|

市場調查報告書

商品編碼

1699260

穿戴式心臟設備市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Wearable Cardiac Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

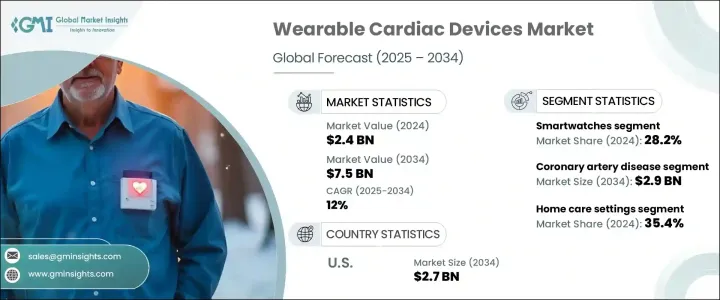

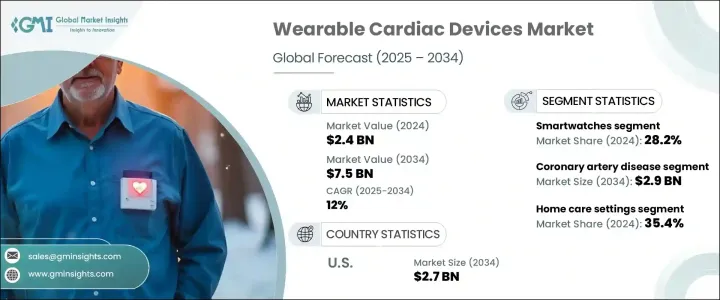

2024 年全球穿戴式心臟設備市場價值為 24 億美元,預計 2025 年至 2034 年期間的複合年成長率為 12%。這些攜帶式醫療設備允許個人每天監測他們的心臟健康,收集和分析基於心率、節律、身體活動和睡眠模式的長期資料。透過實現遠端監控,他們無需頻繁就診,從而提高了患者的便利性和醫療效率。這些設備配備了先進的感測器和人工智慧分析功能,可提供即時洞察,幫助醫療保健專業人員做出明智的決策。預防性醫療保健意識的增強、心血管疾病病例的增加以及遠端病人監控需求的增加正在推動市場成長。穿戴式心臟設備廣泛用於心律不整監測和管理心臟衰竭和周邊動脈疾病等病症。

市場按產品細分為智慧手錶、動態心電圖監測儀、貼片、脈搏血氧儀、除顫器和其他穿戴式裝置。智慧手錶引領了這一領域,佔了 2024 年總收入的 28.2%。其方便用戶使用的設計允許無縫追蹤心臟健康,無需專業協助,使其可以被廣泛的受眾所接受。人工智慧演算法有助於檢測心律不整並提供即時健康見解。由於這些手錶可以監測心電圖、心率和氧氣水平等各種生命徵象,因此它們可以提供心血管健康狀況的全面視圖。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 75億美元 |

| 複合年成長率 | 12% |

根據應用,市場分為冠狀動脈疾病、心肌病變、心肌梗塞後、先天性心臟病、術後心臟護理和其他相關疾病。冠狀動脈疾病領域在 2024 年佔據了 37.4% 的市場佔有率,預計到 2034 年將達到 29 億美元。缺乏運動、肥胖和吸煙等與生活方式相關的風險因素的激增,正在推動該領域對穿戴式心臟設備的需求。隨著冠狀動脈疾病病例的增加,醫療保健提供者越來越依賴穿戴式技術進行早期發現和疾病管理。

根據最終用途,市場進一步分為醫院、專科中心、家庭護理機構和其他設施。 2024 年,居家照護環境佔 35.4%,反映出人們越來越傾向於在舒適的環境中進行持續的心臟監測。這些設備使人們能夠在家中追蹤自己的心血管健康狀況,並減少對醫療機構的依賴。法規遵從性確保了穿戴式裝置在照護端環境中的有效性,進一步推動了該領域的應用。

從地區來看,受心血管疾病高發病率和醫療保健體系發達的推動,美國穿戴式心臟設備市場規模預計到 2034 年將達到 27 億美元。消費者意識的提高和穿戴式健康設備的技術進步進一步增強了市場的成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心血管疾病患者數量不斷增加

- 穿戴式心臟設備的技術快速進步

- 微創設備日益受到青睞

- 健康意識和預防保健意識不斷提高

- 產業陷阱與挑戰

- 資料隱私問題

- 嚴格的監理政策

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 動態心電圖監測儀

- 智慧手錶

- 修補

- 除顫器

- 脈搏血氧儀

- 其他產品

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 冠狀動脈疾病(CAD)

- 心肌病變

- 心肌梗塞後

- 先天性心臟病

- 術後心臟護理

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 專業中心

- 居家照護環境

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Boston Scientific

- Cardiac Insight

- CardiacSense

- Cardiac Rhythm

- iRhythm Technologies

- Integra LifeSciences

- Koninklijke Philips

- Medtronic

- Proteus Digital Health

- Qardio

- ZOLL Medical Corporation

- Welch Allyn

- VitalConnect

- Zimmer Biomet

The Global Wearable Cardiac Devices Market was valued at USD 2.4 billion in 2024 and is expected to expand at a CAGR of 12% from 2025 to 2034. These portable medical devices allow individuals to monitor their heart health daily, collecting and analyzing long-term data based on heart rate, rhythm, physical activity, and sleep patterns. By enabling remote monitoring, they eliminate the need for frequent clinical visits, improving patient convenience and medical efficiency. Equipped with advanced sensors and AI-powered analytics, these devices provide real-time insights, helping healthcare professionals make informed decisions. Growing awareness about preventive healthcare, rising cases of cardiovascular diseases, and increasing demand for remote patient monitoring are driving market growth. Wearable cardiac devices are widely used for cardiac arrhythmia monitoring and managing conditions such as heart failure and peripheral artery disease.

The market is segmented by product into smartwatches, Holter monitors, patches, pulse oximeters, defibrillators, and other wearable devices. Smartwatches led the segment, capturing 28.2% of total revenue in 2024. Their user-friendly design allows seamless heart health tracking without professional assistance, making them accessible to a broad audience. AI-powered algorithms help detect irregular heart rhythms and provide real-time health insights. As these watches monitor various vitals, including ECG, heart rate, and oxygen levels, they offer a comprehensive view of cardiovascular health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 12% |

By application, the market is divided into coronary artery disease, cardiomyopathies, post-myocardial infarction, congenital heart diseases, post-surgical cardiac care, and other related conditions. The coronary artery disease segment held a 37.4% market share in 2024 and is projected to reach USD 2.9 billion by 2034. A surge in lifestyle-related risk factors such as physical inactivity, obesity, and smoking is fueling the demand for wearable cardiac devices in this segment. With rising cases of coronary artery disease, healthcare providers are increasingly relying on wearable technology for early detection and disease management.

The market is further categorized by end use into hospitals, specialty centers, home care settings, and other facilities. Home care settings accounted for a 35.4% share in 2024, reflecting a growing preference for continuous heart monitoring in comfortable environments. These devices enable individuals to track their cardiovascular health at home, reducing dependency on healthcare facilities. Regulatory compliance ensures the effectiveness of wearable devices in point-of-care settings, further driving adoption in this segment.

Regionally, the U.S. wearable cardiac devices market is anticipated to reach USD 2.7 billion by 2034, fueled by a high prevalence of cardiovascular diseases and a well-developed healthcare system. Increasing consumer awareness and technological advancements in wearable health devices are further strengthening market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of patients suffering from cardiovascular diseases

- 3.2.1.2 Rapid technological advancements in wearable cardiac devices

- 3.2.1.3 Growing preference of minimally invasive devices

- 3.2.1.4 Rising health consciousness and preventive care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy issues

- 3.2.2.2 Stringent regulatory policies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Holter monitors

- 5.3 Smartwatches

- 5.4 Patch

- 5.5 Defibrillators

- 5.6 Pulse oximeters

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Coronary artery disease (CAD)

- 6.3 Cardiomyopathies

- 6.4 Post-myocardial infarction

- 6.5 Congenital heart diseases

- 6.6 Post-surgical cardiac care

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty centers

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Boston Scientific

- 9.3 Cardiac Insight

- 9.4 CardiacSense

- 9.5 Cardiac Rhythm

- 9.6 iRhythm Technologies

- 9.7 Integra LifeSciences

- 9.8 Koninklijke Philips

- 9.9 Medtronic

- 9.10 Proteus Digital Health

- 9.11 Qardio

- 9.12 ZOLL Medical Corporation

- 9.13 Welch Allyn

- 9.14 VitalConnect

- 9.15 Zimmer Biomet