|

市場調查報告書

商品編碼

1699400

數位健康市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Digital Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

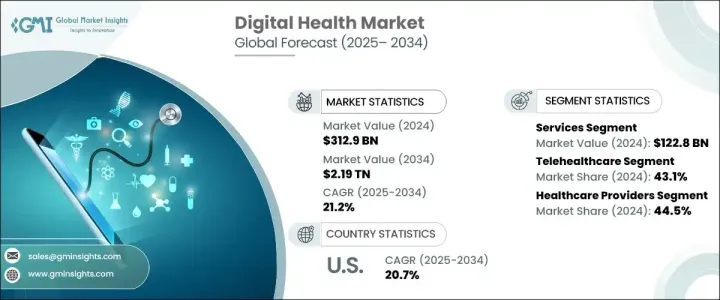

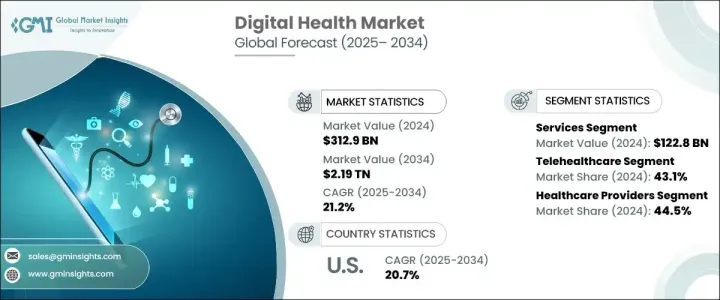

2024 年全球數位健康市場價值為 3,129 億美元,預計在 2025 年至 2034 年期間的複合年成長率將達到 21.2%。這一顯著成長源於尖端數位技術在醫療保健領域的日益融合。人工智慧 (AI)、巨量資料分析、雲端運算和物聯網 (IoT) 正在改變行業、提高效率並加強患者護理。由於對改善可近性、經濟有效的治療和即時患者監控的需求,對數位健康解決方案的需求持續激增。數位醫療解決方案的快速發展不僅提高了營運效率,而且重新定義了患者參與度,為更個人化和數據驅動的醫療方法鋪平了道路。

世界各國政府和私人投資者正在大力資助數位健康計劃,進一步加速市場的擴張。支持遠距醫療、人工智慧診斷和數位治療的強力政策框架在重塑醫療保健服務方面發揮關鍵作用。連網設備和行動醫療 (mHealth) 應用的興起極大地影響了患者的行為,促使人們轉向預防和遠距照護模式。此外,慢性病和人口老化的日益普及也增加了對數位健康平台的需求,使其成為現代醫療保健生態系統不可或缺的組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3129億美元 |

| 預測值 | 2.19兆美元 |

| 複合年成長率 | 21.2% |

數位健康市場分為三個核心部分:硬體、軟體和服務。該服務領域在 2024 年的價值為 1,228 億美元,預計到 2034 年將以 21.3% 的複合年成長率成長。這一擴張是由對遠距病人監控、遠距醫療和醫療保健分析的激增的需求所推動的。隨著人工智慧和物聯網等先進技術的融合,數位醫療服務正在簡化營運、增強醫療服務並促進無縫的患者與提供者互動。隨著醫療保健組織尋求最佳化工作流程和改善患者治療效果,數位服務正成為高效、主動醫療介入的關鍵推動因素。

遠距醫療、行動醫療(mHealth)、健康分析和數位健康系統仍然處於行業進步的前沿。到 2024 年,遠距醫療領域將佔據 43.1% 的市場佔有率,這得益於對虛擬諮詢、遠距診斷和遠距醫療平台的依賴日益增加。 COVID-19 疫情加速了這些技術的採用,凸顯了可訪問且可擴展的醫療保健解決方案的必要性。因此,全球醫療保健提供者繼續整合遠距醫療服務,以擴大其覆蓋範圍並提高醫療服務的可近性,確保患者及時獲得具有成本效益的醫療服務。

2024 年,美國數位醫療市場規模達 1,236 億美元,預估 2025 年至 2034 年期間的複合年成長率為 20.7%。憑藉強大的監管框架、高投資水平和先進的數位基礎設施,美國在數位醫療應用領域仍處於全球領先地位。人工智慧診斷工具、遠端患者監控解決方案和數據驅動醫療保健模式的廣泛實施鞏固了美國市場的主導地位。隨著下一代技術的日益融合和基於價值的醫療的強勁推動,美國的數位醫療產業將經歷持續成長,鞏固其作為全球市場驅動力的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 遠距病人監護服務需求不斷成長

- 智慧型手機普及率和網路連線率不斷提高

- 政府在數位醫療領域採取的優惠措施和資金支持

- 創投不斷成長

- 產業陷阱與挑戰

- 資料隱私和安全問題

- 實施成本高

- 成長動力

- 成長潛力分析

- 市場進入格局

- 監管格局

- 美國

- 歐洲

- 按地區進行的投資分析

- 美國

- 歐洲

- 亞太地區

- 併購格局

- 報銷場景

- 數位健康項目/計劃

- 技術格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按組成部分,2021 年至 2034 年

- 主要趨勢

- 硬體

- 軟體

- 基於雲端

- 本地

- 服務

第6章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 遠距醫療

- 遠距醫療

- 活動監控

- 遠端藥物管理

- 遠距醫療

- 長期照護監測

- 視訊諮詢

- 遠距醫療

- 行動醫療

- 穿戴式裝置和連網醫療設備

- 血壓監測儀

- 心率監測器

- 血糖監測儀

- 脈搏血氧儀

- 睡眠追蹤器

- 神經系統監測器

- 其他穿戴式裝置和連網醫療設備

- 行動醫療應用

- 醫療應用

- 女性健康應用

- 慢性病管理應用

- 個人健康記錄應用

- 藥物管理應用程式

- 遠端監控應用程式

- 其他醫療應用

- 健身應用

- 醫療應用

- 穿戴式裝置和連網醫療設備

- 健康分析

- 預測分析

- 規範分析

- 描述性分析

- 數位健康系統

- 電子健康紀錄(EHR)

- 電子處方系統

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫療保健提供者

- 患者

- 付款人

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Accenture

- AMD Global Telemedicine

- American Well (Amwell)

- Athenahealth

- Capsa Healthcare

- Eagle Telemedicine

- Firstbeat Technologies

- GE Healthcare

- Health Catalyst

- Honeywell International

- IBM

- iHealth Lab

- Koninklijke Philips NV

- McKesson Corporation

- Oracle (Cerner Corporation)

- Qualcomm Technologies

- Teladoc Health

- Veradigm LLC (Allscripts Healthcare Solutions)

The Global Digital Health Market was valued at USD 312.9 billion in 2024 and is poised to expand at a CAGR of 21.2% between 2025 and 2034. This remarkable growth stems from the increasing integration of cutting-edge digital technologies in healthcare. Artificial intelligence (AI), big data analytics, cloud computing, and the Internet of Things (IoT) are transforming the industry, driving efficiency, and enhancing patient care. The demand for digital health solutions continues to surge, fueled by the need for improved accessibility, cost-effective treatments, and real-time patient monitoring. The rapid evolution of digital healthcare solutions is not just improving operational efficiency but also redefining patient engagement, paving the way for more personalized and data-driven medical approaches.

Governments and private investors worldwide are heavily funding digital health initiatives, further accelerating the market's expansion. Strong policy frameworks supporting telehealth adoption, AI-driven diagnostics, and digital therapeutics are playing a pivotal role in reshaping healthcare delivery. The rise of connected devices and mobile health (mHealth) applications has significantly influenced patient behaviors, prompting a shift toward preventive and remote care models. Additionally, the increasing prevalence of chronic diseases and aging populations has heightened the demand for digital health platforms, making them indispensable components of modern healthcare ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $312.9 Billion |

| Forecast Value | $2.19 trillion |

| CAGR | 21.2% |

The digital health market is categorized into three core components: hardware, software, and services. The services segment, valued at USD 122.8 billion in 2024, is expected to grow at a CAGR of 21.3% through 2034. This expansion is driven by the soaring demand for remote patient monitoring, telehealth, and healthcare analytics. With the integration of advanced technologies such as AI and IoT, digital health services are streamlining operations, enhancing care delivery, and fostering seamless patient-provider interactions. As healthcare organizations seek to optimize workflows and improve patient outcomes, digital services are becoming a critical enabler of efficient and proactive medical interventions.

Telehealthcare, mobile health (mHealth), health analytics, and digital health systems remain at the forefront of industry advancements. The telehealthcare segment accounted for 43.1% of the market share in 2024, propelled by the growing reliance on virtual consultations, remote diagnostics, and telemedicine platforms. The COVID-19 pandemic accelerated the adoption of these technologies, highlighting the necessity of accessible and scalable healthcare solutions. As a result, healthcare providers globally continue to integrate telehealth services to expand their reach and enhance care accessibility, ensuring patients receive timely and cost-effective medical attention.

The U.S. digital health market generated USD 123.6 billion in 2024, with a projected CAGR of 20.7% between 2025 and 2034. The country remains a global leader in digital healthcare adoption, backed by strong regulatory frameworks, high investment levels, and an advanced digital infrastructure. The widespread implementation of AI-powered diagnostic tools, remote patient monitoring solutions, and data-driven healthcare models has cemented the U.S. market's dominance. With the increasing integration of next-gen technologies and a robust push toward value-based care, the digital health sector in the U.S. is set to experience sustained growth, reinforcing its position as a driving force in the global market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for remote patient monitoring services

- 3.2.1.2 Increasing smartphone penetration and internet connectivity

- 3.2.1.3 Favorable government initiatives and fundings in digital health

- 3.2.1.4 Growing venture capital investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 High implementation cost

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Market entry landscape

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Europe

- 3.6 Investment analysis, by region

- 3.6.1 U.S.

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.7 Merger and acquisition landscape

- 3.8 Reimbursement scenario

- 3.9 Digital health project/initiatives

- 3.10 Technology landscape

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.3.1 Cloud-based

- 5.3.2 On-premises

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Telehealthcare

- 6.2.1 Telecare

- 6.2.1.1 Activity monitoring

- 6.2.1.2 Remote medication management

- 6.2.2 Telehealth

- 6.2.2.1 LTC monitoring

- 6.2.2.2 Video consultation

- 6.2.1 Telecare

- 6.3 mHealth

- 6.3.1 Wearables and connected medical devices

- 6.3.1.1 Blood pressure monitors

- 6.3.1.2 Heart rate monitors

- 6.3.1.3 Blood glucose monitor

- 6.3.1.4 Pulse oximeters

- 6.3.1.5 Sleep trackers

- 6.3.1.6 Neurological monitors

- 6.3.1.7 Other wearables and connected medical devices

- 6.3.2 mHealth apps

- 6.3.2.1 Medical apps

- 6.3.2.1.1 Womens health apps

- 6.3.2.1.2 Chronic disease management apps

- 6.3.2.1.3 Personal health record apps

- 6.3.2.1.4 Medication management apps

- 6.3.2.1.5 Remote monitoring apps

- 6.3.2.1.6 Other medical apps

- 6.3.2.2 Fitness apps

- 6.3.2.1 Medical apps

- 6.3.1 Wearables and connected medical devices

- 6.4 Health analytics

- 6.4.1 Predictive analytics

- 6.4.2 Prescriptive analytics

- 6.4.3 Descriptive analytics

- 6.5 Digital health systems

- 6.5.1 Electronic health records (EHRs)

- 6.5.2 e-prescribing systems

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Healthcare providers

- 7.3 Patients

- 7.4 Payers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accenture

- 9.2 AMD Global Telemedicine

- 9.3 American Well (Amwell)

- 9.4 Athenahealth

- 9.5 Capsa Healthcare

- 9.6 Eagle Telemedicine

- 9.7 Firstbeat Technologies

- 9.8 GE Healthcare

- 9.9 Health Catalyst

- 9.10 Honeywell International

- 9.11 IBM

- 9.12 iHealth Lab

- 9.13 Koninklijke Philips N.V.

- 9.14 McKesson Corporation

- 9.15 Oracle (Cerner Corporation)

- 9.16 Qualcomm Technologies

- 9.17 Teladoc Health

- 9.18 Veradigm LLC (Allscripts Healthcare Solutions)