|

市場調查報告書

商品編碼

1542849

5G時代的RAN自動化,SON,RIC,xApps,rApps - 機會,課題,策略,預測(2024年~2030年)RAN Automation, SON, RIC, xApps & rApps in the 5G Era: 2024 - 2030 - Opportunities, Challenges, Strategies & Forecasts |

||||||

主要發現

本報告的主要發現如下。

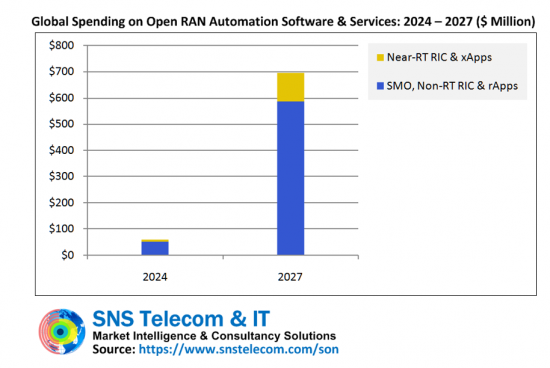

- 棕地業者部署第二波Open RAN 基礎設施的同時,全球在RIC、SMO 和x/rApps 上的支出預計從2024 年到2027 年將以超過125% 的複合年增長率增長。我是。到2027 年底,隨著SMO 到非RT RIC 介面、RIC 平台之間的應用程式可移植性以及x/rApp 之間的衝突緩解等標準化差距和技術課題的解決,Open RAN 自動化市場的投資將出現年度成長。

- RAN自動化軟體與服務市場包括Open RAN自動化、RAN供應商SON解決方案、第三方C-SON平台、基頻整合式智慧RAN應用程式、RAN規劃與最佳化軟體、檢驗及量測解決方案等。年增率約為8%。

- 傳統 D-SON 和 C-SON 方法的缺點,以及蜂窩產業向開放介面、通用資訊模型、虛擬化和軟體驅動網路的轉變,將實現更高水準的 RAN 可程式性和自動化。標準的組件推動向Open RAN 自動化的過渡。

- 開放 RAN 自動化運動正在激發多元化應用程式開發人員社群的創新。除了十幾家公司提供SMO、Non-RT RIC和Near-RT RIC產品外,還有50多家公司正在積極開發xApp和rApp。

- 一些行動電信商創建了專門的業務部門來將 RAN 自動化專業知識商品化。 NTT DoCoMo 的 OREX 品牌和 Rakuten Mobile 的姊妹公司 Rakuten Symphony 就是兩個著名的例子。我們也預計未來幾年將有更多學術衍生產品提供商業級開放 RAN 自動化,例如東北大學的 zTouch Networks 和伊爾梅瑙工業大學的 AiVader。

- 隨著 Broadcom 收購 VMware 以及 HPE 計劃收購 Juniper Networks,SMO 和 RIC 生態系統已顯示出整合的早期跡象。根據第三方 RAN 自動化平台的商業成功,我們預計會看到更多的併??購 (M&A),讓人想起過去十年的 SON 熱潮。

- 雖然基於 SON 的 RAN 自動化在現網中的優勢眾所周知,但 RIC、SMO 和 x/rApps 方法更令人興奮。例如,日本棕地營運商 NTT DoCoMo 期望透過使用 Open RAN 實現自動化,將 TCO 降低高達 30%,並將基地台功耗降低高達 50%。

- 值得注意的是,國內競爭對手 Rakuten Mobile 已使用 RIC 託管的 RAN 自動化應用程序,在其現網中每個小區實現了約 17% 的節能。經過成功的實驗室試驗後,這家新建業者的目標是使用更複雜的 AI/ML 模型將節省成本提高到 25%。

- 除了公共行動電信商網路外,人們對垂直產業和私有無線領域的興趣也與日俱增。美國國防部 (DoD) 正在積極探索 RIC 託管的 x/rApp 在商業和作戰通訊場景中偵測、分析和偵測 Open RAN 網路中的各種安全威脅的潛力。另一個例子是台灣電子製造商英業達,該公司正在將用於室內定位和交通引導的 rApp 納入其智慧工廠專用 5G 網路解決方案的一部分。

本報告提供全球RAN自動化市場相關調查分析,提供價值鏈,推動市場要素,採用的障礙,實行技術,功能領域,使用案例,主要趨勢,未來的藍圖,標準化,案例研究,生態系統企業的簡介與策略等詳細評估。

目錄

第1章 簡介

- 摘要整理

- 辦理的專題

- 預測市場區隔

- 對主要的問題的回答

- 主要調查結果

- 調查手法

- 主要讀者

第 2 章 RAN 自動化概述

- 什麼是 RAN 自動化?

- 智慧型 RAN 實施的自動化水平

- RAN 自動化功能區域

- RAN 自動化價值鏈

- 市場驅動因素

- 5G 時代 RAN 的複雜性不斷增加

- 採用開放式 RAN 和 vRAN(虛擬化 RAN)

- 降低 TCO(總擁有成本)

- 節能、永續、環保

- 操作型人工智慧技術和生成型人工智慧技術都很受歡迎

- 訂閱者體驗與網路效能優勢

- 網路切片與新的創收機會

- 共享頻譜、私人 5G 和中立主機網路的普及

- 市場壁壘

- 服務提供者利潤停滯和成本削減措施

- 棕地 RAN 再投資週期緩慢

- 實施相關的技術課題

- 標準化差距與多供應商互通性

- 緩解 x/rApp 之間的衝突

- 現有 RAN 供應商的優勢

- 對自動化的保守與信任

- 網路安全與隱私問題

第 3 章 RAN 自動化技術、架構、用例

- 傳統 SON 解決方案

- 基於開放規範的 RIC、SMO、xApps、rApps

- AI 原生 RAN 基礎設施

- RAN 規劃與最佳化

- 檢查和測量解決方案

- 超越 RAN 的自動化和智能

- 網路自動化用例

第 4 章智慧 RAN 實施的主要趨勢

- 從 SON 遷移到基於開放 RAN 的 RIC、SMO、xApps、rApps

- 實現更高水準的自動化

- 營運人工智慧與機器學習

- 生成式人工智慧

- 網路資料分析

- 網路運作的可觀察性

- 雲端原生和以軟體為中心的網絡

- 其他趨勢和發展

第5章 標準化與共同活動

- 3GPP

- AI-RAN Alliance

- ETSI

- GSMA

- GTAA

- IETF

- ITU

- Linux Foundation

- NGMN Alliance

- ONF

- O-RAN Alliance

- OSA

- OSSii

- SCF

- TIP

- TM Forum

- 其他的活動與學術研究

第6章 RAN自動化的案例研究

- AT&T

- Bell Canada

- Bharti Airtel

- BT Group

- DT (Deutsche Telekom)

- Elisa

- Globe Telecom

- NTT DoCoMo

- Ooredoo

- Orange

- Rakuten Mobile

- Singtel

- SK Telecom

- STC (Saudi Telecom Company)

- Telecom Argentina

- Telefonica Group

- TIM (Telecom Italia Mobile)

- Turkcell

- Verizon Communications

- Vodafone Group

- 其他近幾年的發展和進行中的計劃

第7章 主要生態系統企業

- A10 Networks

- A5G Networks

- Aalyria

- Aarna Networks

- Abside Networks

- Accedian

- Accelleran

- Accuver (InnoWireless)

- Acentury

- Actiontec Electronics

- Adtran

- Aglocell

- AI-LINK

- Aira Technologies

- AirHop Communications

- Airspan Networks

- AiVader

- Aliniant

- Allot

- Alpha Networks

- Amazon/AWS (Amazon Web Services)

- AMD (Advanced Micro Devices)

- Amdocs

- Anktion (Fujian) Technology

- Anritsu

- Antevia Networks

- Arcadyan Technology Corporation (Compal Electronics)

- Argela

- Arm

- ArrayComm (Chengdu ArrayComm Wireless Technologies)

- Arrcus

- Artemis Networks

- Artiza Networks

- Arukona

- AsiaInfo Technologies

- Askey Computer Corporation (ASUS - ASUSTeK Computer)

- ASOCS

- Aspire Technology (NEC Corporation)

- ASTRI (Hong Kong Applied Science and Technology Research Institute)

- Ataya

- ATDI

- Atesio

- Atrinet (ServiceNow)

- Auray Technology (Auden Techno)

- Aviat Networks

- Azcom Technology

- Baicells

- Betacom

- BLiNQ Networks (CCI - Communication Components Inc.)

- Blu Wireless

- Booz Allen Hamilton

- BravoCom

- Broadcom

- BTI Wireless

- BubbleRAN

- B-Yond/Reailize

- C3Spectra

- CableFree (Wireless Excellence)

- Cambium Networks

- Capgemini Engineering

- CBNG (Cambridge Broadband Networks Group)

- Celfinet (Cyient)

- Celona

- CelPlan Technologies

- Ceragon Networks

- CGI

- Chengdu NTS

- CICT - China Information and Communication Technology Group (China Xinke Group)

- Ciena Corporation

- CIG (Cambridge Industries Group)

- Cisco Systems

- Clavister

- Cohere Technologies

- Comarch

- Comba Telecom

- CommAgility (E-Space)

- CommScope

- Compal Electronics

- COMSovereign

- Contela

- Corning

- Creanord

- Cyient

- DeepSig

- Dell Technologies

- DGS (Digital Global Systems)

- Digis Squared

- Digitata

- D-Link Corporation

- Druid Software

- DZS

- ECE (European Communications Engineering)

- EDX Wireless

- eino

- Elisa Polystar

- Encora

- Equiendo

- Ericsson

- Errigal

- ETRI (Electronics & Telecommunications Research Institute, South Korea)

- EXFO

- F5

- Fairspectrum

- Federated Wireless

- Firecell

- Flash Networks

- Forsk

- Fortinet

- Foxconn (Hon Hai Technology Group)

- Fraunhofer HHI (Heinrich Hertz Institute)

- Fujitsu

- FullRays (LDAS - LocationDAS)

- Future Connections

- FYRA

- G REIGNS (HTC Corporation)

- Gemtek Technology

- GENEViSiO (QNAP Systems)

- Gigamon

- GigaTera Communications (KMW)

- GlobalLogic (Hitachi)

- Globalstar

- Google (Alphabet)

- Groundhog Technologies

- Guavus (Thales)

- GXC (Formerly GenXComm)

- HCLTech (HCL Technologies)

- Helios (Fujian Helios Technologies)

- HFR Networks

- Highstreet Technologies

- Hitachi

- HPE (Hewlett Packard Enterprise)

- HSC (Hughes Systique Corporation)

- Huawei

- IBM

- iBwave Solutions

- iConNext

- Infinera

- Infosys

- Infovista

- Inmanta

- Innovile

- InnoWireless

- Intel Corporation

- InterDigital

- Intracom Telecom

- Inventec Corporation

- ISCO International

- IS-Wireless

- Itential

- ITRI (Industrial Technology Research Institute, Taiwan)

- JMA Wireless

- JRC (Japan Radio Company)

- Juniper Networks (HPE - Hewlett Packard Enterprise)

- Key Bridge Wireless

- Keysight Technologies

- Kleos

- KMW

- Kumu Networks

- Lemko Corporation

- Lenovo

- Lime Microsystems

- LIONS Technology

- LITE-ON Technology Corporation

- LitePoint (Teradyne)

- LS telcom

- LuxCarta

- MantisNet

- Marvell Technology

- Mavenir

- Maxar Technologies

- Meta

- MicroNova

- Microsoft Corporation

- MikroTik

- MitraStar Technology (Unizyx Holding Corporation)

- Mobileum

- MosoLabs (Sercomm Corporation)

- MYCOM OSI

- Nash Technologies

- NEC Corporation

- Net AI

- Netcracker Technology (NEC Corporation)

- NETSCOUT Systems

- Netsia (Argela)

- Neutroon Technologies

- New H3C Technologies (Tsinghua Unigroup)

- New Postcom Equipment

- Nextivity

- Node-H

- Nokia

- Novowi

- NuRAN Wireless

- NVIDIA Corporation

- NXP Semiconductors

- Oceus Networks

- Omnitele

- OneLayer

- Ookla

- Opanga Networks

- OREX (NTT DoCoMo)

- P.I. Works

- Palo Alto Networks

- Parallel Wireless

- Pente Networks

- Phluido

- Picocom

- Pivotal Commware

- Potevio (CETC - China Electronics Technology Group Corporation)

- QCT (Quanta Cloud Technology)

- Qualcomm

- Quanta Computer

- Qucell Networks (InnoWireless)

- RADCOM

- Radisys (Reliance Industries)

- Radware

- Rakuten Symphony

- Ranlytics

- Ranplan Wireless

- Rebaca Technologies

- Red Hat (IBM)

- RED Technologies

- REPLY

- RIMEDO Labs

- Rivada Networks

- Rohde & Schwarz

- Ruijie Networks

- RunEL

- SageRAN (Guangzhou SageRAN Technology)

- Samji Electronics

- Samsung

- Sandvine

- Sercomm Corporation

- ServiceNow

- Shabodi

- Signalwing

- SIRADEL

- Skyvera (TelcoDR)

- SOLiD

- Sooktha

- Spectrum Effect

- Spirent Communications

- SRS (Software Radio Systems)

- SSC (Shared Spectrum Company)

- Star Solutions

- Subex

- Sunwave Communications

- Supermicro (Super Micro Computer)

- SynaXG Technologies

- Systemics-PAB

- T&W (Shenzhen Gongjin Electronics)

- Tarana Wireless

- TCS (Tata Consultancy Services)

- Tech Mahindra

- Tecore Networks

- TECTWIN

- Telrad Networks

- TEOCO/Aircom

- ThinkRF

- TI (Texas Instruments)

- TietoEVRY

- Tropico (CPQD - Center for Research and Development in Telecommunications, Brazil)

- TTG International

- Tupl

- ULAK Communication

- Vavitel (Shenzhen Vavitel Technology)

- VHT (Viettel High Tech)

- VIAVI Solutions

- VMware (Broadcom)

- VNL - Vihaan Networks Limited (Shyam Group)

- Wave Electronics

- WDNA (Wireless DNA)

- WIM Technologies

- Wind River Systems

- Wipro

- Wiwynn (Wistron Corporation)

- WNC (Wistron NeWeb Corporation)

- Xingtera

- ZaiNar

- Z-Com

- Zeetta Networks

- Zinkworks

- ZTE

- zTouch Networks

- Zyxel (Unizyx Holding Corporation)

第8章 市場規模的估計與預測

- 行動網路自動化

- 網路網域二級市場

- RAN 自動化功能區域

- 基於 SON 的自動化二級市場

- 開放 RAN 自動化二級市場

- 幾代接取技術

- 區域細分

- 北美

- 亞太地區

- 歐洲

- 中東·非洲

- 南美和中美

第9章 結論與策略性推薦

- 為什麼市場預期會成長?

- 未來路線圖(2024-2030)

- 檢查 RAN 自動化的實際優勢和降低 TCO 的潛力

- 智慧自動化對 RAN 工程作用的影響

- 從 SON 遷移到開放式 RAN 自動化

- 用例和 AI/ML 演算法的演變

- 更重視能源效率與永續發展

- 垂直工業和民用無線電自動化

- 多元化的 x/rApp 開發者社區

- SMO 和 RIC 生態係出現整合跡象

- 哪家 RAN 自動化平台和應用供應商正在引領市場?

- 在 RAN 基頻產品中託管第三方應用的前景

- 為基於 AI/ML 的 6G 空中介面鋪路

- 人工智慧和 RAN 基礎設施的融合

- 策略建議

第10章 專家的意見 - 採訪的記錄

- AirHop Communications

- Amdocs

- Groundhog Technologies

- Innovile

- Net AI

- Nokia

- P.I. Works

- Qualcomm

- Rakuten Mobile

- RIMEDO Labs

Automation of the RAN (Radio Access Network) - the most expensive, technically complex and power-intensive part of cellular infrastructure - is a key aspect of mobile operators' digital transformation strategies aimed at reducing their TCO (Total Cost of Ownership), improving network quality and achieving revenue generation targets. In conjunction with AI (Artificial Intelligence) and ML (Machine Learning), RAN automation has the potential to significantly transform mobile network economics by reducing the OpEx (Operating Expenditure)-to-revenue ratio, minimizing energy consumption, lowering CO2 (Carbon Dioxide) emissions, deferring avoidable CapEx (Captial Expenditure), optimizing performance, improving user experience and enabling new services.

The RAN automation market traces its origins to the beginning of the LTE era when SON (Self-Organizing Network) technology was introduced to reduce cellular network complexity through self-configuration, self-optimization and self-healing. While embedded D-SON (Distributed SON) capabilities such as ANR (Automatic Neighbor Relations) have become a standard feature in RAN products, C-SON (Centralized SON) solutions that abstract control from edge nodes for network-wide actions have been adopted by less than a third of world's approximately 800 national mobile operators due to constraints associated with multi-vendor interoperability, scalability and latency.

These shortcomings, together with the cellular industry's shift towards open interfaces, common information models, virtualization and software-driven networking, are driving a transition from the traditional D-SON and C-SON approach to Open RAN automation with standards-based components - specifically the Near-RT (Real-Time) and Non-RT RICs (RAN Intelligent Controllers), SMO (Service Management & Orchestration) framework, xApps (Extended Applications) and rApps (RAN Applications) - that enable greater levels of RAN programmability and automation.

Along with the ongoing SON to RIC transition, RAN automation use cases have also evolved over the last decade. For example, relatively basic MLB (Mobility Load Balancing) capabilities have metamorphosed into more sophisticated policy-guided traffic steering applications that utilize AI/ML-driven optimization algorithms to efficiently adapt to peaks and troughs in network load and service usage by dynamically managing and redistributing traffic across radio resources and frequency layers.

Due to the much higher density of radios and cell sites in the 5G era, energy efficiency has emerged as one of the most prioritized use cases of RAN automation as forward-thinking mobile operators push ahead with sustainability initiatives to reduce energy consumption, carbon emissions and operating costs without degrading network quality. Some of the other use cases that have garnered considerable interest from the operator community include network slicing enablement, application-aware optimization and anomaly detection.

While the benefits of SON-based RAN automation in live networks are well-known, expectations are even higher with the RIC, SMO and x/rApps approach. For example, Japanese brownfield operator NTT DoCoMo expects to lower its TCO by up to 30% and decrease power consumption at base stations by as much as 50% using Open RAN automation. It is worth highlighting that domestic rival Rakuten Mobile has already achieved approximately 17% energy savings per cell in its live network using RIC-hosted RAN automation applications. Following successful lab trials, the greenfield operator aims to increase savings to 25% with more sophisticated AI/ML models.

Although Open RAN automation efforts seemingly lost momentum beyond the field trial phase for the past couple of years, several commercial engagements have emerged since then, with much of the initial focus on the SMO, Non-RT RIC and rApps for automated management and optimization across Open RAN, purpose-built and hybrid RAN environments. Within the framework of its five-year $14 Billion Open RAN infrastructure contract with Ericsson, AT&T is adopting the Swedish telecommunications giant's SMO and Non-RT RIC solution to replace two legacy C-SON systems. In neighboring Canada, Telus has also initiated the implementation of an SMO and RIC platform along with its multi-vendor Open RAN deployment to transform up to 50% of its RAN footprint and swap out Huawei equipment from its 4G/5G network.

Similar efforts are also underway in other regions. For example, in Europe, Swisscom is deploying an SMO and Non-RT RIC platform to provide multi-technology network management and automation capabilities as part of a wider effort to future-proof its brownfield mobile network, while Deutsche Telekom is progressing with plans to develop its own vendor-independent SMO framework. Open RAN automation is also expected to be introduced as part of Vodafone Group's global tender for refreshing 170,000 cell sites.

Deployments of newer generations of proprietary SON-based RAN automation solutions have not stalled either. In its pursuit of achieving L4 (Highly Autonomous Network) operations, China Mobile has recently initiated the implementation of a hierarchical RAN automation platform and an associated digital twin system, starting with China's Henan province. Among other interesting examples, SoftBank is implementing a closed loop automation solution for cluster-wide RAN optimization in stadiums, event venues, and other strategic locations across Japan, which supports data collection and parameter tuning in 1-5 minute intervals as opposed to the 15-minute control cycle of traditional C-SON systems. It should be noted that the Japanese operator eventually plans to adopt RIC-hosted centralized RAN optimization applications in the future.

In addition, with the support of several mobile operators, including SoftBank, Vodafone, Bell Canada and Viettel, the idea of hosting third party applications for real-time intelligent control and optimization - also referred to as dApps (Distributed Applications) - directly within RAN baseband platforms is beginning to gain traction. As a counterbalance to this approach, Ericsson, Nokia, Huawei and other established RAN vendors are making considerable progress with a stepwise approach towards embedding AI and ML functionalities deeper into their DU (Distributed Unit) and CU (Centralized Unit) products in line with the 3GPP's long-term vision of an AI/ML-based air interface in the 6G era.

SNS Telecom & IT estimates that global spending on RIC, SMO and x/rApps will grow at a CAGR of more than 125% between 2024 and 2027 alongside the second wave of Open RAN infrastructure rollouts by brownfield operators. The Open RAN automation market will eventually account for nearly $700 Million in annual investments by the end of 2027 as standardization gaps and technical challenges in terms of the SMO-to-Non-RT RIC interface, application portability across RIC platforms and conflict mitigation between x/rApps are ironed out. The wider RAN automation software and services market - which includes Open RAN automation, RAN vendor SON solutions, third party C-SON platforms, baseband-integrated intelligent RAN applications, RAN planning and optimization software, and test/measurement solutions - is expected to grow at a CAGR of approximately 8% during the same period.

The "RAN Automation, SON, RIC, xApps & rApps in the 5G Era: 2024 - 2030 - Opportunities, Challenges, Strategies & Forecasts" report presents an in-depth assessment of the RAN automation market, including the value chain, market drivers, barriers to uptake, enabling technologies, functional areas, use cases, key trends, future roadmap, standardization, case studies, ecosystem player profiles and strategies. The report also provides global and regional market size forecasts for RAN and end-to-end mobile network automation from 2024 to 2030. The forecasts cover three network domains, nine functional areas, three access technologies and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report.

Key Findings

The report has the following key findings:

- SNS Telecom & IT estimates that global spending on RIC, SMO and x/rApps will grow at a CAGR of more than 125% between 2024 and 2027 alongside the second wave of Open RAN infrastructure rollouts by brownfield operators. The Open RAN automation market will eventually account for nearly $700 Million in annual investments by the end of 2027 as standardization gaps and technical challenges in terms of the SMO-to-Non-RT RIC interface, application portability across RIC platforms and conflict mitigation between x/rApps are ironed out.

- The wider market for RAN automation software and services - which includes Open RAN automation, RAN vendor SON solutions, third party C-SON platforms, baseband-integrated intelligent RAN applications, RAN planning and optimization software, and test/measurement solutions - is expected to grow at a CAGR of approximately 8% during the same period.

- The shortcomings of the traditional D-SON and C-SON approach, together with the cellular industry's shift towards open interfaces, common information models, virtualization and software-driven networking, are driving a transition to Open RAN automation with standards-based components that enable greater levels of RAN programmability and automation.

- The Open RAN automation movement is stimulating innovation from a diversified community of application developers. In addition to well over a dozen providers of SMO, Non-RT RIC and Near-RT RIC products, more than 50 companies are actively engaged in the development of xApps and rApps.

- Some mobile operators have established dedicated business units to commoditize their RAN automation expertise. NTT DoCoMo's OREX brand and Rakuten Mobile's sister company Rakuten Symphony are two well-known cases in point. In the coming years, we also expect to see more spinoffs of academic institutes with commercial-grade Open RAN automation offerings, such as Northeastern University's zTouch Networks and TU Ilmenau's AiVader.

- The SMO and RIC ecosystem is exhibiting early signs of consolidation with Broadcom's takeover of VMware and HPE's planned acquisition of Juniper Networks, although both deals have much wider ranging implications for the AI infrastructure and networking industries. Depending on the commercial success of third party RAN automation platforms, we anticipate seeing further M&A (Mergers & Acquisition) activity reminiscent of the SON boom in the previous decade.

- While the benefits of SON-based RAN automation in live networks are well-known, expectations are even higher with the RIC, SMO and x/rApps approach. For example, Japanese brownfield operator NTT DoCoMo expects to lower its TCO by up to 30% and decrease power consumption at base stations by as much as 50% using Open RAN automation.

- It is worth highlighting that domestic rival Rakuten Mobile has already achieved approximately 17% energy savings per cell in its live network using RIC-hosted RAN automation applications. Following successful lab trials, the greenfield operator aims to increase savings to 25% with more sophisticated AI/ML models.

- Outside of public mobile operator networks, interest is also growing in vertical industries and the private wireless segment. The U.S. DOD (Department of Defense) is actively exploring the potential of RIC-hosted x/rApps to enhance the ability to detect, analyze, and mitigate a wide range of security threats in Open RAN networks for both commercial and warfighter communication scenarios. Among other examples, Taiwanese electronics manufacturer Inventec has incorporated rApps for indoor positioning and traffic steering as part of its private 5G network solution for smart factories.

- Although Open RAN automation efforts seemingly lost momentum beyond the field trial phase for the past couple of years, several commercial engagements have emerged since then, with much of the initial focus on the SMO, Non-RT RIC and rApps for automated management and optimization across Open RAN, purpose-built and hybrid RAN environments.

- Within the framework of its five-year $14 Billion Open RAN infrastructure contract with Ericsson, AT&T is adopting the Swedish telecommunications giant's SMO and Non-RT RIC solution to replace two legacy C-SON systems. In neighboring Canada, Telus has also initiated the implementation of an SMO and RIC platform along with its multi-vendor Open RAN deployment to transform up to 50% of its RAN footprint and swap out Huawei equipment from its 4G/5G network.

- Similar efforts are also underway in other regions. For example, in Europe, Swisscom is deploying an SMO and Non-RT RIC platform to provide multi-technology network management and automation capabilities as part of a wider effort to future-proof its brownfield mobile network, while Deutsche Telekom is progressing with plans to develop its own vendor-independent SMO framework. Open RAN automation is also expected to be introduced as part of Vodafone Group's global tender for refreshing 170,000 cell sites.

- Deployments of newer generations of proprietary SON-based RAN automation solutions have not stalled either. In its pursuit of achieving L4 automation, China Mobile has recently initiated the implementation of a hierarchical RAN automation platform and an associated digital twin system, starting with China's Henan province.

- Among other interesting examples, SoftBank is implementing a closed loop automation solution for cluster-wide RAN optimization in stadiums, event venues, and other strategic locations across Japan, which supports data collection and parameter tuning in 1-5 minute intervals as opposed to the 15-minute control cycle of traditional C-SON systems. It should be noted that the Japanese operator eventually plans to adopt RIC-hosted centralized RAN optimization applications in the future.

- In addition, with the support of several mobile operators, including SoftBank, Vodafone, Bell Canada and Viettel, the idea of hosting third party applications for real-time intelligent control and optimization - also referred to as dApps - directly within RAN baseband platforms is beginning to gain traction.

- As a counterbalance to this approach, Ericsson, Nokia, Huawei and other established RAN vendors are making considerable progress with a stepwise approach towards embedding AI and ML functionalities deeper into their DU and CU products in line with the 3GPP's long-term vision of an AI/ML-based air interface in the 6G era.

- Beyond AI-driven RAN performance and efficiency improvements, mobile operators, technology suppliers and other stakeholders are also setting their sights on TCO benefits and new revenue opportunities enabled by the convergence of AI and RAN, including co-hosting vRAN and AI workloads on the same underlying infrastructure to maximize asset utilization and leveraging the RAN as a platform for edge AI services.

Topics Covered

The report covers the following topics:

- Introduction to RAN automation

- Value chain and ecosystem structure

- Market drivers and challenges

- Functional areas of RAN automation

- RAN automation technology and architecture, including D-SON, C-SON, H-SON, Near-RT/Non-RT RICs, SMO, x/rApps, baseband-integrated intelligent RAN applications, RAN planning and optimization software, and test & measurement solutions

- Review of over 70 RAN automation use cases, ranging from ANR, PCI and RACH optimization to advanced traffic steering, QoE-based resource allocation, energy savings, network slicing, private 5G automation, anomaly detection and dynamic RAN security

- Key trends in intelligent RAN implementations, including the SON-to-RIC transition, closed loop automation, intent-driven management, operational AI/ML, Gen AI, data analytics and application awareness

- Cross-domain mobile network automation enablers and application scenarios across the RAN, core and xHaul transport segments of cellular infrastructure

- Detailed case studies of 20 production-grade RAN automation deployments and examination of ongoing projects covering both traditional SON and Open RAN automation approaches

- Future roadmap of RAN automation

- Standardization and collaborative initiatives

- Profiles and strategies of more than 280 ecosystem players, including RAN infrastructure vendors, SON, RIC and SMO platform providers, x/rApp developers, AI/ML technology specialists, RAN planning and optimization software suppliers, and test/measurement solution providers

- Exclusive interview transcripts from 10 companies across the RAN automation value chain: AirHop Communications, Amdocs, Groundhog Technologies, Innovile, Net AI, Nokia, P.I. Works, Qualcomm, Rakuten Mobile and RIMEDO Labs

- Strategic recommendations for RAN automation solution providers and mobile operators

- Market analysis and forecasts from 2024 to 2030

Forecast Segmentation

Market forecasts are provided for each of the following submarkets and their subcategories:

Mobile Network Automation Submarkets

- RAN

- Mobile Core

- xHaul (Fronthaul, Midhaul & Backhaul) Transport

RAN Automation Functional Areas

- SON-Based Automation

- RAN Vendor SON Solutions

- Third Party C-SON Platforms

- Open RAN Automation

- Non-RT RIC & SMO

- Near-RT RIC

- rApps

- xApps

- Baseband-Integrated Intelligent RAN Applications

- RAN Planning & Optimization Software

- Test & Measurement Solutions

Access Technology Generation Submarkets

- LTE

- 5G NR

- 6G

Regional Markets

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin & Central America

Key Questions Answered:

The report provides answers to the following key questions:

- How big is the RAN automation opportunity?

- What trends, drivers and challenges are influencing its growth?

- What will the market size be in 2027, and at what rate will it grow?

- Which submarkets and regions will see the highest percentage of growth?

- What are the practical and quantifiable benefits of RAN automation based on live commercial deployments?

- What is the TCO reduction and cost savings potential of RAN automation?

- What is the adoption status of traditional SON solutions and Open RAN specifications-compliant Near-RT RIC, Non-RT RIC, SMO, xApps and rApps?

- How can brownfield operators capitalize on Open RAN automation to simplify the management and optimization of hybrid RAN environments?

- In what way will automation and AI/ML facilitate network slicing, MIMO, beamforming, lower-layer optimization and other advanced RAN capabilities in the 5G era?

- What are the application scenarios of operational AI/ML and Gen AI in the RAN automation market?

- What opportunities exist for automation in the mobile core and xHaul transport domains?

- How does RAN automation ease the deployment and operation of private 5G networks?

- In what way does intelligent automation impact the role of RAN engineers?

- Who are the key ecosystem players, and what are their strategies?

- Which RAN automation platform and application vendors are leading the market?

- What strategies should RAN automation solution providers and mobile operators adopt to remain competitive?

Table of Contents

1. Chapter 1: Introduction

- 1.1. Executive Summary

- 1.2. Topics Covered

- 1.3. Forecast Segmentation

- 1.4. Key Questions Answered

- 1.5. Key Findings

- 1.6. Methodology

- 1.7. Target Audience

2. Chapter 2: An Overview of RAN Automation

- 2.1. What is RAN Automation?

- 2.1.1. Automating Repetitive Manual Tasks

- 2.1.2. RAN Analytics & Data-Driven Decision Making

- 2.1.3. AI (Artificial Intelligence) & ML (Machine Learning) Integration

- 2.1.4. SMO (Service Management & Orchestration) Frameworks

- 2.2. Levels of Automation in Intelligent RAN Implementations

- 2.2.1. L0 - Manual Operation

- 2.2.2. L1 - Assisted Management

- 2.2.3. L2 - Partial Autonomous Network

- 2.2.4. L3 - Conditional Autonomous Network

- 2.2.5. L4 - Highly Autonomous Network

- 2.2.6. L5 - Fully Autonomous Network

- 2.3. Functional Areas of RAN Automation

- 2.3.1. The SON (Self-Organizing Network) Concept

- 2.3.2. RIC (RAN Intelligent Controller), xApps & rApps

- 2.3.3. Native AI Capabilities in RAN Infrastructure

- 2.3.4. Automation-Assisted RAN Planning & Optimization

- 2.3.5. RAN Test & Measurement Solutions

- 2.4. RAN Automation Value Chain

- 2.4.1. Semiconductor & Enabling AI/ML Technology Specialists

- 2.4.2. RAN Infrastructure Vendors

- 2.4.3. SON, xApp/rApp & Automation Application Developers

- 2.4.4. RIC, SMO & OSS Platform Providers

- 2.4.5. RAN Planning & Optimization Software Suppliers

- 2.4.6. Test & Measurement Solution Providers

- 2.4.7. Wireless Service Providers

- 2.4.7.1. National Mobile Operators

- 2.4.7.2. Fixed-Line Service Providers

- 2.4.7.3. Private 5G Network Operators

- 2.4.7.4. Neutral Hosts

- 2.4.8. End Users

- 2.4.8.1. Consumers

- 2.4.8.2. Enterprises & Vertical Industries

- 2.5. Market Drivers

- 2.5.1. Growing Complexity of RAN in the 5G Era

- 2.5.2. Open RAN & vRAN (Virtualized RAN) Adoption

- 2.5.3. TCO (Total Cost of Ownership) Reduction

- 2.5.4. Energy Savings, Sustainability & Environmental Conservation

- 2.5.5. Popularity of Both Operational & Generative AI Technologies

- 2.5.6. Subscriber Experience & Network Performance Benefits

- 2.5.7. Network Slicing & New Revenue-Generating Opportunities

- 2.5.8. Proliferation of Shared Spectrum, Private 5G & Neutral Host Networks

- 2.6. Market Barriers

- 2.6.1. Service Provider Revenue Stagnation & Cost-Cutting Measures

- 2.6.2. Slow Pace of Brownfield RAN Reinvestment Cycles

- 2.6.3. Implementation-Related Technical Challenges

- 2.6.4. Standardization Gaps & Multi-Vendor Interoperability

- 2.6.5. Conflict Mitigation Between x/rApps

- 2.6.6. Dominance of Incumbent RAN Vendors

- 2.6.7. Conservatism & Trust in Automation

- 2.6.8. Network Security & Privacy Concerns

3. Chapter 3: RAN Automation Technology, Architecture & Use Cases

- 3.1. Traditional SON Solutions

- 3.1.1. Application Areas

- 3.1.1.1. Self-Configuration

- 3.1.1.2. Self-Optimization

- 3.1.1.3. Self-Healing

- 3.1.1.4. Self-Protection

- 3.1.1.5. Self-Learning

- 3.1.2. SON Architecture

- 3.1.2.1. D-SON (Distributed SON)

- 3.1.2.2. C-SON (Centralized SON)

- 3.1.2.3. H-SON (Hybrid SON)

- 3.1.1. Application Areas

- 3.2. Open Specifications-Based RIC, SMO, xApps & rApps

- 3.2.1. Architectural Elements

- 3.2.1.1. Near-RT (Real-Time) RIC

- 3.2.1.2. Non-RT RIC

- 3.2.1.3. SMO Framework

- 3.2.1.4. xApps (Extended Applications)

- 3.2.1.5. rApps (RAN Applications)

- 3.2.2. Open Interfaces

- 3.2.2.1. A1 Interface Between Non-RT RIC & Near-RT RIC

- 3.2.2.2. E2 Interface Between Near RT-RIC & RAN Nodes

- 3.2.2.3. O1 Interface for OAM (Operations, Administration & Maintenance)

- 3.2.2.4. O2 Interface for Cloud Infrastructure Management

- 3.2.2.5. R1 Interface for rApp Portability Across RIC Platforms

- 3.2.2.6. xApp APIs (Application Programming Interfaces)

- 3.2.2.7. Potential Decoupling of the SMO & Non-RT RIC

- 3.2.2.8. Open Fronthaul M-Plane Interface

- 3.2.2.9. Y1 Interface for RAN Analytics Exposure

- 3.2.1. Architectural Elements

- 3.3. AI-Native RAN Infrastructure

- 3.3.1. AI/ML-Based Air Interface for 6G Networks

- 3.3.2. Microsecond-Level Intelligent RAN Control & Optimization

- 3.3.3. Synergies With the dApps (Distributed Applications) Concept

- 3.3.4. AI-RAN Workload Sharing & RAN as a Platform for Edge AI Services

- 3.4. RAN Planning & Optimization

- 3.4.1. RAN Planning & Optimization Software Platforms

- 3.4.2. Specialized Products for In-Building Wireless Network Design

- 3.4.3. Other Categories of RAN Operations Support & Optimization Tools

- 3.5. Test & Measurement Solutions

- 3.5.1. Testing of RIC Platforms & Other RAN Automation Products

- 3.5.2. Automation & AI/ML Features in Test & Measurement Solutions

- 3.6. Automation & Intelligence Beyond the RAN

- 3.6.1. Mobile Core Networks

- 3.6.2. xHaul (Fronthaul, Midhaul & Backhaul) Transport

- 3.6.3. Device-Driven Intelligence & Optimization

- 3.7. Network Automation Use Cases

- 3.7.1. Neighbor Relations, PCI & RACH Optimization

- 3.7.1.1. ANR (Automatic Neighbor Relations)

- 3.7.1.2. CNR (Centralized Neighbor Relations)

- 3.7.1.3. PCI (Physical Cell ID) Conflict Detection & Resolution

- 3.7.1.4. RACH (Random Access Channel)/RSI (Root Sequence Index) Optimization

- 3.7.2. Mobility & Handover Management

- 3.7.2.1. MRO/bMRO (Cell & Beam-Based Mobility Robustness Optimization)

- 3.7.2.2. QoS-Based Adaptive & Intelligent Handover Optimization

- 3.7.2.3. CHO (Conditional Handover) Management

- 3.7.2.4. DAPS (Dual Active Protocol Stack) Handover Management

- 3.7.2.5. Handover Management for V2X, UAV & Railway Communications

- 3.7.3. RAN Resource Optimization

- 3.7.3.1. CCO (Coverage & Capacity Optimization)

- 3.7.3.2. AI/ML-Assisted Dynamic Cell Shaping

- 3.7.3.3. MLB (Mobility Load Balancing)/LBO (Load Balancing Optimization)

- 3.7.3.4. Advanced Traffic Steering for Efficient Load Distribution

- 3.7.3.5. QoS & QoE-Based Dynamic Resource Allocation

- 3.7.3.6. Policy-Guided QoS/QoE Nudging

- 3.7.3.7. Application-Aware RAN Optimization

- 3.7.3.8. Special Event Management

- 3.7.3.9. Intelligent Control in RAN Sharing Arrangements

- 3.7.3.10. Dynamic Reallocation of Idle RAN Compute Resources

- 3.7.4. Energy Efficiency & Sustainability

- 3.7.4.1. Energy Savings in the RAN

- 3.7.4.2. Dynamic Transmit Power Adaptation

- 3.7.4.3. Carrier & Cell On/Off Switching

- 3.7.4.4. RF Channel Reconfiguration: Massive MIMO Muting

- 3.7.4.5. Advanced Sleep Mode Control in RUs (Radio Units)

- 3.7.4.6. DU/CU (Distributed & Centralized Unit) Pooling & Power Management

- 3.7.4.7. Carbon Footprint Awareness & Emission Control

- 3.7.4.8. RAN-Driven Optimization of UE Energy Consumption

- 3.7.5. Spectrum Management & Multi-RAT Connectivity

- 3.7.5.1. Frequency Layer Management

- 3.7.5.2. Sector Carrier Orchestration

- 3.7.5.3. CA (Carrier Aggregation) Optimization

- 3.7.5.4. MCIM/ICIM (Multi/Inter-Cell Interference Management)

- 3.7.5.5. Atmospheric Ducting Interference Mitigation

- 3.7.5.6. Shared & Unlicensed Spectrum Coordination

- 3.7.5.7. DSS (Dynamic Spectrum Sharing)

- 3.7.5.8. 4G-5G DC (Dual Connectivity) Control

- 3.7.5.9. JCAS (Joint Communication & Sensing)

- 3.7.6. Network Healing & Protection

- 3.7.6.1. AD (Anomaly Detection) & Remediation

- 3.7.6.2. COD/COC (Cell Outage Detection & Compensation)

- 3.7.6.3. SCDR (Sleeping Cell Detection & Recovery)

- 3.7.6.4. RET (Remote Electrical Tilt) Adjustment in Disaster Scenarios

- 3.7.6.5. CPM (Congestion Prediction & Management)

- 3.7.6.6. RF Jamming Detection

- 3.7.6.7. Signaling Storm Protection

- 3.7.6.8. Closed Loop RAN Security

- 3.7.7. Massive MIMO, Beamforming & Lower-Layer Optimization

- 3.7.7.1. GoB (Grid-of-Beams) Beamforming Optimization

- 3.7.7.2. Non-GoB (Reciprocity-Based) Beamforming Optimization

- 3.7.7.3. AI/ML-Assisted Beam Selection & Management

- 3.7.7.4. Initial Access Optimization in Massive MIMO Systems

- 3.7.7.5. MU (Multi-User)-MIMO Pairing Enhancement

- 3.7.7.6. Massive MIMO Grouping Optimization

- 3.7.7.7. Channel Estimation, Interpolation & Equalization

- 3.7.7.8. Link Adaptation & Other L1 (PHY)/MAC Algorithms

- 3.7.8. Network Slicing, Private 5G, NTN & Vertical Applications

- 3.7.8.1. RAN Slice Resource Allocation Optimization

- 3.7.8.2. RAN Slice SLA (Service Level Agreement) Assurance

- 3.7.8.3. Multi-Vendor Slice Management

- 3.7.8.4. Private 5G & Neutral Host Network Automation

- 3.7.8.5. IIoT (Industrial IoT) & Enterprise RAN Customization

- 3.7.8.6. NTN (Non-Terrestrial Network) Resource Orchestration

- 3.7.9. Network Planning & Evolution

- 3.7.9.1. RF Design

- 3.7.9.2. Site Selection

- 3.7.9.3. Capacity Planning

- 3.7.9.4. Canary Release

- 3.7.9.5. Network Digital Twin

- 3.7.9.6. Legacy Network Shutdown

- 3.7.10. Automation & AI Enablement

- 3.7.10.1. Conflict Management & Governance

- 3.7.10.2. RAN Geolocation Intelligence

- 3.7.10.3. UE Positioning & Trajectory Prediction

- 3.7.10.4. KPI (Key Performance Indicator) Monitoring

- 3.7.10.5. MDT (Minimization of Drive Tests) & RAN Data Collection

- 3.7.10.6. Integration of Datasets External to the RAN

- 3.7.10.7. AI/ML-Enabled Network Insights & Diagnostics

- 3.7.10.8. Traffic Forecasting & QoS/QoE Prediction

- 3.7.11. Multi-Domain, Core & Transport-Related Use Cases

- 3.7.11.1. Automated Configuration & Testing

- 3.7.11.2. Dynamic Autoscaling of Network Resources

- 3.7.11.3. Service Assurance, Fault Management & Cybersecurity

- 3.7.11.4. AI/ML-Driven Intelligence for End-to-End Network Slicing

- 3.7.11.5. Core Network Automation & Intelligent Orchestration

- 3.7.11.6. NWDAF (Network Data Analytics Function) for Core Network Analytics

- 3.7.11.7. MDAF (Management Data Analytics Function) for Management Plane Analytics

- 3.7.11.8. SDN (Software-Defined Networking)-Based xHaul Transport Automation

- 3.7.11.9. Interference Management in Microwave & mmWave (Millimeter Wave) Transport Links

- 3.7.11.10. Interworking Between RAN SMO, NWDAF, MDAF & Transport Domain SDN Controllers

- 3.7.1. Neighbor Relations, PCI & RACH Optimization

4. Chapter 4: Key Trends in Intelligent RAN Implementations

- 4.1. Transition From SON to Open RAN-Based RIC, SMO, xApps & rApps

- 4.1.1. AI/ML Integration From the Outset

- 4.1.2. Granular Insights & Faster Control Loops

- 4.1.3. Multi-Vendor Interoperability & Scalability

- 4.1.4. Diversified Ecosystem of RAN Application Developers

- 4.1.5. SDKs (Software Development Kits) for Accelerated Development

- 4.2. Moving Closer to Higher Levels of Automation

- 4.2.1. Building Confidence in Closed Loop Automation

- 4.2.2. Service-Centric Automated Network Optimization

- 4.2.3. Intent-Driven Network & Service Management

- 4.2.4. Long-Term Vision of Zero-Touch Operations

- 4.3. Operational AI & ML

- 4.3.1. Replacement of Classic Rule-Based Solutions With AI Algorithms

- 4.3.2. ML Models for Network Operations Automation

- 4.3.3. Supervised & Unsupervised Learning

- 4.3.4. RL (Reinforcement Learning)

- 4.3.5. Federated Learning

- 4.3.6. Deep Learning

- 4.4. Gen AI (Generative AI)

- 4.4.1. Differences From Conventional AI/ML

- 4.4.2. GANs (Generative Adversarial Networks)

- 4.4.3. VAEs (Variational Autoencoders)

- 4.4.4. Transformer Architecture

- 4.4.5. LLMs (Large Language Models)

- 4.4.6. Natural Language Interface for RAN Operations

- 4.5. Network Data Analytics

- 4.5.1. Descriptive Analytics

- 4.5.2. Diagnostic Analytics

- 4.5.3. Predictive Analytics

- 4.5.4. Prescriptive Analytics

- 4.6. Observability of Network Operations

- 4.6.1. Deeper Visibility Into RAN Telemetry

- 4.6.2. Integrating Supplementary Data Sources

- 4.6.3. End-to-End Network Observability Control

- 4.7. Cloud-Native & Software-Centric Networking

- 4.7.1. Cloud-Native Technologies

- 4.7.2. Microservices & SBA (Service-Based Architecture)

- 4.7.3. Network Virtualization & Containerization

- 4.7.4. SDN for Network Programmability

- 4.7.5. DevOps & CI/CD (Continuous Integration & Delivery)

- 4.8. Other Trends & Developments

- 4.8.1. RAN Densification & Multi-Layer Coordination

- 4.8.2. Plug & Play Small Cells in Industrial, Enterprise & Public Venues

- 4.8.3. RAN Automation for Private 5G Network Management

- 4.8.4. Support for Vertical Industry-Specific Use Cases

- 4.8.5. FWA (Fixed Wireless Access) Deployments

- 4.8.6. Shared & Unlicensed Spectrum

- 4.8.7. Network Slicing Enablement

- 4.8.8. AI-RAN & Edge Computing

- 4.8.9. Application Awareness

- 4.8.10. Dynamic Security

5. Chapter 5: Standardization & Collaborative Initiatives

- 5.1. 3GPP (Third Generation Partnership Project)

- 5.1.1. Releases 8-14: LTE SON Features

- 5.1.2. Release 15: 5G ANR, NWDAF & MDAF

- 5.1.3. Release 16: 5G SON, MDT & L2 Measurement Support

- 5.1.4. Release 17: Expansion of 5G Network Intelligence & Automation

- 5.1.5. Release 18: Laying the AI/ML Foundation for 5G Advanced Systems

- 5.1.6. Releases 19, 20, 21 & Beyond: Succession From 5G Advanced to AI-Native 6G Networks

- 5.2. AI-RAN Alliance

- 5.2.1. AI for RAN

- 5.2.2. AI & RAN

- 5.2.3. AI on RAN

- 5.3. ETSI (European Telecommunications Standards Institute)

- 5.3.1. OCG AI (Operational Co-ordination Group on AI)

- 5.3.2. Specific ISGs (Industry Specification Groups) & TCs (Technical Committees)

- 5.3.2.1. ENI (Experiential Networked Intelligence) ISG

- 5.3.2.2. ZSM (Zero-Touch Network & Service Management) ISG

- 5.3.2.3. TC INT (TC on Core Network & Interoperability Testing)

- 5.3.2.4. TC SAI (TC on Securing Artificial Intelligence)

- 5.3.2.5. Other ISGs & TCs

- 5.4. GSMA (GSM Association)

- 5.4.1. Efforts Related to AI & Network Automation

- 5.5. GTAA (Global Telco AI Alliance)

- 5.5.1. Accelerating Telco AI Transformation

- 5.5.2. Multi-Lingual LLM for Telco Operations

- 5.6. IETF (Internet Engineering Task Force)

- 5.6.1. Standardization for Automated Network Management

- 5.7. ITU (International Telecommunication Union)

- 5.7.1. ITU-R (ITU Radiocommunication Sector)

- 5.7.1.1. Work Related to AI-Native Air Interface & RAN

- 5.7.2. ITU-T (ITU Telecommunication Standardization Sector)

- 5.7.2.1. SG13 (Study Group 13): Future Networks & Emerging Technologies

- 5.7.2.2. FG-AN (Focus Group on Autonomous Networks)

- 5.7.2.3. FG-ML5G (Focus Group on ML for 5G & Future Networks)

- 5.7.1. ITU-R (ITU Radiocommunication Sector)

- 5.8. Linux Foundation

- 5.8.1. ONAP (Open Network Automation Platform)

- 5.8.2. Other AI & Network Automation-Related Projects

- 5.9. NGMN Alliance

- 5.9.1. SON Definition & Recommendations

- 5.9.2. Network Automation & Autonomy Based on AI

- 5.9.3. Green Future Networks for Energy Efficiency & Sustainability

- 5.10. ONF (Open Networking Foundation)

- 5.10.1. SMaRT-5G (Sustainable Mobile & RAN Transformation 5G)

- 5.10.2. SD-RAN (Software-Defined RAN): Near-RT RIC & Exemplar xApps

- 5.10.3. RRAIL (RAN RIC & Applications Interoperability Lab)

- 5.11. O-RAN Alliance

- 5.11.1. RIC Architecture Specifications

- 5.11.2. xApp & rApp Use Cases

- 5.11.3. O-RAN SC (Software Community)

- 5.11.4. Testing & Integration Support

- 5.12. OSA (OpenAirInterface Software Alliance)

- 5.12.1. M5G (MOSAIC5G): Flexible RAN & Core Controllers

- 5.12.2. FlexRIC (Flexible RAN Intelligent Controller) & xApp SDK Framework

- 5.13. OSSii (Operations Support Systems Interoperability Initiative)

- 5.13.1. Enabling Multi-Vendor OSS Interoperability

- 5.14. SCF (Small Cell Forum)

- 5.14.1. Small Cell SON & RAN Orchestration

- 5.15. TIP (Telecom Infra Project)

- 5.15.1. OpenRAN Project Group

- 5.15.1.1. RIA (RAN Intelligence & Automation) Subgroup

- 5.15.1.2. ROMA (RAN Orchestration & Lifecycle Management Automation) Subgroup

- 5.15.2. TelcoAI Project Group

- 5.15.1. OpenRAN Project Group

- 5.16. TM Forum

- 5.16.1. Addressing Higher-Level Aspects of Autonomous Networks

- 5.17. Other Initiatives & Academic Research

6. Chapter 6: RAN Automation Case Studies

- 6.1. AT&T

- 6.1.1. Vendor Selection

- 6.1.2. Deployment Review

- 6.1.3. Results & Future Plans

- 6.2. Bell Canada

- 6.2.1. Vendor Selection

- 6.2.2. Deployment Review

- 6.2.3. Results & Future Plans

- 6.3. Bharti Airtel

- 6.3.1. Vendor Selection

- 6.3.2. Deployment Review

- 6.3.3. Results & Future Plans

- 6.4. BT Group

- 6.4.1. Vendor Selection

- 6.4.2. Deployment Review

- 6.4.3. Results & Future Plans

- 6.5. DT (Deutsche Telekom)

- 6.5.1. Vendor Selection

- 6.5.2. Deployment Review

- 6.5.3. Results & Future Plans

- 6.6. Elisa

- 6.6.1. Vendor Selection

- 6.6.2. Deployment Review

- 6.6.3. Results & Future Plans

- 6.7. Globe Telecom

- 6.7.1. Vendor Selection

- 6.7.2. Deployment Review

- 6.7.3. Results & Future Plans

- 6.8. NTT DoCoMo

- 6.8.1. Vendor Selection

- 6.8.2. Deployment Review

- 6.8.3. Results & Future Plans

- 6.9. Ooredoo

- 6.9.1. Vendor Selection

- 6.9.2. Deployment Review

- 6.9.3. Results & Future Plans

- 6.10. Orange

- 6.10.1. Vendor Selection

- 6.10.2. Deployment Review

- 6.10.3. Results & Future Plans

- 6.11. Rakuten Mobile

- 6.11.1. Vendor Selection

- 6.11.2. Deployment Review

- 6.11.3. Results & Future Plans

- 6.12. Singtel

- 6.12.1. Vendor Selection

- 6.12.2. Deployment Review

- 6.12.3. Results & Future Plans

- 6.13. SK Telecom

- 6.13.1. Vendor Selection

- 6.13.2. Deployment Review

- 6.13.3. Results & Future Plans

- 6.14. STC (Saudi Telecom Company)

- 6.14.1. Vendor Selection

- 6.14.2. Deployment Review

- 6.14.3. Results & Future Plans

- 6.15. Telecom Argentina

- 6.15.1. Vendor Selection

- 6.15.2. Deployment Review

- 6.15.3. Results & Future Plans

- 6.16. Telefonica Group

- 6.16.1. Vendor Selection

- 6.16.2. Deployment Review

- 6.16.3. Results & Future Plans

- 6.17. TIM (Telecom Italia Mobile)

- 6.17.1. Vendor Selection

- 6.17.2. Deployment Review

- 6.17.3. Results & Future Plans

- 6.18. Turkcell

- 6.18.1. Vendor Selection

- 6.18.2. Deployment Review

- 6.18.3. Results & Future Plans

- 6.19. Verizon Communications

- 6.19.1. Vendor Selection

- 6.19.2. Deployment Review

- 6.19.3. Results & Future Plans

- 6.20. Vodafone Group

- 6.20.1. Vendor Selection

- 6.20.2. Deployment Review

- 6.20.3. Results & Future Plans

- 6.21. Other Recent Deployments & Ongoing Projects

- 6.21.1. 1&1: Highly Automated Control of Europe's First Greenfield Open RAN Network

- 6.21.2. 4iG Group: Closed Loop Network Management & Customer Experience Monitoring

- 6.21.3. America Movil: SON-Based RAN Automation for 5G Network Rollout & Optimization

- 6.21.4. Andorra Telecom: Doubling Throughput With Automated RF Interference Mitigation

- 6.21.5. Axiata Group: Autonomous Network Initiative for Streamlining Operations

- 6.21.6. Batelco: AI-Powered Energy Savings & Carbon Footprint Reduction

- 6.21.7. beCloud (Belarusian Cloud Technologies): AI-Enabled Network Management

- 6.21.8. Beeline Russia (VimpelCom): Transforming the Mobile Experience Using C-SON

- 6.21.9. BTC (Botswana Telecommunications Corporation): Nationwide Network Optimization

- 6.21.10. C Spire: SON-Enabled Automation of Regional Wireless Network

- 6.21.11. Cellfie Mobile: Intelligent RAN Monitoring & Management

- 6.21.12. CETIN Group: Multi-Domain Automated Network Optimization

- 6.21.13. China Mobile: Aiming for AI/ML-Assisted L4 Automation by 2025

- 6.21.14. China Telecom: Co-Governance of Shared 5G Network Infrastructure

- 6.21.15. China Unicom: CUBE-RAN Intelligent Open Platform

- 6.21.16. CK Hutchison: Accelerating the Journey Towards Fully Automated RAN Operations

- 6.21.17. DIGI Communications: Laying the Groundwork for Zero-Touch Automation

- 6.21.18. DISH Network Corporation: RIC-Based RAN Programmability & Intelligence

- 6.21.19. Djezzy: Harnessing C-SON for Automated RAN Optimization & Management

- 6.21.20. Etisalat Group (e&): AI/ML-Enabled Intelligent Network Management Platform

- 6.21.21. FET (Far EasTone Telecommunications): Advancing Sustainability Goals With ML-Driven RAN Automation

- 6.21.22. KDDI: Moving Towards RIC-Based Automation for Network Slicing Enablement

- 6.21.23. KPN: Replacing Labor-Intensive RAN Optimization Tools With SON-Based Automation

- 6.21.24. KT Corporation: Embracing Intelligent Control of RAN Resources & Operations

- 6.21.25. LG Uplus: Evaluating the RIC Approach for Vendor-Independent RAN Automation

- 6.21.26. Liberty Global: Building a Customer-First 5G Network Using Autonomous Optimization Decisions

- 6.21.27. LTT (Libya Telecom & Technology): Nationwide RAN Automation for Enhanced Network Quality

- 6.21.28. MASMOVIL: Improving Customer Experience During Peak Hours With ML-Assisted Optimization

- 6.21.29. MegaFon: Delivering an Exemplary Subscriber Experience Through SON Technology

- 6.21.30. MEO (Altice Portugal): Automated RAN Optimization & Service Assurance

- 6.21.31. MTN Group: Pioneering Autonomous Mobile Networks in Africa

- 6.21.32. MTS (Mobile TeleSystems): Self-Adjusting Intelligent Network

- 6.21.33. Odido: AI-Driven Cell Site Energy Management Solution

- 6.21.34. Reliance Jio Infocomm: Improving Customer Experience With C-SON

- 6.21.35. Rogers Communications: Cross-Domain Service Orchestration & Automation

- 6.21.36. Smart Communications (PLDT): Planning the SON-to-RIC Transition

- 6.21.37. Smartfren: Automating Heterogenous Network Management

- 6.21.38. SoftBank Group: Spearheading AI/ML-Driven Advancements in the RAN

- 6.21.39. Swisscom: Future-Proofing Brownfield Mobile Network With SMO & Non-RT RIC

- 6.21.40. TDC NET: Inching Towards Net Zero Goals With RAN Automation

- 6.21.41. Telia Company: Setting the Foundation for Zero-Touch Mobile Networks

- 6.21.42. Telkomsel: Autonomous Network Program for Operational Efficiency

- 6.21.43. Telstra: Advancing Mobile Network Automation Capabilities

- 6.21.44. Telus: SMO & RIC-Based RAN Network Intelligence Platform

- 6.21.45. TPG Telecom: Managing Peak Traffic Congestion With C-SON

- 6.21.46. Turk Telekom: Driving Efficiency Through Network Automation

- 6.21.47. Ucom (Armenia): AI Functionalities for Mobile Network Modernization

- 6.21.48. VEON: Leveraging C-SON to Enhance Network Performance

- 6.21.49. Viettel Group: AI/ML-Enabled Physical Layer Signal Processing

- 6.21.50. Zain Group: Targeting L4 Automation for Efficient 5G Network Operations

7. Chapter 7: Key Ecosystem Players

- 7.1. A10 Networks

- 7.2. A5G Networks

- 7.3. Aalyria

- 7.4. Aarna Networks

- 7.5. Abside Networks

- 7.6. Accedian

- 7.7. Accelleran

- 7.8. Accuver (InnoWireless)

- 7.9. Acentury

- 7.10. Actiontec Electronics

- 7.11. Adtran

- 7.12. Aglocell

- 7.13. AI-LINK

- 7.14. Aira Technologies

- 7.15. AirHop Communications

- 7.16. Airspan Networks

- 7.17. AiVader

- 7.18. Aliniant

- 7.19. Allot

- 7.20. Alpha Networks

- 7.21. Amazon/AWS (Amazon Web Services)

- 7.22. AMD (Advanced Micro Devices)

- 7.23. Amdocs

- 7.24. Anktion (Fujian) Technology

- 7.25. Anritsu

- 7.26. Antevia Networks

- 7.27. Arcadyan Technology Corporation (Compal Electronics)

- 7.28. Argela

- 7.29. Arm

- 7.30. ArrayComm (Chengdu ArrayComm Wireless Technologies)

- 7.31. Arrcus

- 7.32. Artemis Networks

- 7.33. Artiza Networks

- 7.34. Arukona

- 7.35. AsiaInfo Technologies

- 7.36. Askey Computer Corporation (ASUS - ASUSTeK Computer)

- 7.37. ASOCS

- 7.38. Aspire Technology (NEC Corporation)

- 7.39. ASTRI (Hong Kong Applied Science and Technology Research Institute)

- 7.40. Ataya

- 7.41. ATDI

- 7.42. Atesio

- 7.43. Atrinet (ServiceNow)

- 7.44. Auray Technology (Auden Techno)

- 7.45. Aviat Networks

- 7.46. Azcom Technology

- 7.47. Baicells

- 7.48. Betacom

- 7.49. BLiNQ Networks (CCI - Communication Components Inc.)

- 7.50. Blu Wireless

- 7.51. Booz Allen Hamilton

- 7.52. BravoCom

- 7.53. Broadcom

- 7.54. BTI Wireless

- 7.55. BubbleRAN

- 7.56. B-Yond/Reailize

- 7.57. C3Spectra

- 7.58. CableFree (Wireless Excellence)

- 7.59. Cambium Networks

- 7.60. Capgemini Engineering

- 7.61. CBNG (Cambridge Broadband Networks Group)

- 7.62. Celfinet (Cyient)

- 7.63. Celona

- 7.64. CelPlan Technologies

- 7.65. Ceragon Networks

- 7.66. CGI

- 7.67. Chengdu NTS

- 7.68. CICT - China Information and Communication Technology Group (China Xinke Group)

- 7.69. Ciena Corporation

- 7.70. CIG (Cambridge Industries Group)

- 7.71. Cisco Systems

- 7.72. Clavister

- 7.73. Cohere Technologies

- 7.74. Comarch

- 7.75. Comba Telecom

- 7.76. CommAgility (E-Space)

- 7.77. CommScope

- 7.78. Compal Electronics

- 7.79. COMSovereign

- 7.80. Contela

- 7.81. Corning

- 7.82. Creanord

- 7.83. Cyient

- 7.84. DeepSig

- 7.85. Dell Technologies

- 7.86. DGS (Digital Global Systems)

- 7.87. Digis Squared

- 7.88. Digitata

- 7.89. D-Link Corporation

- 7.90. Druid Software

- 7.91. DZS

- 7.92. ECE (European Communications Engineering)

- 7.93. EDX Wireless

- 7.94. eino

- 7.95. Elisa Polystar

- 7.96. Encora

- 7.97. Equiendo

- 7.98. Ericsson

- 7.99. Errigal

- 7.100. ETRI (Electronics & Telecommunications Research Institute, South Korea)

- 7.101. EXFO

- 7.102. F5

- 7.103. Fairspectrum

- 7.104. Federated Wireless

- 7.105. Firecell

- 7.106. Flash Networks

- 7.107. Forsk

- 7.108. Fortinet

- 7.109. Foxconn (Hon Hai Technology Group)

- 7.110. Fraunhofer HHI (Heinrich Hertz Institute)

- 7.111. Fujitsu

- 7.112. FullRays (LDAS - LocationDAS)

- 7.113. Future Connections

- 7.114. FYRA

- 7.115. G REIGNS (HTC Corporation)

- 7.116. Gemtek Technology

- 7.117. GENEViSiO (QNAP Systems)

- 7.118. Gigamon

- 7.119. GigaTera Communications (KMW)

- 7.120. GlobalLogic (Hitachi)

- 7.121. Globalstar

- 7.122. Google (Alphabet)

- 7.123. Groundhog Technologies

- 7.124. Guavus (Thales)

- 7.125. GXC (Formerly GenXComm)

- 7.126. HCLTech (HCL Technologies)

- 7.127. Helios (Fujian Helios Technologies)

- 7.128. HFR Networks

- 7.129. Highstreet Technologies

- 7.130. Hitachi

- 7.131. HPE (Hewlett Packard Enterprise)

- 7.132. HSC (Hughes Systique Corporation)

- 7.133. Huawei

- 7.134. IBM

- 7.135. iBwave Solutions

- 7.136. iConNext

- 7.137. Infinera

- 7.138. Infosys

- 7.139. Infovista

- 7.140. Inmanta

- 7.141. Innovile

- 7.142. InnoWireless

- 7.143. Intel Corporation

- 7.144. InterDigital

- 7.145. Intracom Telecom

- 7.146. Inventec Corporation

- 7.147. ISCO International

- 7.148. IS-Wireless

- 7.149. Itential

- 7.150. ITRI (Industrial Technology Research Institute, Taiwan)

- 7.151. JMA Wireless

- 7.152. JRC (Japan Radio Company)

- 7.153. Juniper Networks (HPE - Hewlett Packard Enterprise)

- 7.154. Key Bridge Wireless

- 7.155. Keysight Technologies

- 7.156. Kleos

- 7.157. KMW

- 7.158. Kumu Networks

- 7.159. Lemko Corporation

- 7.160. Lenovo

- 7.161. Lime Microsystems

- 7.162. LIONS Technology

- 7.163. LITE-ON Technology Corporation

- 7.164. LitePoint (Teradyne)

- 7.165. LS telcom

- 7.166. LuxCarta

- 7.167. MantisNet

- 7.168. Marvell Technology

- 7.169. Mavenir

- 7.170. Maxar Technologies

- 7.171. Meta

- 7.172. MicroNova

- 7.173. Microsoft Corporation

- 7.174. MikroTik

- 7.175. MitraStar Technology (Unizyx Holding Corporation)

- 7.176. Mobileum

- 7.177. MosoLabs (Sercomm Corporation)

- 7.178. MYCOM OSI

- 7.179. Nash Technologies

- 7.180. NEC Corporation

- 7.181. Net AI

- 7.182. Netcracker Technology (NEC Corporation)

- 7.183. NETSCOUT Systems

- 7.184. Netsia (Argela)

- 7.185. Neutroon Technologies

- 7.186. New H3C Technologies (Tsinghua Unigroup)

- 7.187. New Postcom Equipment

- 7.188. Nextivity

- 7.189. Node-H

- 7.190. Nokia

- 7.191. Novowi

- 7.192. NuRAN Wireless

- 7.193. NVIDIA Corporation

- 7.194. NXP Semiconductors

- 7.195. Oceus Networks

- 7.196. Omnitele

- 7.197. OneLayer

- 7.198. Ookla

- 7.199. Opanga Networks

- 7.200. OREX (NTT DoCoMo)

- 7.201. P.I. Works

- 7.202. Palo Alto Networks

- 7.203. Parallel Wireless

- 7.204. Pente Networks

- 7.205. Phluido

- 7.206. Picocom

- 7.207. Pivotal Commware

- 7.208. Potevio (CETC - China Electronics Technology Group Corporation)

- 7.209. QCT (Quanta Cloud Technology)

- 7.210. Qualcomm

- 7.211. Quanta Computer

- 7.212. Qucell Networks (InnoWireless)

- 7.213. RADCOM

- 7.214. Radisys (Reliance Industries)

- 7.215. Radware

- 7.216. Rakuten Symphony

- 7.217. Ranlytics

- 7.218. Ranplan Wireless

- 7.219. Rebaca Technologies

- 7.220. Red Hat (IBM)

- 7.221. RED Technologies

- 7.222. REPLY

- 7.223. RIMEDO Labs

- 7.224. Rivada Networks

- 7.225. Rohde & Schwarz

- 7.226. Ruijie Networks

- 7.227. RunEL

- 7.228. SageRAN (Guangzhou SageRAN Technology)

- 7.229. Samji Electronics

- 7.230. Samsung

- 7.231. Sandvine

- 7.232. Sercomm Corporation

- 7.233. ServiceNow

- 7.234. Shabodi

- 7.235. Signalwing

- 7.236. SIRADEL

- 7.237. Skyvera (TelcoDR)

- 7.238. SOLiD

- 7.239. Sooktha

- 7.240. Spectrum Effect

- 7.241. Spirent Communications

- 7.242. SRS (Software Radio Systems)

- 7.243. SSC (Shared Spectrum Company)

- 7.244. Star Solutions

- 7.245. Subex

- 7.246. Sunwave Communications

- 7.247. Supermicro (Super Micro Computer)

- 7.248. SynaXG Technologies

- 7.249. Systemics-PAB

- 7.250. T&W (Shenzhen Gongjin Electronics)

- 7.251. Tarana Wireless

- 7.252. TCS (Tata Consultancy Services)

- 7.253. Tech Mahindra

- 7.254. Tecore Networks

- 7.255. TECTWIN

- 7.256. Telrad Networks

- 7.257. TEOCO/Aircom

- 7.258. ThinkRF

- 7.259. TI (Texas Instruments)

- 7.260. TietoEVRY

- 7.261. Tropico (CPQD - Center for Research and Development in Telecommunications, Brazil)

- 7.262. TTG International

- 7.263. Tupl

- 7.264. ULAK Communication

- 7.265. Vavitel (Shenzhen Vavitel Technology)

- 7.266. VHT (Viettel High Tech)

- 7.267. VIAVI Solutions

- 7.268. VMware (Broadcom)

- 7.269. VNL - Vihaan Networks Limited (Shyam Group)

- 7.270. Wave Electronics

- 7.271. WDNA (Wireless DNA)

- 7.272. WIM Technologies

- 7.273. Wind River Systems

- 7.274. Wipro

- 7.275. Wiwynn (Wistron Corporation)

- 7.276. WNC (Wistron NeWeb Corporation)

- 7.277. Xingtera

- 7.278. ZaiNar

- 7.279. Z-Com

- 7.280. Zeetta Networks

- 7.281. Zinkworks

- 7.282. ZTE

- 7.283. zTouch Networks

- 7.284. Zyxel (Unizyx Holding Corporation)

8. Chapter 8: Market Sizing & Forecasts

- 8.1. Mobile Network Automation

- 8.2. Network Domain Submarkets

- 8.2.1. RAN Automation

- 8.2.2. Mobile Core Automation

- 8.2.3. xHaul Transport Automation

- 8.3. RAN Automation Functional Areas

- 8.3.1. SON-Based Automation

- 8.3.2. Open RAN Automation

- 8.3.3. Baseband-Integrated Intelligent RAN Applications

- 8.3.4. RAN Planning & Optimization Software

- 8.3.5. Test & Measurement Solutions

- 8.4. SON-Based Automation Submarkets

- 8.4.1. RAN Vendor SON Solutions

- 8.4.2. Third Party C-SON Platforms

- 8.5. Open RAN Automation Submarkets

- 8.5.1. Non-RT RIC & SMO

- 8.5.2. Near-RT RIC

- 8.5.3. rApps

- 8.5.4. xApps

- 8.6. Access Technology Generations

- 8.6.1. LTE

- 8.6.2. 5G NR

- 8.6.3. 6G

- 8.7. Regional Segmentation

- 8.7.1. North America

- 8.7.2. Asia Pacific

- 8.7.3. Europe

- 8.7.4. Middle East & Africa

- 8.7.5. Latin & Central America

9. Chapter 9: Conclusion & Strategic Recommendations

- 9.1. Why is the Market Poised to Grow?

- 9.2. Future Roadmap: 2024 - 2030

- 9.2.1. 2024 - 2026: Production-Grade Deployments of SMO & RIC Platforms for Brownfield Networks

- 9.2.2. 2027 - 2029: Widespread Adoption of Open RAN Automation & Diverse RIC-Hosted Applications

- 9.2.3. 2030 & Beyond: Towards AI-Native Air Interfaces & Zero-Touch 5G/6G Network Automation

- 9.3. Reviewing the Real-World Benefits & TCO Savings Potential of RAN Automation

- 9.4. Impact of Intelligent Automation on RAN Engineering Roles

- 9.5. Transition From SON to Open RAN Automation

- 9.6. Evolution of Use Cases & AI/ML Algorithms

- 9.7. Growing Focus on Energy Efficiency & Sustainability

- 9.8. Vertical Industries & Private Wireless Automation

- 9.9. Diversified Community of x/rApp Developers

- 9.10. Signs of Consolidation in the SMO & RIC Ecosystem

- 9.11. Which RAN Automation Platform & Application Vendors Are Leading the Market?

- 9.12. Prospects of Hosting Third Party Applications Within RAN Baseband Products

- 9.13. Paving the Path to an AI/ML-Based 6G Air Interface

- 9.14. Convergence of AI & RAN Infrastructure

- 9.15. Strategic Recommendations

- 9.15.1. RAN Automation Solution Providers

- 9.15.2. Mobile Operators

10. Chapter 10: Expert Opinion - Interview Transcripts

- 10.1. AirHop Communications

- 10.2. Amdocs

- 10.3. Groundhog Technologies

- 10.4. Innovile

- 10.5. Net AI

- 10.6. Nokia

- 10.7. P.I. Works

- 10.8. Qualcomm

- 10.9. Rakuten Mobile

- 10.10. RIMEDO Labs

List of Companies Mentioned

The following companies and organizations have been reviewed, discussed or mentioned in the report:

- 1&1

- 3GPP (Third Generation Partnership Project)

- 4iG Group

- A10 Networks

- A5G Networks

- Aalyria

- Aarna Networks

- Abside Networks

- Accedian

- Accelleran

- Accuver

- Acentury

- Actiontec Electronics

- Adtran

- Aglocell

- AI-LINK

- Aira Technologies

- AI-RAN Alliance

- Aircom

- AirHop Communications

- Airspan Networks

- AiVader

- Aliniant

- Allot

- Alpha Networks

- Alphabet

- Altice Portugal

- Amazon

- AMD (Advanced Micro Devices)

- Amdocs

- America Movil

- Andorra Telecom

- Anktion (Fujian) Technology

- Anritsu

- Antevia Networks

- Arcadyan Technology Corporation

- Argela

- ARIB (Association of Radio Industries and Businesses, Japan)

- Arm

- ArrayComm (Chengdu ArrayComm Wireless Technologies)

- Arrcus

- Artemis Networks

- Artiza Networks

- Arukona

- AsiaInfo Technologies

- Askey Computer Corporation

- ASOCS

- Aspire Technology

- ASTRI (Hong Kong Applied Science and Technology Research Institute)

- ASUS (ASUSTeK Computer)

- AT&T

- Ataya

- ATDI

- Atesio

- ATIS (Alliance for Telecommunications Industry Solutions)

- Atrinet

- Auden Techno

- Auray Technology

- Aviat Networks

- AWS (Amazon Web Services)

- Axiata Group

- Azcom Technology

- Baicells

- Batelco

- beCloud (Belarusian Cloud Technologies)

- Beeline Russia (VimpelCom)

- Bell Canada

- Betacom

- Bharti Airtel

- BLiNQ Networks

- Blu Wireless

- Booz Allen Hamilton

- BravoCom

- Broadcom

- BT Group

- BTC (Botswana Telecommunications Corporation)

- BTI Wireless

- BubbleRAN

- B-Yond

- C Spire

- C3Spectra

- CableFree (Wireless Excellence)

- Cambium Networks

- Capgemini Engineering

- CBNG (Cambridge Broadband Networks Group)

- CCI (Communication Components Inc.)

- CCSA (China Communications Standards Association)

- Celfinet

- Cellfie Mobile

- Celona

- CelPlan Technologies

- Ceragon Networks

- CETC (China Electronics Technology Group Corporation)

- CETIN Group

- CGI

- Chengdu NTS

- China Mobile

- China Telecom

- China Unicom

- CICT - China Information and Communication Technology Group (China Xinke Group)

- Ciena Corporation

- CIG (Cambridge Industries Group)

- Cisco Systems

- CK Hutchison

- Claro Colombia

- Clavister

- Cohere Technologies

- Comarch

- Comba Telecom

- CommAgility

- CommScope

- Compal Electronics

- COMSovereign

- Contela

- Corning

- CPQD (Center for Research and Development in Telecommunications, Brazil)

- Creanord

- Cyient

- Datang Telecom Technology & Industry Group

- DeepSig

- Dell Technologies

- DGS (Digital Global Systems)

- DIGI Communications

- Digis Squared

- Digitata

- DISH Network Corporation

- Djezzy

- D-Link Corporation

- Druid Software

- DSA (Dynamic Spectrum Alliance)

- DT (Deutsche Telekom)

- DZS

- ECE (European Communications Engineering)

- EDX Wireless

- EE

- eino

- Elisa

- Elisa Polystar

- Encora

- Equiendo

- Ericsson

- Errigal

- E-Space

- Etisalat Group (e&)

- ETRI (Electronics & Telecommunications Research Institute, South Korea)

- ETSI (European Telecommunications Standards Institute)

- EXFO

- F5

- Fairspectrum

- Federated Wireless

- FET (Far EasTone Telecommunications)

- FiberHome Technologies

- Firecell

- Flash Networks

- Forsk

- Fortinet

- Foxconn (Hon Hai Technology Group)

- Fraunhofer HHI (Heinrich Hertz Institute)

- Fujitsu

- FullRays (LDAS - LocationDAS)

- Future Connections

- FYRA

- G REIGNS

- Gemtek Technology

- GENEViSiO

- Gigamon

- GigaTera Communications

- GlobalLogic

- Globalstar

- Globe Telecom

- Groundhog Technologies

- GSMA (GSM Association)

- GTAA (Global Telco AI Alliance)

- Guavus

- GXC (Formerly GenXComm)

- HCLTech (HCL Technologies)

- Helios (Fujian Helios Technologies)

- HFR Networks

- Highstreet Technologies

- Hitachi

- HPE (Hewlett Packard Enterprise)

- HSC (Hughes Systique Corporation)

- HTC Corporation

- Huawei

- Hutchison Drei Austria

- IBM

- iBwave Solutions

- iConNext

- IETF (Internet Engineering Task Force)

- Infinera

- Infosys

- Infovista

- Inmanta

- Innovile

- InnoWireless

- Intel Corporation

- InterDigital

- Intracom Telecom

- Inventec Corporation

- ISCO International

- IS-Wireless

- Itential

- ITRI (Industrial Technology Research Institute, Taiwan)

- ITU (International Telecommunication Union)

- JMA Wireless

- JRC (Japan Radio Company)

- Juniper Networks

- KDDI

- Key Bridge Wireless

- Keysight Technologies

- Kleos

- KMW

- KPN

- KT Corporation

- Kumu Networks

- Kuzey Kibris Turkcell

- Kyivstar

- Lemko Corporation

- Lenovo

- LG Uplus

- Liberty Global

- life:)/BeST (Belarusian Telecommunications Network)

- lifecell Ukraine

- Lime Microsystems

- Linux Foundation

- LIONS Technology

- LITE-ON Technology Corporation

- LitePoint

- LS telcom

- LTT (Libya Telecom & Technology)

- LuxCarta

- MantisNet

- Marvell Technology

- MASMOVIL

- Mavenir

- Maxar Technologies

- MegaFon

- MEO

- Meta

- MicroNova

- Microsoft Corporation

- MikroTik

- MitraStar Technology

- Mobileum

- MosoLabs

- MTN Group

- MTS (Mobile TeleSystems)

- MYCOM OSI

- Nash Technologies

- NEC Corporation

- Net AI

- Netcracker Technology

- NETSCOUT Systems

- Netsia

- Neutroon Technologies

- New H3C Technologies

- New Postcom Equipment

- Nextivity

- NGMN Alliance

- Node-H

- Nokia

- Northeastern University

- Novowi

- NTT DoCoMo

- NuRAN Wireless

- NVIDIA Corporation

- NXP Semiconductors

- NYCU (National Yang Ming Chiao Tung University)

- Oceus Networks

- Odido

- Omnitele

- OneLayer

- ONF (Open Networking Foundation)

- OnGo Alliance

- Ookla

- Ooredoo

- Ooredoo Algeria

- Ooredoo Tunisia

- Opanga Networks

- Optus

- O-RAN Alliance

- Orange

- OREX

- OSA (OpenAirInterface Software Alliance)

- P.I. Works

- Palo Alto Networks

- Parallel Wireless

- Pente Networks

- Phluido

- Picocom

- Pivotal Commware

- PLDT

- Potevio

- QCT (Quanta Cloud Technology)

- QNAP Systems

- Qualcomm

- Quanta Computer

- Qucell Networks

- RADCOM

- Radisys

- Radware

- Rakuten Mobile

- Rakuten Symphony

- Ranlytics

- Ranplan Wireless

- Reailize

- Rebaca Technologies

- Red Hat

- RED Technologies

- Reliance Industries

- Reliance Jio Infocomm

- REPLY

- RIMEDO Labs

- Rivada Networks

- Rogers Communications

- Rohde & Schwarz

- Ruijie Networks

- RunEL

- SageRAN (Guangzhou SageRAN Technology)

- Samji Electronics

- Samsung

- Sandvine

- SCF (Small Cell Forum)

- Sercomm Corporation

- ServiceNow

- Shabodi

- Shyam Group

- Signalwing

- Singtel

- SIRADEL

- SK Telecom

- Skyvera (TelcoDR)

- Smart Communications

- Smartfren

- SoftBank Group

- SOLiD

- Sooktha

- Spectrum Effect

- Spirent Communications

- SRS (Software Radio Systems)

- SSC (Shared Spectrum Company)

- Star Solutions

- STC (Saudi Telecom Company)

- Subex

- Sunwave Communications

- Supermicro (Super Micro Computer)

- SUTD (Singapore University of Technology and Design)

- Swisscom

- SynaXG Technologies

- Systemics-PAB

- T&W (Shenzhen Gongjin Electronics)

- Tarana Wireless

- TCS (Tata Consultancy Services)

- TDC NET

- Tech Mahindra

- Tecore Networks

- TECTWIN

- Telecom Argentina

- Telefonica Germany

- Telefonica Group

- Telia Company

- Telkomsel

- Telrad Networks

- Telstra

- Telus

- TEOCO

- Teradyne

- Texas A&M University

- Thales

- ThinkRF

- TI (Texas Instruments)

- TietoEVRY

- TIM (Telecom Italia Mobile)

- TIM Brasil

- TIP (Telecom Infra Project)

- TM Forum

- TPG Telecom

- Tropico

- TSDSI (Telecommunications Standards Development Society, India)

- Tsinghua Unigroup

- TTA (Telecommunications Technology Association, South Korea)

- TTC (Telecommunication Technology Committee, Japan)

- TTG International

- Tupl

- Turk Telekom

- Turkcell

- U.S. DOD (Department of Defense)

- U.S. NTIA (National Telecommunications and Information Administration)

- Ucom (Armenia)

- ULAK Communication

- University of California San Diego

- University of Lancaster

- University of Malaga

- Unizyx Holding Corporation

- Vavitel (Shenzhen Vavitel Technology)

- VEON

- Verizon Communications

- VHT (Viettel High Tech)

- Vi (Vodafone Idea)

- VIAVI Solutions

- Viettel Group

- Virgin Media O2

- VMware

- VNL (Vihaan Networks Limited)

- Vodafone Germany

- Vodafone Group

- Vodafone Ireland

- Vodafone Turkey

- Wave Electronics

- WDNA (Wireless DNA)

- WIM Technologies

- Wind River Systems

- WInnForum (Wireless Innovation Forum)

- Wipro

- Wistron Corporation

- Wiwynn

- WNC (Wistron NeWeb Corporation)

- Xingtera

- Zain Group

- Zain Saudi Arabia (Zain KSA)

- ZaiNar

- Z-Com

- Zeetta Networks

- Zinkworks

- ZTE

- zTouch Networks

- Zyxel