|

市場調查報告書

商品編碼

1698597

堅果市場機會、成長動力、產業趨勢分析及2025-2034年預測Nuts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

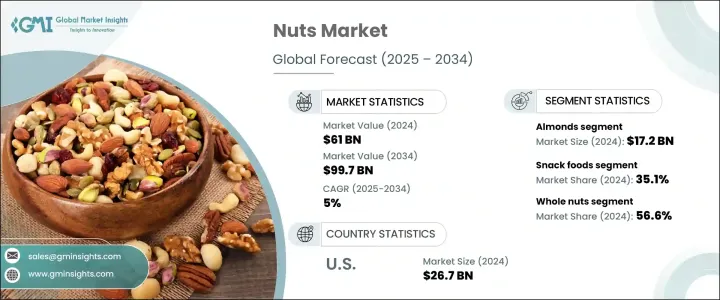

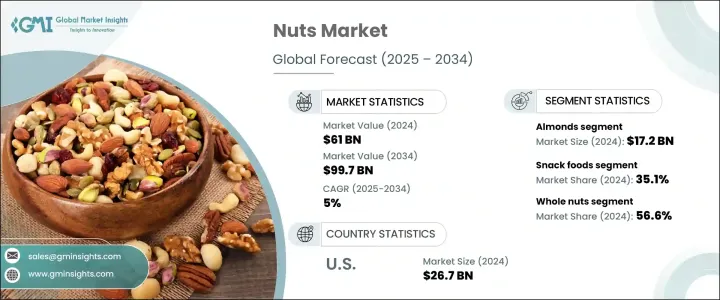

2024 年全球堅果市場價值為 610 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5%。堅果越來越受歡迎,這源於其營養價值以及在日常飲食中的廣泛應用。越來越多的消費者將堅果作為健康零食替代品、植物性膳食主食以及各行各業的天然成分來源。對富含蛋白質、健康脂肪和必需營養素的功能性食品的需求正在上升,從而促進了市場的擴張。堅果已成為植物乳製品、飲料和糖果等行業的重要組成部分。由於人們越來越關注清潔標籤、有機和非基因改造產品,以及提高便利性和吸引力的包裝創新,市場持續成長。

堅果分為不同的類別,包括整顆堅果、加工堅果以及奶油和植物蛋白等堅果製品。其中,2024年整顆堅果佔了56.6%的市佔率。消費者之所以喜歡整顆堅果,是因為它們具有天然的健康益處,尤其是在促進心臟健康、體重管理和整體健康方面。切碎、切片和磨碎等加工堅果也佔有相當大的市場佔有率,滿足了食品和飲料行業的需求。隨著植物性替代品的興起,牛奶和塗抹醬等堅果類產品繼續受到青睞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 610億美元 |

| 預測值 | 997億美元 |

| 複合年成長率 | 5% |

零食產業仍然是市場的主要驅動力,到 2024 年將佔總銷售額的 35.1%。對於尋求方便、營養零食的消費者來說,堅果已成為首選。它們富含蛋白質、纖維和健康脂肪,因此成為健康零食類別中的主食。烤製、醃製和調味等品種的出現進一步豐富了消費者的選擇。向單份和可重新密封包裝解決方案的轉變也透過提高產品的可及性和新鮮度來推動市場成長。

市面上有各式各樣的堅果,包括杏仁、腰果、核桃、開心果、山核桃、花生、榛果、夏威夷果和巴西堅果。尤其是杏仁,預計到 2024 年其估值將達到 172 億美元,預計 2025 年至 2034 年的複合年成長率為 6.1%。杏仁越來越受歡迎是因為它富含營養成分,包括健康脂肪、蛋白質、維生素和抗氧化劑。杏仁已成為各種食品領域不可或缺的一部分,包括零食、乳製品替代品和富含蛋白質的產品,支撐了其強大的市場地位。

美國仍然是全球堅果市場的主導力量,2024 年的收入為 267 億美元。該國對純素、無麩質和有機食品的強勁需求繼續推動市場擴張。成熟的零食產業和不斷創新的產品,包括即食堅果零食,進一步鞏固了該國的領導地位。隨著注重健康的消費趨勢的發展,對永續、可追溯和營養的堅果產品的需求預計將保持強勁,確保市場持續成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 健康意識不斷增強

- 人們越來越意識到慢性病的風險

- 植物性蛋白質需求不斷成長

- 產業陷阱與挑戰

- 替代方案的可用性

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 成長動力

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 杏仁

- 核桃

- 腰果

- 開心果

- 花生

- 山核桃

- 榛子

- 巴西堅果

- 澳洲堅果

- 其他

第6章:市場估計與預測:依形式,2021 年至 2034 年

- 主要趨勢

- 整顆堅果

- 處理堅果

- 堅果醬

- 切碎、切片或磨碎的堅果

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 點心

- 麵包和糖果

- 穀物和燕麥棒

- 營養保健食品

- 烹飪和烹飪應用

- 堅果牛奶和乳製品替代品

- 化妝品和個人護理

- 工業用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Borges Agricultural & Industrial Nuts

- Durak Findik

- Emerald Nuts

- Germack Pistachio Company

- Grower Direct Nut

- Hampton Farms

- Hines Nut Company

- Kraft Foods

- Mariani Nut Company

- Olam International

- Star Snacks

- Sun-Maid Tropical Foods

The Global Nuts Market was valued at USD 61 billion in 2024 and is projected to expand at a 5% CAGR from 2025 to 2034. The increasing popularity of nuts stems from their nutritional benefits and widespread incorporation into daily diets. Consumers are increasingly turning to nuts as healthy snack alternatives, plant-based dietary staples, and sources of natural ingredients in various industries. The demand for functional foods enriched with proteins, healthy fats, and essential nutrients is on the rise, contributing to the expanding market. Nuts have become essential components in industries such as plant-based dairy, beverages, and confectionery. The market continues to grow due to the increasing focus on clean-label, organic, and non-GMO products, alongside packaging innovations that enhance convenience and appeal.

Nuts are segmented into various categories, including whole nuts, processed nuts, and nut-based products like butters and plant proteins. Among them, whole nuts accounted for 56.6% of the market in 2024. Consumers prefer whole nuts due to their natural health benefits, particularly in promoting heart health, weight management, and overall well-being. Processed nuts such as chopped, sliced, and ground varieties also hold a substantial market share, catering to the needs of the food and beverage industry. Nut-based products, including milk and spreads, continue to gain traction with the rise of plant-based alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $61 Billion |

| Forecast Value | $99.7 Billion |

| CAGR | 5% |

The snack food sector remains a major driver of the market, contributing 35.1% of overall sales in 2024. Nuts have become a preferred choice for consumers seeking convenient, nutritious snack options. Their high protein, fiber, and healthy fat content make them a staple in the healthy snacking category. The availability of roasted, salted, and seasoned varieties has further diversified consumer choices. The shift toward single-serving and resealable packaging solutions has also fueled market growth by enhancing product accessibility and freshness.

The market encompasses a diverse range of nuts, including almonds, cashews, walnuts, pistachios, pecans, peanuts, hazelnuts, macadamia nuts, and Brazil nuts. Almonds, in particular, are projected to reach a valuation of USD 17.2 billion in 2024, with an anticipated 6.1% CAGR from 2025 to 2034. Their growing popularity stems from their nutritional profile, which includes healthy fats, proteins, vitamins, and antioxidants. Almonds have become integral to various food segments, including snacks, dairy alternatives, and protein-enriched products, supporting their strong market presence.

The United States remains the dominant force in the global nuts market, generating USD 26.7 billion in revenue in 2024. The country's strong demand for vegan, gluten-free, and organic foods continues to drive market expansion. A well-established snack industry and ongoing innovations in product offerings, including ready-to-eat nut-based snacks, further reinforce the country's leadership position. As health-conscious consumer trends evolve, the demand for sustainable, traceable, and nutritious nut products is expected to remain robust, ensuring continued market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news and initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising health consciousness

- 3.6.1.2 Growing awareness of the risks associated with chronic diseases

- 3.6.1.3 Rising demand for plant-based proteins

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Availability of alternatives

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.6.1 Growth drivers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Almonds

- 5.3 Walnuts

- 5.4 Cashews

- 5.5 Pistachios

- 5.6 Peanuts

- 5.7 Pecans

- 5.8 Hazelnuts

- 5.9 Brazil nuts

- 5.10 Macadamia nuts

- 5.11 Others

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Whole nuts

- 6.3 Processed nuts

- 6.4 Nut butters

- 6.5 Chopped, sliced, or ground nuts

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Snack foods

- 7.3 Bakery and confectionery

- 7.4 Cereals and granola bars

- 7.5 Nutritional and health foods

- 7.6 Cooking and culinary applications

- 7.7 Nut-based milk and dairy alternatives

- 7.8 Cosmetics and personal care

- 7.9 Industrial use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Borges Agricultural & Industrial Nuts

- 9.2 Durak Findik

- 9.3 Emerald Nuts

- 9.4 Germack Pistachio Company

- 9.5 Grower Direct Nut

- 9.6 Hampton Farms

- 9.7 Hines Nut Company

- 9.8 Kraft Foods

- 9.9 Mariani Nut Company

- 9.10 Olam International

- 9.11 Star Snacks

- 9.12 Sun-Maid Tropical Foods