|

市場調查報告書

商品編碼

1708171

內視鏡市場中的人工智慧機會、成長動力、產業趨勢分析及 2025 - 2034 年預測AI in Endoscopy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

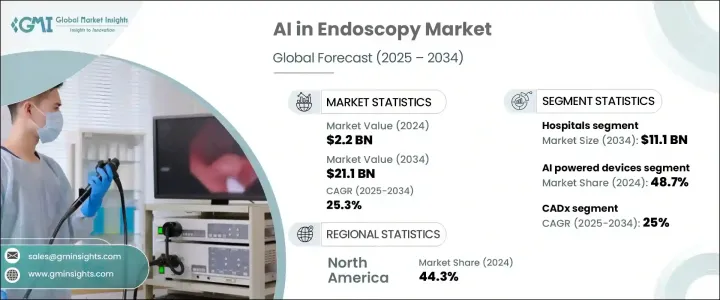

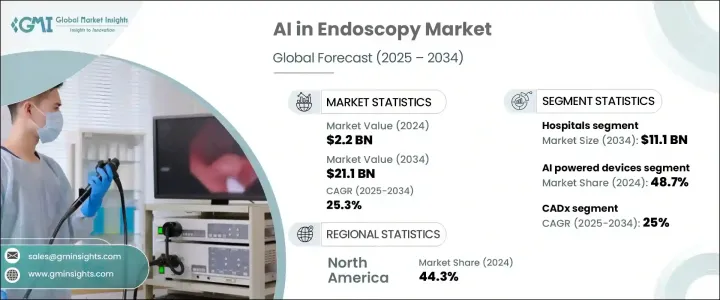

2024 年全球內視鏡人工智慧市場價值為 22 億美元,預計 2025 年至 2034 年期間將以 25.3% 的強勁複合年成長率擴張。該市場的快速成長反映了全球胃腸道及相關疾病激增所推動的對先進診斷工具的需求不斷成長。隨著結腸直腸癌、發炎性腸道疾病和消化性潰瘍等胃腸道疾病的發生率持續上升,醫療保健系統迫切需要提供更準確、更快速、更可靠的診斷解決方案。人工智慧內視鏡正在成為一種變革性工具,它正在重塑臨床醫生即時檢測和治療異常的方式。人工智慧目前在提高診斷準確性、簡化臨床工作流程和提供預測見解方面發揮關鍵作用,所有這些都有助於改善患者的治療效果。

人工智慧在內視鏡檢查程序中的整合使醫生能夠更精確地識別病變、腫瘤和息肉,顯著減少人為錯誤並提高早期診斷率。隨著全球醫療保健提供者專注於微創手術,人工智慧技術在提供增強視覺化、即時分析和自動檢測方面變得至關重要,最終改善臨床決策過程。人工智慧演算法的不斷發展,加上高清成像和機器人輔助平台的整合,進一步推動了對基於人工智慧的內視鏡解決方案的需求,使該市場成為醫療器材製造商和醫療機構關注的重點。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 211億美元 |

| 複合年成長率 | 25.3% |

內視鏡市場中的人工智慧會根據手術類型進行細分,包括胃腸道、泌尿科、呼吸科、大腸鏡檢查等。其中,胃腸內視鏡領域佔據市場主導地位,2023 年市場規模達 6.312 億美元,主要得益於胃腸道疾病盛行率的上升。電腦輔助檢測 (CADe) 系統等人工智慧解決方案正在透過精確識別息肉和腫瘤等異常情況來改變胃腸內視鏡檢查。採用人工智慧即時視訊分析和影像增強技術的工具正在提高診斷速度和準確性,促進更快的臨床干預。這些進步正在鼓勵醫院和診所採用基於人工智慧的內視鏡工具作為其標準診斷協議的一部分。

從組件角度來看,市場分為人工智慧設備、軟體和服務。 2024 年,人工智慧設備領域佔據了 48.7% 的佔有率,這得益於人們對先進診斷和視覺化技術的日益成長的偏好。這些設備使醫療保健提供者能夠執行更有針對性和更有效的內視鏡檢查,以支援更快的診斷和治療。向微創干預的轉變,加上即時人工智慧功能,正在推動緊湊、高性能內視鏡工具開發的重大創新,這些工具可與人工智慧軟體無縫整合,以最佳化結果。

從地區來看,北美在內視鏡人工智慧市場中佔據領先地位,2024 年的佔有率為 44.3%,其中美國憑藉其強大的醫療保健基礎設施和早期採用人工智慧技術而佔據領先地位。技術提供者和醫療機構之間正在進行的合作正在促進創新產品開發並加速市場滲透。該地區積極投資研發並專注於整合人工智慧以提高程序效率和患者護理,並繼續鞏固其在全球市場中的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 胃腸道和呼吸系統疾病盛行率不斷上升

- 微創手術的採用率不斷上升

- 即時成像和診斷人工智慧演算法的進步

- 產業陷阱與挑戰

- 實施和設備成本高

- 人工智慧部署中的監管和道德挑戰

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按內視鏡類型,2021 - 2034 年

- 主要趨勢

- 胃腸內視鏡檢查

- 泌尿內視鏡檢查

- 呼吸內視鏡檢查

- 大腸鏡檢查

- 其他類型

第6章:市場估計與預測:按組成部分,2021 - 2034 年

- 主要趨勢

- 人工智慧設備

- 軟體

- 服務

第7章:市場估計與預測:按 CAD 類型,2021 年至 2034 年

- 主要趨勢

- CADx

- 電腦輔助設計

第 8 章:市場估計與預測、最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 專科診所

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Ambu

- Fujifilm

- Hoya

- Intuitive Surgical

- Iterative Scopes

- Magentiq Eye

- Medtronic

- NEC Corporation

- Odin Vision

- Olympus

- PENTAX Medical

- Wision Al

- Wuhan EndoAngel Medical Technology

The Global AI in Endoscopy Market was valued at USD 2.2 billion in 2024 and is projected to expand at a robust CAGR of 25.3% from 2025 to 2034. The rapid growth of this market reflects the increasing demand for advanced diagnostic tools driven by a surge in gastrointestinal and related disorders worldwide. As gastrointestinal diseases, including colorectal cancer, inflammatory bowel disease, and peptic ulcers, continue to rise, healthcare systems are urgently seeking solutions that offer more accurate, faster, and reliable diagnoses. AI-powered endoscopy is emerging as a transformative tool that is reshaping how clinicians detect and treat abnormalities in real time. Artificial intelligence is now playing a pivotal role in enhancing diagnostic accuracy, streamlining clinical workflows, and delivering predictive insights, all contributing to better patient outcomes.

The integration of AI in endoscopy procedures allows physicians to identify lesions, tumors, and polyps with higher precision, significantly reducing human error and improving early diagnosis rates. With healthcare providers worldwide focusing on minimally invasive procedures, AI technologies are becoming essential in providing enhanced visualization, real-time analysis, and automated detection, ultimately improving clinical decision-making processes. The continuous evolution of AI algorithms, coupled with the integration of high-definition imaging and robotic-assisted platforms, is further driving the demand for AI-based endoscopy solutions, making this market a critical focus for medical device manufacturers and healthcare institutions alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 25.3% |

The AI in endoscopy market is segmented based on procedure types, including gastrointestinal, urological, respiratory, colonoscopy, and others. Among these, the gastrointestinal endoscopy segment dominated the market and generated USD 631.2 million in 2023, largely propelled by the rising prevalence of gastrointestinal conditions. AI-driven solutions such as computer-aided detection (CADe) systems are transforming gastrointestinal endoscopy by enabling precise identification of abnormalities like polyps and tumors. Tools featuring AI-powered real-time video analysis and image enhancement technologies are improving diagnostic speeds and accuracy, facilitating quicker clinical interventions. These advancements are encouraging hospitals and clinics to adopt AI-based endoscopy tools as part of their standard diagnostic protocols.

From a component perspective, the market is divided into AI-powered devices, software, and services. The AI-powered devices segment accounted for a 48.7% share in 2024, underpinned by the growing preference for advanced diagnostic and visualization technologies. These devices are enabling healthcare providers to perform more targeted and efficient endoscopic procedures, supporting faster diagnosis and treatment. The shift toward minimally invasive interventions, coupled with real-time AI capabilities, is driving significant innovations in the development of compact, high-performance endoscopic tools that integrate seamlessly with AI software for optimized outcomes.

Regionally, North America led the AI in endoscopy market with a 44.3% share in 2024, spearheaded by the U.S. due to its strong healthcare infrastructure and early adoption of AI technologies. Ongoing collaborations between technology providers and healthcare institutions are fostering innovative product development and accelerating market penetration. The region's proactive investment in R&D and focus on integrating AI to improve procedural efficiency and patient care continue to strengthen its position in the global market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of gastrointestinal and respiratory diseases

- 3.2.1.2 Rising adoption of minimally invasive surgeries

- 3.2.1.3 Advancements in AI algorithms for real-time imaging and diagnostics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and equipment costs

- 3.2.2.2 Regulatory and ethical challenges in AI deployment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type of Endoscopy, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gastrointestinal endoscopy

- 5.3 Urological endoscopy

- 5.4 Respiratory endoscopy

- 5.5 Colonoscopy

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 AI powered devices

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates and Forecast, By Type of CAD, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 CADx

- 7.3 CADe

Chapter 8 Market Estimates and Forecast, End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ambu

- 10.2 Fujifilm

- 10.3 Hoya

- 10.4 Intuitive Surgical

- 10.5 Iterative Scopes

- 10.6 Magentiq Eye

- 10.7 Medtronic

- 10.8 NEC Corporation

- 10.9 Odin Vision

- 10.10 Olympus

- 10.11 PENTAX Medical

- 10.12 Wision Al

- 10.13 Wuhan EndoAngel Medical Technology