|

市場調查報告書

商品編碼

1699343

機器人軟體市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Robotic Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

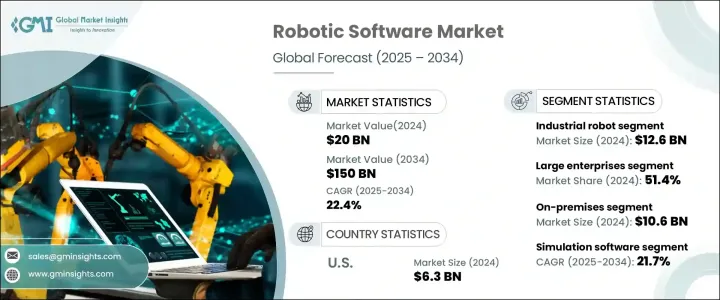

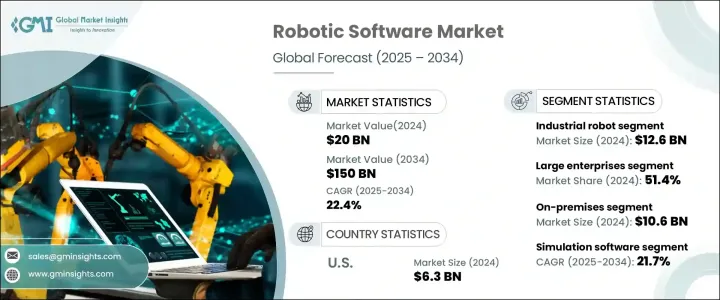

2024 年全球機器人軟體市場價值為 200 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 22.4%。推動這一成長的因素包括人工智慧和機器學習日益融入機器人軟體,以及各行各業對協作機器人的需求不斷成長。企業正在大力投資智慧自動化解決方案,以簡化營運、降低成本並提高生產力。人工智慧和機器學習正在改變機器人系統,使它們能夠做出數據驅動的決策、適應動態環境並以更高的精度執行複雜任務。

這些進步在製造業、醫療保健、物流和農業等領域尤為明顯,自動化正在最佳化效率並提高整體產出。勞動密集和重複性過程對機器人的依賴日益增加,推動了對能夠管理、分析和增強機器人性能的先進軟體解決方案的需求。此外,世界各國政府和企業都在增加對智慧機器人的投資,進一步加速市場擴張。基於雲端的機器人技術、增強的連接性和無縫軟體整合的興起,使得機器人應用更具可擴展性和可訪問性,為各種規模的企業利用自動化獲得競爭優勢開闢了新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 200億美元 |

| 預測值 | 1500億美元 |

| 複合年成長率 | 22.4% |

市場根據機器人類型進行細分,其中工業機器人和服務機器人是兩個主要類別。 2024年,工業機器人軟體佔據市場主導地位,規模達126億美元。這些系統對於自動化製造和組裝流程、減少錯誤和提高營運效率至關重要。工業機器人軟體結合了強大的資料分析工具,可以即時洞察機器人的操作,幫助企業最佳化效能、最大限度地減少停機時間並提高產品品質。此外,模擬和視覺化工具等功能使用戶能夠在部署之前預測和緩解潛在問題,確保無縫整合到生產環境中。隨著各行各業越來越重視自動化以滿足不斷成長的需求並保持競爭優勢,工業機器人軟體的採用率將大幅上升。

企業規模是影響機器人軟體市場的另一個關鍵部分,涵蓋大型企業和中小型企業 (SME)。大型企業在 2024 年佔據了 51.4% 的市場佔有率,凸顯了其在採用機器人解決方案方面的主導作用。這些組織運作多條生產線、倉庫和物流中心,需要先進的軟體來實現無縫協調、任務管理和流程最佳化。機器人軟體使大公司能夠監控效能、自動執行重複性任務並增強可擴展性,最終提高效率並節省成本。同時,中小企業也擴大投資於機器人自動化,以提高營運靈活性、降低勞動力成本,並在不斷變化的商業環境中更有效地競爭。

2024 年美國機器人軟體市場價值為 63 億美元,反映了該國在自動化和先進機器人技術應用方面的領導地位。隨著製造業、醫療保健和物流等行業採用智慧自動化,對機器人軟體解決方案的需求持續激增。對成本效益高、高效和精確的製造流程的追求正在推動企業實施人工智慧機器人技術,以提高生產品質並減少人工干預。隨著美國公司尋求透過智慧自動化最佳化營運,美國仍然是塑造全球機器人軟體格局的關鍵參與者。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 人工智慧和機器學習日益融入機器人軟體

- 協作機器人需求不斷成長

- 各行各業自動化程度提高

- 提高各行各業對機器人的採用率

- 產業陷阱與挑戰

- 初期投資高

- 與現有系統整合的綜合體

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按軟體類型,2021-2034 年

- 主要趨勢

- 模擬軟體

- 導航和地圖軟體

- 數據分析與管理軟體

- 視覺軟體

- 預測性維護軟體

- 其他

第6章:市場估計與預測:依機器人類型,2021-2034

- 主要趨勢

- 工業機器人

- 服務機器人

第7章:市場估計與預測:依部署模式,2021-2034

- 主要趨勢

- 本地

- 基於雲端

第8章:市場估計與預測:依企業規模,2021-2034

- 主要趨勢

- 大型企業

- 中小企業(SME)

第9章:市場估計與預測:依最終用途產業,2021-2034 年

- 主要趨勢

- 製造業

- 汽車

- 衛生保健

- 運輸和物流

- 金融服務業

- 零售與電子商務

- 其他

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- ABB Ltd

- Amazon Robotics (Amazon.com, Inc.)

- Autodesk, Inc.

- Blue Prism Group plc

- Boston Dynamics

- Clearpath Robotics

- Cognex Corporation

- Denso Corporation

- FANUC Corporation

- Hanson Robotics

- iRobot Corporation

- KUKA AG

- Mitsubishi Electric Corporation

- NVIDIA Corporation

- Omron Corporation

- Open Robotics (OSRF)

- Rockwell Automation, Inc.

- Siemens AG

- SoftBank Robotics

- Teradyne Inc.

- UiPath Inc.

- Universal Robots A/S

- Vecna Robotics

- Yaskawa Electric Corporation

The Global Robotic Software Market was valued at USD 20 billion in 2024 and is expected to expand at a CAGR of 22.4% from 2025 to 2034. This growth is being driven by the increasing integration of artificial intelligence and machine learning into robotic software, as well as the rising demand for collaborative robots across industries. Businesses are investing heavily in intelligent automation solutions to streamline operations, reduce costs, and enhance productivity. AI and ML are transforming robotic systems by enabling them to make data-driven decisions, adapt to dynamic environments, and perform complex tasks with greater precision.

These advancements are particularly evident in sectors such as manufacturing, healthcare, logistics, and agriculture, where automation is optimizing efficiency and improving overall output. The growing reliance on robotics for labor-intensive and repetitive processes is fueling the demand for advanced software solutions capable of managing, analyzing, and enhancing robot performance. Additionally, governments and enterprises worldwide are ramping up investments in smart robotics, further accelerating market expansion. The rise of cloud-based robotics, enhanced connectivity, and seamless software integration is making robotic applications more scalable and accessible, opening new opportunities for businesses of all sizes to leverage automation for competitive advantage.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20 Billion |

| Forecast Value | $150 Billion |

| CAGR | 22.4% |

The market is segmented based on the type of robot, with industrial robots and service robots being the two primary categories. In 2024, industrial robot software dominated the market, accounting for USD 12.6 billion. These systems are essential for automating manufacturing and assembly processes, reducing errors, and improving operational efficiency. Industrial robot software incorporates powerful data analytics tools that provide real-time insights into robotic operations, allowing businesses to optimize performance, minimize downtime, and enhance product quality. Additionally, features such as simulation and visualization tools enable users to anticipate and mitigate potential issues before deployment, ensuring seamless integration into production environments. As industries increasingly prioritize automation to meet growing demands and maintain a competitive edge, the adoption of industrial robot software is set to rise significantly.

Enterprise size is another crucial segment shaping the robotic software market, encompassing both large enterprises and small and medium-sized enterprises (SMEs). Large enterprises accounted for a 51.4% market share in 2024, highlighting their dominant role in adopting robotic solutions. These organizations operate multiple production lines, warehouses, and logistics centers, necessitating advanced software for seamless coordination, task management, and process optimization. Robotic software enables large companies to monitor performance, automate repetitive tasks, and enhance scalability, ultimately leading to higher efficiency and cost savings. Meanwhile, SMEs are also increasingly investing in robotic automation to improve operational agility, minimize labor costs, and compete more effectively in an evolving business landscape.

The U.S. robotic software market was valued at USD 6.3 billion in 2024, reflecting the country's leadership in automation and advanced robotics adoption. With industries such as manufacturing, healthcare, and logistics embracing intelligent automation, demand for robotic software solutions continues to surge. The push for cost-effective, efficient, and precise manufacturing processes is driving businesses to implement AI-powered robotics to enhance production quality and reduce human intervention. As American companies seek to optimize operations through intelligent automation, the U.S. remains a key player in shaping the global robotic software landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing integration of AI and ML into robotic software

- 3.6.1.2 Rising demand for collaborative robots

- 3.6.1.3 Increased automation across industries

- 3.6.1.4 Raising the adoption of robots across various sectors

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investments

- 3.6.2.2 Complexes in integration with existing systems

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Software Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Simulation software

- 5.3 Navigation and mapping software

- 5.4 Data analytics and management software

- 5.5 Vision software

- 5.6 Predictive maintenance software

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Robot Type, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Industrial robot

- 6.3 Service robot

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Large enterprise

- 8.3 Small and Medium Enterprises (SME)

Chapter 9 Market Estimates & Forecast, By End-use Industry, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Manufacturing

- 9.3 Automotive

- 9.4 Healthcare

- 9.5 Transportation and logistics

- 9.6 BFSI

- 9.7 Retail & e-commerce

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABB Ltd

- 11.2 Amazon Robotics (Amazon.com, Inc.)

- 11.3 Autodesk, Inc.

- 11.4 Blue Prism Group plc

- 11.5 Boston Dynamics

- 11.6 Clearpath Robotics

- 11.7 Cognex Corporation

- 11.8 Denso Corporation

- 11.9 FANUC Corporation

- 11.10 Hanson Robotics

- 11.11 iRobot Corporation

- 11.12 KUKA AG

- 11.13 Mitsubishi Electric Corporation

- 11.14 NVIDIA Corporation

- 11.15 Omron Corporation

- 11.16 Open Robotics (OSRF)

- 11.17 Rockwell Automation, Inc.

- 11.18 Siemens AG

- 11.19 SoftBank Robotics

- 11.20 Teradyne Inc.

- 11.21 UiPath Inc.

- 11.22 Universal Robots A/S

- 11.23 Vecna Robotics

- 11.24 Yaskawa Electric Corporation