|

市場調查報告書

商品編碼

1708187

雲端儲存服務市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cloud Storage Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

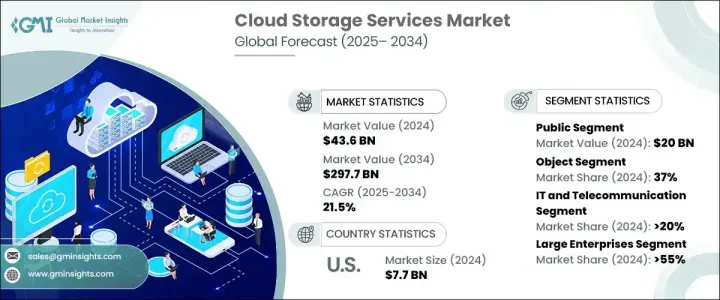

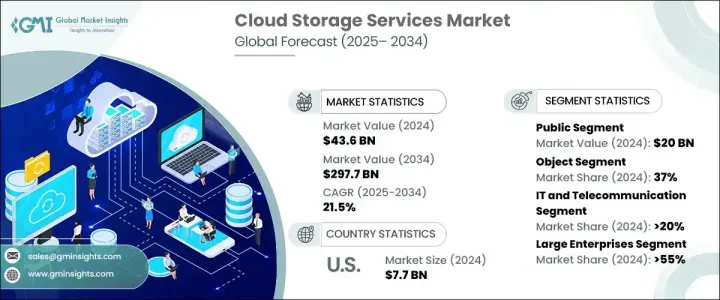

2024 年全球雲端儲存服務市場價值為 436 億美元,預計 2025 年至 2034 年期間的複合年成長率為 21.5%。遠端工作的興起推動了對雲端儲存和文件共享解決方案的需求,使團隊無需親自到場即可儲存和存取文件。服務提供者允許無縫文件共享、安全備份和輕鬆的文件協作,確保從任何位置即時存取文件。社群媒體、數位內容和物聯網設備產生的資料量不斷增加也推動了雲端儲存服務的日益普及。物聯網設備(例如智慧家庭系統)收集大量即時資料,這些設備需要可擴展的儲存解決方案。企業使用雲端儲存來安全地儲存和分析這些資料以獲得可行的見解。

降低維護成本是推動雲端儲存採用的另一個因素。維護內部資料儲存基礎架構需要大量開支,包括硬體維護、技術支援和 IT 人員。雲端服務供應商負責維護,包括安全性修補程式、軟體更新和硬體維修,因此無需專業人員。雲端儲存系統還結合了資料復原和冗餘功能,以防止硬體故障或資料遺失。雲端提供者在不同地區或資料中心之間複製資料,確保無縫的災難復原過程。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 436億美元 |

| 預測值 | 2977億美元 |

| 複合年成長率 | 21.5% |

公共雲端服務為全球員工提供遠端存取和協作,同時在多因素身份驗證 (MFA)、資料加密和存取控制等安全功能上投入大量資金。遵守 GDPR、HIPAA 和 ISO 27001 等行業標準和法規可確保資料安全和隱私。公共雲端儲存允許組織將資料儲存在提供者的資料中心,從而無需硬體維護或軟體更新。混合雲端模型結合了公有雲和私有雲環境,讓組織可以根據需要在兩者之間移動工作負載,從而確保營運靈活性。

物件儲存系統旨在處理大量非結構化資料,例如媒體檔案、備份和日誌檔案。他們的架構允許企業無縫擴展儲存容量,而無需複雜的配置。與需要實體硬體擴充的傳統系統不同,物件儲存可以自動化此過程。文件雲端儲存由於其遠端可存取性和增強的安全性,預計將佔據相當大的市場佔有率。使用者可以透過網路連線從多個裝置存取文件,並且提供者提供加密和 MFA 以增加保護。

區塊儲存適用於金融、醫療保健和遊戲等行業中需要高速、低延遲儲存的資料密集型應用。隨著這些產業產生的資料量不斷增加,對高效能區塊儲存解決方案的需求也不斷上升。冷雲端儲存對於不經常存取的資料更具成本效益,由於其耐用性和跨多個區域的可用性,預計將佔據相當大的市場佔有率。

雲端儲存服務市場按產業垂直細分,包括 BFSI、醫療保健、IT 和電信、零售和消費品、媒體和娛樂、製造業等。 2024 年,IT 和電信領域佔據了超過 20% 的市場佔有率,利用雲端儲存來儲存客戶記錄、網路資料和服務日誌。媒體和娛樂公司也嚴重依賴雲端儲存來管理大文件,包括高解析度視訊內容和音訊檔案。以最終用途分類,大型企業在 2024 年佔據超過 55% 的市場佔有率,利用雲端服務實現運算能力、儲存、網路、安全、分析和災難復原。基礎架構即服務 (IaaS) 和軟體即服務 (SaaS) 解決方案透過雲端為企業提供虛擬化運算資源和完整的託管應用程式。

歐洲佔全球雲端儲存服務市場的約 25%,其中德國因其嚴格的資料隱私法規而成為主要貢獻者。 GDPR 合規性要求雲端提供者提供資料加密、存取控制和稽核追蹤等功能,以確保資料安全和法規遵守。歐洲組織擴大採用多雲和混合雲端策略來平衡成本和效能,同時滿足嚴格的資料安全要求。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 雲端儲存服務供應商

- 雲端儲存基礎設施供應商

- 雲端管理和安全服務供應商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 用例

- 監管格局

- 衝擊力

- 成長動力

- 遠距工作地點的出現

- 對資料安全和備份的需求不斷成長

- 維護成本更低

- 輕鬆恢復資料

- 產業陷阱與挑戰

- 元數據激增

- 勒索軟體的威脅

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 民眾

- 私人的

- 混合

第6章:市場估計與預測:按存儲,2021 - 2034 年

- 主要趨勢

- 目的

- 文件

- 堵塞

- 寒冷的

第7章:市場估計與預測:按產業垂直,2021 - 2034 年

- 主要趨勢

- 金融服務業

- 衛生保健

- IT和電信

- 零售和消費品

- 媒體和娛樂

- 製造業

- 其他

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

- 個人

第9章:市場估計與預測:依定價模型,2021 - 2034 年

- 主要趨勢

- 按需付費

- 基於訂閱

- 免費增值

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Adobe

- Alibaba

- Amazon

- Apple

- Backblaze

- Box

- Dell

- DigitalOcean

- Dropbox

- HPE

- IBM

- Microsoft

- Oracle

- OVHcloud

- pCloud

- RackSpace

- Tencent

- VMware

- Wasabi Technologies

The Global Cloud Storage Services Market was valued at USD 43.6 billion in 2024 and is projected to grow at a CAGR of 21.5% between 2025 and 2034. The rise of remote work has fueled the demand for cloud storage and file-sharing solutions, enabling teams to store and access files without being physically present. Service providers allow seamless file sharing, secure backups, and easy collaboration on documents, ensuring real-time access to files from any location. The growing adoption of cloud storage services is also driven by the increasing volume of data generated by social media, digital content, and IoT devices. Massive real-time data is collected by IoT devices, such as smart home systems, which require scalable storage solutions. Businesses use cloud storage to securely store and analyze this data for actionable insights.

Reduced maintenance costs are another factor driving cloud storage adoption. Maintaining an on-premise data storage infrastructure involves significant expenses, including hardware maintenance, technical support, and IT personnel. Cloud service providers handle maintenance, including security patches, software updates, and hardware repairs, eliminating the need for specialized personnel. Cloud storage systems also incorporate data recovery and redundancy to protect against hardware failures or data loss. Cloud providers replicate data across different regions or data centers, ensuring a seamless disaster recovery process.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.6 Billion |

| Forecast Value | $297.7 Billion |

| CAGR | 21.5% |

Public cloud services enable remote access and collaboration for global workforces while investing heavily in security features such as multi-factor authentication (MFA), data encryption, and access control. Compliance with industry standards and regulations like GDPR, HIPAA, and ISO 27001 ensures data security and privacy. Public cloud storage allows organizations to store data in the provider's data centers, eliminating the need for hardware maintenance or software updates. Hybrid cloud models, which combine public and private cloud environments, allow organizations to move workloads between the two as needed, ensuring operational flexibility.

Object storage systems are designed to handle vast amounts of unstructured data, such as media files, backups, and log files. Their architecture allows businesses to scale storage capacity seamlessly without complex configurations. Unlike traditional systems that require physical hardware scaling, object storage automates the process. File cloud storage is expected to maintain a significant share of the market due to its remote accessibility and enhanced security. Users can access files from multiple devices through an internet connection, and providers offer encryption and MFA for added protection.

Block storage caters to data-intensive applications in industries like finance, healthcare, and gaming that require high-speed storage with low latency. As these industries generate increasing amounts of data, the demand for high-performance block storage solutions continues to rise. Cold cloud storage, which is more cost-effective for infrequently accessed data, is anticipated to hold a significant market share due to its durability and availability across multiple regions.

The cloud storage services market is segmented by industry verticals, including BFSI, healthcare, IT and telecommunication, retail and consumer goods, media and entertainment, manufacturing, and others. The IT and telecommunication segment accounted for over 20% of the market share in 2024, utilizing cloud storage for customer records, network data, and service logs. Media and entertainment companies also rely heavily on cloud storage to manage large files, including high-resolution video content and audio files. By end-use, large enterprises held a market share of over 55% in 2024, leveraging cloud services for computing power, storage, networking, security, analytics, and disaster recovery. Infrastructure-as-a-Service (IaaS) and Software-as-a-Service (SaaS) solutions provide businesses with virtualized computing resources and complete managed applications through the cloud.

Europe holds approximately 25% of the global cloud storage services market, with Germany being a major contributor due to its strict data privacy regulations. GDPR compliance mandates that cloud providers offer features such as data encryption, access controls, and audit trails to ensure data security and regulatory adherence. European organizations increasingly adopt multi-cloud and hybrid cloud strategies to balance cost and performance while addressing stringent data security requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Cloud storage service providers

- 3.2.2 Cloud storage infrastructure providers

- 3.2.3 Cloud management and security service providers

- 3.2.4 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Use cases

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Emergence of remote work location

- 3.9.1.2 Rising demand for data security and back up

- 3.9.1.3 Less maintenance cost

- 3.9.1.4 Ease in data recovery

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Surge in Metadata

- 3.9.2.2 Threats of ransomware

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Public

- 5.3 Private

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Storage, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Object

- 6.3 File

- 6.4 Block

- 6.5 Cold

Chapter 7 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Healthcare

- 7.4 IT and telecommunication

- 7.5 Retail and consumer goods

- 7.6 Media and entertainment

- 7.7 Manufacturing

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

- 8.4 Individual

Chapter 9 Market Estimates & Forecast, By Pricing Model, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Pay-as-you-go

- 9.3 Subscription-based

- 9.4 Freemium

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Adobe

- 11.2 Alibaba

- 11.3 Amazon

- 11.4 Apple

- 11.5 Backblaze

- 11.6 Box

- 11.7 Dell

- 11.8 DigitalOcean

- 11.9 Dropbox

- 11.10 Google

- 11.11 HPE

- 11.12 IBM

- 11.13 Microsoft

- 11.14 Oracle

- 11.15 OVHcloud

- 11.16 pCloud

- 11.17 RackSpace

- 11.18 Tencent

- 11.19 VMware

- 11.20 Wasabi Technologies