|

市場調查報告書

商品編碼

1685704

化妝品和香水玻璃瓶包裝:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Cosmetic Perfumery Glass Bottle Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

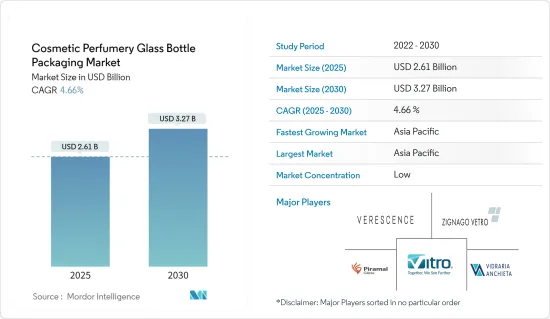

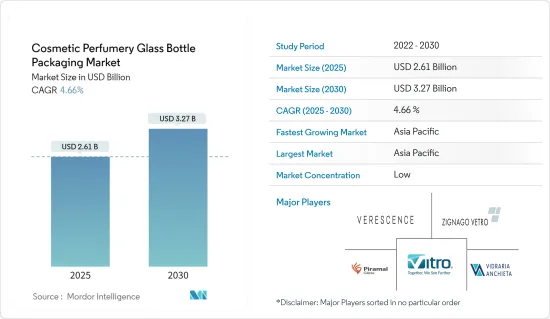

2025 年化妝品香水玻璃瓶包裝市場規模預計為 26.1 億美元,預計到 2030 年將達到 32.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.66%。

從出貨量來看,市場預計將從 2025 年的 164 億台成長到 2030 年的 203.8 億台,預測期間(2025-2030 年)的複合年成長率為 4.44%。

在所有行業中,化妝品行業擁有最多樣化的包裝需求,並且對化妝品包裝的需求持續增加。化妝品產業參與者正在齊心協力對抗塑膠污染,採用創新的包裝策略和先進的配方。

玻璃是一種傳統的包裝材料,無孔且不滲透。它具有化學惰性,不會隨著時間的劣化。玻璃除了具有功能性優勢外,還能為產品帶來高檔的感覺,讓消費者能夠看到內容和顏色,從而幫助他們做出購買決定。這種透明度和奢華的感覺是玻璃在化妝品包裝中如此廣泛使用的主要原因。

隨著對永續解決方案的需求不斷成長,企業正在積極尋求化妝品包裝中傳統塑膠的替代品,尤其是熱固性材料。由於各種包裝法規,此類不可回收材料面臨政府限制的風險。

此外,由於 ABS 等材料面臨區域監管,企業擴大轉向永續選擇,尤其是玻璃包裝。

優質包裝顯著提高了消費者的滿意度,使他們更有可能重複購買或推薦。全球化妝品和香水玻璃包裝市場的主要企業正在拓寬視野,推出一系列用於化妝品和香水的優質玻璃包裝。這些趨勢可能會在未來幾年增強對此類包裝的需求。

從歷史上看,鋁和玻璃是化妝品包裝的主要材料。然而,原物料成本的上漲使這些選擇在經濟上不適合大眾消費,因此人們更傾向於選擇塑膠作為替代品。

化妝品香水玻璃瓶包裝市場趨勢

香水市場預計將大幅成長

- 由於天然香料的需求相對於合成香料的激增以及奢侈香水的普及度上升,預計香水市場在預測期內將顯著成長。這種日益成長的需求正推動各公司投資創新的香水瓶設計。此外,玻璃香水瓶以其優雅的造型和反射特性而聞名,將其定位為高階奢侈品。

- 隨著消費者環保意識的增強,他們明顯轉向使用可最大限度減少廢棄物的永續產品。這種轉變增加了對填充用玻璃瓶的需求。這些填充用的香水瓶不僅透過減少一次性包裝和塑膠廢棄物符合環保價值觀,而且它們還因玻璃可無限回收且不會劣化,成為最佳選擇。

- 可再填充瓶不僅能帶來環境效益,也能為消費者和製造商帶來經濟效益。對消費者來說,這是一項長期投資。每次購買填充用比購買新瓶裝更便宜。對於製造商來說,持續購買填充用瓶可以提供可靠的收入來源。

- 中性高檔香水的日益普及也推動了化妝品產業對玻璃瓶的需求。當今的全球消費者已經超越了傳統的性別標籤,期望他們的品味和偏好得到認可。消費者情緒的轉變也體現在許多全球產品的推出上,從而推動了對玻璃瓶的需求。

預計亞太地區將實現最高成長

- 受國家蓬勃發展的經濟和日益富裕的中產階級的推動,中國包裝產業正在蓬勃發展。隨著中國化妝品市場的不斷成長,對化妝品包裝的需求也不斷飆升。雖然化妝品和香水包裝領域正在努力應對自身的挑戰和機會,但中國消費者不斷變化的生活方式趨勢極大地推動了對玻璃包裝的需求。

- 玻璃包裝可以作為護膚產品的保護罩,保護它們免受濕氣、空氣和有害紫外線的傷害。許多護膚品含有敏感成分,因此保持其完整性至關重要。玻璃包裝已成為最佳選擇,可確保這些產品保持其純度和效力。

- 此外,消費者被韓國產品吸引的一個主要原因是他們認為韓國產品重視健康和福祉。消費者往往會被包裝標籤上突出的天然成分以及實惠的價格和引人注目的設計所吸引。隨著對這些好處的認知不斷提高,在社群媒體的影響和產品個性的推動下,消費者也變得更願意投資。

- 隨著趨勢和消費者偏好的變化,玻璃在化妝品和香水領域的作用也不斷發展。行業領導者利用創新的設計和技術,不斷突破界限,創造出不僅引人注目,而且還能體現其所提供產品奢華的包裝。

化妝品香水玻璃瓶包裝市場概況

化妝品香水玻璃瓶包裝市場競爭激烈,較為分散,幾家主要企業佔據領先地位。目前,其中少數主要參與者佔了相當大的市場佔有率。這些參與者利用其突出的地位,積極努力擴大多個國家的基本客群。 Verescence、Vidraria Anchieta、Vitro SAB de CV、Zignago Vetro SpA 和 Piramal Glass Private Limited 等供應商正在利用策略聯盟引領包裝產業的創新。

- 2024年3月,愛茉莉太平洋集團與韓國資源再生振興院(KORA)合作,推動玻璃化妝品瓶的回收。這些瓶子通常帶有各種塗層,使其難以回收。此項聯合活動於 2024 年 4 月 22 日世界地球日在京畿道啟動,旨在減少環境破壞。該計劃重點關注玻璃化妝品瓶的收集和回收,即使它們來自競爭對手。

- 2024 年 2 月加拿大知名藥局 Shoppers Drug Mart 正致力於透過 Quo Beauty 免費回收計畫減少塑膠垃圾。透過與 TerraCycle 合作,該商店為顧客提供了回收空的 Quo Beauty 化妝品容器的機會,避免它們進入垃圾掩埋場和焚化爐。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 滴管瓶需求不斷增加

- 包裝對於產品差異化的重要性日益增加

- 市場限制

- 塑膠包裝作為玻璃瓶的替代品日益增多

第6章 市場細分

- 依產品類型

- 香水

- 指甲護理

- 護膚

- 其他產品類型

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 韓國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Verescence France

- Vidraria Anchieta

- Vitro SAB De CV

- Zignago Vetro SpA

- Piramal Glass Private Limited(Piramal Group)

- Pragati Glass Pvt Ltd

- Berlin Packaging LLC

- Nekem Packaging

- SGB Packaging Group Inc.

- SKS Bottle & Packaging Inc.

- Stoelzle Oberglas Gmbh(CAG-Holding Gmbh)

- Apackaging Group LLC

- Baralan International SpA

- Bormioli Luigi SpA

- Roetell Group(Jiangsu Rongtai Glass Products Co. Ltd)

- Continental Bottle Company Ltd

- DSM Packaging Sdn Bhd

- Gerresheimer AG

- Heinz-Glas Gmbh & Ko. KGaA

- Lumson SpA

第8章投資分析

第9章:市場的未來

The Cosmetic Perfumery Glass Bottle Packaging Market size is estimated at USD 2.61 billion in 2025, and is expected to reach USD 3.27 billion by 2030, at a CAGR of 4.66% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 16.40 billion units in 2025 to 20.38 billion units by 2030, at a CAGR of 4.44% during the forecast period (2025-2030).

Among all industries, the cosmetic sector boasts the most diverse packaging needs, with a consistent uptick in cosmetic packaging demands. United in their efforts, players in the cosmetics industry are adopting innovative packaging strategies and refined formulations to combat plastic pollution.

Glass, a time-honored packaging material, is both nonporous and impermeable. Its chemically inert nature ensures it does not degrade over time. Beyond its functional benefits, glass enhances the premium allure of products, allowing consumers to view the contents and colors, thus informing their purchase decisions. This transparency and premium feel largely explain glass's prevalent use in cosmetic packaging.

As the demand for sustainable solutions surges, companies are actively seeking alternatives to conventional plastics in cosmetics packaging, notably steering clear of thermoset materials. These non-recyclable materials risk facing government-imposed restrictions due to various packaging regulations.

Moreover, with materials like ABS facing region-specific regulations, companies are increasingly pivoting toward sustainable options, notably glass packaging.

Premium packaging significantly boosts consumer satisfaction, enhancing the chances of repeat purchases and recommendations. Key players in the global cosmetic and perfume glass packaging market are broadening their horizons, introducing a range of luxury glass packaging tailored for cosmetics and perfumes. This trend is poised to bolster the demand for such packaging in the coming years.

Historically, aluminum and glass were the go-to materials for cosmetic packaging. However, rising raw material costs rendered these options less economically viable for mass consumption, paving the way for plastics to emerge as a favored alternative.

Cosmetic Perfumery Glass Bottle Packaging Market Trends

Perfume Segment Expected to Register Significant Growth

- As demand surges for natural fragrances over synthetic ones and luxury perfumes gain traction, the market is poised for significant growth during the forecast period. This rising demand has prompted companies to invest in innovative perfume bottle designs. Furthermore, perfume glass bottles, known for their elegant shapes and reflective quality, are positioned as high-end luxury items.

- As consumers grow increasingly conscious of their environmental footprint, there is a marked shift toward sustainable products that minimize waste. This shift has amplified the demand for refillable glass bottles. These refillable perfume bottles not only align with eco-friendly values by reducing disposable packaging and plastic waste but also stand out as glass, being infinitely recyclable without quality degradation, making it the top choice.

- Beyond environmental benefits, refillable bottles present economic advantages for both consumers and manufacturers. For consumers, it is a savvy long-term investment. Purchasing refills is cheaper than buying a new bottle each time. For manufacturers, the consistent purchase of refills translates to a reliable income stream.

- The rising popularity of unisex luxury perfumes is further fueling the demand for glass bottles in the cosmetic sector. Today's global consumers seek recognition for their preferences and tastes, transcending traditional gender labels. This evolving sentiment is evident in numerous global product launches, amplifying the demand for glass bottles.

Asia-Pacific Expected to Witness Highest Growth

- China's packaging industry is witnessing rapid growth, fueled by the nation's booming economy and an increasingly affluent middle class. As China's cosmetic market grows, the demand for cosmetic packaging has surged in tandem. While the cosmetic and perfume packaging sector grapples with its own set of challenges and opportunities, shifting trends in Chinese consumer lifestyles are notably driving the demand for glass packaging.

- Glass packaging serves as a shield for skincare products, guarding them against moisture, air, and harmful UV rays. Given that many skincare items boast sensitive ingredients, preserving their integrity is paramount. Opting for glass packaging emerges as the optimal choice, ensuring these products maintain their purity and effectiveness.

- Moreover, a significant draw for consumers toward Korean products lies in the perception that these items prioritize health and well-being. Shoppers are often enticed by the natural ingredients highlighted on packaging labels, coupled with the allure of affordable pricing and eye-catching designs. As awareness of these benefits grows, bolstered by social media influence and the distinctiveness of the offerings, consumers are increasingly inclined to invest in them.

- As trends and consumer preferences shift, the role of glass in the cosmetics and perfume sector is continually adapting. Industry frontrunners are pushing boundaries, experimenting with innovative designs and techniques to craft packaging that not only stands out but also mirrors the premium quality of their offerings.

Cosmetic Perfumery Glass Bottle Packaging Market Overview

The cosmetics and perfumery glass bottles market is characterized by intense competition and fragmentation, with several key players at the forefront. A handful of these major players currently command a significant share of the market. Capitalizing on their prominent positions, these players are actively working to broaden their customer base across multiple countries. Market vendors, including Verescence France, Vidraria Anchieta, Vitro SAB de CV, Zignago Vetro SpA, and Piramal Glass Private Limited, are harnessing strategic collaborations to spearhead innovations in the packaging industry.

- March 2024: Amorepacific Group teamed up with the Korea Resource Circulation Service Agency (KORA) to boost the recycling of cosmetic glass bottles. These bottles often have diverse coatings, making recycling a challenge. Their joint effort, which kicked off on Earth Day, April 22, 2024, in Gyeonggi Province, aims to lessen environmental harm. The project will spotlight the collection and recycling of cosmetic glass bottles, even those from rival companies.

- February 2024: Shoppers Drug Mart, a prominent Canadian drugstore, is taking steps to cut down on plastic waste through its Quo Beauty Free Recycling Program. In collaboration with TerraCycle, the retailer is providing customers an opportunity to recycle empty components of Quo Beauty cosmetics, ensuring they do not end up in landfills or incinerators.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Dropper Bottles

- 5.1.2 Increased Emphasis on Packaging for Product Differentiation

- 5.2 Market Restraints

- 5.2.1 Growth of Plastic Packaging as a Substitute for Glass Bottles

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Perfumes

- 6.1.2 Nail Care

- 6.1.3 Skin Care

- 6.1.4 Other Product Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 South Korea

- 6.2.3.3 India

- 6.2.3.4 Japan

- 6.2.3.5 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verescence France

- 7.1.2 Vidraria Anchieta

- 7.1.3 Vitro S.A.B. De C.V.

- 7.1.4 Zignago Vetro SpA

- 7.1.5 Piramal Glass Private Limited (Piramal Group)

- 7.1.6 Pragati Glass Pvt Ltd

- 7.1.7 Berlin Packaging LLC

- 7.1.8 Nekem Packaging

- 7.1.9 SGB Packaging Group Inc.

- 7.1.10 SKS Bottle & Packaging Inc.

- 7.1.11 Stoelzle Oberglas Gmbh (CAG-Holding Gmbh)

- 7.1.12 Apackaging Group LLC

- 7.1.13 Baralan International SpA

- 7.1.14 Bormioli Luigi SpA

- 7.1.15 Roetell Group (Jiangsu Rongtai Glass Products Co. Ltd)

- 7.1.16 Continental Bottle Company Ltd

- 7.1.17 DSM Packaging Sdn Bhd

- 7.1.18 Gerresheimer AG

- 7.1.19 Heinz-Glas Gmbh & Ko. KGaA

- 7.1.20 Lumson SpA