|

市場調查報告書

商品編碼

1699250

工業鋰離子電池市場機會、成長動力、產業趨勢分析及2025-2034年預測Industrial Lithium-Ion Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

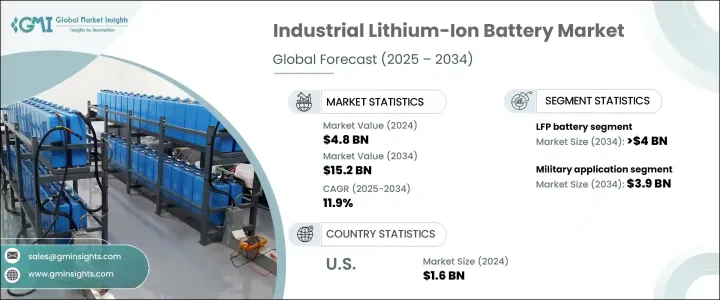

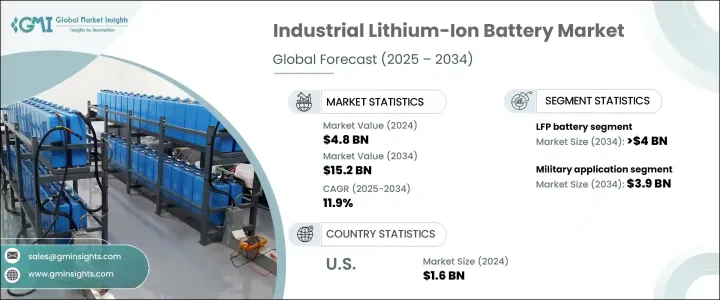

2024 年全球工業鋰離子電池市場價值為 48 億美元,預計 2025 年至 2034 年期間的複合年成長率為 11.9%。這些電池已成為各種工業應用(包括重型機械和醫療設備)的首選可充電電源。工業化和城市化進程的加速以及對再生能源的依賴不斷增加推動了市場擴張。預計到 2030 年再生能源發電量將翻倍,進一步刺激需求。此外,發展中國家電氣化進程正在快速成長,尤其是在汽車領域,這增加了對鋰離子電池的需求。世界各國政府正在推出優惠政策,以加強各產業對電池的採用。作為回應,製造商正在擴大生產規模並完善分銷網路,從而導致成本穩定下降。

預計到 2034 年,磷酸鐵鋰 (LFP) 電池市場的規模將超過 40 億美元。 LFP 電池採用磷酸鐵陰極,因其高能量密度、耐用性和可靠性能而受到認可。它們廣泛應用於電動車、工業機械、船舶應用和航空領域。這些電池的日益普及促使多家公司加大對 LFP 生產設施的投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 48億美元 |

| 預測值 | 152億美元 |

| 複合年成長率 | 11.9% |

各行各業對鋰離子電池的需求不斷成長,促使企業和研究機構開發創新技術。預計到 2034 年,鎳錳鈷 (NMC) 電池領域的複合年成長率將達到 10.4%。產業參與者正在投資 NMC 電池生產,同時將環境永續材料整合到陰極中,以最大限度地減少能量損失和碳排放。

根據應用,工業鋰離子電池市場分為軍事、重工業設備、醫療、船舶和其他。 2024 年,軍事領域佔總市佔率的 24.7%。由於鋰離子電池為無人機、GPS 設備、通訊系統和其他國防技術提供高效的能源存儲,因此需求正在增加。預計到 2034 年軍事應用領域的規模將超過 39 億美元。

由於對鐵和工業礦物等金屬的需求不斷增加,重工業設備產業對鋰離子電池的需求也越來越大。採礦和建築活動的擴大正在推動對高性能電池解決方案的需求。預計到 2034 年重型工業設備領域的複合年成長率將超過 10.8%。向電動交通的轉變日益加劇,進一步加速了工業鋰離子電池的普及。對永續交通的不斷推動以及政府的激勵措施繼續支持電池市場的擴張。

在美國,工業鋰離子電池市場規模在 2022 年超過 12 億美元,2023 年超過 14 億美元,2024 年超過 16 億美元。政府旨在加強國內電池生產的措施預計將推動市場進一步成長。同樣,政府支持的措施正在加強發展中經濟體對鋰離子電池的需求。

目錄

第1章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依化學成分,2021 年至 2034 年

- 主要趨勢

- 利物浦足球俱樂部

- 低碳

- 國家管理委員會

- 其他

第6章:市場規模及預測:依應用,2021 年至 2034 年

- 主要趨勢

- 軍隊

- 重型工業設備

- 醫療的

- 海洋

- 其他

第7章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- A123 Systems

- Akku Tronics New Energy Technology

- BYD

- CATL

- Clarios

- Ding Tai Battery Company

- Duracell

- EaglePicher Technologies

- EnerDel

- ENERGON

- Energus Power Solutions

- Exide Technologies

- General Electric

- Hitachi Energy

- Koninklijke Philips

- LG Chem

- Lithium Werks

- Maxell

- SK innovation

- Padre Electronics

- Panasonic Corporation

- ProLogium Technology

- Saft

- Samsung SDI

- Tesla

- Toshiba Corporation

The Global Industrial Lithium-Ion Battery Market was valued at USD 4.8 billion in 2024 and is anticipated to expand at a CAGR of 11.9% from 2025 to 2034. These batteries have become the preferred rechargeable power source for various industrial applications, including heavy machinery and medical equipment. Market expansion is driven by increasing industrialization and urbanization, alongside the rising reliance on renewable energy. Renewable power generation is projected to double by 2030, further boosting demand. Additionally, developing nations are experiencing rapid growth in electrification, particularly within the automotive sector, enhancing the need for lithium-ion batteries. Governments worldwide are introducing favorable policies to strengthen battery adoption across industries. In response, manufacturers are scaling up production and refining distribution networks, leading to a steady decline in costs.

The lithium iron phosphate (LFP) battery segment is expected to surpass USD 4 billion by 2034. LFP batteries, featuring an iron phosphate cathode, are recognized for high energy density, durability, and reliable performance. They are widely utilized in electric vehicles, industrial machinery, marine applications, and aviation. The growing adoption of these batteries has led multiple corporations to ramp up investments in LFP production facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $15.2 Billion |

| CAGR | 11.9% |

Growing demand for lithium-ion batteries across industries has prompted corporations and research institutions to develop innovative technologies. The nickel manganese cobalt (NMC) battery segment is projected to grow at a 10.4% CAGR through 2034. Industry participants are investing in NMC battery production while integrating environmentally sustainable materials into cathodes to minimize energy loss and carbon emissions.

By application, the industrial lithium-ion battery market is divided into military, heavy industrial equipment, medical, marine, and others. The military sector accounted for 24.7% of the total market share in 2024. Demand is increasing as lithium-ion batteries provide efficient energy storage for drones, GPS devices, communication systems, and other defense technologies. The military application segment is projected to exceed USD 3.9 billion by 2034.

The heavy industrial equipment sector is witnessing higher demand for lithium-ion batteries due to the rising need for metals such as iron and industrial minerals. Expanding mining and construction activities are fueling the demand for high-performance battery solutions. The heavy industrial equipment segment is forecast to register a CAGR exceeding 10.8% by 2034. The growing shift toward electric transportation is further accelerating industrial lithium-ion battery adoption. The increasing push for sustainable mobility, along with government incentives, continues to support battery market expansion.

In the United States, the industrial lithium-ion battery market surpassed USD 1.2 billion in 2022, USD 1.4 billion in 2023, and USD 1.6 billion in 2024. Government initiatives aimed at strengthening domestic battery production are expected to drive further market growth. Similarly, government-backed initiatives are reinforcing lithium-ion battery demand in developing economies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Chemistry, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 LFP

- 5.3 LCO

- 5.4 NMC

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Military

- 6.3 Heavy industrial equipment

- 6.4 Medical

- 6.5 Marine

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 A123 Systems

- 8.2 Akku Tronics New Energy Technology

- 8.3 BYD

- 8.4 CATL

- 8.5 Clarios

- 8.6 Ding Tai Battery Company

- 8.7 Duracell

- 8.8 EaglePicher Technologies

- 8.9 EnerDel

- 8.10 ENERGON

- 8.11 Energus Power Solutions

- 8.12 Exide Technologies

- 8.13 General Electric

- 8.14 Hitachi Energy

- 8.15 Koninklijke Philips

- 8.16 LG Chem

- 8.17 Lithium Werks

- 8.18 Maxell

- 8.19 SK innovation

- 8.20 Padre Electronics

- 8.21 Panasonic Corporation

- 8.22 ProLogium Technology

- 8.23 Saft

- 8.24 Samsung SDI

- 8.25 Tesla

- 8.26 Toshiba Corporation