|

市場調查報告書

商品編碼

1699325

商業電線電纜市場機會、成長動力、產業趨勢分析及2025-2034年預測Commercial Wire and Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

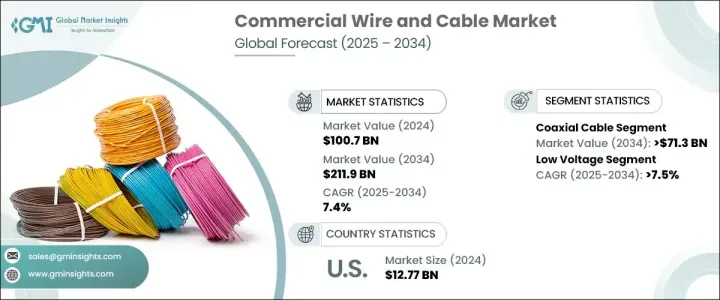

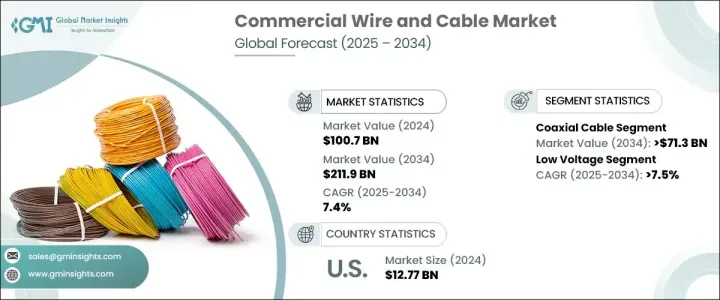

2024 年,全球商業電線電纜市場規模達到 1,007 億美元,並有望大幅成長,預計 2025 年至 2034 年期間的複合年成長率為 7.4%。這一擴張是由各行各業的快速商業化推動的,從而刺激了對高品質電線電纜解決方案的需求。隨著城市化和工業化的加速,企業正在大力投資電力基礎設施以支持其營運。對先進連接解決方案的日益依賴、不斷增加的基礎設施開發項目以及嚴格的監管標準,促使市場參與者提高生產能力並創新新產品,以在競爭中保持領先地位。

電信業持續成為商業電線電纜市場需求的重要推手。受電信和商業領域對可靠高速連接的需求不斷成長的推動,預計到 2034 年,僅光纖電纜領域就將創造 400 億美元的產值。過去十年,電信業每年平均投資 500 億美元用於網路升級,這進一步凸顯了商業電線電纜解決方案的重要性。該領域的公司正在投入大量資源來提高生產能力並滿足不斷成長的行業需求,從而進一步鞏固未來幾年的市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1007億美元 |

| 預測值 | 2119億美元 |

| 複合年成長率 | 7.4% |

根據電壓,預計到 2034 年低壓部分將以 7.5% 的複合年成長率成長,這主要受到基礎設施開發項目對電線電纜需求不斷成長的推動。世界各國政府和私人企業正大力投資電網現代化,促進市場擴張。 2023年,光是中國就為電網建設項目撥款590億美元,凸顯了商業電線電纜在未來城鎮化和工業進步中所扮演的關鍵角色。

美國商業電線電纜市場價值預計在 2024 年達到 127.7 億美元,由於對電力基礎設施的大量投資,該市場預計將實現穩步成長。 2022年,美國在電力網路上的投資約890億美元,是近年來最高的支出之一。該國大力推動再生能源的應用進一步推動了對先進電線電纜解決方案的需求。北美正將自己定位為能源轉型的領導者,增強商業電線電纜製造商的市場潛力。

目錄

第1章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 同軸電纜/電子線

- 光纖電纜

- 訊號和控制電纜

- 電信和資料電纜

- 其他

第6章:市場規模及預測:按電壓 2021 – 2034

- 主要趨勢

- 低的

- 中等的

第7章:市場規模與預測:按應用分類 2021 年至 2034 年

- 主要趨勢

- 物料搬運/物流

- 娛樂/休閒

- 消費性電子產品

- 建設基礎設施

- 其他

第8章:市場規模及預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 荷蘭

- 義大利

- 西班牙

- 德國

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

- 秘魯

第9章:公司簡介

- Bergen Cable Technology

- Belden Inc.

- FURUKAWA ELECTRIC CO., LTD.

- Havell India Ltd.

- KEI Industries Limited

- Klaus Faber AG

- LS Cables

- Leoni Cables

- NKT A/S

- Polycab

- Prysmian Group

- RR Kabel

- Riyadh Cables

- Sumitomo Electric Industries, Ltd.

- Southwire Company LLC

- Top Cables

- Thermo Cables

- ZM Cables

The Global Commercial Wire And Cable Market reached USD 100.7 billion in 2024 and is poised for significant growth, with projections indicating a CAGR of 7.4% between 2025 and 2034. This expansion is driven by rapid commercialization across industries, fueling the demand for high-quality wire and cable solutions. As urbanization and industrialization accelerate, businesses are investing heavily in electrical infrastructure to support their operations. The increasing reliance on advanced connectivity solutions, rising infrastructure development projects, and stringent regulatory standards are prompting market players to enhance their production capabilities and innovate new product offerings to stay ahead in the competitive landscape.

The telecommunications sector continues to be a significant driver of demand in the commercial wire and cable market. The fiber optics cable segment alone is expected to generate USD 40 billion by 2034, fueled by the rising need for reliable and high-speed connectivity in telecommunications and commercial sectors. Over the past decade, the telecom industry has invested an average of USD 50 billion annually in upgrading networks, reinforcing the importance of commercial wire and cable solutions. Companies operating in this sector are allocating substantial resources to enhance production capacity and meet growing industry requirements, further solidifying market expansion over the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $100.7 Billion |

| Forecast Value | $211.9 Billion |

| CAGR | 7.4% |

Based on voltage, the low voltage segment is projected to grow at a CAGR of 7.5% by 2034, primarily driven by the increasing demand for wire and cable in infrastructure development projects. Governments and private enterprises worldwide are investing heavily in electrical grid modernization, contributing to market expansion. In 2023, China alone allocated USD 59 billion for electric power grid construction projects, emphasizing the critical role of commercial wire and cable in powering the future of urbanization and industrial advancements.

The U.S. commercial wire and cable market, valued at USD 12.77 billion in 2024, is set to witness steady growth owing to substantial investments in electrical infrastructure. In 2022, the U.S. invested approximately USD 89 billion in electricity networks, marking one of the highest expenditures in recent years. The country's strong push towards renewable energy adoption further drives the demand for advanced wire and cable solutions. North America is positioning itself as a leader in energy transition, enhancing the market potential for commercial wire and cable manufacturers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Coaxial Cables/Electronic Wires

- 5.3 Fiber optics cables

- 5.4 Signal & Control cable

- 5.5 Telecom & data cables

- 5.6 Others

Chapter 6 Market Size and Forecast, By Voltage 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

Chapter 7 Market Size and Forecast, By Application 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Material Handling/Logistics

- 7.3 Entertainment/Leisure

- 7.4 Consumer electronics

- 7.5 Building infrastructure

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Netherlands

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Germany

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 South Africa

- 8.5.6 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

Chapter 9 Company Profiles

- 9.1 Bergen Cable Technology

- 9.2 Belden Inc.

- 9.3 FURUKAWA ELECTRIC CO., LTD.

- 9.4 Havell India Ltd.

- 9.5 KEI Industries Limited

- 9.6 Klaus Faber AG

- 9.7 LS Cables

- 9.8 Leoni Cables

- 9.9 NKT A/S

- 9.10 Polycab

- 9.11 Prysmian Group

- 9.12 RR Kabel

- 9.13 Riyadh Cables

- 9.14 Sumitomo Electric Industries, Ltd.

- 9.15 Southwire Company LLC

- 9.16 Top Cables

- 9.17 Thermo Cables

- 9.18 ZM Cables