|

市場調查報告書

商品編碼

1630240

雲端儲存閘道器:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Cloud Storage Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

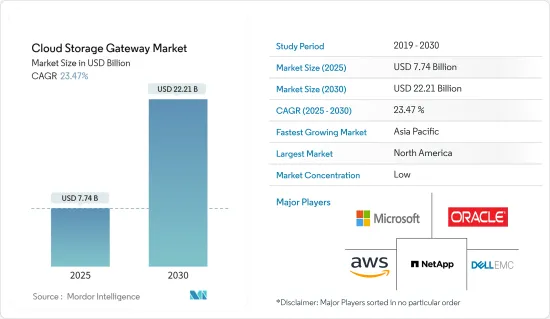

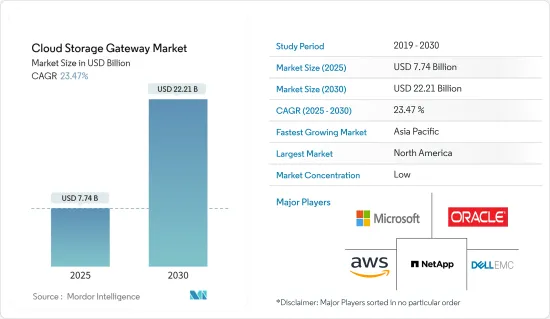

雲端儲存閘道器市場規模預計到2025年為77.4億美元,預計到2030年將達到222.1億美元,預測期間(2025-2030年)複合年成長率為23.47%。

隨著數十億設備連接到智慧網路,物聯網 (IoT) 需求快速成長,物聯網 (IoT) 閘道器市場正在經歷顯著成長。物聯網閘道器是物聯網產品和服務部署中的關鍵元件,可協助企業安全連接和遠端管理雲端網路上的感測器、裝置和應用程式。透過採用閘道器,企業可以減少在邊緣設備和雲端應用程式之間建立通訊通道所花費的精力。

主要亮點

- 儲存閘道器的重要性在通訊領域也顯而易見。隨著物聯網在通訊路上產生更多通訊,需要閘道器來聚合訊息並確保低延遲和安全性。例如,愛立信將於 2022 年 3 月為通訊服務提供者 (CSP) 提供新的 5G 邊緣用例,以管理本地用戶資料流量並簡化營運階段的生命週期管理。這使得通訊服務提供者能夠降低計劃階段的基礎設施實施成本。

- 麥肯錫報告顯示,大型企業正迅速轉向雲端技術,計劃在 2025 年將 60% 的環境轉變為雲端。到 2028 年,雲端運算市場預計將超過 1 兆美元。由於雲端服務的加速採用,雲端儲存閘道器市場的需求很高。

- 然而,保護資料免受線上入侵是雲端閘道器供應商面臨的主要挑戰。當使用集中式安全檔案傳輸解決方案在本機和雲端基礎的系統之間傳輸檔案時,必須在閘道器提供者與其用戶端之間建立信任關係。

- COVID-19 的爆發凸顯了對數位化的需求,許多組織轉向採用雲端來進行遠端工作和資料儲存。 Amazon Web Services 和 Microsoft Azure 已成為許多公司的熱門選擇。隨著組織從危機中恢復並擺脫困境,雲端技術的採用預計將繼續成長。

雲端儲存閘道器市場趨勢

醫療保健最終用戶產業預計將佔據主要市場佔有率

- 在當今的數位時代,許多醫療保健組織正在利用雲端技術來有效地儲存和存取資料。然而,並非所有資料都是一樣的,有些資料需要比其他數據更強的安全措施。例如,庫存記錄可能適合公有雲端存儲,但患者資料需要提供更高安全性、敏捷性、成本效率和擴充性的混合解決方案。

- 2023 年 2 月,新加坡國家健康科技機構綜合健康資訊系統與 Google Cloud 和Accenture合作,加速資料驅動應用程式的開發,以提供高品質、數位優先的醫療保健體驗。Accenture將支援實作Google雲端的API管理平台Apigee,使第三方開發者能夠跨iHiS管理的系統存取資料和服務,以開發應用程式和功能。

- 世界各國政府正在大力投資,將醫療保健產業轉變為具有人工智慧功能的數位平台。例如,印度政府正在推動 Ayushman Bharat Digital Mission 等舉措。同時,預計全球 80% 的醫療保健系統將在未來五年內增加對數位醫療工具的投資。

- 雲端運算公司根據個人客戶的需求開發各種平台。其中之一就是工業雲,它為醫療保健組織提供了簡化業務流程並適應不斷變化的數位環境的機會。行業雲不僅僅是運算和資料儲存解決方案;它們還是業務加速器。

- 2023 年 6 月,Hitachi, Ltd. 旗下現代基礎設施、資料管理和數位解決方案子公司 Hitachi Vantara 宣布與思科達成夥伴關係協議。透過這項協議,Hitachi Vantara 將加入解決方案技術整合商 (STI) 和思科服務供應商合作夥伴計劃,將思科技術整合到 Hitachi Vantara 的儲存產品中,並提供資料中心基礎設施和混合雲端服務,並將我們定位為領先的提供者之一。

亞太地區市場預計將顯著成長

- 亞太地區是主要貢獻者,佔全球雲端資料中心市場的近37%。馬來西亞、泰國和越南等新興市場正在進行有針對性的投資,以擴大陸上產能。在中國,92% 的基礎設施決策者表示他們在業務中使用雲端解決方案,我們計劃在未來兩年內達到 63%。

- 根據阿里巴巴發布的報告,泰國的雲端支出最高,貢獻率為 95%,其次是印度尼西亞,為 94%。同時,新加坡、香港和日本使用雲端服務超過三年的組織數量最多。

- 2022 年 4 月,NEC 在日本宣布推出雲端閘道解決方案,可增強現有本地 NEC 商務電話系統的效能、行動性和功能。該解決方案是與 Intermedia Cloud Communications 合作開發的,消除了在日本實施整合通訊即服務 (UCaaS) 的障礙。除了現有的NEC電話系統外,此雲端閘道器還提供聊天、視訊會議和文件共用等通訊和協作服務。

- 2023 年 3 月,AWS Storage Gateway 在 AWS 亞太地區(海得拉巴)和 AWS 亞太地區(墨爾本)區域推出,使客戶能夠管理和部署本地工作負載的混合雲端儲存。 AWS Storage Gateway 是一種混合雲端儲存服務,可讓本機應用程式存取幾乎無限的雲端儲存。使用者可以使用AWS Storage Gateway將資料存檔和備份到AWS,共用備份到雲端儲存的本機文件,並為本機應用程式提供對雲端資料的低延遲存取。

雲端儲存閘道器產業概況

由於存在多個參與者,全球雲端儲存閘道器市場競爭非常激烈。隨著各領域數位化的不斷提高,大量的資料不斷產生,雲端儲存成為了非常合適的儲存選擇。雲端儲存閘道器提供資料壓縮功能,促進快速且有效率的資料傳輸。為了在這個市場中脫穎而出,雲端儲存公司正在大力投資新技術,以證明他們的閘道器產品不僅僅是本地和雲端儲存之間的橋樑。

2023 年 11 月,全球雲端主導、以資料為中心的軟體公司 NetApp 宣布與微軟續簽夥伴關係關係。基於業界領先的 NetApp 和 Microsoft 技術,NetApp 為 Microsoft Azure 使用者提供雲端儲存解決方案的整合創新,包括為您提供的 Azure NetApp Files (ANF)、NetApp BlueXP、Cloud Volumes ONTAP 和 Spot by NetApp 的 CloudOps 解決方案。

2022 年 7 月,Moxa 發布了 AIG-300,這是 IIoT 閘道的修訂版系列。這些閘道器提供分散式和無人值守領域所需的穩定連接,以收集、儲存、處理和分析來自感測器和其他工業物聯網設備的操作資料,並在遠端現場實現更快、更安全的感測器到雲端連接。 AIG-300 系列是多種行業的完美解決方案,包括製造、運輸和能源。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 各行業雲端採用率的提高

- 對低成本資料儲存和更快資料存取的需求不斷成長

- 市場限制因素

- 雲端儲存的安全性問題

第6章 市場細分

- 按發展

- 私有雲端

- 公共雲端

- 混合雲端

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶產業

- 零售

- 衛生保健

- 製造業

- 媒體與娛樂

- 政府機構

- 教育

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Amazon Web Services

- Riverbed Technology

- CTERA Networks Ltd

- Cloud Gateway Co

- Microsoft Corporation

- Google LLC(Alphabet Inc.)

- NetApp Inc

- Dell EMC

- IBM Corporation

- Nasuni Corporation

- Panzura Inc.

- Oracle Corporation

第8章投資分析

第9章 市場機會及未來趨勢

The Cloud Storage Gateway Market size is estimated at USD 7.74 billion in 2025, and is expected to reach USD 22.21 billion by 2030, at a CAGR of 23.47% during the forecast period (2025-2030).

The Internet of Things (IoT) Gateway market is experiencing significant growth, driven by the surging demand for IoT due to the billions of devices connecting to smart networks. IoT gateways are critical components in IoT product and service deployments, helping enterprises securely connect their sensors, devices, and applications across cloud networks and manage them remotely. By adopting a gateway, companies can reduce the effort they spend on enabling the communication channel between edge devices and cloud apps.

Key Highlights

- The importance of storage gateways is also evident in the telecom sector. The IoT generates additional messaging on telecommunication networks, requiring gateways to aggregate the messages and ensure low latency and security. For example, in March 2022, Ericsson launched the Local Packet Gateway, which enables communication service providers (CSPs) to enable new 5G edge use cases, manage user data traffic on the premises, and simplify lifecycle management in the operations phase. This will benefit CSPs by lowering the cost of infrastructure deployments in the project phase.

- According to a report by McKinsey, large enterprises are rapidly turning towards cloud technologies and are willing to switch 60% of their environment to the cloud by 2025. The cloud computing market is expected to surpass 1 trillion USD by 2028. This accelerating adoption of cloud services will create high demand for Cloud Storage Gateway Market.

- However, safeguarding data from online intrusion is a significant challenge for Cloud Gateway providers. Trust needs to be built between gateway providers and their clients when transferring files between on-premises and cloud-based systems using a centralized Secure File Transfer solution.

- The COVID-19 pandemic highlighted the need for digitalization, and many organizations turned to cloud adoption for remote working and data storage. Amazon Web Services and Microsoft Azure became popular choices for many businesses. As organizations rebound and climb out of the crisis, the adoption of cloud technologies is expected to continue growing.

Cloud Storage Gateway Market Trends

Healthcare End-user Industry Segment is Expected to Hold Significant Market Share

- In today's digital age, many healthcare organizations leverage cloud technology to store and access data efficiently. However, not all data is created equal; some require more robust security measures than others. For example, while inventory records may be suitable for public cloud storage, patient data demands a hybrid solution that provides greater security, agility, cost-efficiency, and scalability.

- In February 2023, Integrated Health Information Systems, Singapore's national healthcare technology agency, partnered with Google Cloud and Accenture to promote the development of data-driven applications to offer high-quality and digital-first healthcare experiences. Accenture is assisting in deploying Apigee, Google Cloud's API management platform, which would provide third-party developers access to data and services across iHiS's managed systems to create applications and capabilities.

- Governments worldwide are investing heavily in the healthcare industry to transform it into digital platforms with AI capabilities. For example, the Indian Government is promoting initiatives like the Ayushman Bharat Digital Mission. At the same time, 80% of healthcare systems globally are expected to invest more in digital healthcare tools over the next five years.

- Cloud computing companies are developing various platforms tailored to individual client requirements. One such option is industry clouds, which offer healthcare organizations an opportunity to streamline their business processes and stay abreast of the changing digital landscape. Industry clouds serve as business accelerators and not just computing and data storage solutions.

- In June 2023, Hitachi Vantara, the modern infrastructure, data management, and digital solutions subsidiary of Hitachi, Ltd., announced a partnership agreement with Cisco. The deals offer Hitachi Vantara into Solution Technology Integrator (STI) and Cisco's Service Provider partner programs, allowing Hitachi Vantara to integrate Cisco technologies with its storage offerings and position the company as one of the leading data center infrastructure and hybrid cloud-managed services provider.

Asia Pacific Expected to Witness Significant Growth in the Market

- APAC significantly contributes to the world's cloud data center market, accounting for nearly 37% of it. To expand onshore capacity in emerging markets such as Malaysia, Thailand, and Vietnam, targeted investments are being made. In China, 92% of infrastructure decision-makers report that their businesses utilize cloud solutions, and these companies are planning to shift their operations to the cloud, with a target of reaching 63% within the next two years.

- According to a report released by Alibaba, cloud spending is most prevalent in Thailand, with a 95% contribution, followed by Indonesia at 94%. Meanwhile, Singapore, Hong Kong, and Japan have the highest number of organizations that have used cloud services for at least three years.

- In April 2022, NEC launched a Cloud Gateway solution in Japan to enhance existing on-premises NEC business phone systems' performance, mobility, and capabilities. This solution was developed in partnership with Intermedia Cloud Communications and eliminated barriers to adopting unified communications as a service (UCaaS) in Japan. In addition to an existing NEC phone system, this cloud gateway also provides communications and collaboration services such as chat, video conferencing, and file sharing.

- In March 2023, AWS Storage Gateway expanded availability to the AWS Asia Pacific in Hyderabad and AWS Asia Pacific (Melbourne) Regions, enabling customers to manage and deploy hybrid cloud storage for their on-premises workloads. AWS Storage Gateway is a hybrid cloud storage service that offers on-premises applications access to virtually unlimited storage in the cloud. Users can use AWS Storage Gateway for archiving data and backing up to AWS, offering on-premises file shares backed by cloud storage and offering on-premises applications with low latency access to data in the cloud.

Cloud Storage Gateway Industry Overview

The global market for cloud storage gateways is highly competitive due to the presence of multiple players. With the increasing digitization of every sector, a significant amount of data is being generated, and cloud storage is a highly suitable option for its storage. Cloud storage gateways provide data compression features that facilitate fast and efficient data transfer. In order to stand out in this market, cloud storage companies are investing heavily in new technologies to demonstrate that their gateway products can do more than just serve as a bridge between on-premises and cloud storage.

In November 2023, NetApp, a global cloud-led, data-centric software company, announced the renewal of its partnership with Microsoft. NetApp delivers innovations to Microsoft Azure users that bring together solutions for cloud storage with Azure NetApp Files (ANF) NetApp BlueXP, and Cloud Volumes ONTAP and now CloudOps solutions from Spot by NetApp-all based on industry-leading NetApp and Microsoft technologies.

In July 2022, Moxa introduced the AIG-300, a revised series of IIoT gateways. These gateways provide faster and more secure sensor-to-cloud connections in remote field locations, offering the stable connectivity required in distributed and unmanned sites for collecting, storing, processing, and analyzing operational data from sensors and other IIoT devices. The AIG-300 series is an ideal solution for various industries, including manufacturing, transportation, energy, and more.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Cloud Adoption Across Several Industry Verticals

- 5.1.2 Growing Demand for Low Cost Data Storage and Faster Data Accessibility

- 5.2 Market Restraints

- 5.2.1 Security Concerns Over Cloud Storage

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Private Cloud

- 6.1.2 Public Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By Organization Size

- 6.2.1 SME

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Media & Entertainment

- 6.3.5 Government

- 6.3.6 Education

- 6.3.7 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of the Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of the Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services

- 7.1.2 Riverbed Technology

- 7.1.3 CTERA Networks Ltd

- 7.1.4 Cloud Gateway Co

- 7.1.5 Microsoft Corporation

- 7.1.6 Google LLC (Alphabet Inc.)

- 7.1.7 NetApp Inc

- 7.1.8 Dell EMC

- 7.1.9 IBM Corporation

- 7.1.10 Nasuni Corporation

- 7.1.11 Panzura Inc.

- 7.1.12 Oracle Corporation