|

市場調查報告書

商品編碼

1699294

心血管設備市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Cardiovascular Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

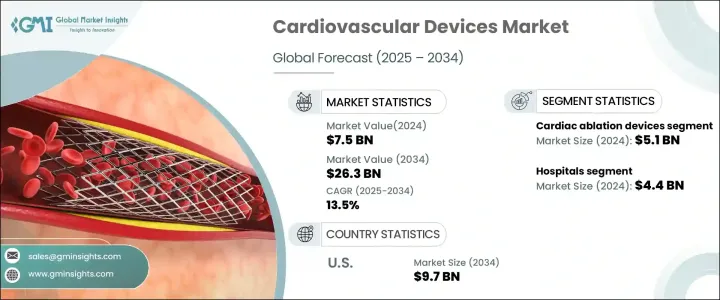

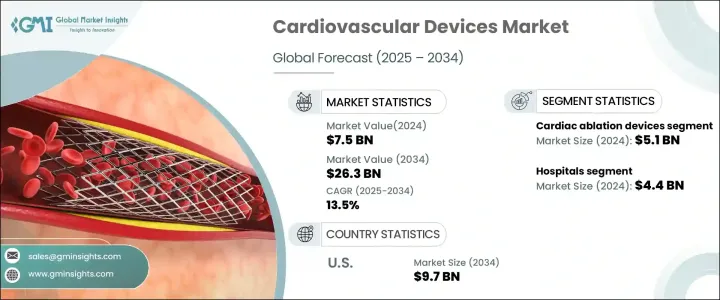

2024 年全球心血管設備市場價值為 75 億美元,預計 2025 年至 2034 年期間的複合年成長率為 13.5%,這得益於心血管疾病 (CVD) 病例的增加、技術進步和醫療保健支出的增加。心臟相關疾病的負擔不斷加重,主要原因是人口老化和生活方式相關的疾病,這極大地推動了對先進心血管解決方案的需求。由於久坐習慣、不良飲食選擇和高壓力水平繼續導致全球心血管疾病,對創新診斷和治療設備的需求變得比以往任何時候都更加迫切。此外,人們對預防性醫療保健和早期檢測策略的認知不斷提高,進一步推動了市場採用。

醫療技術的尖端進步正在徹底改變心血管護理。人工智慧診斷、機器人輔助手術和微創手術的引入正在改善患者的治療效果,同時縮短恢復時間。該行業正在經歷法規核准的激增,擴大了獲得最先進心血管設備的機會。政府和私人醫療保健實體正在大力投資研發,以推出滿足不斷變化的患者需求的下一代解決方案。醫療保健支出的不斷成長,尤其是在已開發經濟體中,促進了先進心臟設備的廣泛普及,進一步推動了市場的成長。此外,門診心血管介入和家庭監測系統數量的增加使患者能夠更方便地接受治療。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 75億美元 |

| 預測值 | 263億美元 |

| 複合年成長率 | 13.5% |

根據設備類型,市場分為心臟消融設備、左心耳封堵器和內視鏡血管採集設備。其中,心臟消融設備佔據市場主導地位,2024 年估值達 51 億美元,預計預測期內複合年成長率為 13.7%。心房顫動盛行率的上升是這些設備需求增加的一個主要促進因素。隨著越來越多的人被診斷出患有心律不齊,微創消融技術的採用正在增加。此外,人們對有效治療方案的認知不斷提高,加上消融技術的不斷進步,正在促進市場擴張。

根據最終用途,心血管設備市場分為醫院、門診手術中心、心臟中心和其他醫療機構。醫院在該領域佔據主導地位,2024 年創造了 44 億美元的收入,佔總收入的 58.3%。接受心臟繞道手術、導管插入術和設備植入等複雜心臟干預的患者數量不斷增加,鞏固了醫院在這一領域的領導地位。醫院配備了先進的影像技術、專門的心臟科和多學科團隊,仍然是危重心血管病例的主要治療中心。此外,他們處理緊急和住院手術的能力使他們成為患者和醫療保健提供者的首選。

2023 年,美國心血管設備市場規模為 25 億美元,預計 2034 年將成長至 97 億美元。美國擁有完善的醫療保健基礎設施、尖端心血管技術的快速應用以及強大的熟練專業人員網路,包括心臟外科醫生、介入性心臟病專家和電生理學家。治療方法的不斷創新和支持性監管政策正在加速市場滲透。優惠的報銷框架進一步鼓勵採用先進的心血管設備,使美國成為心臟護理解決方案的領先市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心血管疾病患者數量不斷增加

- 老年人口不斷增加

- 政府措施不斷湧現

- 心血管設備的技術進步

- 微創手術需求不斷成長

- 產業陷阱與挑戰

- 心臟手術的高風險

- 嚴格的監管情景

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按設備類型,2021 年至 2034 年

- 主要趨勢

- 心臟消融設備

- 射頻消融儀

- 電動消融器

- 冷凍消融設備

- 超音波設備

- 其他心臟消融設備

- 左心耳封堵器

- 心內左心耳封堵器

- 心外膜左心耳封堵器

- 內視鏡血管採集裝置

- EVH 系統

- 內視鏡

- 配件

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 心臟中心

- 其他最終用途

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Abbott Laboratories

- AngioDynamics

- AtriCure

- Biosense Webster

- Boston Scientific Corporation

- Biotronik

- CardioFocus

- Getinge

- Japan Lifeline

- Karl Storz

- Lepu Medical Technology

- Lifetech Scientific

- Livanova

- Microport Scientific Corporation

- Medical Instruments

- Medtronic

- Occlutech

- Saphena Medical

- Stereotaxis

- Terumo Corporation

The Global Cardiovascular Devices Market was valued at USD 7.5 billion in 2024 and is projected to register a CAGR of 13.5% from 2025 to 2034, driven by rising cases of cardiovascular diseases (CVDs), technological advancements, and increasing healthcare expenditures. The escalating burden of heart-related ailments, largely fueled by an aging population and lifestyle-related disorders, is significantly propelling demand for advanced cardiovascular solutions. As sedentary habits, poor dietary choices, and high-stress levels continue to contribute to CVDs worldwide, the need for innovative diagnostic and treatment devices is becoming more pressing than ever. Additionally, greater awareness regarding preventive healthcare and early detection strategies is further boosting market adoption.

Cutting-edge advancements in medical technology are revolutionizing cardiovascular care. The introduction of AI-powered diagnostics, robotic-assisted surgeries, and minimally invasive procedures is enhancing patient outcomes while reducing recovery time. The industry is witnessing a surge in regulatory approvals, expanding access to state-of-the-art cardiovascular devices. Governments and private healthcare entities are heavily investing in research and development to introduce next-generation solutions that cater to evolving patient needs. Rising healthcare expenditures, particularly in developed economies, are facilitating the widespread availability of advanced cardiac devices, further propelling market growth. Moreover, the increasing number of outpatient cardiovascular interventions and home-based monitoring systems is making treatments more accessible and convenient for patients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $26.3 Billion |

| CAGR | 13.5% |

The market is categorized by device type into cardiac ablation devices, left atrial appendage closure devices, and endoscopic vessel harvesting devices. Among these, cardiac ablation devices led the market with a valuation of USD 5.1 billion in 2024 and are projected to witness a CAGR of 13.7% over the forecast period. The rising prevalence of atrial fibrillation is a key driver behind the demand for these devices. With more individuals diagnosed with irregular heart rhythms, the adoption of minimally invasive ablation techniques is on the rise. Additionally, growing awareness about effective treatment options, coupled with continuous advancements in ablation technology, is fostering market expansion.

By end use, the cardiovascular devices market is segmented into hospitals, ambulatory surgical centers, cardiac centers, and other healthcare facilities. Hospitals dominated the sector, generating USD 4.4 billion in 2024 and accounting for 58.3% of the total revenue. A higher patient influx for complex cardiac interventions, including bypass surgeries, catheterizations, and device implantations, is solidifying hospitals' leadership in this space. Equipped with advanced imaging technologies, specialized cardiac units, and multidisciplinary teams, hospitals remain the primary treatment hubs for critical cardiovascular cases. Additionally, their ability to handle emergency and inpatient procedures makes them a preferred choice among both patients and healthcare providers.

The U.S. cardiovascular devices market stood at USD 2.5 billion in 2023 and is projected to grow to USD 9.7 billion by 2034. The country benefits from a well-established healthcare infrastructure, rapid adoption of cutting-edge cardiovascular technologies, and a strong network of skilled professionals, including cardiac surgeons, interventional cardiologists, and electrophysiologists. Continuous innovation in treatment methodologies and supportive regulatory policies are accelerating market penetration. Favorable reimbursement frameworks are further encouraging the adoption of advanced cardiovascular devices, positioning the U.S. as a leading market for cardiac care solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of patients suffering from cardiovascular diseases

- 3.2.1.2 Expanding geriatric population

- 3.2.1.3 Rising government initiatives

- 3.2.1.4 Technological advancements in cardiovascular devices

- 3.2.1.5 Rising demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk associated with cardiac procedures

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiac ablation devices

- 5.2.1 Radiofrequency ablators

- 5.2.2 Electric ablators

- 5.2.3 Cryoablation devices

- 5.2.4 Ultrasound devices

- 5.2.5 Other cardiac ablation devices

- 5.3 Left atrial appendage closure devices

- 5.3.1 Endocardial LAA closure devices

- 5.3.2 Epicardial LAA closure devices

- 5.4 Endoscopic vessel harvesting devices

- 5.4.1 EVH systems

- 5.4.2 Endoscopes

- 5.4.3 Accessories

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Cardiac centers

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 AngioDynamics

- 8.3 AtriCure

- 8.4 Biosense Webster

- 8.5 Boston Scientific Corporation

- 8.6 Biotronik

- 8.7 CardioFocus

- 8.8 Getinge

- 8.9 Japan Lifeline

- 8.10 Karl Storz

- 8.11 Lepu Medical Technology

- 8.12 Lifetech Scientific

- 8.13 Livanova

- 8.14 Microport Scientific Corporation

- 8.15 Medical Instruments

- 8.16 Medtronic

- 8.17 Occlutech

- 8.18 Saphena Medical

- 8.19 Stereotaxis

- 8.20 Terumo Corporation