|

市場調查報告書

商品編碼

1708184

越野車座椅市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Off-Road Vehicle Seats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

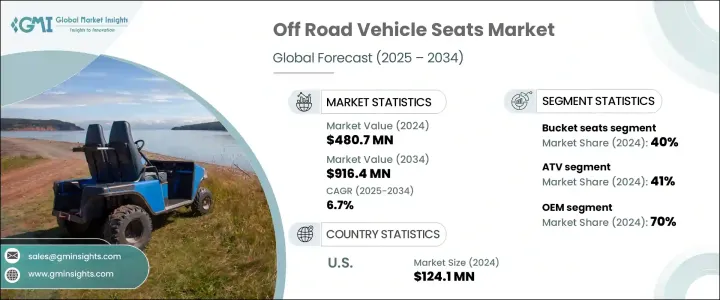

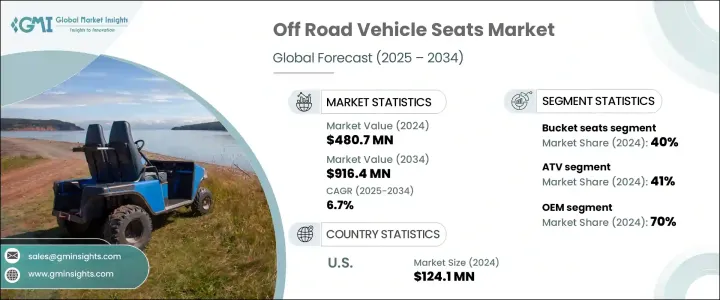

2024 年全球越野車座椅市場規模達 4.807 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.7%。受休閒和商業應用日益增多的推動,越野車的需求不斷成長,推動了市場的成長。隨著消費者不斷接受越野冒險,各行各業也越來越依賴這些車輛完成專門任務,對高品質、舒適耐用座椅的需求激增。越野車廣泛應用於農業、採礦、林業和建築等領域,傳統車輛無法在這些具有挑戰性的地形上有效行駛。此外,全地形車越野賽、UTV 賽車和越野摩托車賽事等休閒越野活動的日益普及也推動了市場的發展。

在崎嶇地形上長途駕駛時,消費者優先考慮舒適性和安全性,因此,能夠最大程度減少疲勞並增強支撐性的先進座椅設計是越野車性能的關鍵方面。製造商專注於採用創新材料和人體工學設計,以確保最大程度的舒適性、穩定性和彈性。減震技術、記憶泡棉坐墊和可調式座椅位置等先進功能正日益成為標準,進一步提升了這些座椅的吸引力。此外,越野愛好者對車輛客製化的日益成長的趨勢正在推動對滿足特定用戶偏好的個人化座椅解決方案的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.807億美元 |

| 預測值 | 9.164億美元 |

| 複合年成長率 | 6.7% |

越野車座椅市場按座椅類型細分,最受歡迎的類別是桶形座椅、長條座椅、懸吊座椅和可折疊/可調式座椅。 2024年,桶形座椅憑藉其在極端環境下的出色支撐性和舒適性佔據了40%的市場佔有率。桶形座椅採用高密度泡棉和耐用布料設計,可承受越野路徑的惡劣條件。較新的車型採用了傾斜功能和可調節功能,以便在長途駕駛時提供額外的舒適度並適應各種駕駛位置。

根據車輛類型,市場分為全地形車、多功能車、雪地摩托車和越野摩托車。 2024 年,ATV 領域佔據市場主導地位,佔據 41% 的佔有率。 ATV 座椅經過精心設計,可提供最大的安全性和穩定性,特別是在高速機動和崎嶇地形導航期間。許多座椅都配有側墊,以提供額外的側向支撐,確保乘客在急轉彎或跳躍時保持安全位置。此外,越野卡車座椅通常採用記憶泡棉和凝膠墊,以最大限度地減少壓力點並提高整體舒適度,增強在嚴苛環境下的駕駛體驗。

2024年,北美佔據越野車座椅市場的36%,其中美國市場價值1.241億美元。越野賽車和休閒活動的日益普及,加上該地區對越野車在工業應用上的依賴,正在推動市場成長。越野車在建築、農業和採礦等行業中發揮著至關重要的作用,因為在這些行業中,穿越崎嶇的地形至關重要。休閒和工業需求的結合支撐了北美越野車座椅市場的擴張。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 零件供應商

- 越野車座椅製造商

- 分銷商/物流

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 價格趨勢

- 成本明細

- 衝擊力

- 成長動力

- 越野車座椅設計的技術進步

- 千禧世代對越野活動的興趣日益濃厚

- 越野車座椅售後市場客製

- 可支配所得增加和生活方式改變

- 產業陷阱與挑戰

- 高級座位價格高昂

- 維護和耐用性問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依座位,2021-2034

- 主要趨勢

- 桶形座椅

- 長椅座椅

- 懸浮座椅

- 可調式/可調式座椅

第6章:市場估計與預測:依車型,2021-2034

- 主要趨勢

- 沙灘車

- UTV

- 雪地摩托車

- 越野摩托車

第7章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- OEM

- 售後市場

第8章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 織品座椅

- 乙烯基座椅

- 真皮座椅

- 其他

第9章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 個人消費者

- 商業用戶

- 賽車運動和賽車隊

- 其他

第 10 章:市場估計與預測,2021 年至 2034 年

- 主要趨勢

- 電動座椅驅動系統(ESAS)

- 手動座椅驅動系統(MSAS)

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- Beard Seats

- Bestop

- Bimarco Racing Seats

- Cobra Seats

- MOMO Automotive

- Corbeau Seats

- Great Day Inc

- Holley Performance Products Inc

- Jettrim

- Kirkey Racing

- MasterCraft Safety

- Pro Armor

- PRP Seats

- Recaro Automotive

- Rugged Ridge

- Simpson Race Products

- Sparco

- TV Parts Holding NV

- UTV Mountain Accessories

The Global Off-Road Vehicle Seats Market generated USD 480.7 million in 2024 and is anticipated to grow at a CAGR of 6.7% between 2025 and 2034. The growing demand for off-road vehicles, driven by increasing recreational and commercial applications, is fueling the market's growth. As consumers continue to embrace off-road adventures and industries increasingly rely on these vehicles for specialized tasks, the need for high-quality, comfortable, and durable seats has surged. Off-road vehicles are widely used in sectors such as agriculture, mining, forestry, and construction, where traditional vehicles fail to operate effectively in challenging terrains. Additionally, the rising popularity of recreational off-road activities, including ATV trail riding, UTV racing, and off-road motorcycle events, is boosting the market.

Consumers prioritize comfort and safety during prolonged rides over rugged terrains, making advanced seat designs that minimize fatigue and enhance support a crucial aspect of off-road vehicle performance. Manufacturers are focusing on incorporating innovative materials and ergonomic designs to ensure maximum comfort, stability, and resilience. Advanced features such as shock-absorbing technologies, memory foam cushions, and adjustable seating positions are increasingly becoming standard, further elevating the appeal of these seats. Moreover, the growing trend of vehicle customization among off-road enthusiasts is driving demand for personalized seating solutions that meet specific user preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $480.7 Million |

| Forecast Value | $916.4 Million |

| CAGR | 6.7% |

The off-road vehicle seats market is segmented by seat type, with the most popular categories being bucket seats, bench seats, suspension seats, and foldable/adjustable seats. In 2024, the bucket seats segment held 40% of the market share due to its superior support and comfort in extreme environments. Bucket seats are designed with high-density foam and durable fabrics to withstand the harsh conditions of off-road trails. Newer models incorporate reclining functionality and adjustable features to provide additional comfort during extended rides and accommodate various driving positions.

Based on vehicle type, the market is divided into ATVs, UTVs, snowmobiles, and off-road motorcycles. The ATV segment led the market in 2024, capturing 41% of the share. ATV seats are engineered to offer maximum safety and stability, particularly during high-speed maneuvers and rough terrain navigation. Many of these seats feature side bolsters for extra lateral support, ensuring riders stay securely positioned during sharp turns or jumps. Furthermore, off-road truck seats often integrate memory foam and gel cushions to minimize pressure points and improve overall comfort, enhancing the driving experience in demanding environments.

North America accounted for 36% of the off-road vehicle seats market in 2024, with the United States generating USD 124.1 million. The rising popularity of off-road racing and recreational activities, coupled with the region's reliance on off-road vehicles for industrial applications, is driving market growth. Off-road vehicles play a vital role in industries such as construction, agriculture, and mining, where navigating difficult terrain is essential. This combination of leisure and industrial demand is sustaining the off-road vehicle seats market expansion in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1.1 Component supplier

- 3.2.1.2 Off road vehicle seat manufacturer

- 3.2.1.3 Distributors/Logistics

- 3.2.1.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Price trends

- 3.8 Cost breakdown

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Technological advancements in designing off road vehicle seat

- 3.9.1.2 Rising interest in millennials towards off-road activities

- 3.9.1.3 Customization of off-road vehicle seats aftermarket

- 3.9.1.4 Rising disposable income and lifestyle changes

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High Cost of Premium Seats

- 3.9.2.2 Maintenance and Durability Concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Seat, 2021-2034 ($Mn, units)

- 5.1 Key trends

- 5.2 Bucket seat

- 5.3 Bench seat

- 5.4 Suspension seats

- 5.5 Foldable/Adjustable seats

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021-2034 ($Mn, units)

- 6.1 Key trends

- 6.2 ATV

- 6.3 UTV

- 6.4 Snowmobile

- 6.5 Off-Road motorcycle

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Mn, units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Material, 2021-2034 ($Mn, units)

- 8.1 Key trends

- 8.2 Fabric seats

- 8.3 Vinyl seats

- 8.4 Leather seats

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 ($Mn, units)

- 9.1 Key trends

- 9.2 Individual consumers

- 9.3 Commercial users

- 9.4 Motorsports and racing teams

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By, 2021-2034 ($Mn, units)

- 10.1 Key trends

- 10.2 Electric seat actuation system (ESAS)

- 10.3 Manual seat actuation system (MSAS)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Beard Seats

- 12.2 Bestop

- 12.3 Bimarco Racing Seats

- 12.4 Cobra Seats

- 12.5 MOMO Automotive

- 12.6 Corbeau Seats

- 12.7 Great Day Inc

- 12.8 Holley Performance Products Inc

- 12.9 Jettrim

- 12.10 Kirkey Racing

- 12.11 MasterCraft Safety

- 12.12 Pro Armor

- 12.13 PRP Seats

- 12.14 Recaro Automotive

- 12.15 Rugged Ridge

- 12.16 Simpson Race Products

- 12.17 Sparco

- 12.18 TV Parts Holding NV

- 12.19 UTV Mountain Accessories