|

市場調查報告書

商品編碼

1685744

可程式邏輯控制器(PLC):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Programmable Logic Controller (PLC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

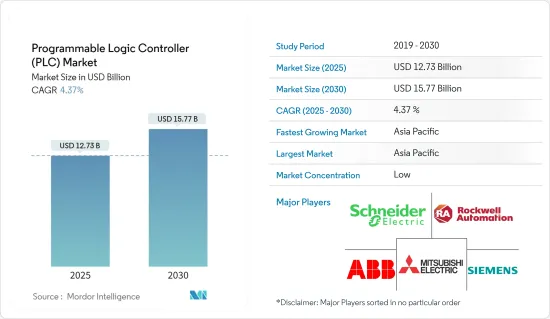

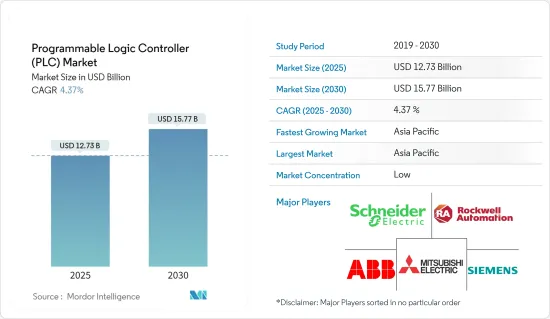

可程式邏輯控制器市場規模預計在 2025 年為 127.3 億美元,預計到 2030 年將達到 157.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.37%。

由於對自動化的需求不斷增加以滿足生產目標和提高產品質量,市場正在經歷顯著成長。這是因為 PLC 可以精確控制製造參數,確保生產的一致性和遵守品質標準。

主要亮點

- 市場研究很大程度受到工業產出和電腦及軟體投資的影響。傳統上,PLC 系統一直是流程和單一工廠自動化的基礎。各個工業領域對工業 4.0 的採用日益增加,進一步推動了市場的成長。離散製造業中 PLC 的一個顯著成長指標是汽車製造業以及電氣和電子產業中機器人的應用日益增多。

- 由於機器人是 PLC 的主要用戶之一,預計市場將從全球工業機器人安裝量的增加中受益匪淺。近年來,由於智慧工廠系統的普及,工業機器人的需求很大。據國際機器人聯合會 (IFR) 稱,美國製造公司正在大力投資自動化。 2023年工業機器人安裝總量將成長12%,達到44,303台。

- 另一個主要的市場趨勢是整合解決方案和設備的採用日益增多,例如在 HMI 和 SCADA 等工業控制設備中嵌入 PLC。這種整合提高了工廠運作的效率和可視性,同時減少了中央控制設備的工作量。

- 將 PLC、運動控制和 HMI 程式整合到單一環境中是預期在預測期內將會發展的趨勢。我們預計,在同一機架中整合 HMI 處理器和 PLC 的需求將顯著增加,其中監視器要么包含在套件中,要么作為外部選項提供。

- 產品客製化需求的不斷成長以及離散製造業從批量處理向連續處理的轉變,對 PLC 市場提出了重大挑戰。靈活性的提高、與先進技術的整合、擴充性和成本壓力正在推動製造商探索更先進的自動化解決方案,包括 DCS、SCADA、工業用電腦和雲端基礎的系統。雖然 PLC 在許多應用中仍然必不可少,但它們在處理這些不斷變化的環境中的動態、即時、大規模流程方面的局限性促使各行各業尋求具有更高適應性、擴充性和效率的替代方案。

- 經濟成長,尤其是製造業和工業領域的成長,正在推動對各種類型 PLC 的需求。隨著經濟擴張和產業現代化,對自動化解決方案的需求日益成長,以使這些行業更有效率、更有生產力和更具競爭力。

可程式邏輯控制器(PLC)市場趨勢

汽車產業是成長最快的最終用戶

- PLC 可用於各種汽車製造應用,包括組裝、噴漆和焊接。 PLC 控制生產線上材料和零件的移動,確保高效運作。這表明,隨著全球汽車製造業的成長,對 PLC 系統的潛在需求也在不斷成長。隨著科技的發展,PLC 在汽車製造業的潛力將會不斷擴大。人工智慧 (AI)、物聯網 (IoT) 與 PLC 的結合為智慧工廠鋪平了道路。這些工廠可以即時監控和最佳化生產,從而提高生產效率。例如,配備感測器的機器可以收集性能資料並進行必要的調整以提高產量。

- 汽車業在產品應用方面PLC應用較多,且以中型PLC最多。某種形式的 PLC 最常見於舊電動車的處理等應用。此外,由於機器視覺、協作機器人、無人駕駛/自動駕駛汽車的人工智慧以及物聯網聯網汽車的認知運算等新技術,汽車產業的 PLC 市場預計將進一步擴大。此外,許多汽車製造商正在研究區域擴建電動車工廠,進一步推動市場發展。預計這將支持對智慧工廠的需求並為市場供應商創造成長機會。

- 例如,2023年10月,現代汽車宣布計劃在美國建造第一家電動車工廠,目標是在2025年開始生產。這將有助於汽車製造業在市場上的擴張,並由於其在工廠自動化中的應用而產生對PLC系統的需求。

- 管理多個自動化控制點的製造商擴大選擇集中管理,以獲得更高的可視性和安全性。預計這一趨勢將推動市場對先進 PLC 解決方案的需求。

- 例如,2024年5月,福特汽車宣布計畫部署西門子自動化系統,以實現工廠集中控制。此創新解決方案將硬體可程式邏輯控制器 (PLC)、傳統人機介面和邊緣設備的功能整合到軟體主導的平台中。透過將網際網路技術 (IT) 工作流程整合到營運技術 (OT) 環境中,該系統簡化了操作,突顯了 PLC 解決方案的技術進步並提高了市場採用率。

- 電動車(EV)的大幅成長將推動市場需求。 PLC 對於控制電動車生產設施中執行焊接、噴漆、物料輸送和組裝的各種機器人系統、輸送機和機器至關重要。國際能源總署預測,2023年中國將成為亞太地區電動車銷量最多的國家,銷量將超過800萬輛。

- 因此,在汽車製造業引入 PLC 可以提高生產力和質量,同時最大限度地減少停機時間。透過自動化流程,製造商可以提高生產力,同時減少出錯的機會,從而支持未來研究市場的成長。

亞太地區實現強勁成長

- 中國正在推動工業自動化,特別是在製造業、汽車業、電子業和化學工業,因此採用 PLC 至關重要。中國政府已推出「中國製造2025」等舉措,旨在透過自動化和智慧技術實現製造業的現代化。這導致對 PLC 系統的投資增加,以提高效率、減少人為錯誤並提高生產線的靈活性。到2023年,自主移動機器人(AMR)和自動導引運輸車(AGV)的銷售將達到14萬台。

- 中國最近宣布了多項產業政策,以推動先進製造業的發展。這些指南將支持中國實現未來二十五年成為高科技強國的目標。例如,中國政府正在透過一系列旨在推動國家製造業轉型的指令,推動下一代無線技術的工業應用。

- 國際機器人聯合會(IFR)表示,對工業機器人的巨額投資幫助中國在機器人密度方面首次超過美國。運作工業機器人與製造業工人的比例達到每萬名員工322台機器人。這個國家在每年引進的機器人數量方面位居世界第一,並且在過去幾年中也一直保持著機器人運作數量最多的國家。

- 中國目前佔全球工業機器人安裝基數(IFR)的近四分之一,該國成長最快的垂直市場預計將推動機器人在一系列垂直領域的應用。此外,武漢大學品質發展策略研究所預測,到2025年,中國將有近5%的勞動力被機器和機器人取代。預計此類投資將在預測期內推動 PLC 市場的發展。

- 在「印度製造」等計劃的推動下,印度製造業擴大採用自動化來提高生產力、品質和競爭力。汽車、電子、紡織、食品飲料等行業正在投資基於 PLC 的自動化系統,以簡化業務並減少人工干預,從而導致對 PLC 的需求增加。

- 根據 IBEF 估計,到 2025 年,印度電動車 (EV) 市場規模將達到 70.9 億美元(5,000 億印度盧比)。 CEEW 能源金融中心的一項研究表明,到 2030 年,電動車將為印度帶來 2,060 億美元的商機。這將需要在汽車製造和充電基礎設施方面投資 1800 億美元。

- 日本是工業自動化領域的重要參與者,汽車、電子和製造等產業擴大採用智慧工廠解決方案。 PLC 對於生產流程自動化、提高效率和降低營運成本至關重要。 「舉措正在鼓勵更多地採用 PLC 來實現智慧製造系統。

可程式邏輯控制器(PLC)產業概況

競爭取決於影響市場的因素,例如品牌識別、強大的競爭策略和透明度。在這個市場中,由於買家尋求更有效的解決方案來最佳化他們的流程,創新提供了永續的競爭優勢。

該市場由一些歷史較悠久、信譽卓著的公司組成,這些公司在改進產品技術方面投入了大量資金。供應商包括 ABB、西門子和艾默生電氣。新公司進入市場需要高水準的廣告。但對於產業主要企業來說,這是顯而易見的。每家公司都可以透過強力的競爭策略(如技術聯盟、大量的研發投資和收購)來維持自身生存。

ABB 有限公司、羅克韋爾自動化公司、霍尼韋爾國際公司和三菱電機公司等現有供應商的存在對新進入者構成了較高的進入門檻,因為他們佔據了很大的市場佔有率,並且擁有廣泛的配銷通路。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 宏觀經濟趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 自動化系統的採用日益增多

- PLC 程式設計的易用性和熟悉度支援成長

- 市場限制

- 離散製造業產品客製化需求及由批量向連續加工的逐步轉變

- 分散式控制系統 (DCS) 的採用率不斷提高,安全性和控制能力均增強

第6章市場區隔

- 按類型

- 硬體和軟體

- 大型PLC

- 奈米PLC

- 小型PLC

- 中型PLC

- 其他類型

- 按服務

- 硬體和軟體

- 按最終用戶產業

- 食品、菸草、食物和飲料

- 車

- 化工和石化

- 能源與公共產業

- 紙漿和造紙

- 石油和天然氣

- 用水和污水處理

- 製藥

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- ABB Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Rockwell Automation Inc.

- Siemens AG

- Honeywell International Inc.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Emerson Electric Co.

- Hitachi Ltd

- Toshiba International Corporation

第8章投資分析

第9章:市場的未來

The Programmable Logic Controller Market size is estimated at USD 12.73 billion in 2025, and is expected to reach USD 15.77 billion by 2030, at a CAGR of 4.37% during the forecast period (2025-2030).

The market is experiencing significant growth due to the increasing demand for automation to meet production goals and enhance product quality. The need for higher production volumes without compromising quality standards also drives this demand, as PLCs enable precise control over manufacturing parameters, ensuring consistent output and adherence to quality benchmarks.

Key Highlights

- The market studied is significantly influenced by industrial output and investments in computers and software. PLC systems have traditionally served as the foundation of process and discrete factory automation. The increasing adoption of Industry 4.0 across various industrial sectors has further driven market growth. A notable growth indicator for PLCs in discrete manufacturing is the increased deployment of robots in the automotive manufacturing, electrical, and electronics industries.

- With robots being one of the key users of PLCs, the market is expected to benefit significantly from the growth of global industrial robot installations. Industrial robots have witnessed a huge demand in recent years due to the rising adoption of smart factory systems. According to the International Robotics Federation (IFR), manufacturing companies in the United States have invested heavily in automation. The number of total industrial robots installed increased by 12% and reached 44,303 units in 2023.

- Another major trend in the market is the growing adoption of integrated solutions and devices, such as embedding PLCs with industrial controls such as HMIs or SCADA. These integrations improve efficacy and visibility in factory operations while reducing the workload on central controllers.

- The integration of PLC, motion control, and HMI programming into a single environment is a trend expected to advance over the forecast period. The demand for combining HMI processors and PLCs into the same rack, with a monitor included in the package or offered as an external option, is projected to increase significantly.

- The growing demand for product customization and the shift from batch to continuous processing in discrete industries are creating significant challenges for the PLC market. Factors such as greater flexibility, integration with advanced technologies, scalability, and cost pressures are pushing manufacturers to explore more advanced automation solutions like DCS, SCADA, industrial PCs, and cloud-based systems. While PLCs remain essential in many applications, their limitations in handling dynamic, real-time, and large-scale processes in these evolving environments drive industries to seek alternatives that offer better adaptability, scalability, and efficiency.

- Economic growth, particularly in the manufacturing and industrial sectors, is significantly driving demand for various types of PLCs. As economies expand and industries modernize, the demand for automation solutions is increasing, enabling these industries to enhance efficiency, productivity, and competitiveness.

Programmable Logic Controller (PLC) Market Trends

Automotive Industry to be the Fastest Growing End User

- PLCs can be used in various automotive manufacturing applications, including assembly lines, painting, and welding. They control the movement of materials and parts on the production line, ensuring efficient operations, which shows the potential demand for PLC systems in line with the growth of Automotive manufacturing worldwide. The potential for PLC in automotive manufacturing expands as technology evolves. Integrating Artificial Intelligence (AI) and the Internet of Things (IoT) with PLC paves the way for smart factories. These factories can monitor and optimize production in real-time, heightening efficiency. For instance, machines equipped with sensors can gather performance data and make necessary adjustments to enhance production.

- The automobile industry finds many PLC applications from the product application view, and the most significant amount is medium-sized PLC. Some forms of the PLC are mostly at the electric car's former disposal in the application. Moreover, the PLC market in the automotive industry is anticipated to expand further with new technologies such as machine vision, collaborative robotics, artificial intelligence for driverless/autonomous automobiles, cognitive computing in IoT-connected cars, and more. Furthermore, many automakers are expanding their Electric Vehicle factory in the studied region, further driving the market, which would support the demand for smart factories and create a growth opportunity for the market vendors.

- For instance, in October 2023, Hyundai planned to build its first US electric vehicle plant, with production on track for 2025. This would support the expansion of automobile manufacturing in the market and create a demand for PLC systems due to their applications in plant automation.

- Manufacturers managing multiple automation control points increasingly opt for centralized management to boost visibility and security. This trend would drive the demand for advanced PLC solutions in the market.

- For example, in May 2024, Ford Motors announced its plan to implement an automated system from Siemens to centralize its factory control. This innovative solution merges the capabilities of a hardware Programmable Logic Controller (PLC), a traditional Human Machine Interface, and an edge device into a unified, software-driven platform. By integrating Internet Technology (IT) workflows into Operational Technology (OT) environments, the system streamlines operations and underscores the technological strides in PLC solutions, bolstering their market adoption rate.

- Significant Growth in Electric Vehicles (EVs) To Boost the Market Demand. PLCs are essential for controlling the various robotic systems, conveyors, and machines that perform welding, painting, material handling, and assembly in EV production facilities. According to IEA, in 2023, China experienced the most electric car sales throughout the Asia-Pacific region, with over eight million electric cars sold.

- Therefore, deploying PLCs in automotive manufacturing results in benefits such as enhancing productivity and quality while minimizing downtime. Manufacturers can boost production rates through process automation while decreasing error probabilities, supporting the growth of the studied market in the future.

Asia-Pacific to Register Major Growth

- China's push for industrial automation, especially in manufacturing, automotive, electronics, and chemicals, is crucial for adopting PLC. The Chinese government has launched initiatives, such as Made in China 2025, to modernize its manufacturing sector through automation and smart technologies. This has increased investments in PLC systems to improve efficiency, reduce human error, and enhance production line flexibility. In 2023, the sales volume of automated mobile robots (AMR) and automated guided vehicles (AGV) amounted to 140 thousand units.

- China recently released multiple industrial policies as part of its advanced manufacturing drive. The guidelines support the country's objective of becoming a high-tech superpower during the next quarter-century. For instance, the Chinese government has been pushing for the industrial use of next-generation wireless technology amid a steady stream of directives focused on transforming the country's manufacturing.

- According to the International Federation of Robotics (IFR), China's massive investment in industrial robotics has put the nation in the top ranking in terms of robot density, surpassing the United States for the first time. The ratio of operational industrial robots to workers in manufacturing reached 322 units per 10,000 employees. The nation leads in annual robot installations and has consistently boasted the most significant operational stock of robots for several years.

- The fastest-growing vertical markets in the country are expected to facilitate robotics applications across different verticals, as China now accounts for almost a quarter of all the industrial robots installed globally (IFR). Also, the Wuhan University Institute of Quality Development Strategy predicts that by 2025, machinery and robotics will replace nearly 5% of China's workforce. Such investments are expected to drive the PLC market during the forecast period.

- India's manufacturing sector, driven by initiatives like "Make in India," is increasingly adopting automation to enhance productivity, quality, and competitiveness. Industries such as automotive, electronics, textiles, and food and beverages are investing in PLC-based automation systems to streamline operations and reduce human intervention, which leads to increased demand for PLCs.

- According to IBEF, India's electric vehicle (EV) market is estimated to reach USD 7.09 billion (INR 50,000 crore) by 2025. A study by the CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by 2030. This will necessitate a USD 180 billion investment in vehicle manufacturing and charging infrastructure.

- Japan is a significant player in industrial automation, with industries like automotive, electronics, and manufacturing increasingly adopting smart factory solutions. PLCs are crucial in automating production processes, improving efficiency, and reducing operational costs. The push toward "Industry 4.0" and "Society 5.0" initiatives encourages greater adoption of PLCs to enable smart manufacturing systems.

Programmable Logic Controller (PLC) Industry Overview

Competition depends on factors affecting the market, such as brand identity, powerful competitive strategy, and degree of transparency. The market studied has a highly sustainable competitive advantage through innovation, as buyers seek more efficient solutions to optimize the process.

The market consists of long-standing established players who have significantly invested in improving product technology. Some vendors include ABB Ltd, Siemens AG, and Emerson Electric Co.. The new players entering the market require a high level of advertising. However, this is quite simple for the key players in the industry. The companies can sustain themselves through powerful competitive strategies like technological collaborations, extensive R&D investments, and acquisitions.

The presence of established vendors, such as ABB Ltd, Rockwell Automation Inc., Honeywell International Inc., and Mitsubishi Electric Corporation, pose high barriers to the entry of new players since these players occupy the majority of the market and have greater access to the distribution channels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Automation Systems

- 5.1.2 Ease of Use and Familiarity with PLC Programming to Sustain Growth

- 5.2 Market Restraints

- 5.2.1 Demand for Customization of Products and Gradual Shift from Batch to Continuous Processing in the Discrete Industries

- 5.2.2 Increase in Adoption of Distributed Control Systems (DCS), with Enhanced Safety and Advanced Control Capabilities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware and Software

- 6.1.1.1 Large PLC

- 6.1.1.2 Nano PLC

- 6.1.1.3 Small PLC

- 6.1.1.4 Medium PLC

- 6.1.1.5 Other Types

- 6.1.2 Services

- 6.1.1 Hardware and Software

- 6.2 By End-user Industry

- 6.2.1 Food, Tobacco, and Beverage

- 6.2.2 Automotive

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Energy and Utilities

- 6.2.5 Pulp and Paper

- 6.2.6 Oil and Gas

- 6.2.7 Water and Wastewater Treatment

- 6.2.8 Pharmaceutical

- 6.2.9 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Schneider Electric SE

- 7.1.4 Rockwell Automation Inc.

- 7.1.5 Siemens AG

- 7.1.6 Honeywell International Inc.

- 7.1.7 Omron Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Emerson Electric Co.

- 7.1.11 Hitachi Ltd

- 7.1.12 Toshiba International Corporation