|

市場調查報告書

商品編碼

1699410

生物標記發現外包服務市場機會、成長動力、產業趨勢分析及預測(2025-2034)Biomarker Discovery Outsourcing Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

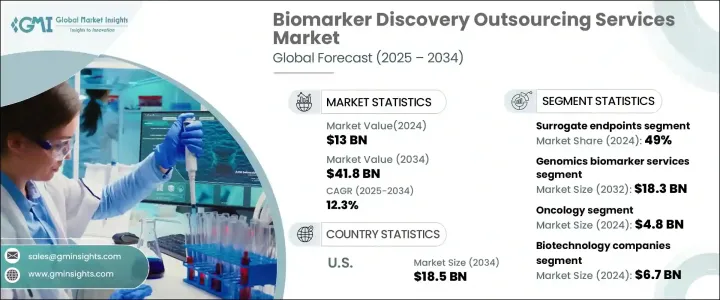

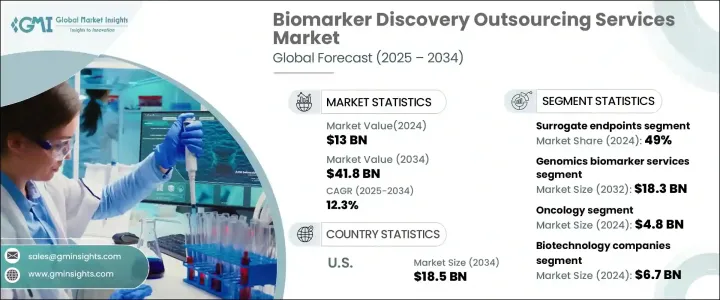

2024 年全球生物標記發現外包服務市場價值為 130 億美元,預計 2025 年至 2034 年期間的複合年成長率為 12.3%。受慢性病發病率上升、組學技術的快速進步以及製藥和生物技術領域研發投資增加的推動,該市場正在經歷顯著成長。對個人化醫療的日益重視進一步推動了對新型生物標記的需求,這些生物標記能夠早期發現、診斷和監測癌症、心血管疾病和糖尿病等慢性疾病。隨著全球慢性病盛行率的上升,對生物標記的需求也不斷增加,以促進有針對性的治療策略。

政府舉措的不斷增加、製藥公司和研究機構之間的合作以及對生物標記驗證的監管支持正在加速市場擴張。人工智慧 (AI) 和機器學習 (ML) 在生物標記發現中的日益普及也正在改變這個行業,從而更快地識別和驗證潛在的生物標記。由於醫療保健支出的增加和先進臨床研究中心的建立,新興經濟體正在成為生物標記研究的關鍵參與者。此外,數位健康解決方案和生物資訊學工具的採用正在增強數據驅動的生物標記發現,從而改善患者的治療效果並提高藥物開發流程的效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 130億美元 |

| 預測值 | 418億美元 |

| 複合年成長率 | 12.3% |

市場分為不同的生物標記類型,包括預測性生物標記、預後生物標記、安全生物標記、替代終點等。替代終點在 2024 年佔據市場主導地位,佔總收入佔有率的 49%,預計從 2025 年到 2034 年的複合年成長率為 12.1%。替代生物標記在臨床試驗中發揮著至關重要的作用,使研究人員能夠及早評估治療效果,從而大大加快臨床研究進程。它們的廣泛應用(尤其是在新興市場)以及美國 FDA 等機構對腫瘤學和罕見疾病藥物核准的強力監管支持繼續推動其市場佔有率。

生物標記發現外包服務市場進一步按服務類型細分,包括基因組學、蛋白質組學、生物資訊學等。光是基因組生物標記服務領域在 2024 年就創造了 57 億美元的收入。遺傳疾病病例的增加以及與癌症和神經退化性疾病等慢性疾病相關的死亡率的上升,正在推動對基因組生物標記服務的需求。公共和私營部門對基因組學研究的投資不斷增加,加速了基因組生物標記的發現和驗證,進一步加強了市場。下一代定序 (NGS) 和其他高通量基因組技術的整合正在增強生物標記識別,確保更精確的診斷和個人化的治療方案。

預計到 2034 年,美國生物標記發現外包服務市場規模將達到 185 億美元。美國在生物技術領域的領導地位、先進的醫療保健基礎設施和完善的監管框架,為其在該領域的主導地位做出了貢獻。美國FDA對生物標記驗證實施了嚴格但支持性的監管機制,確保生物標記成功融入診斷和藥物開發過程。生物製藥公司、學術研究機構和政府機構之間的持續合作正在進一步推動創新和市場擴張。因此,美國仍然處於生物標記發現外包服務的前沿,在整個預測期內引領全球市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 研發投入不斷增加

- 更重視個人化醫療和標靶治療

- 高通量技術的進步

- 蓬勃發展的生物製劑產業

- 產業陷阱與挑戰

- 智慧財產權問題

- 資料安全

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 預測性生物標記

- 預後生物標記

- 安全生物標記

- 替代終點

- 其他類型

第6章:市場估計與預測:按服務,2021 年至 2034 年

- 主要趨勢

- 基因組學生物標記服務

- 蛋白質體學生物標記服務

- 生物資訊學生物標記服務

- 其他生物標記服務

第7章:市場估計與預測:按治療領域,2021 年至 2034 年

- 主要趨勢

- 腫瘤學

- 心臟病學

- 神經病學

- 自體免疫疾病

- 其他治療領域

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥公司

- 生技公司

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Almac Group Limited

- Biomcare ApS

- Bio-Rad Laboratories

- Crown Bioscience

- Evotec

- Excelra

- Frontage Labs

- ICON

- Integrated DNA Technologies

- Parexel International (MA) Corporation

- RayBiotech

- REPROCELL

- Sino Biological

- Svar Life Science

The Global Biomarker Discovery Outsourcing Services Market was valued at USD 13 billion in 2024 and is projected to expand at a CAGR of 12.3% between 2025 and 2034. The market is witnessing significant growth, driven by the increasing incidence of chronic diseases, rapid advancements in omics technologies, and rising investments in research and development within the pharmaceutical and biotechnology sectors. The growing emphasis on personalized medicine is further fueling demand for novel biomarkers that enable early detection, diagnosis, and monitoring of chronic conditions such as cancer, cardiovascular diseases, and diabetes. With chronic disease prevalence on the rise worldwide, the demand for biomarkers to facilitate targeted treatment strategies continues to increase.

Rising government initiatives, collaborations between pharmaceutical companies and research organizations, and regulatory support for biomarker validation are accelerating market expansion. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in biomarker discovery is also transforming the industry, allowing for faster identification and validation of potential biomarkers. Emerging economies are becoming key players in biomarker research due to rising healthcare expenditures and the establishment of advanced clinical research centers. Additionally, the adoption of digital health solutions and bioinformatics tools is enhancing data-driven biomarker discovery, leading to improved patient outcomes and more efficient drug development processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13 Billion |

| Forecast Value | $41.8 Billion |

| CAGR | 12.3% |

The market is categorized into different biomarker types, including predictive, prognostic, safety biomarkers, surrogate endpoints, and others. Surrogate endpoints dominated the market in 2024, accounting for 49% of the total revenue share, and are expected to grow at a CAGR of 12.1% from 2025 to 2034. Surrogate biomarkers play a crucial role in clinical trials by enabling researchers to assess treatment efficacy early, significantly expediting the clinical study process. Their widespread adoption, particularly in emerging markets, and strong regulatory support from authorities such as the U.S. FDA for drug approvals in oncology and rare diseases continue to drive their market share.

The biomarker discovery outsourcing services market is further segmented by service type, which includes genomics, proteomics, bioinformatics, and others. The genomics biomarker services segment alone generated USD 5.7 billion in 2024. Increasing cases of genetic disorders and the rising mortality rates associated with chronic diseases like cancer and neurodegenerative conditions are fueling the demand for genomic biomarker services. Growing public and private sector investments in genomics research are expediting the discovery and validation of genomic biomarkers, further strengthening the market. The integration of next-generation sequencing (NGS) and other high-throughput genomic technologies is enhancing biomarker identification, ensuring more precise diagnostics and personalized treatment plans.

The U.S. Biomarker Discovery Outsourcing Services Market is expected to reach USD 18.5 billion by 2034. The country's leadership in the biotechnology sector, advanced healthcare infrastructure, and well-established regulatory framework are contributing to its dominance in this space. The U.S. FDA has implemented stringent yet supportive regulatory mechanisms for biomarker validation, ensuring the successful integration of biomarkers into diagnostics and drug development processes. Ongoing partnerships between biopharmaceutical companies, academic research institutions, and government agencies are further propelling innovation and market expansion. As a result, the U.S. remains at the forefront of biomarker discovery outsourcing services, leading the global market throughout the forecast period.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising investments in research and development

- 3.2.1.2 Increasing focus on personalized medicine and targeted therapies

- 3.2.1.3 Advancements in high-throughput technologies

- 3.2.1.4 Booming biologics industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Intellectual property concerns

- 3.2.2.2 Data security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Predictive biomarkers

- 5.3 Prognostic biomarkers

- 5.4 Safety biomarkers

- 5.5 Surrogate endpoints

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Service, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Genomics biomarker services

- 6.3 Proteomics biomarker services

- 6.4 Bioinformatics biomarker services

- 6.5 Other biomarker services

Chapter 7 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oncology

- 7.3 Cardiology

- 7.4 Neurology

- 7.5 Autoimmune diseases

- 7.6 Other therapeutic areas

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Biotechnology companies

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Almac Group Limited

- 10.2 Biomcare ApS

- 10.3 Bio-Rad Laboratories

- 10.4 Crown Bioscience

- 10.5 Evotec

- 10.6 Excelra

- 10.7 Frontage Labs

- 10.8 ICON

- 10.9 Integrated DNA Technologies

- 10.10 Parexel International (MA) Corporation

- 10.11 RayBiotech

- 10.12 REPROCELL

- 10.13 Sino Biological

- 10.14 Svar Life Science