|

市場調查報告書

商品編碼

1699330

冷凝食品加工鍋爐市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Condensing Food Processing Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

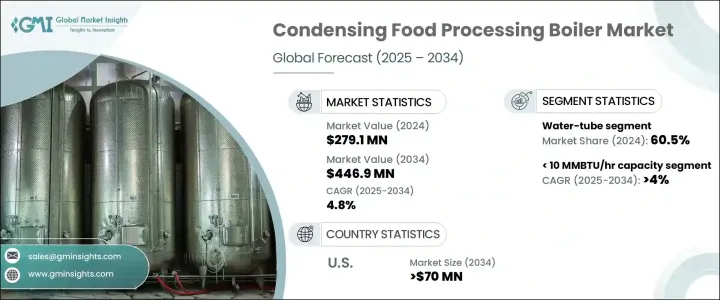

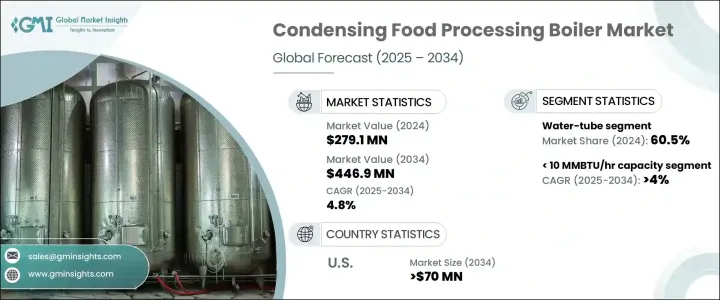

全球冷凝食品加工鍋爐市場在 2024 年的價值為 2.791 億美元,預計在 2025 年至 2034 年期間將以 4.8% 的複合年成長率擴張,這得益於對能源效率、永續性和嚴格的監管要求的日益重視。隨著工業化、城市化進程加快以及消費者對包裝和加工食品的需求不斷成長,食品加工行業正在經歷快速轉型。隨著製造商優先考慮營運效率和減少碳足跡,冷凝鍋爐正在成為首選的加熱解決方案,提供卓越的熱效率,同時最大限度地減少排放。

暖氣技術的進步和智慧控制系統的整合進一步增強了這些鍋爐的吸引力,實現了精確的溫度調節和最佳化的燃料消耗。政府推行的清潔能源使用政策和對節能工業設備的財政激勵措施也促進了市場擴張。此外,食品加工廠的持續現代化,特別是在新興經濟體,正在為市場參與者創造有利可圖的機會。對永續性的高度關注,加上節能供暖系統的長期成本效益,正在推動更多公司投資冷凝鍋爐。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.791億美元 |

| 預測值 | 4.469億美元 |

| 複合年成長率 | 4.8% |

市場依產品類型分為火管鍋爐和水管鍋爐。 2024年水管鍋爐佔據產業主導地位,佔總收入的60.5%。它們的需求不斷成長,與自動化和大容量食品加工系統的日益普及有關,而這些系統需要先進的蒸汽生成能力。向現代化製造設施的轉變,加上消費者飲食習慣的不斷變化,推動了食品生產工廠採用高效的加熱解決方案。此外,嚴格的食品安全法規要求穩定可靠的蒸汽供應,促使製造商選擇高性能冷凝鍋爐,以提高生產率並滿足合規標準。

根據燃料類型,冷凝食品加工鍋爐市場分為天然氣、石油、煤炭和其他。受天然氣基礎設施擴張、鍋爐效率技術創新以及對環保替代品日益成長的青睞的推動,天然氣市場規模預計到 2034 年將達到 1.5 億美元。天然氣鍋爐能夠穩定地生產蒸汽和熱水,同時降低營運成本,因此成為食品加工設施的理想選擇。隨著能源法規的收緊,向清潔燃料的轉變正在加速,進一步推動市場成長。

在美國,冷凝式食品加工鍋爐市場在 2024 年創造了 4,530 萬美元的產值,預計到 2034 年將達到 7,000 萬美元。這一成長主要得益於職業安全與健康管理局 (OSHA) 和環境保護署 (EPA) 等機構實施的嚴格排放法規。這些法規鼓勵食品加工產業採用先進的低排放加熱系統。隨著合規要求越來越嚴格,食品製造商正在轉向高效冷凝鍋爐,以滿足環境標準,同時確保最佳生產效率。隨著技術的不斷進步和監管壓力的不斷增加,未來幾年市場將穩步擴張。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依產能,2021 年至 2034 年

- 主要趨勢

- < 10 百萬英熱單位/小時

- 10 - 25 百萬英熱單位/小時

- 25 - 50 百萬英熱單位/小時

- 50 - 75 百萬英熱單位/小時

- 75 - 100 百萬英熱單位/小時

- 100 - 175 百萬英熱單位/小時

- 175 - 250 百萬英熱單位/小時

- > 250 百萬英熱單位/小時

第6章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 火管

- 水管

第7章:市場規模及預測:依燃料,2021 年至 2034 年

- 主要趨勢

- 天然氣

- 油

- 煤炭

- 其他

第8章:市場規模及預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 英國

- 波蘭

- 義大利

- 西班牙

- 奧地利

- 德國

- 瑞典

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 菲律賓

- 日本

- 韓國

- 澳洲

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 奈及利亞

- 南非

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

第9章:公司簡介

- ALFA LAVAL

- Babcock & Wilcox Enterprises

- Babcock Wanson

- BM GreenTech

- Bosch Industriekessel

- Clayton Industries

- Cleaver-Brooks

- Cochran

- Forbes Marshall

- Hurst Boiler

- Miura America

- Rentech Boiler Systems

- Thermax

- Thermodyne Boilers

- Viessmann

The Global Condensing Food Processing Boiler Market, valued at USD 279.1 million in 2024, is projected to expand at a CAGR of 4.8% between 2025 and 2034, driven by a rising emphasis on energy efficiency, sustainability, and stringent regulatory requirements. The food processing sector is witnessing a rapid transformation, fueled by increasing industrialization, urbanization, and growing consumer demand for packaged and processed foods. As manufacturers prioritize operational efficiency and carbon footprint reduction, condensing boilers are emerging as a preferred heating solution, delivering superior thermal efficiency while minimizing emissions.

Advancements in heating technology and the integration of smart control systems further enhance the appeal of these boilers, enabling precise temperature regulation and optimized fuel consumption. Government policies promoting cleaner energy adoption and financial incentives for energy-efficient industrial equipment are also contributing to market expansion. In addition, the ongoing modernization of food processing plants, particularly in emerging economies, is creating lucrative opportunities for market players. The heightened focus on sustainability, coupled with the long-term cost benefits of energy-efficient heating systems, is pushing more companies to invest in condensing boilers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $279.1 Million |

| Forecast Value | $446.9 Million |

| CAGR | 4.8% |

The market is segmented by product type into fire-tube and water-tube boilers. Water-tube boilers dominated the industry in 2024, accounting for 60.5% of total revenue. Their rising demand is linked to the increased adoption of automated and high-capacity food processing systems, which require advanced steam generation capabilities. The shift toward modernized manufacturing facilities, coupled with evolving consumer eating habits, is fueling the adoption of efficient heating solutions across food production plants. Additionally, strict food safety regulations necessitate consistent and reliable steam supply, prompting manufacturers to opt for high-performance condensing boilers that enhance productivity while meeting compliance standards.

Based on fuel type, the condensing food processing boiler market is categorized into natural gas, oil, coal, and others. The natural gas segment is projected to reach USD 150 million by 2034, driven by expanding gas infrastructure, technological innovations in boiler efficiency, and the rising preference for eco-friendly alternatives. Natural gas boilers offer consistent steam and hot water production with reduced operational costs, making them an attractive choice for food processing facilities. As energy regulations tighten, the transition toward cleaner-burning fuels is accelerating, further propelling market growth.

In the United States, the condensing food processing boiler market generated USD 45.3 million in 2024 and is expected to reach USD 70 million by 2034. This growth is primarily supported by stringent emissions regulations imposed by agencies such as the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA). These regulations encourage the adoption of advanced, low-emission heating systems across the food processing sector. As compliance requirements become more rigorous, food manufacturers are transitioning to high-efficiency condensing boilers to meet environmental standards while ensuring optimal production efficiency. With ongoing technological advancements and increasing regulatory pressure, the market is set to witness steady expansion in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 < 10 MMBTU/hr

- 5.3 10 - 25 MMBTU/hr

- 5.4 25 - 50 MMBTU/hr

- 5.5 50 - 75 MMBTU/hr

- 5.6 75 - 100 MMBTU/hr

- 5.7 100 - 175 MMBTU/hr

- 5.8 175 - 250 MMBTU/hr

- 5.9 > 250 MMBTU/hr

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 Fire-tube

- 6.3 Water-tube

Chapter 7 Market Size and Forecast, By Fuel, 2021 – 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 Natural gas

- 7.3 Oil

- 7.4 Coal

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Philippines

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Australia

- 8.4.7 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 Nigeria

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Argentina

- 8.6.2 Chile

- 8.6.3 Brazil

Chapter 9 Company Profiles

- 9.1 ALFA LAVAL

- 9.2 Babcock & Wilcox Enterprises

- 9.3 Babcock Wanson

- 9.4 BM GreenTech

- 9.5 Bosch Industriekessel

- 9.6 Clayton Industries

- 9.7 Cleaver-Brooks

- 9.8 Cochran

- 9.9 Forbes Marshall

- 9.10 Hurst Boiler

- 9.11 Miura America

- 9.12 Rentech Boiler Systems

- 9.13 Thermax

- 9.14 Thermodyne Boilers

- 9.15 Viessmann