|

市場調查報告書

商品編碼

1642129

機器人軟體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Robot Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

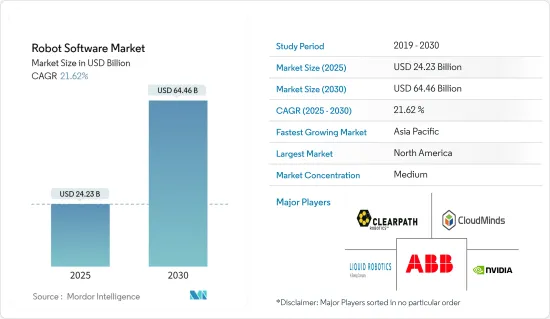

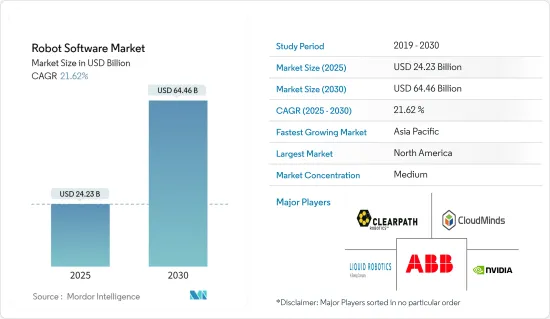

機器人軟體市場規模預計在 2025 年為 242.3 億美元,預計到 2030 年將達到 644.6 億美元,預測期內(2025-2030 年)的複合年成長率為 21.62%。

機器人軟體可實現智慧、運動、安全和生產力功能,使機器人能夠觀察、感知、學習並保持安全。這些功能和優勢使用戶能夠快速輕鬆地推出並運作機器人,以實現最佳生產力。

主要亮點

- 推動機器人軟體市場發展的關鍵因素是採用人工智慧、提高速度、提高品質、降低人事費用、提高精度和提高生產的擴充性。

- 製造業、電氣電子、汽車、食品飲料和製程控制等各種終端用戶產業對機器人技術的採用日益廣泛,預計將成為機器人軟體平台市場的主要成長要素。機器人技術在各個終端用戶產業的應用日益廣泛,有助於滿足客製化需求,同時降低人事費用。

- 自從機器人發明以來,軟體在機器人領域就發揮著至關重要的作用。隨著新軟體功能的推出,可以更好地控制機器人、更快地自訂序列和易於使用,該軟體預計將在未來幾年進一步推動機器人技術的應用。

- 然而,資料安全和日益增多的網路攻擊正在阻礙市場成長。此外,機器人犯罪的增加阻礙了各個領域採用機器人,從而降低了採用機器人軟體的前景。此外,缺乏熟練的專業知識也是該市場發展的一大限制。

- COVID-19 有力地推動了機器人軟體的擴大使用和機器人研究的改進。疫情期間,各公司部署了機器人對區域進行消毒,並為隔離人員運送食物。其他公司也設計了機器人軟體來幫助追蹤當地社區的 COVID-19。

機器人軟體市場趨勢

工業機器人是主要應用

- 隨著物聯網 (IIoT) 等技術的出現,再加上工業 4.0 以及智慧工廠概念的重要性,工業機器人在整個製造業的應用正在日益增加。工業機器人通常用於取代人類工人執行危險或重複性的高精度任務。根據IFR預測,到2024年,亞洲/澳洲安裝的工業機器人數量將達到37萬台。

- 為了有效率地運作機器人,機器人軟體對於根據製造商的需求操作機器人至關重要。該軟體是人類能力的延伸。它體現了人類的視野隨著每一代和技術的飛躍而日益清晰。隨著工業領域機器人技術的快速發展,對機器人軟體的需求也大幅增加。

- 此外,人工智慧和機器學習能力正在迅速滲透到工業機器人技術中。機器人技術與人工智慧技術結合的最大優勢之一是透過預測性維護來提高運作和生產力。

- 人工智慧與工業機器人技術的整合將使機器人能夠監控自身的準確性和性能,並在需要維護時提供訊號,從而避免代價高昂的停機。

- 此外,2023 年 5 月,Alphabet 宣布推出其工業機器人部門 Intrinsic 的首款產品 Flowstate。 Flowstate 是一個直覺的基於 Web 的開發環境,可協助公司建立機器人工作流程,為使用者提供開始建立機器人系統的基礎和測試其設計的模擬功能。具體來說,該軟體旨在使非專家能夠理解和使用機器人系統。

亞太地區:預計大幅成長

- 預計亞太地區在預測期內將呈現顯著的成長機會。為該地區機器人軟體市場的成長做出貢獻的主要國家是中國、日本、新加坡、韓國和印度。該地區的國家正在增加整體行業對機器人技術的採用。

- 中國市場預計將增加對人工智慧和機器人技術的支出,因為中國在其「十三五」規劃中明確表示將重點放在這些技術。中國國家發展和改革委員會宣布了一項為期三年的人工智慧實施方案,預計將加速採用先進技術,幫助中國在 2030 年成為超級大國。

- 化工廠等執行危險作業的組織對自動化和安全的需求不斷增加,推動了市場的成長。此外,工業物聯網 (IIoT) 等最尖端科技的日益普及(該技術是智慧工廠計劃與工業 4.0 結合不可或缺的一部分)正在推動工業機器人市場的成長。

- 此外,過去幾年來,機器人工作單元的成本每年下降 5-10%,而機器人的速度和產量卻大幅提高。

機器人軟體產業概況

隨著機器人技術在全球範圍內的滲透及其在各個行業的應用,機器人軟體市場變得越來越複雜。機器人軟體公司不斷專注於開發先進技術以增強機器人流程並幫助增強製造流程。市場上的知名供應商包括 ABB Ltd、Clearpath Robotics、NVIDIA Corporation 和 CloudMinds Technology Inc.

- 2023 年 12 月-ABB 有限公司宣布加強與沃爾沃汽車的長期夥伴關係關係,為該公司打造下一代電動車提供 1,300 多個機器人和功能套件。這將有助於這家瑞典汽車製造商實現其雄心勃勃的永續性目標。

- 2023 年 10 月-NVIDIA 在其 Jeston 平台上宣布了兩個用於邊緣 AI 和機器人的框架:NVIDIA Isaac ROS 機器人框架。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 組織對自動化和安全的需求日益增加

- 中小企業快速採用機器人軟體來降低人事費用和能源成本

- 市場挑戰

- 部署成本上升以及針對軟體的惡意軟體攻擊增多

第6章 市場細分

- 依軟體類型

- 辨識軟體

- 模擬軟體

- 預測性維護軟體

- 資料管理與分析軟體

- 通訊管理軟體

- 按機器人類型

- 工業機器人

- 服務機器人

- 按部署

- 本地

- 一經請求

- 按公司規模

- 中小型企業

- 大型企業

- 按行業

- 車

- 零售與電子商務

- 政府和國防

- 衛生保健

- 運輸和物流

- 製造業

- 資訊科技/通訊

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Clearpath Robotics

- NVIDIA Corporation

- CloudMinds Technology Inc.

- Liquid Robotics Inc.

- Brain Corporation

- AIBrain Inc.

- Furhat Corporation

- Neurala Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Robot Software Market size is estimated at USD 24.23 billion in 2025, and is expected to reach USD 64.46 billion by 2030, at a CAGR of 21.62% during the forecast period (2025-2030).

Robot software enables functions for intelligence, motion, safety, and productivity and gives the power to get the robots to see, feel, learn, and maintain security. These characteristics and benefits allow users to instantly and easily get their robots up and running at optimum productivity.

Key Highlights

- The major factors driving the robot software market are the adoption of artificial intelligence, enhanced speed, improved quality, reduced labor cost, increased accuracy, and production scalability.

- Rising adoption of robots across various end-user industries such as manufacturing, electrical and electronics, automotive, food and beverage, and process controls are seen as primary growth drivers for the robotics software platforms market. The growing utilization of robots in varied end-user industries helps meet customized demand while simultaneously helping lower labor costs.

- Since the invention of robots, software has played a key role in the field of robotics. With the introduction of new software features that enable better control of the robot, quick customization of sequences, and ease of use, the software is expected to further boost the adoption of robotics in the coming years.

- However, data security and increasing cyberattacks are hindering market growth. Also, increasing robot crimes are impeding the adoption of robots in various sectors, thus, reducing the robot software adoption prospects. Also, the lack of skilled expertise is another major restraining factor for this market.

- COVID-19 provided a solid push to expand the usage of robot software and improve robotics research. During the pandemic, various companies have installed robots to disinfect areas and deliver food to quarantined people. Some companies designed robot software to help people track COVID-19 in their communities.

Robot Software Market Trends

Industrial Robots to Have the Majority Application

- With the advent of technologies like the Industrial Internet of Things (IIoT), vital to the smart factory concept coupled with Industry 4.0, industrial robot adoption is increasing across the manufacturing industries. An industrial robot is generally used in place of human laborers to perform dangerous or repetitive tasks with high accuracy. and According to IFR It is projected that by 2024, industrial robot installations in Asia/Australia will reach 370,000 units.

- In order to make the robots perform efficiently, robot software is essential to operate the robots according to the needs of the manufacturers. This software is an extension of human capability. It reflects the human vision that gets keener with every generation and every technological leap. With the enormous growth of robotics in the industrial sector, the need for robotic software is also increasing substantially.

- Moreover, Artificial Intelligence and machine learning capabilities have been rapidly making their way into industrial robotics technology. One of the most significant benefits derived from the merging of robotics and AI technology is increased uptime and productivity from predictive maintenance.

- With AI integrated with industrial robotics technology, robots are able to monitor their own accuracy and performance, providing signals when maintenance is required to avoid expensive downtime.

- Furthermore, in May 2023, Alphabet launched the first product under its industrial robotics business unit Intrinsic, called Flowstate, which is an intuitive, web-based developer environment where companies can create robotic workflows, offering users the foundation to begin building robotic systems, as well as simulation capabilities to test designs. In particular, the software is aimed at helping non-experts understand and leverage robotic systems.

The Asia-Pacific Region Expected to Register Significant Growth

- The Asia-Pacific region is expected to exhibit significant growth opportunities over the forecast period. The major economies contributing to the growth of the robot software market in this region are China, Japan, Singapore, South Korea, and India. The countries in this region are increasingly adopting robotics across industries.

- The Chinese market is expected to increase its expenditure on AI and robotics, as the country has categorically prioritized its focus on AI and robotics in its 13th five-year plans. China's National Development and Reform Commission has announced an AI three-year implementation program expected to accelerate the adoption of advanced technologies to help the country become a superpower by 2030.

- Rise in demand for automation and safety in organization for hazardous works like chemical plants and others, is driving the growth of the market. Furthermore, with the rising adoption of cutting-edge technologies like the Industrial Internet of Things (IIoT) vital to the smart factory concept coupled with Industry 4.0, and industrial robot is driving the growth of the market

- In addition, the cost of robot work cells has decreased by 5-10% per year since few years and the speed and throughput of robot has increased significantly; due to which there is an increase in adoption of robots, which in turns drives the growth of the market across the region.

Robot Software Industry Overview

The Robot Software Market is semi-conslodiated owing to the penetration of robotics globally with applications in various industries. Robotic software companies are constantly focusing on developing advanced technologies that would enhance the robotic processes and help the manufacturing industries to intensify their process. Some of the prominent vendors in the market include ABB Ltd, Clearpath Robotics, NVIDIA Corporation, and CloudMinds Technology Inc.

- December 2023 - ABB Ltd has announced the strengthening of its long-standing partnership with Volvo Cars to supply more than 1,300 robots and functional packages to build the next generation of electric vehicles. This will support the Swedish car manufacturer to achieve its ambitious sustainability targets.

- October 2023 - NVIDIA announced launch of its to two frameworks on the Jeston Platform for edge AI and robotics the NVIDIA Isaac ROS robotics framework for Robotics Platform to Meet the Rise of Generative AI, More than 10,000 companies building on the NVIDIA Jetson platform can now use new generative AI, APIs and microservices to accelerate industrial digitalization.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in need for automation and safety in organizations

- 5.1.2 Rapid adoption of robot software by SMEs to reduce labor and energy costs

- 5.2 Market Challenges

- 5.2.1 High cost of implementation and rise in malware attacks on the software

6 MARKET SEGMENTATION

- 6.1 By Software Type

- 6.1.1 Recognition Software

- 6.1.2 Simulation Software

- 6.1.3 Predictive Maintenance Software

- 6.1.4 Data Management and Analysis Software

- 6.1.5 Communication Management Software

- 6.2 By Robot Type

- 6.2.1 Industrial Robots

- 6.2.2 Service Robots

- 6.3 By Deployment

- 6.3.1 On-Premise

- 6.3.2 On-Demand

- 6.4 By Enterprise Size

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By End-user Vertical

- 6.5.1 Automotive

- 6.5.2 Retail and E-commerce

- 6.5.3 Government and Defense

- 6.5.4 Healthcare

- 6.5.5 Transportation and Logistics

- 6.5.6 Manufacturing

- 6.5.7 IT and Telecommunications

- 6.5.8 Other End-user Verticals

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Clearpath Robotics

- 7.1.3 NVIDIA Corporation

- 7.1.4 CloudMinds Technology Inc.

- 7.1.5 Liquid Robotics Inc.

- 7.1.6 Brain Corporation

- 7.1.7 AIBrain Inc.

- 7.1.8 Furhat Corporation

- 7.1.9 Neurala Inc.