|

市場調查報告書

商品編碼

1521777

汽車被動電子元件:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Passive Electronic Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

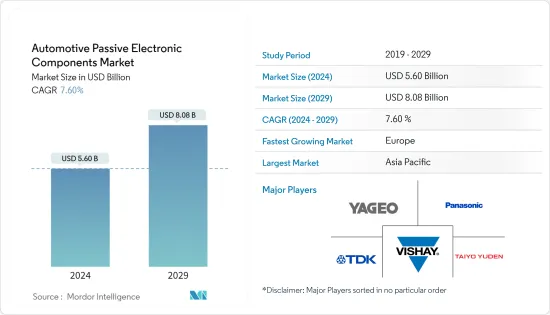

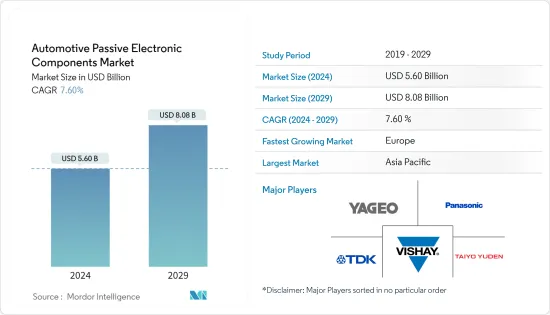

汽車被動電子元件市場規模預計到2024年為56億美元,預計到2029年將達到80.8億美元,在預測期內(2024-2029年)複合年成長率為7.60%。

主要亮點

- 汽車產業在被動元件需求不斷成長方面處於領先地位。各種應用對汽車電子系統的需求不斷成長,包括引擎蓋下的電控系統(ECU)、資訊娛樂系統和高級駕駛員輔助系統 (ADAS)。汽車電子系統需要高品質的元件來確保可靠的性能,包括用於濾波和儲能的電容器、用於電路保護的壓敏電阻、用於小型ECU的連接器以及用於連接支援所需的射頻和微波被動元件和天線。

- 汽車製造商擴大將電子元件整合到傳統內燃機汽車中,以提高燃油效率、減少排放氣體並提高車輛的整體性能。這一趨勢正在推動對電阻器、電容器和電感器等被動電子元件的需求。例如,根據SIAM India的數據,2023會計年度國內市場乘用車銷量超過389萬輛。

- ADAS(高級駕駛輔助系統),例如防撞系統和主動式車距維持定速系統,嚴重依賴電容器等被動電子元件來進行感測器訊號處理、濾波和資料傳輸。現代車輛配備了先進的資訊娛樂系統、遠端訊息和連接解決方案,需要被動元件來進行無線通訊、訊號處理和資料傳輸。

- 隨著汽車電子變得越來越小、整合度越來越高,被動元件必須滿足日益嚴格的尺寸和重量要求。小型化挑戰(例如在縮小封裝尺寸的同時保持性能)可能會限制市場成長。此外,設計和製造汽車級被動電子元件需要大量的研究、開發和測試。高開發成本限制了市場創新。

- 永續性和氣候變遷等環境議題影響著汽車產業的趨勢和法規。對生態永續性的日益重視可能會推動汽車中採用節能環保的電子元件。此外,貿易政策、關稅和貿易協定也會影響汽車零件的成本和可得性。貿易政策的變化可能會擾亂供應鏈、影響定價並影響市場競爭。

汽車被動電子元件市場趨勢

電容器正在經歷顯著成長

- 電容器技術的進步正在開發更小、更輕、更有效率的電容器。這使得汽車製造商能夠設計更小、更輕的電子系統,從而減輕車輛總重量並提高燃油效率。 ADAS(高級駕駛輔助系統)、資訊娛樂系統和汽車連接功能的日益普及需要強大且可靠的電子元件。電容器透過提供穩定的電源並確保感測器、攝影機和通訊模組的平穩運作來支援這些功能的實現。

- 例如,2023年8月,TDK公司在印度(Nasik)提高了產能,並開啟了業務前景。納西克的這項特殊工廠擴大了生產能力,並引進了佔地約 23,000平方公尺的新建築。未來四年,將增加更多用於汽車領域的直流電容器生產線。這些電容器是為印度國內市場製造並出口國外的。產能的增加創造了支持公司中期成長策略的新前景。

- 嚴格的政府法規和燃油經濟性標準正在推動對節能車輛系統的需求。電容器有助於最佳化能源使用並最大限度地減少功率損耗,滿足監管要求和永續性目標。電容器對於汽車電子系統的功能至關重要,隨著汽車電氣化、互聯化和自動化趨勢的加速,預計需求將持續成長。

- 例如,2024 年 5 月,現代汽車計劃利用其在美國已獲得的投資,在其電動車工廠生產混合動力汽車。這家全球第三大汽車製造商及其附屬公司起亞汽車公司打算利用專門用於其位於喬治亞的電動車和電池製造工廠的資金來生產混合動力汽車。擁有現代汽車和起亞汽車的韓國現代汽車集團宣布,計劃投資126億美元在喬治亞建設新的電動車和電池生產工廠。

歐洲佔主要市場佔有率

- 歐洲擁有一些世界上最大的汽車市場,包括英國、德國和法國。歐洲佔世界汽車產量和銷售量的大部分。這些國家對商用車和乘用車的需求不斷成長,為各種汽車系統中使用的被動電子元件市場做出了貢獻。

- 在歐洲,電動車 (EV)、純電動車 (BEV) 和混合動力電動車 (HEV) 的引進進展迅速。歐洲政府的激勵措施和技術進步正在促進動力傳動系統電氣化的過渡。這種轉變將增加對電動傳動系統、電池管理系統和汽車電子中使用的電容器、電感器和電阻器等被動電子元件的需求。例如,根據KBA的一份報告,到2023年,包括純電動車和插電式混合動力車在內的電動車將佔德國乘用車的約4.8%。在規定的時間內,電動車的比例每年都在穩定成長,特別是純電動車車型。

- 英國、德國、法國等歐洲國家的汽車工業走在技術創新的前沿,致力於發展先進的汽車技術。這包括智慧功能、連接解決方案和 ADAS 整合。這些技術需要各種被動電子元件來支援車輛網路等功能。

- 例如,2023 年 11 月,英國政府宣布投資 1.5 億歐元(1 億美元),作為 45 億歐元(570 萬美元)重大投資的一部分,以支持英國製造業並刺激經濟擴張(8,900 萬美元)。這筆資金的目標是到 2030 年連網型和自動化移動 (CAM) 領域。分配給支持 CAM 的預算將得到行業捐款的補充。這將使英國連網型和自動駕駛汽車中心(CCAV)鞏固英國作為自動駕駛技術、產品和服務的創造、進步、實施和生產的全球領導者的地位。

汽車無源電子元件產業概況

汽車被動電子元件市場競爭激烈。市場高度集中,參與企業規模各異。所有主要公司都佔有重要的市場佔有率,並致力於擴大其全球消費群。該市場的主要企業包括國巨公司、松下公司、TDK公司、Vishay Intertechnology Inc.和太陽誘電公司。公司正在透過建立多個聯盟、合作夥伴關係、收購和投資新產品推出來增加其市場佔有率,以獲得在預測期內的競爭優勢。

2024 年 3 月 JF Kilfoil 公司擴大 Knowles 產品的經銷範圍,將 Cornell Dubilier 品牌納入中西部市場。此次合作是在 Knowles 收購 Cornell Dubilier 之際達成的,後者現在提供更廣泛的薄膜、電解和特殊電容器。產品系列包括單層電容器、微調電容器、電解電容器、鋁聚合物電容器、薄膜電容器、雲母電容器和超級電容。這些產品以其高可靠性、長壽命以及在惡劣條件下的優異性能而聞名。

2023 年 9 月 Knowles Precision Devices 以 2.63 億美元現金收購 Cornell Dubilier。此次收購包括薄膜、電解和雲端母電容器產品,預計到 2024 年將增加非 GAAP 每股收益。 Cornell Dubilier 的各種電源薄膜、電解電容器和雲母電容器與 Knowles 的精密裝置部門結合,為目前和未來的客戶提供了價值提案和擴展的產品系列。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 先進電子設備在工業上的使用增加

- 對較小設計的偏好增加

- 市場限制因素

- 用於生產被動電子元件的重要金屬的價格波動/各種被動元件生產中的挑戰

第6章 市場細分

- 按類型

- 冷凝器

- 陶瓷電容器

- 鉭電容

- 電解電容器

- 紙/塑膜電容器

- 超級電容

- 電感器

- 電阻器

- 表面黏著技術晶片

- 網路和陣列

- 其他特殊物品

- EMC濾波器

- 冷凝器

- 按地區*

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 中東/非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Yageo Corporation

- Panasonic Corporation

- TDK Corporation

- Vishay Intertechnology Inc.

- Taiyo Yuden Corporation

- Kyocera Corporation(includes AVX Corporation)

- Knowles Precision Devices

- Murata Manufacturing Co. Ltd

- Samsung Electro-Mechanical

- KOA Corporation

- Rubycon Corporation

- Nippon Chemi-Con Corporation

第8章投資分析

第9章市場的未來

The Automotive Passive Electronic Components Market size is estimated at USD 5.60 billion in 2024, and is expected to reach USD 8.08 billion by 2029, growing at a CAGR of 7.60% during the forecast period (2024-2029).

Key Highlights

- The automotive industry is leading the way in the increasing need for passive components. The demand for electronic vehicle systems is rising for various uses, such as electronic control units (ECUs) under the hood, infotainment systems, and advanced driver assistance systems (ADASs). Automotive electronic systems require high-quality components to guarantee dependable performance, like capacitors for filtering and storing energy, varistors for circuit protection, connectors for small ECUs, and RF and microwave passive components and antennas for connectivity support.

- Automobile manufacturers increasingly integrate electronic components into traditional combustion engine vehicles to enhance fuel efficiency, reduce emissions, and improve overall vehicle performance. This trend drives the demand for passive electronic components like resistors, capacitors, and inductors. For instance, according to SIAM India, during the fiscal year 2023, more than 3.89 million passenger vehicles were sold in the domestic market.

- ADAS (advanced driver assistance systems), such as collision avoidance systems and adaptive cruise control, rely heavily on passive electronic components like capacitors for sensor signal processing, filtering, and data transmission. Modern vehicles feature advanced infotainment systems, telematics, and connectivity solutions that require passive components for wireless communication, signal processing, and data transmission.

- As automotive electronics become more compact and integrated, passive components must meet increasingly stringent size and weight requirements. Miniaturization challenges, such as maintaining performance while reducing package size, can limit market growth. In addition, designing and manufacturing automotive-grade passive electronic components require significant research, development, and testing. High development costs limit innovation in the market.

- Environmental concerns, including sustainability and climate change, influence automotive industry trends and regulations. Growing emphasis on ecological sustainability may drive the adoption of vehicles' energy-efficient and environmentally friendly electronic components. Moreover, trade policies, tariffs, and trade agreements can impact the cost and availability of automotive components. Changes in trade policies may disrupt supply chains, affect pricing, and influence market competition.

Automotive Passive Electronic Components Market Trends

Capacitors to Witness Significant Growth

- Advancements in capacitor technology have led to the development of smaller, lighter, and more efficient capacitors. This enables automotive manufacturers to design compact and lightweight electronic systems, reducing overall vehicle weight and improving fuel efficiency. The increasing adoption of ADAS (advanced driver assistance systems), infotainment systems, and automobile connectivity features require robust and reliable electronic components. Capacitors support implementing these features by providing a stable power supply and ensuring the smooth operation of sensors, cameras, and communication modules.

- For instance, in August 2023, TDK Corporation in India (Nasik) was set for business prospects as it has enhanced its capacity. This specific facility in Nashik is growing its production capabilities and has introduced a new structure spanning approximately 23,000 square meters. In the coming four years, more production lines will be established for DC capacitors used in automotive sectors. These capacitors will be manufactured for the local market in India and overseas export. The increase in capacity creates new prospects that will support the company's medium-term growth strategy.

- Stringent government regulations and fuel economy standards drive the demand for energy-efficient automotive systems. Capacitors help optimize energy usage and minimize power losses, aligning with regulator requirements and sustainability goals. Capacitors are integral to the functioning of automotive electronic systems, and the demand is expected to continue growing as vehicle electrification, connectivity, and automation trends accelerate.

- For instance, in May 2024, Hyundai Motor Co. planned to utilize the investment already set aside for the United States to manufacture hybrid vehicles at its EV plant. The third-largest automaker globally, along with affiliate Kia Corp, intends to use funds allocated for EV and battery manufacturing facilities in Georgia to produce hybrid cars. Hyundai Motor Group of South Korea, which includes Hyundai Motor and Kia, announced plans to invest USD 12.6 billion in building new electric vehicle and battery production plants in Georgia, marking its most significant investment outside of South Korea.

Europe to Hold Significant Market Share

- Europe is home to some of the world's largest automotive markets, including the United Kingdom, Germany, and France. Europe accounts for a significant portion of worldwide vehicle production and sales. The rising demand for commercial and passenger vehicles in these countries contributes to the market for passive electronic components used in various automotive systems.

- Europe is experiencing rapid growth in the adoption of electric vehicles (EVs), battery electric vehicles (BEVs), and hybrid electric vehicles (HEVs). European government incentives and technological advancements are driving the shift toward electrified powertrains. This transition increases the demand for passive electronic components such as capacitors, inductors, and resistors used in electric drivetrains, battery management systems, and onboard electronics. For instance, in 2023, electric cars, including both BEV and PHEV, accounted for approximately 4.8& of passenger cars in Germany, as reported by KBA. The proportion of electric vehicles has steadily risen each year within the specified time frame, particularly for BEV models.

- The automotive industry in European countries like the United Kingdom, Germany, and France is at the forefront of innovation, strongly focusing on developing advanced vehicle technologies. This includes the integration of smart features, connectivity solutions, and ADAS. These technologies require various passive electronic components to support functions such as vehicle networking.

- For instance, in November 2023, the United Kingdom government allocated EUR 150 million (USD 189 million) as part of a larger EUR 4.5 billion (USD 5.7 million) investment to support British manufacturing and stimulate economic expansion. This funding is aimed at the connected and automated mobility (CAM) sector up to 2030. The budget allocated to help CAM will be supplemented by industry contributions, which will allow the United Kingdom's Centre for Connected and Autonomous Vehicles (CCAV) to solidify the UK's position as a global leader in the creation, advancement, implementation, and production of self-driving technologies, products, and services.

Automotive Passive Electronic Components Industry Overview

The automotive passive electronic components market is very competitive. The market is highly concentrated due to various small and large players. All the major players account for a significant market share and focus on expanding the global consumer base. Some significant players in the market are Yageo Corporation, Panasonic Corporation, TDK Corporation, Vishay Intertechnology Inc., Taiyo Yuden Corporation, and many more. Companies are increasing their market share by forming multiple collaborations, partnerships, and acquisitions and investing in introducing new products to earn a competitive edge during the forecast period.

March 2024: JF Kilfoil Company expanded its representation of Knowles' products to include the Cornell Dubilier brand in the Midwest market. This partnership was established due to Knowles' acquisition of Cornell Dubilier, which allowed the company to offer a broader range of film, electrolytic, and specialty capacitors. The product range comprises single-layer capacitors, trimmers, aluminum electrolytic capacitors, aluminum polymer capacitors, film capacitors, mica capacitors, and supercapacitors. These items are known for their reliability, longevity, and excellent performance in challenging situations.

September 2023: Knowles Precision Devices acquired Cornell Dubilier for USD 263 million in cash. This acquisition will include film, electrolytic, and mica capacitor products and is anticipated to enhance non-GAAP EPS by 2024. Cornell Dubilier's diverse range of power film, electrolytic, and mica capacitors, combined with Knowles' Precision Devices segment, will offer a valuable proposition and expanded product portfolio to current and potential customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Advanced Electronic Devices in the Industry

- 5.1.2 Increasing Preference for Miniaturized Designs

- 5.2 Market Restraints

- 5.2.1 Fluctuating Prices of Critical Metals Used in Manufacturing of Passive Electronic Components/ Challenges in the manufacturing of various Passive Components

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Capacitors

- 6.1.1.1 Ceramic Capacitors

- 6.1.1.2 Tantalum Capacitors

- 6.1.1.3 Aluminum Electrolytic Capacitors

- 6.1.1.4 Paper and Plastic Film Capacitors

- 6.1.1.5 Supercapacitors

- 6.1.2 Inductors

- 6.1.3 Resistors

- 6.1.3.1 Surface-mounted Chips

- 6.1.3.2 Network and Array

- 6.1.3.3 Other Specialty

- 6.1.4 EMC Filters

- 6.1.1 Capacitors

- 6.2 By Geography***

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Middle East and Africa

- 6.2.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Yageo Corporation

- 7.1.2 Panasonic Corporation

- 7.1.3 TDK Corporation

- 7.1.4 Vishay Intertechnology Inc.

- 7.1.5 Taiyo Yuden Corporation

- 7.1.6 Kyocera Corporation (includes AVX Corporation)

- 7.1.7 Knowles Precision Devices

- 7.1.8 Murata Manufacturing Co. Ltd

- 7.1.9 Samsung Electro-Mechanical

- 7.1.10 KOA Corporation

- 7.1.11 Rubycon Corporation

- 7.1.12 Nippon Chemi-Con Corporation