|

市場調查報告書

商品編碼

1699312

資料中心晶片市場機會、成長動力、產業趨勢分析及2025-2034年預測Data Center Chip Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

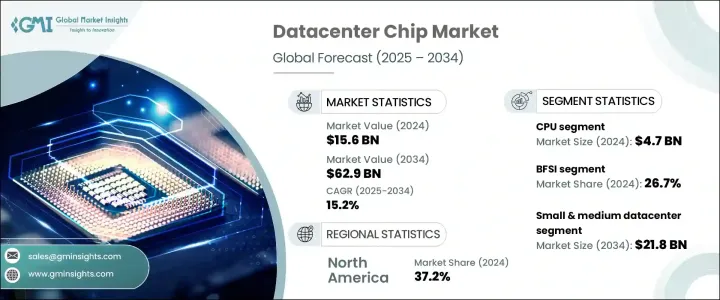

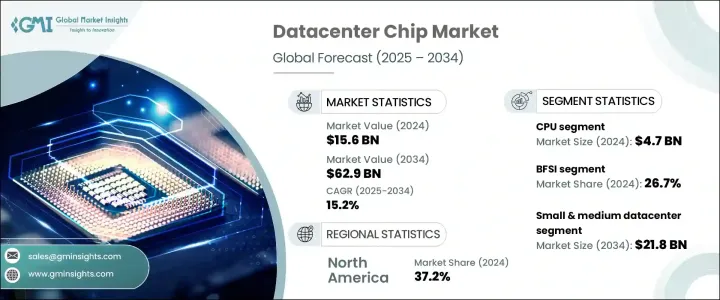

2024 年全球資料中心晶片市場價值為 156 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 15.2%。這一成長主要得益於對人工智慧 (AI)、機器學習 (ML) 和高效能運算日益成長的需求。隨著企業不斷擁抱數位轉型,對先進資料處理能力的需求從未如此強烈。各組織正在轉向基於雲端的平台,依靠人工智慧驅動的分析,並部署複雜的運算解決方案來有效管理大量資料。這些進步推動了資料中心晶片技術的擴展,使其成為現代運算基礎設施的重要組成部分。

5G網路的快速部署、資料流量的不斷成長以及對雲端服務的日益依賴正在加速市場需求。企業正在大力投資下一代晶片,以最佳化運算能力、提高能源效率並減少資料處理的延遲。向邊緣運算的轉變,其中即時處理至關重要,進一步凸顯了尖端晶片技術的必要性。隨著資料密集型應用成為各行各業的主流,半導體製造商正專注於設計具有卓越處理能力、更高功率效率和增強安全功能的晶片。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 156億美元 |

| 預測值 | 629億美元 |

| 複合年成長率 | 15.2% |

市場按晶片類型細分,包括中央處理器 (CPU)、圖形處理單元 (GPU)、現場可編程閘陣列 (FPGA)、專用積體電路 (ASIC) 等。受雲端運算日益普及、IT 基礎設施向虛擬環境遷移以及人工智慧應用不斷成長的運算需求的推動,CPU 將在 2024 年創造 47 億美元的收入。作為現代運算的支柱,CPU 實現了無縫的系統操作,支援從企業軟體到資料分析的一切。對高速處理能力的需求持續激增,特別是隨著基於人工智慧的工作負載在各個行業中的擴展。

根據產業垂直情況,資料中心晶片市場在 BFSI、政府、IT 和電信、運輸、能源和公用事業以及其他領域廣泛應用。受安全、高速資料處理需求和區塊鏈技術日益普及的推動,BFSI 產業在 2024 年佔據了 26.7% 的市場佔有率。隨著金融科技公司和數位銀行平台的快速擴張,金融服務對先進晶片技術的需求達到了前所未有的高度。資料中心晶片在確保交易安全、最大限度地減少停機時間和提高金融機構整體營運效率方面發揮關鍵作用。

2024 年,北美佔據全球市場 37.2% 的佔有率,這主要得益於對人工智慧、機器學習和雲端運算的大量投資。美國的市場收入為 44 億美元,預計到 2034 年將以 15.4% 的複合年成長率成長。美國高度重視半導體製造、人工智慧驅動的運算和即時資料處理,使其成為全球資料中心晶片領域的關鍵參與者。隨著雲端運算的採用和政府在半導體研發方面的舉措不斷增加,北美將在不斷發展的市場中保持領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 人工智慧和機器學習需求激增

- 注重能源效率和永續性

- 超大規模資料中心和雲端運算

- 5G基礎設施快速擴張

- 不斷成長的儲存需求和數據分析

- 成長動力

- 產業陷阱與挑戰

- 快速的技術變革

- 供應鏈中斷

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按晶片類型,2021 年至 2034 年

- 主要趨勢

- 中央處理器(CPU)

- 圖形處理單元 (GPU)

- 現場可程式閘陣列(FPGA)

- 專用積體電路(ASIC)

- 其他

第6章:市場估計與預測:按垂直產業,2021 年至 2034 年

- 主要趨勢

- 金融服務業

- 政府

- IT和電信

- 運輸

- 能源與公用事業

- 其他

第7章:市場估計與預測:依資料中心規模,2021 年至 2034 年

- 主要趨勢

- 小型和中型

- 大尺寸

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Advanced Micro Devices

- Broadcom

- GlobalFoundries

- Huawei Technologies

- Intel

- MediaTek

- Micron Technology

- Microsoft

- NVIDIA

- Qualcomm Technologies

- Samsung Electronics

- SK Hynix

- Taiwan Semiconductor Manufacturing Company

The Global Data Center Chip Market was valued at USD 15.6 billion in 2024 and is projected to reflect a robust CAGR of 15.2% between 2025 and 2034. The growth is fueled by the rising demand for artificial intelligence (AI), machine learning (ML), and high-performance computing. As businesses continue to embrace digital transformation, the need for advanced data processing capabilities has never been greater. Organizations are shifting to cloud-based platforms, relying on AI-driven analytics, and deploying sophisticated computing solutions to manage vast volumes of data efficiently. These advancements are fueling the expansion of data center chip technologies, making them essential components in modern computing infrastructures.

The rapid deployment of 5G networks, growing data traffic, and increasing reliance on cloud services are accelerating market demand. Enterprises are heavily investing in next-generation chips to optimize computing power, enhance energy efficiency, and reduce latency in data processing. The shift toward edge computing, where real-time processing is critical, further underscores the necessity of cutting-edge chip technologies. With data-intensive applications becoming mainstream across industries, semiconductor manufacturers are focusing on designing chips with superior processing capabilities, improved power efficiency, and enhanced security features.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.6 Billion |

| Forecast Value | $62.9 Billion |

| CAGR | 15.2% |

The market is segmented by chip type, including central processing units (CPU), graphics processing units (GPU), field-programmable gate arrays (FPGA), application-specific integrated circuits (ASIC), and others. CPUs generated USD 4.7 billion in 2024, driven by the increasing adoption of cloud computing, the migration of IT infrastructure to virtual environments, and growing computational demands from AI applications. As the backbone of modern computing, CPUs enable seamless system operations, supporting everything from enterprise software to data analytics. The demand for high-speed processing power continues to surge, particularly as AI-based workloads expand across industries.

Based on industry verticals, the data center chip market is witnessing high adoption across BFSI, government, IT and telecom, transportation, energy and utility, and other sectors. The BFSI sector accounted for 26.7% of the market share in 2024, fueled by the need for secure, high-speed data processing and the increasing adoption of blockchain technology. With fintech companies and digital banking platforms expanding rapidly, the demand for advanced chip technologies in financial services is at an all-time high. Data center chips play a pivotal role in ensuring transaction security, minimizing downtime, and enhancing overall operational efficiency for financial institutions.

North America dominated the global market with a 37.2% share in 2024, led by substantial investments in AI, machine learning, and cloud computing. The United States accounted for USD 4.4 billion in market revenue and is projected to grow at a CAGR of 15.4% through 2034. The country's strong focus on semiconductor manufacturing, AI-driven computing, and real-time data processing positions it as a key player in the global data center chip landscape. As cloud adoption and government initiatives in semiconductor R&D continue to rise, North America is set to maintain its leadership in the evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in Demand for AI & Machine Learning

- 3.2.1.2 Focus on Energy-Efficiency & Sustainability

- 3.2.1.3 Hyperscale Data Centres & Cloud Computing

- 3.2.1.4 Rapid Expansion of 5G Infrastructure

- 3.2.1.5 Growing Storage Demands and Data Analytics

- 3.2.1 Growth drivers

- 3.3 Industry pitfalls and challenges

- 3.3.1.1 Rapid Technological Changes

- 3.3.1.2 Supply Chain Disruptions

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Chip Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Central Processing Unit (CPU)

- 5.3 Graphics Processing Unit (GPU)

- 5.4 Field-Programmable Gate Array (FPGA)

- 5.5 Application Specific Integrated Circuit (ASIC)

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Vertical Industry, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 BFSI

- 6.3 Government

- 6.4 IT and telecom

- 6.5 Transportation

- 6.6 Energy & utilities

- 6.7 Other

Chapter 7 Market Estimates and Forecast, By Data Center Size, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Small and medium size

- 7.3 Large size

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Advanced Micro Devices

- 9.2 Broadcom

- 9.3 Google

- 9.4 GlobalFoundries

- 9.5 Huawei Technologies

- 9.6 Intel

- 9.7 MediaTek

- 9.8 Micron Technology

- 9.9 Microsoft

- 9.10 NVIDIA

- 9.11 Qualcomm Technologies

- 9.12 Samsung Electronics

- 9.13 SK Hynix

- 9.14 Taiwan Semiconductor Manufacturing Company