|

市場調查報告書

商品編碼

1699397

被動及互連電子元件市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Passive and Interconnecting Electronic Components Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

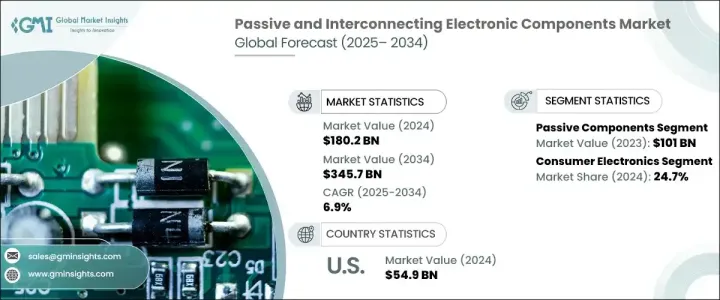

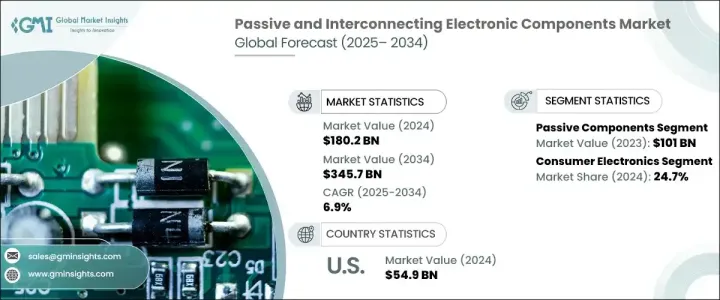

2024 年全球被動和互連電子元件市場規模達到 1802 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.9%。這一成長得益於物聯網 (IoT) 的日益普及、汽車電子的快速發展以及多個行業對高性能電子元件不斷成長的需求。隨著世界聯繫日益緊密,各行各業都更加重視能源效率、自動化和無縫連接,從而推動了對可靠電子元件的需求。

物聯網整合一直是塑造市場格局的關鍵因素。隨著智慧型裝置成為日常生活的重要組成部分,對高品質被動和互連元件的需求持續激增。智慧家庭系統、穿戴式裝置、工業自動化和智慧城市都依賴這些電子元件來實現高效的性能和連接性。數據驅動技術、邊緣運算和基於雲端的應用程式的興起進一步加速了需求。此外,5G 網路、人工智慧 (AI) 和先進電信基礎設施的日益普及也增加了對彈性和高效能電子元件的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1802億美元 |

| 預測值 | 3457億美元 |

| 複合年成長率 | 6.9% |

汽車產業也是市場擴張的主要貢獻者。現代車輛越來越依賴電子系統,從高級駕駛輔助系統 (ADAS) 和資訊娛樂系統到電動車 (EV) 動力系統和電池管理系統。向電動和自動駕駛汽車的轉變對被動和互連組件提出了更高的需求,以確保下一代汽車技術的性能、安全性和壽命。汽車製造商正在整合更多的電子控制單元 (ECU)、感測器和高速連接器,以提高車輛效率、自動化程度和使用者體驗。

2023 年,被動元件領域產值達 1,010 億美元,包括電阻器、電容器、電感器和變壓器等基本元件。這些組件不需要外部電源來運行,而是在電路內儲存、吸收或耗散能量。它們在消費性電子、工業應用、電信和醫療設備中不可或缺的作用正在推動穩定的需求。隨著製造商優先考慮小型化和更高的能源效率,被動元件對於確保現代電子設備的耐用性、性能和可靠性變得至關重要。

2024 年,被動和互連電子元件市場中的消費性電子部分佔據了 24.7% 的佔有率。智慧型手機、筆記型電腦、家用電器和穿戴式裝置的日益普及繼續推動對高品質電容器、電阻器和連接器的需求。隨著電子設備的處理速度越來越快、電池壽命越來越長、設計越來越緊湊,製造商越來越依賴被動和互連組件來保持無縫功能。

在強勁的技術進步、自動化程度的提高以及對數位基礎設施的持續投資的推動下,美國被動和互連電子元件市場規模到 2024 年將達到 549 億美元。該國在汽車、電信和消費性電子等領域仍處於創新前沿,對電子元件的需求持續存在。隨著各行各業擴大採用人工智慧、機器人技術和智慧製造,預計未來幾年對可靠、高性能被動和互連組件的需求將進一步增加。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 物聯網(IoT)的興起

- 對先進汽車電子產品的需求不斷成長

- 消費性電子產業快速擴張

- 再生能源解決方案的普及

- 產業陷阱與挑戰

- 原料成本高

- 環境和永續性議題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 被動的

- 電阻器

- 電容器

- 電感器

- 變形金剛

- 其他

- 互連

- 印刷電路板

- 連接器

- 開關和繼電器

- 其他

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 消費性電子產品

- 智慧型手機和平板電腦

- 筆記型電腦和桌上型電腦

- 電視和家用電器

- 其他

- 汽車

- 車載資訊娛樂系統

- 安全與安保系統

- 駕駛員輔助系統

- 引擎控制系統

- 其他

- 衛生保健

- 影像系統

- 病人監護系統

- 治療設備

- 其他

- IT和電信

- 電信設備

- 網路裝置

- 工業的

- 自動化與機器人

- 發電

- 工業控制系統

- 其他

- 航太與國防

- 軍事通訊

- 武器系統

- 飛機安全系統

- 其他

- 其他

第7章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Amphenol Corporation

- Fenghua (HK) Electronics Ltd.

- Fujitsu Component Limited

- Hirose Electric Co. Ltd

- Hosiden Corporation

- KYOCERA AVX Components Corporation

- Molex Incorporated

- Murata Manufacturing Co., Ltd.

- Nichicon Corporation

- Panasonic Corporation

- Rohm Co., Ltd.

- Samsung Electro-Mechanics Co., Ltd.

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- TE Connectivity Ltd.

- TT Electronics PLC

- United Chemi-Con

- Vishay Intertechnology, Inc.

- Walsin Technology Corporation

- Yageo Corporation

The Global Passive And Interconnecting Electronic Components Market reached USD 180.2 billion in 2024 and is projected to grow at a CAGR of 6.9% between 2025 and 2034. This growth is fueled by the increasing adoption of the Internet of Things (IoT), rapid advancements in automotive electronics, and rising demand for high-performance electronic components across multiple industries. As the world becomes more connected, industries are placing greater emphasis on energy efficiency, automation, and seamless connectivity, driving the need for reliable electronic components.

IoT integration has been a key factor in shaping the market landscape. With smart devices becoming an essential part of everyday life, the demand for high-quality passive and interconnecting components continues to surge. Smart home systems, wearable devices, industrial automation, and smart cities all rely on these electronic components for efficient performance and connectivity. The rise in data-driven technologies, edge computing, and cloud-based applications has further accelerated demand. Additionally, the increasing penetration of 5G networks, artificial intelligence (AI), and advanced telecommunication infrastructure has amplified the need for resilient and high-efficiency electronic components.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $180.2 Billion |

| Forecast Value | $345.7 Billion |

| CAGR | 6.9% |

The automotive sector is also a major contributor to market expansion. Modern vehicles are increasingly dependent on electronic systems, from advanced driver-assistance systems (ADAS) and infotainment to electric vehicle (EV) powertrains and battery management systems. The shift toward electric and autonomous vehicles has created a higher demand for passive and interconnecting components, ensuring performance, safety, and longevity in next-generation automotive technologies. Automakers are integrating more electronic control units (ECUs), sensors, and high-speed connectors to enhance vehicle efficiency, automation, and user experience.

The passive components segment generated USD 101 billion in 2023, comprising essential components such as resistors, capacitors, inductors, and transformers. These components do not require external power to operate but instead store, absorb, or dissipate energy within circuits. Their indispensable role in consumer electronics, industrial applications, telecommunications, and medical devices is fueling steady demand. With manufacturers prioritizing miniaturization and higher energy efficiency, passive components have become critical to ensuring durability, performance, and reliability in modern electronic devices.

The consumer electronics segment in the passive and interconnecting electronic components market accounted for a 24.7% share in 2024. The growing proliferation of smartphones, laptops, home appliances, and wearable devices continues to drive demand for high-quality capacitors, resistors, and connectors. As electronic devices evolve with faster processing speeds, enhanced battery life, and compact designs, manufacturers increasingly depend on passive and interconnecting components to maintain seamless functionality.

The U.S. passive and interconnecting electronic components market reached USD 54.9 billion in 2024, driven by strong technological advancements, increasing automation, and continued investment in digital infrastructure. The country remains at the forefront of innovation in sectors like automotive, telecommunications, and consumer electronics, creating a sustained demand for electronic components. With industries increasingly adopting AI, robotics, and smart manufacturing, the need for reliable, high-performance passive and interconnecting components is expected to rise further in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rise of the Internet of Things (IoT)

- 3.6.1.2 Increasing demand for advanced automotive electronics

- 3.6.1.3 Rapid expansion of the consumer electronics industry

- 3.6.1.4 Proliferation of renewable energy solutions

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High raw material costs

- 3.6.2.2 Environmental and sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion & Unit)

- 5.1 Key trends

- 5.2 Passive

- 5.2.1 Resistors

- 5.2.2 Capacitors

- 5.2.3 Inductors

- 5.2.4 Transformers

- 5.2.5 Others

- 5.3 Interconnecting

- 5.3.1 PCB

- 5.3.2 Connectors

- 5.3.3 Switches & relays

- 5.3.4 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Unit)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.2.1 Smartphones & tablets

- 6.2.2 Laptops & desktops

- 6.2.3 Televisions & home appliances

- 6.2.4 Others

- 6.3 Automotive

- 6.3.1 In-vehicle infotainment

- 6.3.2 Safety & security systems

- 6.3.3 Driver assistance systems

- 6.3.4 Engine control systems

- 6.3.5 Others

- 6.4 Healthcare

- 6.4.1 Imaging systems

- 6.4.2 Patient monitoring systems

- 6.4.3 Therapeutic equipment

- 6.4.4 Others

- 6.5 IT & telecom

- 6.5.1 Telecom equipment

- 6.5.2 Networking devices

- 6.6 Industrial

- 6.6.1 Automation & robotics

- 6.6.2 Power generation

- 6.6.3 Industrial control systems

- 6.6.4 Others

- 6.7 Aerospace & defense

- 6.7.1 Military communications

- 6.7.2 Weaponry systems

- 6.7.3 Aircraft safety systems

- 6.7.4 Others

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Unit)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Amphenol Corporation

- 8.2 Fenghua (HK) Electronics Ltd.

- 8.3 Fujitsu Component Limited

- 8.4 Hirose Electric Co. Ltd

- 8.5 Hosiden Corporation

- 8.6 KYOCERA AVX Components Corporation

- 8.7 Molex Incorporated

- 8.8 Murata Manufacturing Co., Ltd.

- 8.9 Nichicon Corporation

- 8.10 Panasonic Corporation

- 8.11 Rohm Co., Ltd.

- 8.12 Samsung Electro-Mechanics Co., Ltd.

- 8.13 Taiyo Yuden Co., Ltd.

- 8.14 TDK Corporation

- 8.15 TE Connectivity Ltd.

- 8.16 TT Electronics PLC

- 8.17 United Chemi-Con

- 8.18 Vishay Intertechnology, Inc.

- 8.19 Walsin Technology Corporation

- 8.20 Yageo Corporation