|

市場調查報告書

商品編碼

1699277

可程式邏輯控制器 (PLC) 市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Programmable Logic Controller (PLC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

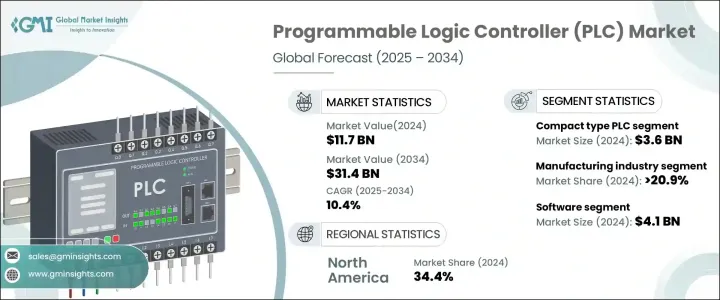

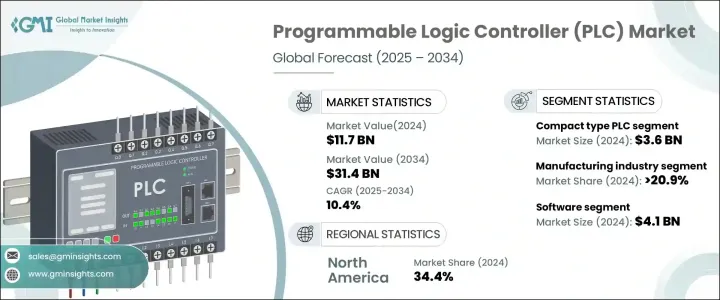

2024 年全球可程式邏輯控制器市場價值為 117 億美元,預計 2025 年至 2034 年的複合年成長率為 10.4%。工業 4.0、數位孿生技術和自動化驅動解決方案的日益普及正在推動市場擴張。由於基於 PLC 的系統在自動化生產線和最佳化製造效率方面發揮關鍵作用,因此電動車 (EV) 的需求不斷成長,進一步加速了成長。汽車製造商依靠 PLC 驅動的解決方案來簡化電動車的生產、增強可擴展性並減少停機時間。此外,這些系統對於電池製造和複雜的組裝過程至關重要,可確保最高的生產力。

工業 4.0 計畫整合了人工智慧驅動的分析、機器通訊和雲端運算,正在推動對先進 PLC 的巨大需求。這些系統促進了即時資料處理和無縫連接,使其成為智慧製造不可或缺的一部分。數位孿生技術與基於 PLC 的系統的整合使製造商能夠創建虛擬模型來測試和最佳化效能,而不會中斷實體操作。隨著越來越多的公司採用數位孿生進行預測性維護和效率改進,PLC 製造商正專注於開發與這些進步一致的解決方案。各行各業對智慧自動化的需求日益成長,確保了對 PLC 的持續需求,使其成為現代工業生態系統的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 117億美元 |

| 預測值 | 314億美元 |

| 複合年成長率 | 10.4% |

根據類型,市場分為模組化、緊湊型和機架式 PLC。其中,模組化 PLC 預計將實現最高成長,預測期內複合年成長率為 11.1%。這些 PLC 具有出色的可擴展性和靈活性,使其成為製造、能源、水處理和食品加工等行業的首選。它們能夠在不中斷整個系統的情況下更換故障模組,從而最大限度地減少停機時間,這推動了它們的廣泛應用。

根據最終用途,市場分為航太和國防、汽車、化學品、能源和公用事業、食品和飲料、醫療保健、製造業、採礦和金屬、石油和天然氣以及運輸業。受智慧工廠和自動化生產線中 PLC 部署日益增多的推動,製造業將在 2024 年佔據總市場佔有率的 20.9% 以上。現代 PLC 系統透過即時資料處理、預測性維護和自適應自動化來提高效率,使其成為工業進步不可或缺的一部分。

市場也依組件分為軟體、硬體和服務。在工業 4.0 快速應用和物聯網整合的推動下,軟體產業的規模到 2024 年將達到 41 億美元。基於軟體的 PLC 支援即時監控、預測分析和流程最佳化,幫助產業提高效率並最大限度地減少操作錯誤。隨著智慧製造的發展勢頭強勁,它們在減少系統停機時間和簡化生產流程方面的作用不斷擴大。

從地理位置來看,由於對智慧基礎設施和自動化技術的投資增加,北美在 2024 年佔據了全球 PLC 市場的 34.4% 的佔有率。美國引領區域市場,2024 年創造 31 億美元的收入,預計複合年成長率為 10.8%。工業 4.0 計劃的擴展和對電動車生產的日益關注是推動該地區採用 PLC 的關鍵因素。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 採用工業 4.0 和數位孿生計劃

- 各行各業對自動化的需求不斷成長

- 工業機器人需求不斷成長

- 老化基礎設施升級

- 電動汽車(EV)產業的興起

- 成長動力

- 產業陷阱與挑戰

- 投資成本高

- 網路安全攻擊的威脅

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 模組化的

- 袖珍的

- 機架式

第6章:市場估計與預測:按組件,2021 年至 2034 年

- 主要趨勢

- 硬體

- 中央處理器(CPU)

- 記憶體模組

- 輸入模組

- 輸出模組

- 通訊模組

- 電源單元

- 人機介面(HMI)

- 其他

- 軟體

- 服務

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 航太和國防

- 汽車

- 化學

- 能源與公用事業

- 食品和飲料

- 衛生保健

- 製造業

- 採礦和金屬

- 石油和天然氣

- 運輸

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- ABB

- Bosch Rexroth

- Delta Electronics

- Eaton

- General Electric

- Honeywell International

- Keyence

- Mitsubishi Electric

- Omron

- Panasonic

- Phoenix Contact

- Rockwell Automation

- Schneider Electric

- Siemens

- Yokogawa Electric

The Global Programmable Logic Controller Market was valued at USD 11.7 billion in 2024 and is projected to grow at a CAGR of 10.4% from 2025 to 2034. The increasing adoption of Industry 4.0, digital twin technology, and automation-driven solutions is fueling market expansion. The rising demand for electric vehicles (EVs) is further accelerating growth, as PLC-based systems play a critical role in automating production lines and optimizing manufacturing efficiency. Automakers rely on PLC-driven solutions to streamline EV production, enhance scalability, and reduce downtime. Additionally, these systems are essential for battery manufacturing and complex assembly processes, ensuring maximum productivity.

Industry 4.0 initiatives, which integrate AI-driven analytics, machine communication, and cloud computing, are driving significant demand for advanced PLCs. These systems facilitate real-time data processing and seamless connectivity, making them indispensable for smart manufacturing. The integration of digital twin technology with PLC-based systems enables manufacturers to create virtual models for testing and optimizing performance without disrupting physical operations. As companies increasingly adopt digital twins for predictive maintenance and efficiency improvements, PLC manufacturers are focusing on developing solutions that align with these advancements. The growing need for intelligent automation across various industries ensures sustained demand for PLCs, positioning them as essential components of modern industrial ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.7 Billion |

| Forecast Value | $31.4 Billion |

| CAGR | 10.4% |

The market is segmented based on type into modular, compact, and rack-mounted PLCs. Among these, modular PLCs are expected to witness the highest growth, registering a CAGR of 11.1% during the forecast period. These PLCs offer superior scalability and flexibility, making them a preferred choice across industries, including manufacturing, energy, water treatment, and food processing. Their ability to minimize downtime by enabling faulty module replacements without disrupting entire systems drives their widespread adoption.

By end-use, the market is divided into aerospace and defense, automotive, chemicals, energy and utilities, food and beverages, healthcare, manufacturing, mining and metals, oil and gas, and transportation. The manufacturing sector accounted for over 20.9% of the total market share in 2024, driven by the increasing deployment of PLCs in smart factories and automated production lines. Modern PLC systems enhance efficiency through real-time data processing, predictive maintenance, and adaptive automation, making them integral to industrial advancements.

The market is also categorized by component into software, hardware, and services. The software segment accounted for USD 4.1 billion in 2024, driven by rapid Industry 4.0 adoption and IoT integration. Software-based PLCs support real-time monitoring, predictive analytics, and process optimization, helping industries improve efficiency and minimize operational errors. Their role in reducing system downtime and streamlining production processes continues to expand as smart manufacturing gains momentum.

Geographically, North America held a 34.4% share of the global PLC market in 2024, fueled by increased investments in smart infrastructure and automation technologies. The U.S. led the regional market, generating USD 3.1 billion in 2024, and is projected to grow at a CAGR of 10.8%. The expansion of Industry 4.0 initiatives and the rising focus on EV production are key factors driving PLC adoption in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Adoption of industry 4.0 and digital twin initiatives

- 3.2.1.2 Growing demand for automation across industries

- 3.2.1.3 Rising demand for Industrial robotics

- 3.2.1.4 Upgradation of aging infrastructure

- 3.2.1.5 The rise of electric vehicles (EV) industry

- 3.2.1 Growth drivers

- 3.3 Industry pitfalls and challenges

- 3.3.1.1 High investment costs

- 3.3.1.2 Threats of cybersecurity attacks

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Bn & Units)

- 5.1 Key trends

- 5.2 Modular

- 5.3 Compact

- 5.4 Rack mounted

Chapter 6 Market Estimates and Forecast, By Component, 2021 – 2034 (USD Bn & Units)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 Central Processing Unit (CPU)

- 6.2.2 Memory modules

- 6.2.3 Input modules

- 6.2.4 Output modules

- 6.2.5 Communication modules

- 6.2.6 Power supply unit

- 6.2.7 Human Machine Interface (HMI)

- 6.2.8 Others

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Bn & Units)

- 7.1 Key trends

- 7.2 Aerospace & defence

- 7.3 Automotive

- 7.4 Chemical

- 7.5 Energy & utilities

- 7.6 Food & beverages

- 7.7 Healthcare

- 7.8 Manufacturing

- 7.9 Mining & metal

- 7.10 Oil & gas

- 7.11 Transportation

- 7.12 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Bosch Rexroth

- 9.3 Delta Electronics

- 9.4 Eaton

- 9.5 General Electric

- 9.6 Honeywell International

- 9.7 Keyence

- 9.8 Mitsubishi Electric

- 9.9 Omron

- 9.10 Panasonic

- 9.11 Phoenix Contact

- 9.12 Rockwell Automation

- 9.13 Schneider Electric

- 9.14 Siemens

- 9.15 Yokogawa Electric