效率、更具成本效益,推動了其在城市和農村的應用。製造商正在積極開發標準化的渦輪機解決方案,以提供更好的功率輸出、更好的環境相容性和增強的熱力學循環,從而為產業的擴張做出貢獻。

在發展中地區,小型風力渦輪機正在成為分散式發電的可靠且經濟的解決方案。它們在離網地區的日益普及正在促進亞洲和非洲農村社區的電氣化。城市風力渦輪機的日益普及正在進一步影響市場動態,這種渦輪機可以從多個方向捕獲風能,同時保持較低的噪音水平。先進材料、空氣動力學和控制器技術的整合使得小型風力發電系統對家庭和企業更具吸引力。此外,財政激勵措施和支持清潔能源計劃的政府計劃正在增強市場前景。住宅應用中對微型渦輪機的需求不斷成長,進一步推動了其採用,幫助消費者降低電力成本並實現能源獨立。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 36.3億美元 |

| 預測值 | 109.8億美元 |

| 複合年成長率 | 10.5% |

隨著各國強調減少溫室氣體排放和擴大再生能源的應用,該產業正獲得發展動力。新興經濟體電氣化程度的提高和全球擺脫傳統電源的趨勢是支持市場擴張的關鍵因素。在不同的安裝類型中,屋頂小型風力渦輪機越來越受歡迎,預計到 2034 年成長率將超過 11%。這些系統利用高空風流,使屋主、企業和社區能夠就地發電。最近的技術進步提高了它們的效率,同時降低了噪音並改善了美觀性,使其成為一種有吸引力的能源解決方案。

獨立小型風力渦輪機的需求也在不斷成長,尤其是在離網和農村地區。技術進步、成本下降以及對永續能源解決方案日益成長的需求正在推動它們的採用。葉片設計、控制機制和材料的創新正在提高渦輪機的性能,使其成為遠端安裝的首選。預計到 2024 年,10 千瓦至 50 千瓦範圍內的小型風力渦輪機將佔 50% 的市場佔有率,這主要歸因於偏遠地區對清潔能源的需求不斷增加以及對農村電氣化的監管支持。它們在住宅區的部署以及家庭、農場和社區對離網解決方案的日益偏好正在強化市場趨勢。

北美小型風力渦輪機產業預計將實現強勁成長,預計到 2034 年該產業的產值將超過 11 億美元。政府推動風能發展的政策以及研發資金投入正在促進該產業的擴張。對專注於中小型風力渦輪機製造商的支持進一步加強了市場成長,為持續創新創造了良好的商業環境。

目錄

第1章:研究方法

- 研究設計

- 基礎估算與計算

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依軸,2021 年至 2034 年

- 主要趨勢

- 水平軸風力發電機組

- 垂直軸風力發電機 (VAWT)

第6章:市場規模及預測:依安裝量,2021 年至 2034 年

- 主要趨勢

- 屋頂

- 獨立

第7章:市場規模及預測:依產能,2021 年至 2034 年

- 主要趨勢

- < 3 千瓦

- 3至10千瓦

- > 10至50千瓦

- > 50至100千瓦

第 8 章:市場規模與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業的

第9章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 愛爾蘭

- 德國

- 丹麥

- 法國

- 荷蘭

- 比利時

- 亞太地區

- 中國

- 日本

- 韓國

- 越南

- 台灣

- 中東和非洲

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

第10章:公司簡介

- Aeolos Wind Energy Ltd

- Airturb

- Avant Garde Innovations Pvt Ltd

- Bergey Windpower

- City Windmills

- Northern Power Systems

- Plugin India

- Ryse Energy

- SDWE

- Senwei Energy

- TESUP

- TUGE

- Unitron Energy

- Vestas

- Wind Energy Solutions

The Global Small Wind Turbine Market was valued at USD 3.63 billion in 2024 and is expected to expand at a CAGR of 10.5% between 2025 and 2034. The market is witnessing significant growth due to ongoing advancements in wind turbine technology, including improved foundation designs, enhanced turbine blades, and optimized rotation mechanisms. These innovations are making small wind systems more efficient and cost-effective, driving their adoption in both urban and rural settings. Manufacturers are actively developing standardized turbine solutions that offer better power output, improved environmental compatibility, and enhanced thermodynamic cycles, contributing to the industry's expansion.

In developing regions, small wind turbines are emerging as a reliable and affordable solution for decentralized energy generation. Their increasing adoption in off-grid areas is facilitating electrification in rural communities across Asia and Africa. The growing popularity of urban wind turbines, which capture wind energy from multiple directions while maintaining low noise levels, is further influencing market dynamics. The integration of advanced materials, aerodynamics, and controller technologies is making small wind systems more attractive to homeowners and businesses. Additionally, financial incentives and government programs supporting clean energy initiatives are strengthening the market outlook. The rising demand for micro turbines in residential applications is further boosting adoption, helping consumers lower electricity costs and achieve energy independence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.63 Billion |

| Forecast Value | $10.98 Billion |

| CAGR | 10.5% |

The industry is gaining momentum as nations emphasize reducing greenhouse gas emissions and expanding renewable energy adoption. The increasing electrification of emerging economies and the global shift away from conventional power sources are key factors supporting market expansion. Among different installation types, rooftop small wind turbines are gaining traction, with projected growth exceeding 11% through 2034. These systems harness high-altitude wind currents, enabling homeowners, businesses, and communities to generate on-site electricity. Recent technological advancements are enhancing their efficiency while reducing noise and improving aesthetics, making them an appealing energy solution.

Standalone small wind turbines are also seeing rising demand, particularly in off-grid and rural locations. Technological improvements, declining costs, and the growing need for sustainable energy solutions are driving their adoption. Innovations in blade design, control mechanisms, and materials are improving turbine performance, making them a preferred choice for remote installations. Small wind turbines in the 10 kW to 50 kW range are expected to account for 50% of the market share in 2024, primarily due to increasing demand for clean energy in isolated regions and regulatory support for rural electrification. Their deployment in residential areas and the growing preference for off-grid solutions across homes, farms, and communities are reinforcing market trends.

North America small wind turbine sector is poised for strong growth, with projections indicating it will surpass USD 1.1 billion by 2034. Government policies promoting wind energy, coupled with funding for research and development, are fostering industry expansion. Support for manufacturers focused on small and medium-scale wind turbines is further reinforcing market growth, creating a favorable business environment for continued innovation.

Table of Contents

Chapter 1 Research Methodology

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Axis, 2021 – 2034 (MW & USD Million)

- 5.1 Key trends

- 5.2 Horizontal (HAWTs)

- 5.3 Vertical (VAWTs)

Chapter 6 Market Size and Forecast, By Installation, 2021 – 2034 (MW & USD Million)

- 6.1 Key trends

- 6.2 Rooftop

- 6.3 Standalone

Chapter 7 Market Size and Forecast, By Capacity, 2021 – 2034 (MW & USD Million)

- 7.1 Key trends

- 7.2 < 3 kW

- 7.3 3 to 10 kW

- 7.4 > 10 to 50 kW

- 7.5 > 50 to 100 kW

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (MW & USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (MW & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Ireland

- 9.3.3 Germany

- 9.3.4 Denmark

- 9.3.5 France

- 9.3.6 Netherlands

- 9.3.7 Belgium

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 Vietnam

- 9.4.5 Taiwan

- 9.5 Middle East & Africa

- 9.5.1 South Africa

- 9.5.2 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Chile

- 9.6.3 Argentina

Chapter 10 Company Profiles

- 10.1 Aeolos Wind Energy Ltd

- 10.2 Airturb

- 10.3 Avant Garde Innovations Pvt Ltd

- 10.4 Bergey Windpower

- 10.5 City Windmills

- 10.6 Northern Power Systems

- 10.7 Plugin India

- 10.8 Ryse Energy

- 10.9 SDWE

- 10.10 Senwei Energy

- 10.11 TESUP

- 10.12 TUGE

- 10.13 Unitron Energy

- 10.14 Vestas

- 10.15 Wind Energy Solutions