|

市場調查報告書

商品編碼

1699361

互動式平板顯示器市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Interactive Flat Panel Display Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

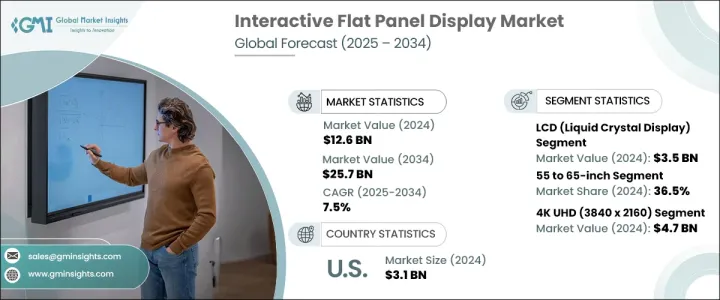

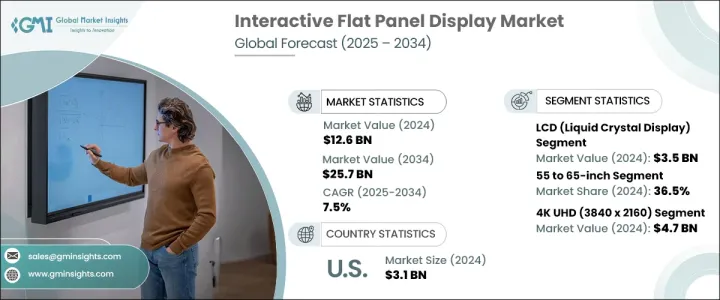

2024 年全球互動式平板顯示器市場價值為 126 億美元,預計 2025 年至 2034 年的複合年成長率為 7.5%。互動式顯示器在多個行業的快速應用推動了這一擴張,尤其是在教育、企業環境和零售領域。隨著數位轉型的加速,企業和機構認知到互動式平板顯示器在增強溝通、參與和協作方面的價值。智慧教室的推動以及政府整合先進學習工具的措施進一步推動了市場成長。這些顯示器有利於即時資訊共享和沈浸式學習,從而帶來豐富的教育體驗。隨著各機構尋求傳統教學方法的有效數位化替代方案,遠距和混合學習模式的興起也促進了採用率的提高。同樣,企業正在利用這些顯示器進行互動式演示、資料視覺化和無縫遠端協作,從而推動全球需求。

技術進步在市場擴張中發揮著至關重要的作用。市場細分為 LED(發光二極體)、LCD(液晶顯示器)、OLED(有機發光二極體)、電子紙和 DLP(數位光處理)。受零售、醫療保健和汽車等行業對高清顯示器需求不斷成長的推動,LCD 市場的規模到 2024 年將達到 35 億美元。智慧型手機、平板電腦和智慧電視等消費性電子產品嚴重依賴 LCD 技術,因為它具有卓越的解析度、緊湊的設計和能源效率。色彩精度、對比度和刷新率的進步提高了顯示質量,使 LCD 成為高階應用的首選。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 126億美元 |

| 預測值 | 257億美元 |

| 複合年成長率 | 7.5% |

螢幕尺寸在消費者的購買決策中扮演重要角色。市場分為 55 吋以下、55 至 65 吋、65 至 75 吋和 75 吋以上。預計到 2024 年,55 至 65 吋電視將佔據 36.5% 的市場佔有率,這得益於其在家庭娛樂和企業會議空間中的普及。隨著消費者尋求高品質的視覺效果和身臨其境的體驗,而又不想承擔更大顯示器的成本負擔,對中型家庭劇院系統的需求正在上升。家庭媒體室、遊戲設定和智慧家庭整合正在推動這些顯示器的採用,使其成為個人和專業應用的首選。

2024 年北美互動式平板顯示器市場價值為 31 億美元,其中美國引領區域成長。汽車、醫療保健和企業等領域擴大採用互動式螢幕,這推動了需求。企業正在整合這些顯示器,以實現高效的協作、資料共享和增強的客戶互動。智慧辦公室和數位化工作場所的不斷發展正在進一步擴大市場。觸控螢幕創新、4K 和 8K 解析度以及人工智慧功能等技術進步使美國成為全球市場的主導力量。隨著對智慧互動解決方案的需求不斷成長,該行業不斷發展,為各種應用提供更先進、更方便用戶使用的顯示器。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 互動式平板顯示器在教育領域的新興應用

- 政府對互動式平板顯示器的支援不斷增加

- 遊戲和娛樂產業對互動式平板顯示器的採用激增

- 互動式平板顯示器在汽車領域的應用日益廣泛

- 科技快速發展

- 產業陷阱與挑戰

- 互動組件、顯示面板等零件成本高

- 對安全的擔憂日益加劇

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依螢幕尺寸,2021-2034

- 主要趨勢

- 55吋以下

- 55至65英寸

- 65 至 75 英寸

- 75吋以上

第6章:市場估計與預測:依技術,2021-2034 年

- 主要趨勢

- LCD(液晶顯示器)

- LED(發光二極體)

- OLED(有機發光二極體)

- DLP(數位光處理)

- 電子紙

第7章:市場估計與預測:依決議,2021-2034

- 主要趨勢

- 高清(1280 x 720)

- 全高清 (1920 x 1080)

- 4K 超高清 (3840 x 2160)

- 8K 超高清 (7680 x 4320)

第8章:市場預估與預測:按面板類型,2021-2034

- 主要趨勢

- 電阻式

- 電容式

- 紅外線的

- 光學的

- 電磁

- 表面聲波(SAW)

第9章:市場估計與預測:依連結性,2021-2034

- 主要趨勢

- 有線

- 無線的

第10章:市場估計與預測:依互動技術,2021-2034 年

- 主要趨勢

- 基於觸摸

- 筆式

- 基於手勢

第 11 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 教育

- 公司的

- 衛生保健

- 零售

- 飯店業

- 其他

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- BenQ Corporation

- Boxlight Corporation

- Casio Computer Co., Ltd.

- Clevertouch Technologies

- Dell Technologies Inc.

- Epson America, Inc.

- Gaoke

- Genee World

- Hisense Group

- Hitachi Ltd.

- LG Electronics Inc.

- Microsoft Corporation

- NEC Display Solutions

- Newline Interactive Inc.

- Optoma Corporation

- Panasonic Corporation

- Philips

- Promethean Limited

- Ricoh Company, Ltd.

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Sony Corporation

- TouchIT Technologies

- Vestel Group

- ViewSonic Corporation

The Global Interactive Flat Panel Display Market was valued at USD 12.6 billion in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2034. The rapid adoption of interactive displays across multiple industries is fueling this expansion, particularly in education, corporate environments, and the retail sector. As digital transformation accelerates, businesses and institutions recognize the value of interactive flat panel displays in enhancing communication, engagement, and collaboration. The push for smart classrooms, alongside government initiatives to integrate advanced learning tools, is further propelling market growth. These displays facilitate real-time information sharing and immersive learning, fostering an enriched educational experience. The rise of remote and hybrid learning models is also contributing to increased adoption as institutions seek effective digital alternatives to traditional teaching methods. Similarly, businesses are leveraging these displays for interactive presentations, data visualization, and seamless remote collaboration, boosting demand globally.

Technology advancements are playing a crucial role in market expansion. The market is segmented into LED (Light Emitting Diode), LCD (Liquid Crystal Display), OLED (Organic Light Emitting Diode), E-Paper, and DLP (Digital Light Processing). The LCD segment accounted for USD 3.5 billion in 2024, driven by rising demand for high-definition displays across industries such as retail, healthcare, and automotive. Consumer electronics, including smartphones, tablets, and smart TVs, heavily rely on LCD technology due to its superior resolution, compact design, and energy efficiency. Advancements in color accuracy, contrast ratios, and refresh rates are enhancing display quality, making LCDs a preferred choice for high-end applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.6 Billion |

| Forecast Value | $25.7 Billion |

| CAGR | 7.5% |

Screen size plays a significant role in consumer purchasing decisions. The market is categorized into Below 55 Inches, 55 to 65 Inches, 65 to 75 Inches, and Above 75 Inches. The 55 to 65-inch segment is expected to hold a 36.5% market share in 2024, driven by its popularity in home entertainment and corporate meeting spaces. The demand for mid-sized home theater systems is rising as consumers seek high-quality visuals and immersive experiences without the cost burden of larger displays. Family media rooms, gaming setups, and smart home integrations are fueling the adoption of these displays, making them a preferred option for both personal and professional applications.

North America Interactive Flat Panel Display Market was valued at USD 3.1 billion in 2024, with the United States leading regional growth. The increasing implementation of interactive screens across sectors like automotive, healthcare, and corporate enterprises is driving demand. Businesses are integrating these displays for efficient collaboration, data sharing, and enhanced customer interactions. The ongoing development of smart offices and digital workplaces is further amplifying market expansion. Technological advancements, including touch-screen innovations, 4K and 8K resolutions, and AI-powered features, are positioning the United States as a dominant force in the global market. As demand for intelligent, interactive solutions rises, the industry continues to evolve, offering more advanced and user-friendly displays for diverse applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Emerging use of interactive flat panel display in education sector

- 3.6.1.2 Rising government support for interactive flat panel display

- 3.6.1.3 Surge in adoption of interactive flat panel display in gaming and entertainment industry

- 3.6.1.4 Increasing application of interactive flat panel display in automotives

- 3.6.1.5 Rapid technological developments

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of interactive components, display panels, and other components

- 3.6.2.2 Growing concerns regarding security

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Screen Size, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Below 55 inches

- 5.3 55 to 65 inches

- 5.4 65 to 75 inches

- 5.5 Above 75 inches

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 LCD (Liquid Crystal Display)

- 6.3 LED (Light Emitting Diode)

- 6.4 OLED (Organic Light Emitting Diode)

- 6.5 DLP (Digital Light Processing)

- 6.6 E-Paper

Chapter 7 Market Estimates & Forecast, By Resolution, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 HD (1280 x 720)

- 7.3 Full HD (1920 x 1080)

- 7.4 4K UHD (3840 x 2160)

- 7.5 8K UHD (7680 x 4320)

Chapter 8 Market Estimates & Forecast, By Panel Type, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Resistive

- 8.3 Capacitive

- 8.4 Infrared

- 8.5 Optical

- 8.6 Electromagnetic

- 8.7 Surface Acoustic Wave (SAW)

Chapter 9 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Wired

- 9.3 Wireless

Chapter 10 Market Estimates & Forecast, By Interactive Technology, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 Touch-based

- 10.3 Pen-based

- 10.4 Gesture-based

Chapter 11 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 11.1 Key trends

- 11.2 Education

- 11.3 Corporate

- 11.4 Healthcare

- 11.5 Retail

- 11.6 Hospitality

- 11.7 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 BenQ Corporation

- 13.2 Boxlight Corporation

- 13.3 Casio Computer Co., Ltd.

- 13.4 Clevertouch Technologies

- 13.5 Dell Technologies Inc.

- 13.6 Epson America, Inc.

- 13.7 Gaoke

- 13.8 Genee World

- 13.9 Hisense Group

- 13.10 Hitachi Ltd.

- 13.11 LG Electronics Inc.

- 13.12 Microsoft Corporation

- 13.13 NEC Display Solutions

- 13.14 Newline Interactive Inc.

- 13.15 Optoma Corporation

- 13.16 Panasonic Corporation

- 13.17 Philips

- 13.18 Promethean Limited

- 13.19 Ricoh Company, Ltd.

- 13.20 Samsung Electronics Co., Ltd.

- 13.21 Sharp Corporation

- 13.22 Sony Corporation

- 13.23 TouchIT Technologies

- 13.24 Vestel Group

- 13.25 ViewSonic Corporation