|

市場調查報告書

商品編碼

1473279

全球半導體製造設備:市場、市場佔有率、市場預測Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts |

||||||

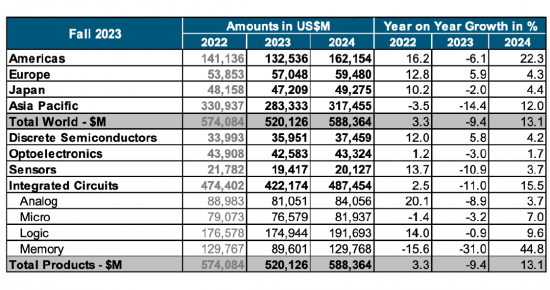

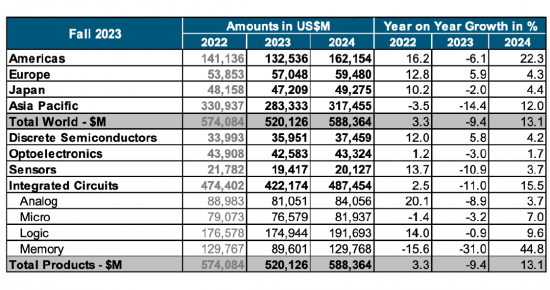

2023年全球半導體產業銷售額總計5,268億美元,較2022年產業史上最高點5,741億美元下降8.2%。 然而,銷售在 2023 年下半年有所恢復。 事實上,第四季銷售額為1,460億美元,比去年同期成長11.6%,比2023年第三季成長8.4%。 此外,2023年12月全球銷售額為486億美元,較上季成長1.5%。

依地區劃分,歐洲是2023年唯一實現年度成長的地區市場,該地區銷售額成長4.0%。 所有其他市場 2023 年銷售額均下降:日本 (-3.1%)、美洲 (-5.2%)、亞太/其他地區 (-10.1%) 和中國 (-14.0%)。 與11 月相比,2023 年12 月的月銷售額在中國(成長4.7%)、美洲(成長1.8%)和亞太/其他地區(成長0.3%)有所成長,但日本(下降2.4 %)和歐洲(下降3.9%)。

2023年,多個半導體產品領域脫穎而出。 2023年邏輯產品銷售額將達到1,785億美元,成為銷售額最大的產品類別。 記憶體產品銷售額排名第二,總計923億美元。 微控制器 (MCU) 成長 11.4%,達到 279 億美元。 此外,汽車IC銷售額年增23.7%至422億美元,創歷史新高。

全球經濟放緩和超支引發了 2023 年半導體供應過剩和設備崩潰。 隨著現有半導體工廠的擴建和新半導體工廠的規劃,產能正在大幅擴張。

拜登政府推動投資 500 億美元建立國內製造能力,以提高美國的自給自足並減少對亞洲的依賴,此舉可能會導致供應過剩和產能擴張。

本報告分析了全球半導體製造設備市場,包括市場的基本結構和驅動因素、最新情況、整體市場規模趨勢和佔有率結構(2012-2023年)以及依類型劃分的詳細趨勢(24種類型)。

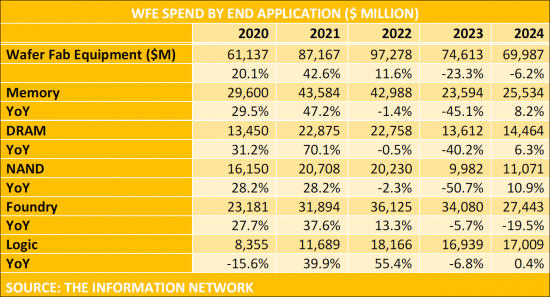

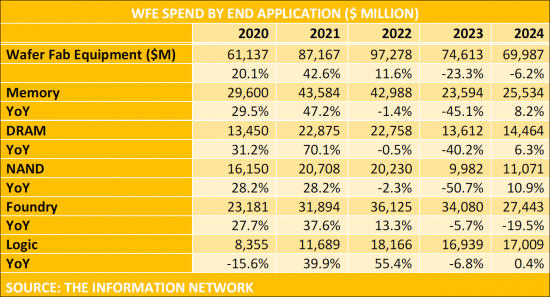

晶圓前端(WFE)設備投資額:依元件最終產品劃分(2020-2024)

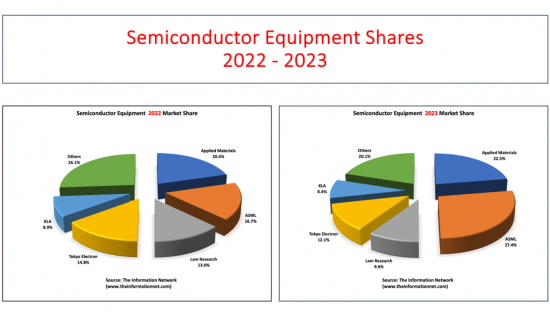

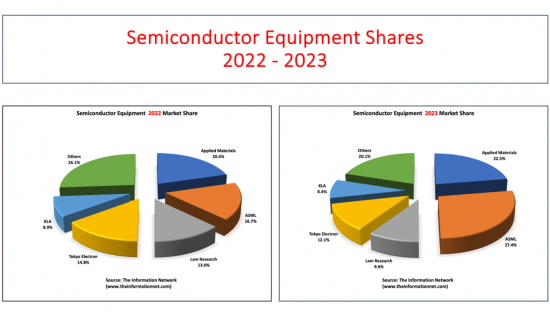

全球WFE設備市場的市佔率:前5名公司及其他公司(2022/2023)

目錄

第一章簡介

第二章半導體產業驅動力

- 簡介

- 鑄造廠

- 代工資本投資趨勢

- 代工所得成長率

- 代工市佔率

- 收入成長率:依代工廠劃分

- 全球代工/邏輯微影需求

- 全球鑄造設備需求:依類型

- 台積電晶圓價格:依節點

- 鑄造技術:線寬路線圖

- 產能趨勢:依線寬劃分

- 產能比例:依地區劃分

- 記憶體

- DRAM目前與未來的產能:依廠商劃分

- DRAM 收入/需求預測:依應用分類

- DRAM 市佔率

- DRAM資本投資

- NAND

- NAND 收入/需求預測:依應用程式分類

- NAND市佔率

- 3D NAND產能

- 中國

- 中國的半導體基礎設施

- 中國半導體市場

- 中國的積體電路生產

- 中國IC消費

- 中國IC產銷比

- 中國積體電路進口要求

- 中國IC需求與供應

- 中國IC晶圓廠產能

- 中國IC晶圓廠產能:依地區劃分

- 中國8吋和12吋晶圓廠和代工廠

- 中國IC晶圓廠產能:依晶圓尺寸劃分

- 中國IC晶圓廠產能:依形狀分類

- 中國積體電路產量:依類型

第三章市場/業務板塊/佔有率/預測

- AMHS(自動化物料搬運設備)市場佔有率與預測

- CMP(化學機械平坦化)市佔率及預測

- 清潔設備市場佔有率及預測

- 等離子條帶

- 噴霧處理器

- 濕站

- 薄膜形成設備的市佔率及預測

- ALD(電子層沉積法)

- 外延

- MOCVD(有機化學氣相沉積)

- LPCVD(低壓CVD:非管式)

- LPCVD(低壓CVD:管式)

- 等離子 CVD(化學氣相沉積)

- PVD(物理氣相沉積)

- 離子注入機市佔率及預測

- 光刻設備市場佔有率及預測

- 直寫電子束光刻

- 掩模製造光刻

- 步進器

- 氧化/擴散設備市場佔有率及預測

- 光阻加工(車)設備市佔率及預測

- RTP(快速熱處理)設備市佔率及預測

- 等離子蝕刻設備市場佔有率及預測

- 電介質

- 指揮

- 製程控制設備市場佔有率及預測

- 光刻測量

- 薄膜測量

- 晶圓檢查與缺陷審查

第 4 章美國半導體設備供應商:簡介

- 應用材料

- 市場分析涵蓋的業務領域

- 公司簡介

- 財務指標

- Axcelis Technologies

- KLA

- Lam Research

- Mattson Technology

- Opto Innovation

- 公司簡介:奈米技術

- 公司簡介:Rudolph Technologies

- 維科

第五章歐洲半導體設備供應商:簡介

- Aixtron

- ASM International

- ASML

- Carl Zeiss

- Camtek

- EV Group

- LPE

- Mycronic

- Nova Measuring Instruments9

- Oerlikon/Evatec

- Semilab

第六章亞洲半導體設備供應商:簡介

- ACM Research

- Advantest

- AMEC

- Avaco

- Canon

- Canon Anelva

- Daifuku

- Ebara

- Eugene Technology

- Hitachi High-Technologies

- Hitachi Kokusai Electric

- Hwatsing

- JEOL

- Jusung Engineering

- KC Tech

- Lasertec

- Murata Machinery

- Murata Machinery

- Nikon

- Nippon Sanso

- Nissin Ion Equipment

- NuFlare Technology

- Piotech

- PSK

- Raintree Scientific Instruments

- Screen Semiconductor Solutions

- SEMES

- SEN

- TES

- Tokyo Electron

- Tokyo Seimitsu

- Topcon Technohouse

- Toray Engineering

- Ulvac

- Ushio

- Wonik IPS

The Semiconductor Industry Association (SIA) announced global semiconductor industry sales totaled $526.8 billion in 2023, a decrease of 8.2% compared to the 2022 total of $574.1 billion, which was the industry's highest-ever annual total. Sales picked up during the second half of 2023. In fact, fourth-quarter sales of $146.0 billion were 11.6% more than the total from the fourth quarter of 2022 and 8.4% higher than the total from third quarter of 2023. And global sales for the month of December 2023 were $48.6 billion, an increase of 1.5% compared to November 2023 total. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

On a regional basis, Europe was the only regional market that experienced annual growth in 2023, with sales there increasing 4.0%. Annual sales into all other regional markets decreased in 2023: Japan (-3.1%), the Americas (-5.2%), Asia- Pacific/All Other (-10.1%), and China (-14.0%). Sales for the month of December 2023 increased compared to November 2023 in China (4.7%), the Americas (1.8%), and Asia Pacific/All Other (0.3%), but decreased in Japan (-2.4%) and Europe (-3.9%).

Several semiconductor product segments stood out in 2023. Sales of logic products totaled $178.5 billion in 2023, making it the largest product category by sales. Memory products were second in terms of sales, totaling $92.3 billion. Microcontroller units (MCUs) grew by 11.4% to a total of $27.9 billion. And sales of automotive ICs grew by 23.7% year-over-year to a record total of $42.2 billion.

Global economic slowdowns and capes overspend were catalysts for producing an oversupply of semiconductors and an equipment meltdown in 2023. A significant capacity expansion is underway as current fabs expand and new fabs are planned.

A push by the Biden administration to invest $50 billion on domestic manufacturing facilities to improve US self-sufficiency and reduce reliance on Asia has initiated a course that will likely result in oversupply and capacity expansion:

Intel

- Arizona - Fab 42 expansion for 7nm capacity

- Oregon - Fab D1X $3B Mod3 expansion; tools installed Aug. '21 to Feb. '22

- New Mexico - $3.5B spend for advanced packaging

- Israel - $10B 7nm fab; 2023 production

- Ireland - spent additional $7B from 2019-2021 to expand to 7nm

- Arizona Foundry $20B for 2 fabs (~35k wspm each) starting production in 2023 and 2024

- Malaysia - $7B for advanced packaging fab expansion; 2024 production

TSMC

- Fab 18 - 3nm $20B fab expected to be completed in 2023

- Arizona Fab -$12B over time; 5nm initial phase to produce 20k wspm starting in 1Q24 with equipment installation commencing in 2H2022

- Japan 22 / 28nm fab with Sony; $7B 45k wspm targeting late 2024 production

- 7/6nm & 28nm fab in Kaohsiung, Taiwan for 2024 production for a reported $10B; phase 1 = 40k wspm for 7nm and 6nm with phase 2 for 28nm

Samsung

- Pyeongtaek line 3 (P3) equipment move-in expected to start in April 2022; rst 40-50k wspm 176L 3D NAND line, 130k-140k wspm DRAM and 10k-20k wspm 5nm foundry lines in 2H2022

- Pyeongtaek P2 S5-1; 3nm 60k wspm in 2021 & ramp to 120k wspm in 2022

- Pyeongtaek P2 S5-2; 3nm 60k wspm targeted production in 2024

- U.S. $17B 5nm Foundry fab in Texas; expected 2H2024 production (120k wspm est.)

GlobalFoundries

- $4 billion Singapore Module 7H 38k wspm starting wafer production in early-2023; full ramp end of 2023

- $1B Malta New York fab expansion of 12,500 wspm; additional fab to double capacity

- Spending $1.4B to expand capacity in U.S., Singapore, and Germany

SMIC

- 100k wspm 28nm & above fab for $8.87B in Shanghai; timing unknown

- 40k wspm 28nm & above fab in Shenzhen for $2.35B; production starting 2022

UMC

- Fab 12A Phase 6 (P6) $3.5B plan for expansion; scheduled for production in 2Q23

Kioxia / Western Digital

- Fab 7 in Mie Prefecture, Japan; expected production in late 2022 / early 2023

- Kitakami (K2) fab at $18.4B expected completion in early 2023; use of Yokkaichi equip.?

Micron

- DRAM - $7B fab in Japan expected to commence production in 2024

SK Hynix

- $106B fab complex with 800k wspm capacity and 200k EUV - rst fab completed in 2025 Nanya

- DRAM - $10.7B 10nm 110k wspm fab expected to be completed in 2023; production in 2024

Powerchip Semi (PSMC)

- $10B 12-inch fab in the Tongluo Science Park; 100k wspm of 1x to 50nm technology will be put into production in stages beginning in 2023

Texas Instruments

- RFAB2 - $850M fab coming online in 2H2022 with equipment over next few years

- LFAB (acquired from Micron) - spend $3B of capex over time with target of coming online in early-2023 - more details in February at capital management call

- North Texas Fab site (option for up to 4 fabs over time) - 1st & 2nd fab construction commencing in 2022 with First fab targeting production in 2025 (70k wspm estimated)

Wafer Front End equipment spend between 2020 and 2024 by device end product is shown below:

In Figure 1.1 below, we show market shares for the global WFE equipment market for 2022 and 2023, listing shares for the Top 5 global equipment companies and the other equipment companies in the market.

Report Coverage

This 325-page report analyzes and forecasts the semiconductor market for 24 different equipment types, including market shares for 2023 by type:

AMHS (Automated Material Handling Systems) Market

CMP (Chemical Mechanical Planarization) Market

Clean Market

- Plasma Strip

- Spray Processors

- Wet Stations

Deposition Market

- ALD

- Epitaxy

- MOCVD

- LPCVD (non-tube)

- LPCVD (tube)

- PECVD

- PVD

Ion Implantation Market

Lithography Market

- Direct-Write E-Beam Lithography

- Mask-Making Lithography

- Steppers

Oxidation/Diffusion Market

Photoresist Processing (Track) Market

RTP Market

Plasma Etch Market

- Dielectric

- Conductor

Process Control Market

- Lithography Metrology

- Thin-Film Metrology

- Wafer Inspection and Defect Review

The report in pdf format profiles 6 U.S., 11 European, and 26 Asian equipment companies.

An Excel File accompanies the report and covers Market Shares of each company by each equipment type between 2012 and 2023.

Driving forces of technology and geopolitics are analyzed and forecast by semiconductor type including China markets.

Table of Contents

Chapter 1. Introduction

Chapter 2. Semiconductor Industry Driving Forces

- 2.1. Introduction

- 2.2. Foundries

- 2.2.1. Foundry Capex Trends

- 2.2.2. Foundry Revenue Growth

- 2.2.3. Foundry Market Share

- 2.2.4. Revenue Growth by Foundry

- 2.2.5. Global Foundry / Logic Lithography Demand

- 2.2.6. Global Foundry Equipment Demand By Type

- 2.2.7. TSMC Wafer Price By Node

- 2.2.8. Foundry Technology Linewidth Roadmap

- 2.2.9. Capacity trend by linewidth

- 2.2.10. Capacity ratio by region

- 2.3. DRAM

- 2.3.1. Present and Future Capacity of DRAM by Manufacturer

- 2.3.2. DRAM Revenue Demand Forecast By Application

- 2.3.3. DRAM Market Shares

- 2.3.4. DRAM Capex

- 2.4. NAND

- 2.4.1. NAND Revenue Demand Forecast By Applications

- 2.4.2. NAND Market Shares

- 2.4.3 3D NAND Capacity

- 2.5. China

- 2.5.1. China's Semiconductor Infrastructure

- 2.5.2. China's Semiconductor Market

- 2.5.3. China's IC Production

- 2.5.4. China's IC Consumption

- 2.5.5. China's IC Production/Consumption Ratio

- 2.5.6. China's IC Import Requirements

- 2.5.7. China's IC Supply/Demand

- 2.5.8. China's IC Fab Capacity

- 2.5.9. China's IC Fab Capacity by Region

- 2.5.10. China's 8- And 12-Inch Fabs and Foundries

- 2.5.11. China's IC Fab Capacity by Wafer Size

- 2.5.12. China's IC Fab Capacity by Geometry

- 2.5.13. China's IC Production by Type

Chapter 3. Market Business Sectors Shares and Forecast

- 3.1. AMHS Market Shares and Forecast

- 3.2. CMP Market Shares and Forecast

- 3.3. Clean Market Shares and Forecast

- 3.3.1. Plasma Strip

- 3.3.2. Spray Processors

- 3.3.3. Wet Stations

- 3.4. Deposition Market Shares and Forecast

- 3.4.1. ALD

- 3.4.2. Epitaxy

- 3.4.3. MOCVD

- 3.4.4. LPCVD (non-tube)

- 3.4.5. LPCVD (tube)

- 3.4.6. PECVD

- 3.4.7. PVD

- 3.5. Ion Implantation Market Shares and Forecast

- 3.6. Lithography Market Shares and Forecast

- 3.6.1. Direct-Write E-Beam Lithography

- 3.6.2. Mask-Making Lithography

- 3.6.3. Steppers

- 3.7. Oxidation/Diffusion Market Shares and Forecast

- 3.8. Photoresist Processing (Track) Market Shares and Forecast

- 3.9. RTP Market Shares and Forecast

- 3.10. Plasma Etch Market Shares and Forecast

- 3.10.1. Dielectric

- 3.10.2. Conductor

- 3.11. Process Control Market Shares and Forecast

- 3.11.1. Lithography Metrology

- 3.11.2. Thin-Film Metrology

- 3.11.3. Wafer Inspection and Defect Review

Chapter 4. U.S. Semiconductor Equipment Suppliers - Profiles

- 4.1. Applied Materials

- 4.1.1. Business Sectors Covered In The Market Analysis Chapter

- 4.1.2. Company Profile

- 4.1.3. Company Financials

- 4.2. Axcelis Technologies

- 4.1.2. Business Sectors Covered In The Market Analysis Chapter

- 4.2.2. Company Profile

- 4.2.3. Company Financials

- 4.3. KLA

- 4.3.1. Business Sectors Covered In The Market Analysis Chapter

- 4.3.2. Company Profile

- 4.3.3. Company Financials

- 4.4. Lam Research

- 4.4.1. Business Sectors Covered In The Market Analysis Chapter

- 4.4.2. Company Profile

- 4.4.3. Company Financials

- 4.5. Mattson Technology

- 4.5.1. Business Sectors Covered In The Market Analysis Chapter

- 4.5.2. Company Profile

- 4.5.3. Company Financials

- 4.6. Opto Innovation

- 4.6.1. Business Sectors Covered In The Market Analysis Chapter

- 4.6.2. Company Profile - Nanometrics

- 4.6.3. Sectors Covered In The Market Analysis Chapter

- 4.6.4. Company Profile - Rudolph Technologies

- 4.6.5. Company Financials

- 4.7. Veeco

- 4.7.1. Business Sectors Covered In The Market Analysis Chapter

- 4.7.2. Company Profile

- 4.7.3. Company Financials

Chapter 5. European Semiconductor Equipment Suppliers - Profiles

- 5.1. Aixtron

- 5.1.1. Business Sectors Covered In The Market Analysis Chapter

- 5.1.2. Company Profile

- 5.1.3. Company Financials

- 5.2. ASM International

- 5.2.1. Business Sectors Covered In The Market Analysis Chapter

- 5.2.2. Company Profile

- 5.2.3. Company Financials

- 5.3. ASML

- 5.3.1. Business Sectors Covered In The Market Analysis Chapter

- 5.3.2. Company Profile

- 5.3.3. Company Financials

- 5.4. Carl Zeiss

- 5.4.1. Business Sectors Covered In The Market Analysis Chapter

- 5.4.2. Company Profile

- 5.4.3. Company Financials

- 5.5. Camtek

- 5.5.1. Business Sectors Covered In The Market Analysis Chapter

- 5.5.2. Company Profile

- 5.5.3. Company Financials

- 5.6. EV Group

- 5.6.1. Business Sectors Covered In The Market Analysis Chapter

- 5.6.2. Company Profile

- 5.6.3. Company Financials

- 5.7. LPE

- 5.7.1. Business Sectors Covered In The Market Analysis Chapter

- 5.7.2. Company Profile

- 5.7.3. Company Financials

- 5.8. Mycronic

- 5.8.1. Business Sectors Covered In The Market Analysis Chapter

- 5.8.2. Company Profile

- 5.8.3. Company Financials

- 5.9. Nova Measuring Instruments9

- 5.9.1. Business Sectors Covered In The Market Analysis Chapter

- 5.9.2. Company Profile

- 5.9.3. Company Financials

- 5.10. Oerlikon / Evatec

- 5.10.1. Business Sectors Covered In The Market Analysis Chapter

- 5.10.2. Company Profile

- 5.10.3. Company Financials

- 5.11. Semilab

- 5.11.1. Business Sectors Covered In The Market Analysis Chapter

- 5.11.2. Company Profile

- 5.11.3. Company Financials

Chapter 6. Asian Semiconductor Equipment Suppliers - Profiles

- 6.1. ACM Research

- 6.1.1. Business Sectors Covered In The Market Analysis Chapter

- 6.1.2. Company Profile

- 6.1.3. Company Financials

- 6.2. Advantest

- 6.2.1. Business Sectors Covered In The Market Analysis Chapter

- 6.2.2. Company Profile

- 6.2.3. Company Financials

- 6.3. AMEC

- 6.3.1. Business Sectors Covered In The Market Analysis Chapter

- 6.3.2. Company Profile

- 6.3.3. Company Financials

- 6.4. Avaco

- 6.4.1. Business Sectors Covered In The Market Analysis Chapter

- 6.4.2. Company Profile

- 6.4.3. Company Financials

- 6.5. Canon

- 6.5.1. Business Sectors Covered In The Market Analysis Chapter

- 6.5.2. Company Profile

- 6.5.3. Company Financials

- 6.5.6. Canon Anelva

- 6.6.1. Business Sectors Covered In The Market Analysis Chapter

- 6.6.2. Company Profile

- 6.6.3. Company Financials

- 6.7. Daifuku

- 6.7.1. Business Sectors Covered In The Market Analysis Chapter

- 6.7.2. Company Profile

- 6.7.3. Company Financials

- 6.8. Ebara

- 6.8.1. Business Sectors Covered In The Market Analysis Chapter

- 6.8.2. Company Profile

- 6.8.3. Company Financials

- 6.9. Eugene Technology

- 6.9.1. Business Sectors Covered In The Market Analysis Chapter

- 6.9.2. Company Profile

- 6.9.3. Company Financials

- 6.10. Hitachi High-Technologies

- 6.10.1. Business Sectors Covered In The Market Analysis Chapter

- 6.10.2. Company Profile

- 6.1.3. Company Financials

- 6.10. Hitachi Kokusai Electric

- 6.11.1. Business Sectors Covered In The Market Analysis Chapter

- 6.11.2. Company Profile

- 6.11.3. Company Financials

- 6.12. Hwatsing

- 6.12.1. Business Sectors Covered In The Market Analysis Chapter

- 6.12.2. Company Profile

- 6.12.3. Company Financials

- 6.13. JEOL

- 6.13.1. Business Sectors Covered In The Market Analysis Chapter

- 6.13.2. Company Profile

- 6.13.3. Company Financials

- 6.14. Jusung Engineering

- 6.14.1. Business Sectors Covered In The Market Analysis Chapter

- 6.14.2. Company Profile

- 6.14.3. Company Financials

- 6.15. KC Tech

- 6.15.1. Business Sectors Covered In The Market Analysis Chapter

- 6.15.2. Company Profile

- 6.15.3. Company Financials

- 6.16. Lasertec

- 6.16.1. Business Sectors Covered In The Market Analysis Chapter

- 6.16.2. Company Profile

- 6.16.3. Company Financials

- 6.17. Murata Machinery

- 6.17.1. Business Sectors Covered In The Market Analysis Chapter

- 6.17.2. Company Profile

- 6.17.3. Company Financials

- 6.18. Murata Machinery

- 6.18.1. Business Sectors Covered In The Market Analysis Chapter

- 6.18.2. Company Profile

- 6.18.3. Company Financials

- 6.19. Nikon

- 6.19.1. Business Sectors Covered In The Market Analysis Chapter

- 6.19.2. Company Profile

- 6.19.3. Company Financials

- 6.20. Nippon Sanso

- 6.20.1. Business Sectors Covered In The Market Analysis Chapter

- 6.20.2. Company Profile

- 6.20.3. Company Financials

- 6.21. Nissin Ion Equipment

- 6.21.1. Business Sectors Covered In The Market Analysis Chapter

- 6.21.2. Company Profile

- 6.21.3. Company Financials

- 6.22. NuFlare Technology

- 6.22.1. Business Sectors Covered In The Market Analysis Chapter

- 6.22.2. Company Profile

- 6.22.3. Company Financials

- 6.23. Piotech

- 6.23.1. Business Sectors Covered In The Market Analysis Chapter

- 6.23.2. Company Profile

- 6.23.3. Company Financials

- 6.24. PSK

- 6.24.1. Business Sectors Covered In The Market Analysis Chapter

- 6.24.2. Company Profile

- 6.24.3. Company Financials

- 6.25. Raintree Scientific Instruments

- 6.25.1. Business Sectors Covered In The Market Analysis Chapter

- 6.25.2. Company Profile

- 6.25.3. Company Financials

- 6.26. Screen Semiconductor Solutions

- 6.26.1. Business Sectors Covered In The Market Analysis Chapter

- 6.26.2. Company Profile

- 6.26.3. Company Financials

- 6.27. SEMES

- 6.27.1. Business Sectors Covered In The Market Analysis Chapter

- 6.27.2. Company Profile

- 6.27.3. Company Financials

- 6.28. SEN

- 6.28.1. Business Sectors Covered In The Market Analysis Chapter

- 6.28.2. Company Profile

- 6.28.3. Company Financials

- 6.29. TES

- 6.29.1. Business Sectors Covered In The Market Analysis Chapter

- 6.29.2. Company Profile

- 6.29.3. Company Financials

- 6.30. Tokyo Electron

- 6.30.1. Business Sectors Covered In The Market Analysis Chapter

- 6.30.2. Company Profile

- 6.30.3. Company Financials

- 6.31. Tokyo Seimitsu

- 6.31.1. Business Sectors Covered In The Market Analysis Chapter

- 6.31.2. Company Profile

- 6.31.3. Company Financials

- 6.32. Topcon Technohouse

- 6.32.1. Business Sectors Covered In The Market Analysis Chapter

- 6.32.2. Company Profile

- 6.32.3. Company Financials

- 6.33. Toray Engineering

- 6.33.1. Business Sectors Covered In The Market Analysis Chapter

- 6.33.2. Company Profile

- 6.33.3. Company Financials

- 6.34. Ulvac

- 6.34.1. Business Sectors Covered In The Market Analysis Chapter

- 6.34.2. Company Profile

- 6.34.3. Company Financials

- 6.35. Ushio

- 6.35.1. Business Sectors Covered In The Market Analysis Chapter

- 6.35.2. Company Profile

- 6.35.3. Company Financials

- 6.36. Wonik IPS

- 6.36.1. Business Sectors Covered In The Market Analysis Chapter

- 6.36.2. Company Profile

- 6.36.3. Company Financials

LIST OF TABLES

- 1.1. Global Wafer Front End Equipment Companies

- 1.2. Capex By Company

- 2.1. Foundry Capex ($ Millions)

- 2.2. Pure Play Foundry Forecast

- 2.3. Pure Play Foundry Revenue Shares

- 2.4. Foundry / Logic Lithography Demand

- 2.5. New Capacity Equipment Demand By Type

- 2.6. TSMC Wafer Price By Node - 2020-2025

- 2.7. TSMC Wafer Price By Node - 2025

- 2.8. TSMC Chip Features By Node

- 2.9. TSMC Top Customers By Revenue

- 2.10. Technology Roadmaps For China Foundries

- 2.11. Global Foundry Market By Linewidth

- 2.12. Foundry Capacity By Region

- 2.13. DRAM Wafer Capacity Forecast by Fab - Wafers

- 2.14. DRAM Earnings Comparisons by Company

- 2.15. DRAM Revenue Demand Forecast by Application

- 2.16. DRAM Market Shares

- 2.17. DRAM Capex Forecast by Company

- 2.18. NAND Wafer Capacity by Fab

- 2.19. NAND Earnings Comparison by Company

- 2.20. NAND Bit Growth Demand Forecast by Application

- 2.21. NAND Market Shares

- 2.22. Average Selling Prices (ASPs) Forecast

- 2.23. NAND Capex Forecast By Company

- 2.24. China Manufacturing Capacity

- 2.25. Chinese Equipment Suppliers And Top Foreign Supplier

- 2-26. China's 8- And 12-Inch Fabs and Foundries

- 3.1. AMHS Market Forecast

- 3.2. CMP Market Forecast

- 3.3. Plasma Strip Market Forecast

- 3.4. Spray Processors Market Forecast

- 3.5. Wet Stations Market Forecast

- 3.6. ALD Market Forecast

- 3.7. Epitaxy Market Forecast

- 3.8. MOCVD Market Forecast

- 3.9. LPCVD (non-tube) Market Forecast

- 3.10. LPCVD (tube) Market Forecast

- 3.11. PECVD Market Forecast

- 3.12. PVD Market Forecast

- 3.13. Ion Implantation Market Forecast

- 3.14. Direct-Write E-Beam Lithography Market Forecast

- 3.15. Mask-Making Lithography Market Forecast

- 3.16. Steppers Market Forecast

- 3.17. Oxidation Market Forecast

- 3.18. Photoresist Processing (Track) Market Forecast

- 3.19. RTP Market Forecast

- 3.20. Dielectric Etch Market Forecast

- 3.21. Conductive Etch Market Forecast

- 3.22. Lithography Metrology Market Forecast

- 3.23. Thin-Film Metrology Market Forecast

- 3.24. Wafer Inspection and Defect Review Market Forecast

LIST OF FIGURES

- 1.1. Semiconductor Equipment Billings

- 2.1. China's IC Production Forecast

- 2.2. China's IC Consumption

- 2.3. China's IC Production/Consumption Ratio

- 2.4. IC Import to China

- 2.5. China's IC Supply/Demand

- 2.6. China's IC Fab Capacity

- 2.7. China's IC Fab Capacity by Region

- 2.8. China's IC Fab Capacity by Wafer Size

- 2.9. China's IC Fab Capacity by Geometry

- 2.10. China's IC Production by Application

- 3.1. AMHS Market Shares

- 3.2. CMP Market Shares

- 3.3. Plasma Strip Market Shares

- 3.4. Spray Processors Market Shares

- 3.5. Wet Stations Market Shares

- 3.6. ALD Market Shares

- 3.7. Epitaxy Market Shares

- 3.8. MOCVD Market Shares

- 3.9. LPCVD (non-tube) Market Shares

- 3.10. LPCVD (tube) Market Shares

- 3.11. PECVD Market Shares

- 3.12. PVD Market Shares

- 3.13. Ion Implantation Market Shares

- 3.14. Direct-Write E-Beam Lithography Market Shares

- 3.15. Mask-Making Lithography Market Shares

- 3.16. Steppers Market Shares

- 3.17. Oxidation Market Shares

- 3.18. Photoresist Processing (Track) Market Shares

- 3.19. RTP Market Shares

- 3.20. Dielectric Etch Market Shares

- 3.21. Conductive Etch Market Shares

- 3.22. Lithography Metrology Market Shares

- 3.23. Thin-Film Metrology Market Shares

- 3.24. Wafer Inspection and Defect Review Market Shares