|

市場調查報告書

商品編碼

1699393

家居裝修市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Home Improvement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 -2034 |

||||||

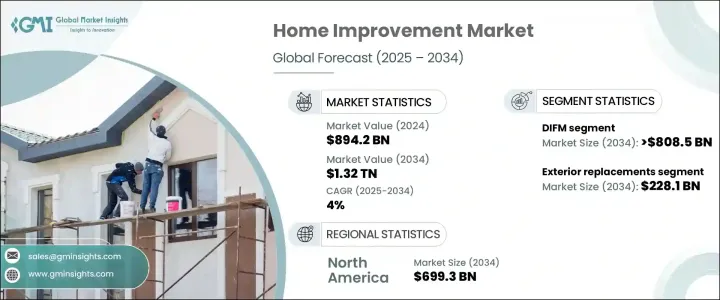

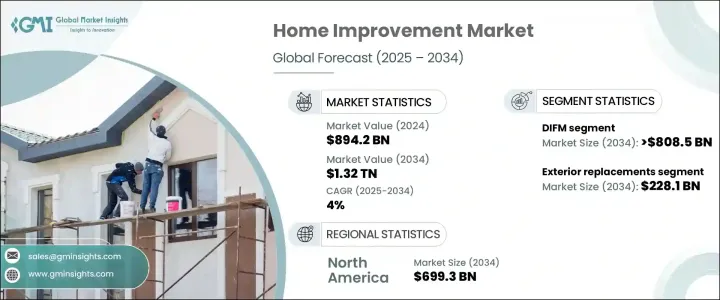

2024 年全球家居裝修市場價值為 8,942 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4%。家居裝修產品和服務的需求受到經濟狀況、住房趨勢變化和不斷變化的消費者偏好的影響。可支配收入水準和整體經濟穩定性等因素在決定屋主願意在裝修和升級上投入多少資金方面起著關鍵作用。隨著屋主尋求提高房產價值、提高能源效率和個人化居住空間,市場持續成長。城市化進程的擴大和房屋自有率的上升進一步促進了該行業的穩步成長,人們對永續和耐用的家居裝飾材料的關注度也不斷提高。

市場根據項目類型分為 DIY 和 DIFM。選擇 DIFM 解決方案的屋主在 2024 年貢獻了 5,517 億美元的收入,預計到 2034 年這一數字將成長超過 8,085 億美元。對於經濟高效的家居升級來說,DIY 領域仍然是一個有吸引力的選擇。隨著教學資源的便利性取得以及工具和材料可用性的提高,越來越多的人開始承擔簡單的裝修任務。價格實惠和便利性是推動這一領域擴張的主要因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8942億美元 |

| 預測值 | 1.32兆美元 |

| 複合年成長率 | 4% |

就最終用途而言,市場包括廚房和浴室改進、系統升級、外部更換、內部改造、災難修復、財產增值和額外的房間改造。 2024 年,外部替代品引領了市場,創造了超過 1,609 億美元的收入,預計到 2034 年該領域的收入將達到 2,281 億美元。對耐用、節能和耐候材料的需求不斷成長是推動這一類別投資的主要因素。

屋主經常專注於提高結構的耐用性和美觀性,同時解決隔熱和氣候相關損害等問題。隨著全球氣候模式的不斷變化,對能夠更好地抵禦極端條件的材料的需求正在上升。這一趨勢支持了耐候建築產品和永續翻新材料的創新。

北美仍是主導地區,2024 年的營收將達到 4,828 億美元,預計到 2034 年將達到 6,993 億美元。美國和加拿大的高房屋自有率推動了對裝修和改造服務的持續需求。房價和利率波動等經濟因素在決定消費模式方面發揮著至關重要的作用,屋主擴大投資於改善住房以提高房產價值。隨著個人在有利的經濟條件下尋找具有成本效益的方式來升級他們的房產,不斷發展的房地產市場影響著改造趨勢。

在技術進步、消費者意識增強以及對節能和永續家居解決方案日益重視的推動下,家居裝飾產業持續擴張。隨著越來越多的屋主尋求改善居住空間,市場有望長期成長。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 技術概述

- 監管格局

- 衝擊力

- 成長動力

- 快速城市化

- 可支配所得增加

- 消費者對節能和豪華生活空間的偏好正在改變

- 產業陷阱與挑戰

- 原料成本波動

- 熟練勞動力短缺

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依項目,2021-2034

- 主要趨勢

- DIY

- DIFM

第6章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 廚房改良擴建

- 浴室改良和增建

- 系統升級

- 外部更換

- 內裝更換

- 物業改善

- 災難修復

- 其他房間增建改建

第7章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- MEA 其餘地區

第8章:公司簡介

- ABC Supply Co.

- American Exteriors

- Belfor

- Coit Services, Inc.

- Crane Renovation Group

- DKI Ventures, LLC

- FirstService Corporation

- Henkel Corporation

- Kohler

- Lowe's Companies

- Masco Corporation

- Mr. Handyman

- Neil Kelly Company

- Sherwin-Williams

- Stanley Black & Decker

- The Home Depot

- Venturi Restoration

The Global Home Improvement Market was valued at USD 894.2 billion in 2024 and is projected to expand at a CAGR of 4% between 2025 and 2034. Demand for home improvement products and services is influenced by economic conditions, shifts in housing trends, and evolving consumer preferences. Factors such as disposable income levels and overall economic stability play a key role in determining how much homeowners are willing to invest in renovations and upgrades. The market continues to grow as homeowners seek to enhance property value, improve energy efficiency, and personalize their living spaces. Expanding urbanization and rising homeownership rates further contribute to the industry's steady growth, as does the increasing focus on sustainable and durable home improvement materials.

The market is segmented by project type into DIY and DIFM. Homeowners opting for DIFM solutions contributed USD 551.7 billion in revenue in 2024, with projections indicating growth beyond USD 808.5 billion by 2034. The DIY segment remains an appealing choice for cost-effective home upgrades. With easily accessible instructional resources and improved availability of tools and materials, more individuals are taking on simple renovation tasks. Affordability and convenience are major factors driving this segment's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $894.2 Billion |

| Forecast Value | $1.32 Trillion |

| CAGR | 4% |

In terms of end-use, the market includes kitchen and bath improvements, system upgrades, exterior replacements, interior modifications, disaster repairs, property enhancements, and additional room alterations. Exterior replacements led the market in 2024, generating more than USD 160.9 billion in revenue, with estimates placing the segment at USD 228.1 billion by 2034. The increasing need for durable, energy-efficient, and weather-resistant materials is a major factor driving investments in this category.

Homeowners frequently focus on improving structural durability and aesthetic appeal while addressing issues such as insulation and climate-related damage. As global weather patterns continue to shift, demand for materials that offer better protection against extreme conditions is rising. This trend supports innovation in weather-resistant construction products and sustainable renovation materials.

North America remains the dominant region, securing USD 482.8 billion in revenue in 2024, with expectations to reach USD 699.3 billion by 2034. High homeownership rates in the United States and Canada drive consistent demand for renovation and remodeling services. Economic factors such as fluctuations in home prices and interest rates play a crucial role in determining spending patterns, with homeowners increasingly investing in improvements to enhance property value. The evolving housing market influences remodeling trends as individuals look for cost-effective ways to upgrade their properties during favorable economic conditions.

The home improvement industry continues to expand, supported by technological advancements, increased consumer awareness, and a growing emphasis on energy-efficient and sustainable home solutions. With a steady influx of homeowners seeking to upgrade their living spaces, the market is poised for long-term growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technological overview

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rapid urbanization

- 3.6.1.2 Rising disposable income

- 3.6.1.3 Changing consumer preferences for energy efficient & luxurious living spaces

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuation in raw material cost

- 3.6.2.2 Scarcity of skilled labor

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Project, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 DIY

- 5.3 DIFM

Chapter 6 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Kitchen improvement & additions

- 6.3 Bath improvement & additions

- 6.4 System upgrades

- 6.5 Exterior replacements

- 6.6 Interior replacements

- 6.7 Property improvements

- 6.8 Disaster repairs

- 6.9 Other room additions & alterations

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.3.7 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Rest of Latin America

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Rest of MEA

Chapter 8 Company Profiles

- 8.1 ABC Supply Co.

- 8.2 American Exteriors

- 8.3 Belfor

- 8.4 Coit Services, Inc.

- 8.5 Crane Renovation Group

- 8.6 DKI Ventures, LLC

- 8.7 FirstService Corporation

- 8.8 Henkel Corporation

- 8.9 Kohler

- 8.10 Lowe's Companies

- 8.11 Masco Corporation

- 8.12 Mr. Handyman

- 8.13 Neil Kelly Company

- 8.14 Sherwin-Williams

- 8.15 Stanley Black & Decker

- 8.16 The Home Depot

- 8.17 Venturi Restoration