|

市場調查報告書

商品編碼

1699295

無線接取網路市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Radio Access Network Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

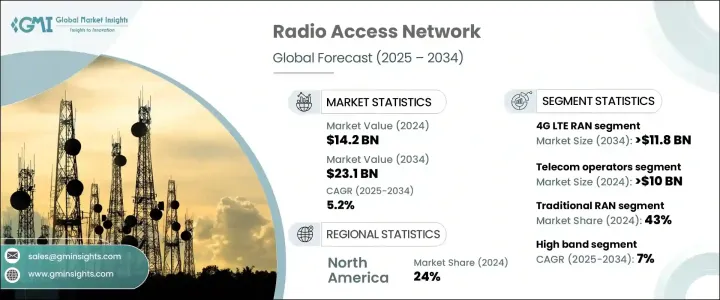

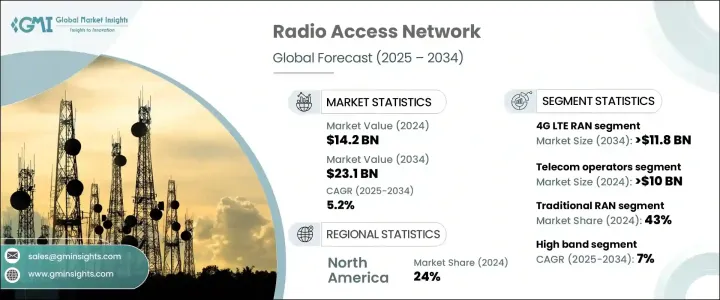

2024 年全球無線接取網路市場價值為 142 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.2%。對無縫連接的需求不斷成長、行動網路的快速擴張以及對電信基礎設施的持續投資正在推動市場成長。隨著全球行動資料消費激增,網路供應商優先考慮覆蓋範圍、容量和效率,以支援越來越多的行動用戶。數位轉型、智慧城市計畫的興起以及基於物聯網的應用的激增,正在推動電信公司升級其網路能力並部署尖端技術。

5G技術的廣泛應用雖然仍處於早期階段,但正在加速網路基礎設施的進步。然而,4G LTE 仍然是主導技術,確保數十億用戶的持續連線。對高速網際網路、低延遲通訊和卓越網路可靠性的需求正在推動電信巨頭透過戰略合作夥伴關係和投資來擴展其基礎設施。世界各國政府和監管機構正在透過優惠政策、頻譜分配和資金措施支持網路擴張,進一步推動市場擴張。此外,人工智慧 (AI) 和機器學習 (ML) 融入網路營運正在提高效率並減少延遲,使現代 RAN 解決方案更加穩健和適應性更強。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 142億美元 |

| 預測值 | 231億美元 |

| 複合年成長率 | 5.2% |

4G LTE RAN 領域在 2024 年佔據了 54% 的市場佔有率,預計到 2034 年將創造 118 億美元的市場價值。這種主導地位歸功於 4G 網路的廣泛覆蓋和可靠性,該網路已經運作了十多年。儘管已經部署了 5G,但由於 4G LTE 的可訪問性和穩定性,大多數行動用戶仍然依賴 4G LTE。行動網路營運商正在大力投資最佳化和擴展 4G 基礎設施,以確保在城鄉地區提供卓越的效能。鑑於許多地區的 5G 覆蓋範圍仍然有限,4G LTE 仍然是行動連線最廣泛使用和最可靠的選擇。

電信營運商部門在 2024 年創造了 100 億美元的收入,由於對 RAN 基礎設施的大量投資而保持領先地位。這些營運商在建造、升級和維護蜂窩網路方面發揮關鍵作用,構成了電信業的支柱。對頻譜獲取、基地台和網路擴展的投資繼續推動行業成長。隨著對高速連接的需求不斷成長,電信公司正在分配大量資源來提高網路效能,確保低延遲通訊,並支援向 5G 的過渡。行動技術的持續進步將進一步維持對 RAN 基礎設施的投資,營運商將專注於長期網路可靠性和可擴展性。

北美接取網路市場佔24%的佔有率,2024年創造29.2億美元的收入。該地區仍然處於電信基礎設施投資的前沿,特別是在5G網路的擴展方面。獨立 5G 和固定無線接入技術的持續發展正在鞏固北美在全球 RAN 市場的領先地位。隨著主要電信營運商專注於下一代網路的創新和大規模部署,北美繼續在先進的連接解決方案方面樹立標竿。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 製造商

- 技術提供者

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 用例

- 衝擊力

- 成長動力

- 5G網路的普及率不斷提高

- 行動資料流量不斷成長和物聯網擴展

- 政府措施和5G頻譜分配

- 開放式 RAN 和虛擬化 RAN 的採用率不斷提高

- 企業私有5G網路的成長

- 產業陷阱與挑戰

- 基礎設施成本高

- 頻譜分配和監管問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 2G 無線存取網

- 3G 無線存取網

- 4G LTE 無線接取網

- 5G 無線存取網

第6章:市場估計與預測:依基礎設施,2021 - 2034 年

- 主要趨勢

- 傳統 RAN

- 雲端 RAN

- 開放式 RAN

- 虛擬化RAN

第7章:市場估計與預測:按頻段,2021 - 2034 年

- 主要趨勢

- 低頻段(低於 1 GHz)

- 中頻段(1-6 GHz)

- 高頻段(毫米波,24 GHz 以上)

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 電信營運商

- 企業

- 智慧城市和公共部門

- 國防和安全

- 工業和製造業

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Airspan Networks

- Altiostar Networks

- ASOCS

- AT&T

- Cisco

- CommScope

- Ericsson

- Fujitsu Limited

- Huawei

- Intel

- Juniper Networks

- Mavenir

- NEC

- Nokia

- Parallel Wireless

- Radisys

- Rakuten Symphony

- Samsung Electronics

- Verizon Communications

- ZTE

The Global Radio Access Network Market was valued at USD 14.2 billion in 2024 and is projected to grow at a CAGR of 5.2% between 2025 and 2034. Increasing demand for seamless connectivity, rapid expansion of mobile networks, and continuous investments in telecommunications infrastructure are fueling market growth. As mobile data consumption surges worldwide, network providers are prioritizing coverage, capacity, and efficiency to support a growing number of mobile users. The rise of digital transformation, smart city initiatives, and the proliferation of IoT-based applications are pushing telecom companies to upgrade their network capabilities and deploy cutting-edge technologies.

The widespread adoption of 5G technology, though still in its early stages, is accelerating advancements in network infrastructure. However, 4G LTE remains the dominant technology, ensuring consistent connectivity for billions of users. The demand for high-speed internet, low-latency communication, and superior network reliability is pushing telecom giants to expand their infrastructure through strategic partnerships and investments. Governments and regulatory bodies worldwide are supporting network expansion with favorable policies, spectrum allocation, and funding initiatives, further driving market expansion. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into network operations is improving efficiency and reducing latency, making modern RAN solutions more robust and adaptive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.2 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 5.2% |

The 4G LTE RAN segment held a 54% market share in 2024 and is expected to generate USD 11.8 billion by 2034. This dominance is attributed to the extensive coverage and reliability of 4G networks, which have been operational for over a decade. Despite 5G deployment, the majority of mobile users continue to rely on 4G LTE due to its accessibility and stability. Mobile network operators are heavily investing in optimizing and expanding 4G infrastructure to ensure superior performance across urban and rural areas. Given that 5G coverage is still limited in many regions, 4G LTE remains the most widely used and dependable option for mobile connectivity.

The telecom operators segment generated USD 10 billion in 2024, maintaining a leading position due to massive investments in RAN infrastructure. These operators play a critical role in building, upgrading, and maintaining cellular networks, forming the backbone of the telecommunications industry. Investments in spectrum acquisition, base stations, and network expansion continue to drive industry growth. As demand for high-speed connectivity rises, telecom companies are allocating substantial resources to enhance network performance, ensure low-latency communication, and support the transition toward 5G. Ongoing advancements in mobile technology will further sustain investment in RAN infrastructure, with operators focusing on long-term network reliability and scalability.

North America's access network market accounted for a 24% share, generating USD 2.92 billion in 2024. The region remains at the forefront of telecommunications infrastructure investments, particularly in the expansion of 5G networks. Ongoing developments in standalone 5G and fixed wireless access technologies are reinforcing North America's position as a leader in the global RAN market. With major telecom players focusing on innovation and large-scale deployment of next-generation networks, North America continues to set benchmarks in advanced connectivity solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Manufacturers

- 3.1.3 Technology providers

- 3.1.4 End Use

- 3.1.5 Profit margin analysis

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Use cases

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing adoption of 5G networks

- 3.6.1.2 Rising mobile data traffic and IoT expansion

- 3.6.1.3 Government initiatives and 5G spectrum allocation

- 3.6.1.4 Increasing adoption of open RAN and virtualized RAN

- 3.6.1.5 Growth in private 5G networks for enterprises

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High infrastructure costs

- 3.6.2.2 Spectrum allocation and regulatory issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 2G RAN

- 5.3 3G RAN

- 5.4 4G LTE RAN

- 5.5 5G RAN

Chapter 6 Market Estimates & Forecast, By Infrastructure, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Traditional RAN

- 6.3 Cloud RAN

- 6.4 Open RAN

- 6.5 Virtualized RAN

Chapter 7 Market Estimates & Forecast, By Frequency Band, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Low band (Below 1 GHz)

- 7.3 Mid band (1-6 GHz)

- 7.4 High band (mmWave, 24 GHz and above)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Telecom operators

- 8.3 Enterprises

- 8.4 Smart cities & public sector

- 8.5 Defense & security

- 8.6 Industrial & manufacturing

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airspan Networks

- 10.2 Altiostar Networks

- 10.3 ASOCS

- 10.4 AT&T

- 10.5 Cisco

- 10.6 CommScope

- 10.7 Ericsson

- 10.8 Fujitsu Limited

- 10.9 Huawei

- 10.10 Intel

- 10.11 Juniper Networks

- 10.12 Mavenir

- 10.13 NEC

- 10.14 Nokia

- 10.15 Parallel Wireless

- 10.16 Radisys

- 10.17 Rakuten Symphony

- 10.18 Samsung Electronics

- 10.19 Verizon Communications

- 10.20 ZTE