|

市場調查報告書

商品編碼

1583179

智慧工廠介紹:2024Smart Factory Adoption Report 2024 |

|||||||

本報告是 IoT Analytics 正在進行的工業物聯網和工業 4.0 研究的一部分,該研究基□□於對企業營運商進行的調查結果。目的是為參賽者提供有關智慧工廠用例和製造商技術採用現狀的資訊。

本報告從以下六個角度檢視智慧工廠的引進。

6 個鏡頭:

- 1.範式

- 2.技術

- 3.預算

- 4.作業

- 5.投資前景

- 6.投資報酬率

四個深層詳細分析:

- 1.工業人工智慧與邊緣人工智慧

- 2.工業資料運營

- 3.設備管理

- 4.OT 容器化

為什麼製造商致力於讓他們的工廠變得更聰明?

保持成本競爭力:

保持成本競爭力對於生存至關重要,尤其是在價格敏感的行業。一個顯著的例子是德國太陽能電池製造業的崩潰。德國的太陽能電池產業一度領先世界,但在2000年代末,廉價的中國太陽能組件進入市場,削弱了像SolarWorld這樣的國內製造商,該公司最終走到了破產的地步。類似的情況目前可能正在電動車(EV)產業上演。

緩解勞力短缺與技能差距:

許多高收入國家正在經歷出生率下降,並且在退休時面臨失去許多專業人員的邊緣。這也對製造業造成沉重打擊。光是在美國,未來十年就可能有 190 萬個製造業職缺,而自動化和數位化可以幫助緩解這些課題。

為了解決永續性和監管壓力:

許多監管機構正在透過推出相關法規來應對氣候變遷的課題。例如,歐盟現已開始要求大公司以及上市中小企業報告其碳足跡和相關主題。如果沒有技術基礎,準確的追蹤和報告是困難的。

為了獲得更大的靈活性和客製化:

汽車產業目前向電動車的轉變是製造靈活性重要性的一個很好的例子。為內燃機汽車建造的傳統生產線通常缺乏靈活性,無法適應電動車所需的各種零件和配置。此外,電動車的需求波動很大,因此汽車製造商在能夠靈活調整生產以滿足當前需求方面具有顯著優勢。因此,實施更具適應性和可擴展性的製造解決方案以應對客戶偏好、產品設計和材料的變化將是未來的關鍵。

問題解答

- 智慧工廠的現況如何?

- 對於部署智慧工廠策略的製造商來說,哪些技術最重要?

- 哪些製造商在採用數位技術方面被認為是 "先進" 的?

- 製造商模式正在發生怎樣的變化?

- 製造商正在部署哪些人工智慧用例?

- AI 模型訓練和推理在哪裡進行?

- 選擇 DataOps 解時主要考慮哪些因素?

- 製造商使用什麼類型的軟體來管理設備?

- 用於邊緣容器化的主要容器化工具有哪些?

提及的公司

|

|

|

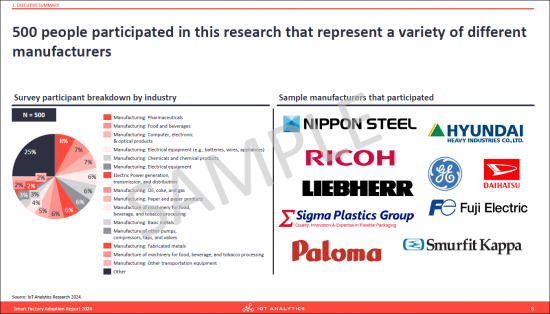

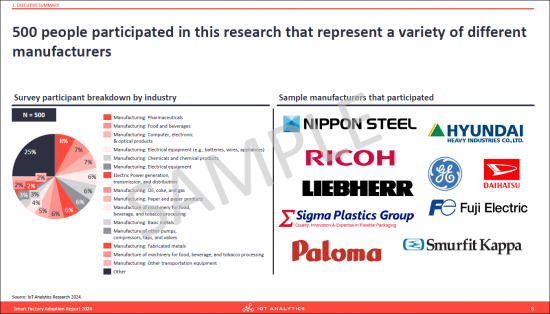

"The Smart Factory Adoption Report 2024" is part of IoT Analytics' ongoing coverage of Industrial IoT & Industry 4.0. The information presented in this report is based on the results of a survey of 500 manufacturers between February 2024 to March 2024. The purpose is to inform other market participants about the current state of adoption of smart factory use cases and technology across manufacturers. Survey participants were selected randomly, and their knowledge was verified independently. To ensure complete objectivity, IoT Analytics did not alter or supplement any survey results and did not accept participants who were suggested by third parties (e.g., customers from specific vendors).

INFOGRAPHICS

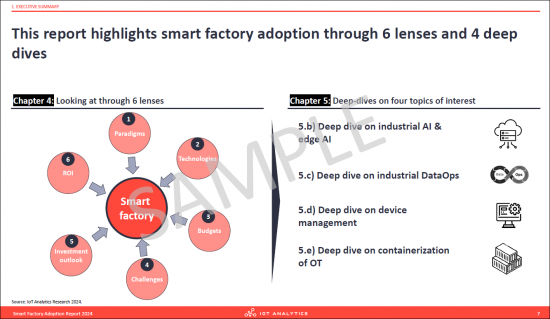

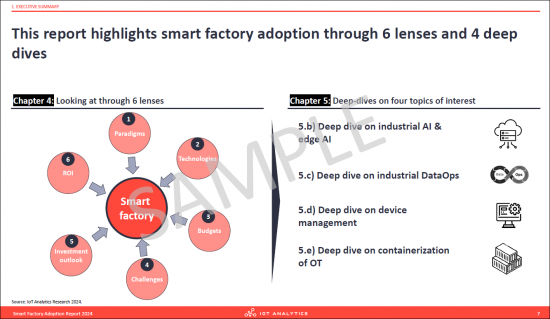

This report highlights smart factory adoption through

6 lenses

- 1. Paradigms

- 2. Technologies

- 3. Budgets

- 4. Challenges

- 5. Investment outlooks

- 6. ROI

INFOGRAPHICS

and 4 deep dives

- 1. Industrial AI & edge AI

- 2. Industrial DataOps

- 3. Device management

- 4. Containerization of OT

INFOGRAPHICS

Why do manufacturers look to make factories smarter?

To stay (cost-)competitive.

Especially in industries where price sensitivity is high, maintaining cost competitiveness is crucial for survival. A stark example is the collapse of the German solar manufacturing industry. Once a global leader, Germany's solar sector struggled when cheaper Chinese solar modules flooded the market in the late 2000s, undercutting domestic producers like SolarWorld, which eventually declared insolvency. A similar scenario may currently be unfolding in the electric vehicle (EV) industry.

To mitigate labor shortages and skill gaps.

Many high-income countries are experiencing declining birth rates and stand on the brink of losing a large chunk of experts as they transition into retirement. This is also harming manufacturing companies. In the US alone, 1.9 million manufacturing jobs could remain unfilled in the next 10 years. Automation and digitalization can help to mitigate these challenges.

INFOGRAPHICS

To address sustainability and regulatory pressures.

Many regulatory bodies have reacted to climate change challenges by introducing related regulations. The European Union, for example, now requires a broad set of large companies, as well as listed SMEs, to start reporting on carbon footprint and related topics. The new rules are first coming into effect in the 2024 financial year, for reports published in 2025. Accurate tracking and reporting will not be difficult without the technological foundation.

INFOGRAPHICS

To achieve greater flexibility and customization.

The automotive industry's current shift towards EVs is a good example of why manufacturing flexibility matters. Traditional production lines built for internal combustion engine vehicles often lack the flexibility to accommodate the variety of components and configurations required for EVs. Additionally, with EV demand highly fluctuating, automotive manufacturers that can flexibly adjust their manufacturing setup to the current demand have massive advantages. That is why implementing more adaptive and scalable manufacturing solutions to handle changes in customer preferences, product design, and materials will be key in the future.

Questions answered:

- What is the current state of smart factories?

- Which technologies are most important for manufacturers who roll out a smart factory strategy?

- Which manufacturers are considered "leading" when it comes to adoption of digital technologies?

- How are the paradigms of manufacturers changing?

- Which AI use cases are manufacturers rolling out?

- Where are training and inference of AI models happening?

- What are key considerations when choosing a DataOps solution?

- Which type of software are manufacturers using to manage devices?

- What are the leading containerization tools used for containerization at the edge?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

|

Table of Tables

1. Executive Summary

- 1. Executive summary

- 2. This report highlights smart factory adoption through 6 lenses and 4 deep dives

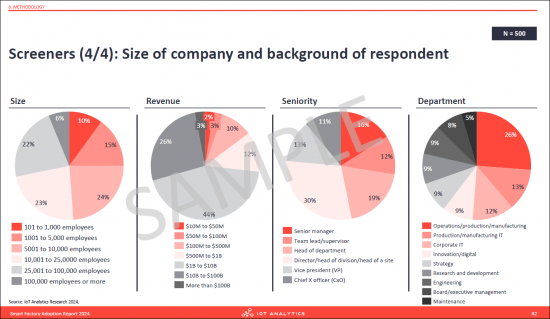

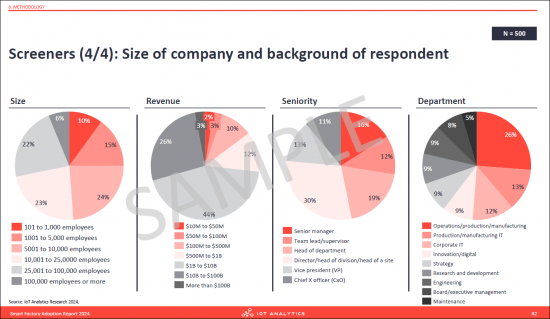

- 3. 500 people participated in this research that represent a variety of different manufacturers

- 4. The Smart Factory Adoption Report 2024 is part of IoT Analytics' ongoing coverage of Industry 4.0 and IIoT

2. Introduction

- 1. Recap: In 2022, manufacturers had or were in the process to develop a smart factory strategy

- 2. Why do manufacturers look to make factories smarter?

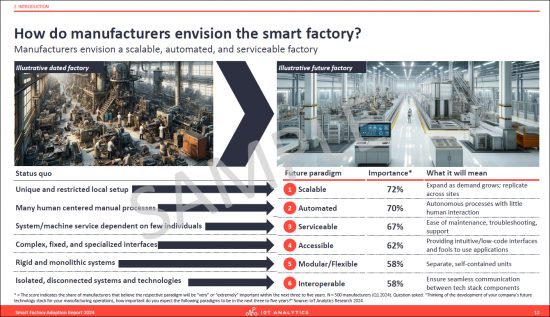

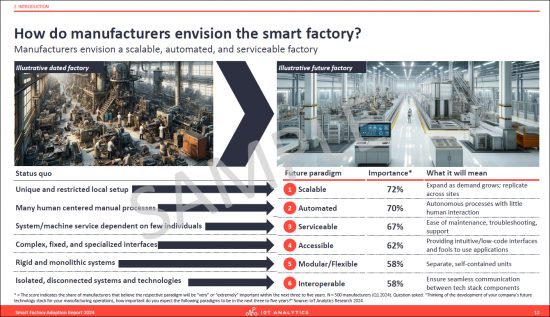

- 3. How do manufacturers envision the smart factory?

- 4. Technology plays a key role for smart factories

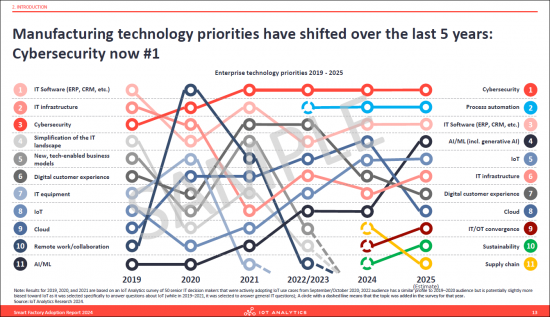

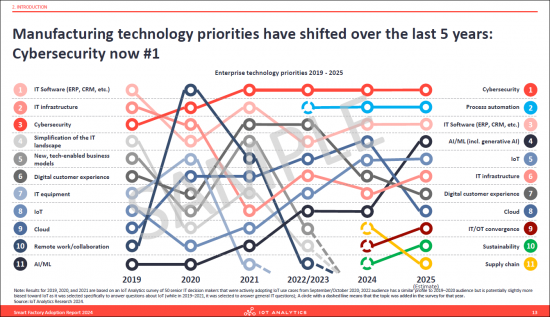

- 5. Manufacturing technology priorities have shifted over the last 5 years

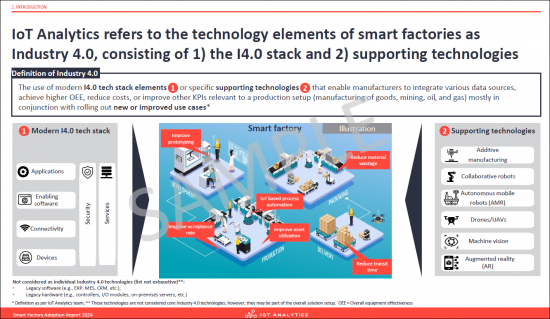

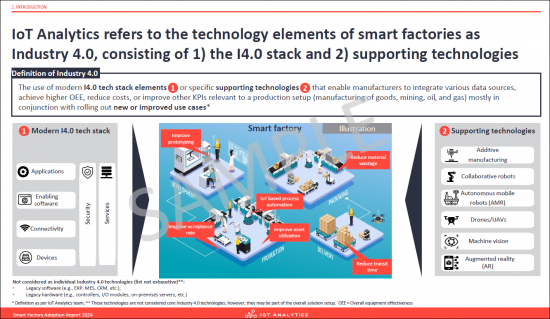

- 6. IoT Analytics refers to the technology elements of smart factories as Industry 4.0

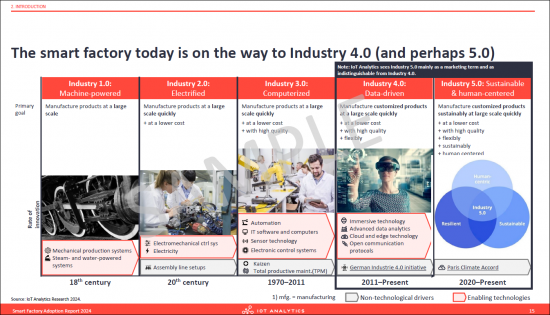

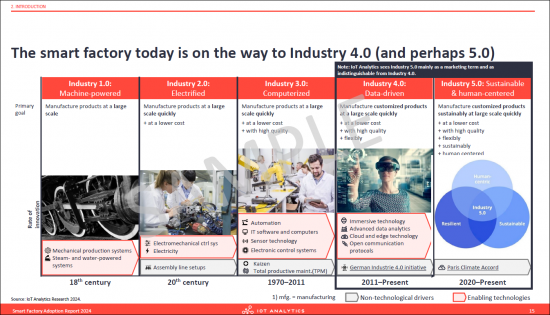

- 7. The smart factory today is on the way to Industry 4.0 (and perhaps 5.0)

- 8. The Industry 4.0 tech stack is forecasted to reach by 2030

- 9. The four deep-dives in chapter 4 have been trending in public search interest in the last 3-4 years

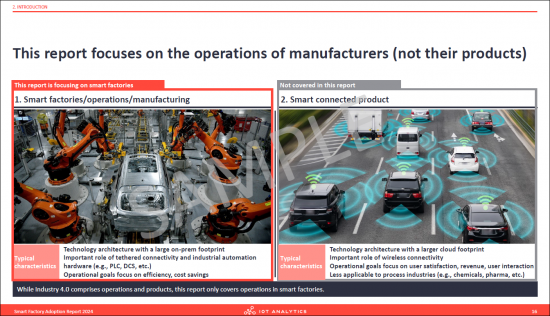

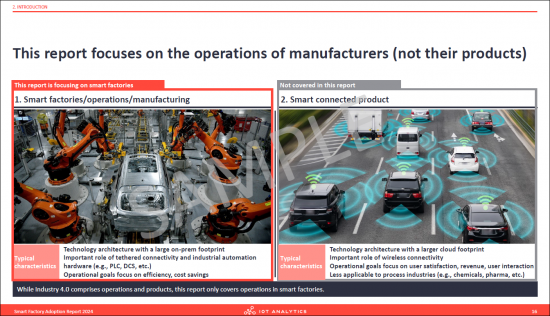

- 10. This report focuses on the operations of manufacturers (not their products)

3. State of smart factories in 2024

- 1. Chapter 3: State of smart factories 2024 - Overview & key takeaways

- 2. State of smart factories 2024: Focus on scalability and security

- 3. How do manufacturers envision the smart factory?

- 4. Importance of smart factory paradigms in the next 3-5 years (1/3)

- 5. Importance of smart factory paradigms in the next 3-5 years (2/3) - By region/industry/company size

- 6. Importance of smart factory paradigms in the next 3-5 years (3/3) - By function

- 7. Importance of technologies in the next 3-5 years (1/3) - Overview

- 8. Importance of technologies in the next 3-5 years (2/3) - By type

- 9. Importance of technologies in the next 3-5 years (3/3) - By department

- 10. Severity of challenges (1/3) - Overview

- 11. Severity of challenges (2/3) - By region/industry/company size

- 12. Severity of challenges (3/3) - By department

- 13. Example: Why cybersecurity is so important - 3 recent notable breaches

4. Leading smart factory adopters 2024

- 1. Chapter 4: Leading smart factory adopters 2024 - Overview & key takeaways

- 2. Leading smart factory adopters - Top 25

- 3. Why these manufacturers are seen as leading adopters (1/3)

- 4. Example: Tesla Giga Berlin is often regarded as the most advanced Tesla factory

- 5. Why these manufacturers are seen as leading adopters (2/3)

- 6. Why these manufacturers are seen as leading adopters (3/3)

- 7. Extensive list of all companies mentioned by respondents

5. a) Selected deep-dives: Overview

- 1. Chapter 5: Selected deep-dives - Overview & key takeaways

- 2. Smart factory technology deep-dives: Overview

- 3. Budgets for smart factory topics in 2024 (1/3): Overview

- 4. Budgets for smart factory topics in 2024 (2/3): By vertical

- 5. Budgets for smart factory topics in 2024 (3/3): By region

- 6. Budgets for smart factory topics in 2024 (in $M) (1/2): Budget by topic

- 7. Budgets for smart factory topics in 2024 (in $M) (2/2): Budget

- 8. Expected budget change between 2024 and 2026 (1/2): Overview

- 9. Expected budget change between 2024 and 2026 (2/2): By company type

- 10. Severity of challenges by type of technology

- 11. Return on investment by type of technology (1/3): Overview

- 12. Return on investment by type of technology (2/3): By company type

- 13. Return on investment by type of technology (3/3): By department

5. b) Selected deep-dives: Industrial AI & edge AI

- 1. Chapter 5b: Deep-dive on Industrial & Edge AI - Overview & key takeaways

- 2. Importance of AI use cases (1/3): Overview

- 3. Importance of AI use cases (2/3): By company type

- 4. Importance of AI use cases (3/3): By function

- 5. Training and inferencing of AI use cases 2 years from now (1/2): Overview

- 6. Training and Inferencing of AI use cases 2 years from now (2/2): Deep-dive

- 7. Example: Machine vision training and inference of AI models is happening across the edge-cloud continuum

5. c) Selected deep-dives: Industrial DataOps

- 1. Chapter 5c: Deep-dive on industrial DataOps - Overview & key takeaways

- 2. Importance of industrial DataOps themes (1/3): Overview

- 3. Importance of industrial DataOps themes (2/3): By company type

- 4. Importance of industrial DataOps themes (3/3): By function

- 5. Finding: Combined IT/OT data platform is crucial - Example: Vendors react

- 6. How manufacturers implement industrial DataOps (1/3): Overview

- 7. How manufacturers implement industrial DataOps (2/3): Vendors

- 8. How manufacturers implement industrial DataOps (3/3): In-house

- 9. Challenges when adopting industrial DataOps (1/3)

- 10. Challenges when adopting industrial DataOps (2/3): By company type

- 11. Challenges when adopting industrial DataOps (3/3): By department

5. d) Selected deep-dives: Device management

- 1. Chapter 5d: Deep-dive on device management - Overview & key takeaways

- 2. How manufacturers procure device management solutions (1/3): Overview

- 3. How manufacturers procure device management solutions (2/3): Third party

- 4. How manufacturers procure device management solutions (3/3): Device manufacturer

- 5. Importance of aspects in device management (1/3): Overview

- 6. Importance of aspects in device management (2/3): By company type

- 7. Importance of aspects in device management (3/3): By function

- 8. How manufacturers manage and update of devices on the shopfloor

- 9. Management of devices on the shopfloor: By company type

- 10. Update of devices on the shopfloor: By company type

- 11. Most challenging aspects when adopting device management (1/3)

- 12. Most challenging aspects when adopting device management (2/3): By company type

- 13. Most challenging aspects when adopting device management (3/3): By function

5. e) Selected deep-dives: Containerization of OT

- 1. Chapter 5e: Deep-dive on containerization of OT - Overview & key takeaways

- 2. Containerization of manufacturing software (next 3 years) (1/3): Overview

- 3. Containerization of manufacturing software (next 3 years) (2/3)

- 4. Containerization of manufacturing software (next 3 years) (3/3)

- 5. Mitigation of challenges by using containerization (1/3): Overview

- 6. Mitigation of challenges by using containerization (2/3): By company type

- 7. Mitigation of challenges by using containerization (3/3): By department

- 8. Usage of container management solutions (1/2): Overview

- 9. Usage of container management solutions (2/2): By company type

- 10. Reasons to use container management tools at the edge (1/3): Overview

- 11. Reasons to use container management tools at the edge (2/3): By company

- 12. Reasons to use container management tools at the edge (3/3): By function

- 13. Usage of containerized workloads today and in the future (1/3): Overview

- 14. Usage of containerized workloads today and in the future (2/3): By company type

- 15. Usage of containerized workloads today and in the future (3/3): By function

- 16. Most challenging aspects when adopting containerization (1/3): Overview

- 17. Most challenging aspects when adopting containerization (2/3): By company type

- 18. Most challenging aspects when adopting containerization (3/3): By function