|

市場調查報告書

商品編碼

1708212

單位劑量包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Unit Dose Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

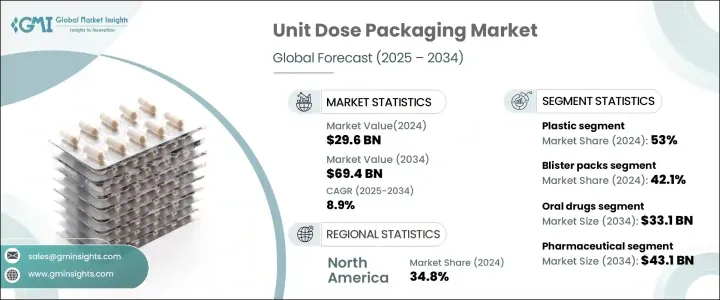

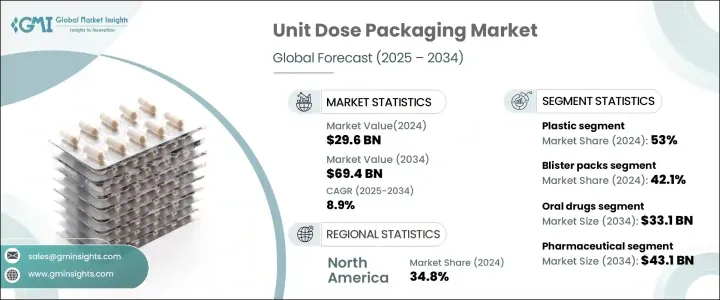

2024 年全球單位劑量包裝市場價值為 296 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.9%。這一強勁成長是由各行各業對精確、便捷的劑量解決方案日益成長的需求推動的,尤其是藥品、營養保健品和膳食補充劑。單位劑量包裝因其能夠增強患者依從性、減少用藥錯誤並提高安全性而受到關注。隨著世界各地的醫療保健系統強調準確劑量的重要性,製藥公司擴大採用泡殼包裝、預填充注射器、安瓿瓶和小瓶等單位劑量形式,以確保安全有效地輸送藥物。此外,個人化營養和預防性醫療保健的日益普及擴大了單位劑量包裝在功能性食品和益生菌補充劑中的使用,為市場創造了新的成長機會。

市場的成長軌跡也受到監管政策的影響,這些政策提倡使用更安全和防篡改的包裝,特別是在製藥領域。隨著人們越來越關注減少用藥錯誤和提高病人安全,單位劑量包裝形式正成為首選。此外,尤其是在後疫情時代,對便利性包裝解決方案的需求激增,進一步推動了市場的發展。消費者現在尋求的是一次性、衛生、便攜的包裝形式,以適應他們的忙碌生活方式。這一趨勢也延伸到了食品和飲料行業,單劑量小袋和小包裝因其易於使用和精確的份量控制而越來越受歡迎。因此,製造商正在大力投資先進的包裝技術和永續材料,以滿足不斷變化的消費者偏好,同時遵守嚴格的監管要求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 296億美元 |

| 預測值 | 694億美元 |

| 複合年成長率 | 8.9% |

市場按材料類型細分,主要類別為塑膠、鋁、紙和紙板以及玻璃。 2024 年,塑膠將佔據 53% 的市場佔有率,這得益於其強度、多功能性以及提供有效屏障保護的能力。塑膠包裝在確保安全的同時延長了產品的保存期限,成為藥品和食品包裝的首選。然而,對環境永續性的日益重視促使製造商開發環保替代品,例如可回收和可生物分解的塑膠。這些創新提供了環保解決方案,同時又不損害包裝功能,使塑膠領域繼續佔據市場主導地位。

就包裝類型而言,市場分為泡殼包裝、小袋和小袋、安瓿瓶和小瓶、預充式注射器等。 2024 年泡殼包裝佔 42.1% 的佔有率,反映了其在藥品和營養保健品領域的廣泛應用。製造商正在透過可剝離的蓋子、易於打開的設計和改進的阻隔性能來增強泡殼包裝,以確保產品安全,同時提供方便用戶使用的體驗。這些創新符合對平衡功能性和永續性的包裝解決方案日益成長的需求,推動了泡殼包裝在市場上的普及。

受先進包裝解決方案需求旺盛的推動,北美單位劑量包裝市場到 2024 年將佔全球佔有率的 34.8%。該地區專注於提高患者安全和藥物依從性,導致預充式注射器、單劑量小瓶和條狀包裝等單位劑量形式的採用激增。糖尿病、心血管疾病和呼吸系統疾病等慢性病的盛行率不斷上升,進一步促使製藥公司投資包裝技術,以最大限度地減少用藥錯誤並改善治療效果。因此,北美仍然是單位劑量包裝創新的關鍵市場,持續的研發投資預計將塑造該產業的未來。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 精準計量解決方案的需求不斷成長

- 製藥業的成長

- 非處方藥(OTC)的成長

- 營養保健品和補充劑中單位劑量包裝的使用日益增多

- 擴大即時檢測與診斷試劑盒

- 產業陷阱與挑戰

- 先進包裝機械初期投資高

- 一次性塑膠垃圾的環境問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依材料類型,2021-2034

- 主要趨勢

- 塑膠

- 鋁

- 紙和紙板

- 玻璃

第6章:市場估計與預測:依包裝類型,2021-2034

- 主要趨勢

- 泡殼包裝

- 小袋和小袋

- 安瓿瓶與小瓶

- 預充式注射器

- 其他

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 口服藥物

- 注射劑

- 外用和經皮

- 其他

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 製藥

- 化妝品和個人護理

- 營養保健品

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Adelphi Healthcare Packaging

- Amcor

- AptarGroup

- Berry Global

- Borosil

- Catalent

- Constantia Flexibles

- Corning

- DWK Life Sciences

- Gerresheimer

- Glenroy

- Lameplast

- Nipro

- Schott

- SGD Pharma

- Shiotani Glass

- Stevanato Group

- Unit Pack Company

- Valmatic

- West Pharmaceutical Services

The Global Unit Dose Packaging Market was valued at USD 29.6 billion in 2024 and is projected to grow at a CAGR of 8.9% between 2025 and 2034. This robust growth is fueled by the rising demand for precise and convenient dosing solutions across industries, particularly pharmaceuticals, nutraceuticals, and dietary supplements. Unit dose packaging has gained traction due to its ability to enhance patient compliance, reduce medication errors, and improve safety. As healthcare systems worldwide emphasize the importance of accurate dosing, pharmaceutical companies are increasingly adopting unit dose formats such as blister packs, pre-filled syringes, ampoules, and vials to ensure safe and effective medication delivery. Furthermore, the growing popularity of personalized nutrition and preventive healthcare has expanded the use of unit dose packaging in functional foods and probiotic supplements, creating new growth opportunities in the market.

The market's growth trajectory is also influenced by regulatory policies that promote the use of safer and tamper-evident packaging, particularly in the pharmaceutical sector. With an increasing focus on minimizing medication errors and enhancing patient safety, unit dose packaging formats are becoming a preferred choice. Additionally, the surge in demand for convenience-driven packaging solutions, especially in the post-COVID-19 era, has further propelled the market. Consumers now seek single-use, hygienic, and portable packaging formats that align with their on-the-go lifestyles. The trend has also extended to the food and beverage industry, where single-dose sachets and pouches are gaining momentum due to their ease of use and precise portion control. As a result, manufacturers are investing heavily in advanced packaging technologies and sustainable materials to cater to evolving consumer preferences while complying with stringent regulatory requirements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.6 Billion |

| Forecast Value | $69.4 Billion |

| CAGR | 8.9% |

The market is segmented by material type, with plastic, aluminum, paper & paperboard, and glass being the primary categories. In 2024, the plastic segment accounted for 53% of the market share, driven by its strength, versatility, and ability to provide effective barrier protection. Plastic packaging extends product shelf life while ensuring safety, making it a preferred choice in pharmaceuticals and food packaging. However, the increasing emphasis on environmental sustainability has prompted manufacturers to develop eco-friendly alternatives, such as recyclable and biodegradable plastics. These innovations provide environmentally conscious solutions without compromising packaging functionality, positioning the plastic segment for continued dominance in the market.

In terms of packaging types, the market is divided into blister packs, sachets & pouches, ampoules & vials, pre-filled syringes, and others. Blister packs held a 42.1% share in 2024, reflecting their widespread use in pharmaceutical and nutraceutical applications. Manufacturers are enhancing blister packs with peelable lids, easy-open designs, and improved barrier properties to ensure product safety while delivering a user-friendly experience. These innovations align with the growing demand for packaging solutions that balance functionality and sustainability, driving the popularity of blister packs in the market.

North America unit dose packaging market accounted for 34.8% of the global share in 2024, propelled by a high demand for advanced packaging solutions. The region's focus on improving patient safety and medication adherence has led to a surge in the adoption of unit dose formats such as pre-filled syringes, single-dose vials, and stick packs. The increasing prevalence of chronic conditions, including diabetes, cardiovascular diseases, and respiratory issues, has further driven pharmaceutical companies to invest in packaging technologies that minimize medication errors and improve treatment outcomes. As a result, North America remains a critical market for unit dose packaging innovations, with continued investments in research and development expected to shape the future of the industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for precision dosing solutions

- 3.2.1.2 Growth in the pharmaceutical industry

- 3.2.1.3 Growth in over-the-counter (OTC) medicines

- 3.2.1.4 Increasing use of unit dose packaging in nutraceuticals and supplements

- 3.2.1.5 Expansion of point-of-care testing and diagnostic kits

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment in advanced packaging machinery

- 3.2.2.2 Environmental concerns regarding single-use plastic waste

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Aluminum

- 5.4 Paper & paperboard

- 5.5 Glass

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Blister packs

- 6.3 Sachets & pouches

- 6.4 Ampoules & vials

- 6.5 Pre-filled syringes

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Oral drugs

- 7.3 Injectables

- 7.4 Topical & transdermal

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceutical

- 8.3 Cosmetics & personal care

- 8.4 Nutraceuticals

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adelphi Healthcare Packaging

- 10.2 Amcor

- 10.3 AptarGroup

- 10.4 Berry Global

- 10.5 Borosil

- 10.6 Catalent

- 10.7 Constantia Flexibles

- 10.8 Corning

- 10.9 DWK Life Sciences

- 10.10 Gerresheimer

- 10.11 Glenroy

- 10.12 Lameplast

- 10.13 Nipro

- 10.14 Schott

- 10.15 SGD Pharma

- 10.16 Shiotani Glass

- 10.17 Stevanato Group

- 10.18 Unit Pack Company

- 10.19 Valmatic

- 10.20 West Pharmaceutical Services