|

市場調查報告書

商品編碼

1581327

CBDC (中央銀行數位貨幣) 及穩定幣的全球市場:2024-2031年Global CBDCs & Stablecoins Market: 2024-2031 |

||||||

"CBDC (中央銀行數位貨幣) 的交易數2031年預計達到78億"

| 主要統計 | |

|---|---|

| 2024年的交易額 | 2,252億美元 |

| 2031年的交易額 | 1兆6,000億美元 |

| 從2024年開始2031年的市場成長率 | 612% |

| 預測期間 | 2024-2031年 |

我們的研究套件對不斷發展的 CBDC(中央銀行數位貨幣)和穩定幣市場提供了深入而深刻的分析。利害關係人,包括中央銀行、商業銀行、穩定幣發行者和支付服務供應商,可以了解未來的成長、主要趨勢和競爭格局。這包括對 CBDC 開發的潛在設計選項以及世界各地數位貨幣監管框架的現狀的分析。它還討論了批發 CBDC 如何加強貨幣主權,以及零售 CBDC 如何增加金融包容性並促進無銀行帳戶者更多地參與數位金融。

該套件包含幾個可單獨購買的選項,包括存取映射 CBDC 和穩定幣交易未來成長的數據,以及揭示金融市場最新趨勢和機會的深刻研究。它還包括對 CBDC 領域 14 位市場領導者的廣泛分析。

主要特點

- 市場動態:包括 CBDC 和穩定幣採用的推動因素和障礙、對市場擴張的主要趨勢和課題的見解、跨境支付面臨的交易成本課題、在構建 CBDC 時建立互通性的重要性,以及 CBDC 和穩定幣在金融市場中的互動。它還針對八個主要地區的當前發展和成長領域提供了針對特定國家的準備指標,以著眼於未來。

- 關鍵要點和策略建議:深入分析 CBDC 和穩定幣市場中的關鍵發展機會和見解,並為利害關係人提供策略建議。

- 基準產業預測:CBDC 和穩定幣資料集包括市場規模預測,包括使用這些支付方式的預期節省總額以及各個細分市場的交易數量。

- Juniper Research 競賽排行榜:確定 CBDC 開發行業主要參與者的市場規模,並評估 14 家領先的 CBDC 供應商的能力。

樣品view

市場資料·預測報告:

市場趨勢·策略報告:

市場數據及預測報告

研究套件包括一整套 95 個表格和預測,包含 45,600 個數據點。該調查套件包括以下指標:

- CBDC 市場的交易總數、交易總價值和總儲蓄

- 穩定幣市場的交易總數、交易總價值和總儲蓄

- 按 CBDC 和穩定幣細分市場劃分的總交易量和交易金額:

- 國內消費者交易

- 國內 B2B 交易

- 跨國消費者交易

- 跨國 B2B 交易

Juniper Research Interactive Forecast Excel 提供以下功能:

- 統計分析:您可以搜尋資料期間內所有地區和國家顯示的特定指標。圖表可以輕鬆修改並匯出到剪貼簿。

- 國家資料工具:此工具可讓您查看預測期間內所有地區和國家的指標。您可以使用搜尋欄縮小顯示的指標範圍。

- 國家比較工具:您可以選擇特定的國家進行比較。該工具具有匯出圖表的功能。

- 假設分析:五種互動式場景讓使用者可以比較預測假設。

目錄

市場趨勢·策略

第1章 重要點·策略性推薦事項

- 重要點

- 策略性推薦事項

第2章 市場形勢

- CBDC及穩定幣的歷史

- 主要趨勢與推動因素

- 穩定幣的使用將對金融格局產生重大顛覆性影響

- 監管在引導數位貨幣方面的作用

- 新興經濟體將從 rCBDC 的發展中獲益最多

- 隱私保護需要先進的加密方法

- 智能合約如何改變經濟?

第3章 市場區隔分析

- 零售CBDC

- 批發CBDC

- 穩定幣

- 穩定幣和CBDC的相互作用

第4章 各國準備指數

- 各國準備指數:簡介

- 關注的市場

- 成長市場

- 飽和市場

- 新興國家市場

競爭的排行榜

第1章 Juniper Research的競爭排行榜

- 讀該報告的理由

- CBDC業者簡介

- Accenture

- Bitt

- Consensys

- eCurrency

- EMTECH

- FIS

- Giesecke + Devrient

- IDEMIA

- Mastercard

- Nahmii

- R3

- Ripple

- Soramitsu

- Stellar

資料·預測

第1章 市場概要

- 調查手法·前提

第2章 預測概要

- CBDC及穩定幣的整體交易數

- 穩定幣和CBDC的整體交易額

- CBDC及穩定幣的整體儲蓄額

第3章 CBDC:市場預測

- CBDC整體交易數:主要8大地區

- CBDC整體交易數:市場部門別

- CBDC整體交易額:主要8大地區

- CBDC整體交易額:市場部門別

- 由於CBDC的潛在的整體儲蓄額:主要8大地區

- 由於CBDC的潛在的整體儲蓄額:市場部門別

第4章 穩定幣:市場預測

- 穩定幣整體交易數:主要8大地區

- 穩定幣整體交易數:市場部門別

- 穩定幣整體交易額:主要8大地區

- 穩定幣整體交易額:市場部門別

- 由於穩定幣的潛在的整體儲蓄額:主要8大地區

- 由於穩定幣的潛在的整體儲蓄額:市場部門別

'CBDC Transaction Volume to Reach 7.8 Billion by 2031'

| KEY STATISTICS | |

|---|---|

| Transaction value in 2024: | $225.2bn |

| Transaction value in 2031: | $1.6tn |

| 2024 to 2031 market growth: | 612% |

| Forecast period: | 2024-2031 |

Overview

Our CBDCs (Central Bank Digital Currency) & Stablecoin research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders such as central banks, commercial banks, stablecoin issuers and payment service providers to understand future growth, key trends and the competitive environment. This includes an analysis of possible design choices in the development of CBDCs and the current state of digital currency regulatory frameworks around the globe. The report also discusses how wholesale CBDCs can strengthen monetary sovereignty and how retail CBDCs can increase financial inclusion and facilitate participation in digital finance among unbanked populations.

The suite includes several different options that can be purchased separately, including access to data mapping the future growth of CBDC & stablecoin transactions; an insightful study uncovering the latest trends and opportunities within the financial markets. It also includes a document containing extensive analysis of the 14 market leaders in the CBDC space. The coverage can also be purchased as a Full Research Suite, containing all of these elements, at a substantial discount.

Collectively, they provide a critical tool for understanding this rapidly emerging market; allowing stakeholders in the CBDC and stablecoins market to shape their future strategy. Its unparalleled coverage makes this research suite an incredibly useful resource for charting the future of such an uncertain and fast-growing market.

Key Features

- Market Dynamics: Insights into key trends and market expansion challenges within the CBDC & stablecoin market, including drivers and barriers for CBDC and stablecoin adoption. The report addresses the challenges that the cross-border payments sector faces regarding transaction costs; how incorporating interoperability is key when building CBDCs; and the interplay between CBDCs and stablecoins in financial markets. The research also features a Country Readiness Index on the current development and segment growth of the CBDC & stablecoins market across 8 key regions, as well as providing a future outlook.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the CBDC & stablecoins market, accompanied by strategic recommendations for stakeholders.

- Benchmark Industry Forecasts: The CBDC & stablecoins dataset includes forecasts for total value of the CBDC & stablecoin market, including the total expected savings that can be gained using these payments method, and the transaction volume of various market segments.

- Juniper Research Competitor Leaderboard: Key market player capability and capacity assessment for 14 CBDC vendors, via the Juniper Research Competitor Leaderboard; featuring market size for major players in the CBDC development industry.

SAMPLE VIEW

Market Data & Forecasting Report:

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the CBDCs and Stablecoin market includes access to the full set of forecast data of 95 tables and 45,600 datapoints. Metrics in the research suite include:

- Total Transaction Volume, Value, and Savings Received from the CBDC Market

- Total Transaction Volume, Value, and Savings Received from the Stablecoin Market

- Total Transaction Volume and Value of the CBDC and Stablecoin Market, Split by the following Market Segments:

- Domestic Consumer Transactions

- Domestic B2B Transactions

- Cross-border Consumer Transactions

- Cross-Border B2B Transactions

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios.

Market Trends & Strategies Report

This report examines the CBDC & Stablecoin market landscape in detail; assessing trends and factors shaping the evolution of this rapidly growing market. The report delivers comprehensive analysis of the strategic opportunities for CBDC vendors; addressing key verticals and developing challenges, and highlighting how stakeholders should navigate these. It also includes evaluation of key country-level opportunities for stakeholders in the CBDC & stablecoins market.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 14 leading vendors in the CBDC space. The vendors are positioned as established leaders, leading challengers, or disruptors and challengers, based on capacity and capability assessments:

|

|

This document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.2. History of CBDCs and Stablecoins

- 2.3. Key Trends and Drivers

- 2.3.1. Stablecoin Use has an Outsized Disruptive Impact on the Financial Landscape

- 2.3.2. The Role of Regulations in Guiding Digital Currencies

- 2.3.3. Emerging Nations Have the Most to Gain from Developing rCBDCs

- 2.3.4. Advanced Cryptographic Methods Necessary to Preserve Privacy

- 2.3.5. How Could Smart Contracts Transform the Economy?

- i. Subscriptions

- ii. Liquidity Management

- iii. DvP (Delivery Versus Payment)

- iv. (PVP) Payment Versus Payment

- v. M2M (Machine-to-Machine) Payments

3. Segment Analysis

- 3.1. Retail CBDCs

- Figure 3.1: The Status of Retail CBDCs Worldwide as of September 2024

- 3.1.1. Why Develop a Retail CBDC?

- Figure 3.2: Potential Goals of Retail CBDC Development

- 3.1.2. Potential Goals/Motives of CBDC Development

- i. Geopolitics

- ii. Enhance Cross-border Payments

- iii. Financial Inclusion in the Digital Economy

- iv. Retaining Monetary Sovereignty

- Figure 3.3: Design Principles for a Digital Pound

- 3.1.3. High-level Technological Analysis: Design Choices for CBDCs

- 3.1.4. What Are the Potential Barriers to Adoption?

- Figure 3.4: CBDC Features Compared to Physical Cash

- 3.2. Wholesale CBDCs

- Figure 3.5: Status of Wholesale CBDCs Worldwide as of September 2024

- 3.2.1. The Evolution of Wholesale Payment Systems

- Figure 3.6: How Wholesale Bank Payments Happen Today

- i. What Are the Inefficiencies in this System?

- 3.2.2. How Can Wholesale CBDCs Address This?

- Figure 3.7: Objectives of Wholesale CBDC Development

- 3.2.3. Current wCBDC Cross-border Projects

- Figure 3.8: The Project Agora Platform

- 3.2.4. Alternatives to Wholesale CBDC Development

- 3.3. Stablecoins

- 3.3.1. Key Actors in the Stablecoin Market

- i. What Are the Use Cases of Stablecoins?

- Figure 3.9: Use Cases for Stablecoins

- ii. What Are Future Use Cases for Stablecoins?

- i. What Are the Use Cases of Stablecoins?

- 3.3.1. Key Actors in the Stablecoin Market

- 3.4. The Interplay Between Stablecoins and CBDCs

4. Country Readiness Index

- 4.1. Introduction to the Country Readiness Index

- Figure 4.1: CBDC and Stablecoin Country Readiness Index Regional Definitions

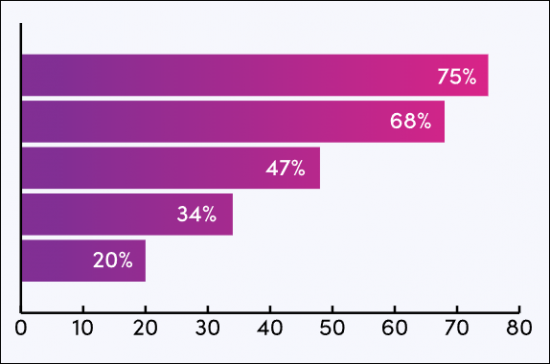

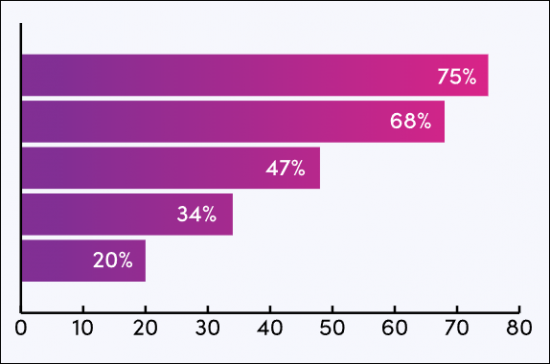

- Figure 4.2: Juniper Research Country Readiness Index Scoring Criteria: CBDC and Stablecoins

- Figure 4.3: Juniper Research Country Readiness Index: Global CBDC and Stablecoin Market

- Figure 4.4: CBDC and Stablecoin Country Readiness Index: Market Segments

- 4.1.1. Focus Market

- i. The Strength of BRICS

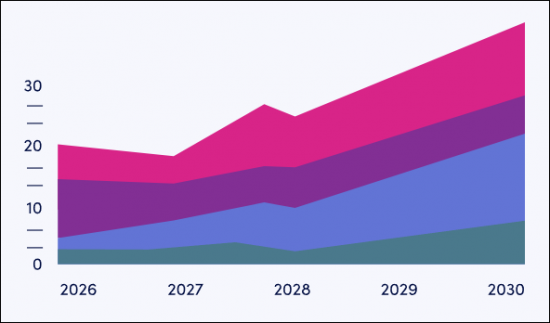

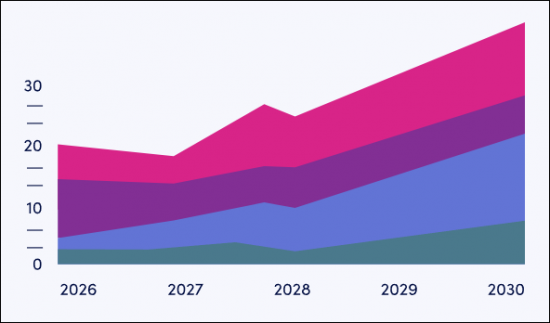

- Figure 4.5: Total CBDC & Stablecoin Market Value per Annum ($m), Split by Seven Key Markets, 2024-2031

- ii. West Europe and the Digital Euro

- iii. Japan

- iv. The US

- v. China

- i. The Strength of BRICS

- 4.1.2. Growth Market

- Figure 4.6: Total Value of CBDCs and Stablecoins in Growth Markets, ($m), By Country 2024-2031

- i. Prioritising Wholesale over Retail CBDC Development

- 4.1.3. Saturated Markets

- Figure 4.7: Saturated Markets' CBDC & Stablecoin Market Value, ($m), By Country, 2024-2031

- i. Heavy Restrictions on Cryptocurrency

- 4.1.4. Developing Markets

- Figure 4.8: CBDC & Stablecoin Market Value in Six Developing Markets, ($m), By Country, 2024-2031

- i. Restrictive Legislation

- ii. Gaps in Technological Infrastructure

- iii. Adequate Alternative Financial Systems

- Table 4.9: Juniper Research's Country Readiness Index Heatmap: North America

- Table 4.10: Juniper Research's Country Readiness Index Heatmap: Latin America

- Table 4.11: Juniper Research's Country Readiness Index Heatmap: West Europe

- Table 4.12: Juniper Research's Country Readiness Index Heatmap: Central & East Europe

- Table 4.13: Juniper Research's Country Readiness Index Heatmap: Far East & China

- Table 4.14: Juniper Research's Country Readiness Index Heatmap: Indian Subcontinent

- Table 4.15: Juniper Research's Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 4.16: Juniper Research's Country Readiness Index Heatmap: Africa & Middle East

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report?

- Table 1.1: Juniper Research Competitor Leaderboard CBDC Vendor Product Portfolio

- Figure 1.2: Juniper Research Leaderboard: CBDC Vendors

- Table 1.3: Juniper Research Leaderboard: CBDC Vendor Positioning

- Figure 1.4: Juniper Research Leaderboard Heatmap: CBDC Vendors

- 1.2. CBDC Vendor Profiles

- 1.2.1. Accenture

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Partnerships

- 1.2.2. Bitt

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.3. Consensys

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.4. eCurrency

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 1.5: Use Cases for eCurrency DSC3

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.5. EMTECH

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 1.6: The Features and Benefits of the Beyond Cash

- v. Juniper Research Key Strengths and Strategic Opportunities

- 1.2.6. FIS

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.7. Giesecke + Devrient

- vi. Corporate

- vii. Geographic Spread

- viii. Key Clients & Strategic Partnerships

- ix. High-level View of Offerings

- x. Juniper Research's View: Key Strengths & Strategic Opportunities

- 1.2.8. IDEMIA

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Recommendations

- 1.2.9. Mastercard

- i. Corporate

- Table 1.7: Mastercard Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 1.8: Mastercard's CBDC Sandbox Architecture

- v. Juniper Research's View: Key Strengths & Strategic Recommendations

- i. Corporate

- 1.2.10. Nahmii

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.11. R3

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Recommendations

- 1.2.12. Ripple

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development

- 1.2.13. Soramitsu

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Recommendations

- 1.2.14. Stellar

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 1.2.1. Accenture

Data & Forecasting

1. Market Overview

- 1.1. Introduction

- 1.2. Methodology & Assumptions

- Figure 1.1: Consumer Domestic CBDCs/Stablecoins Methodology

- Figure 1.2: Consumer Cross-border CBDCs/Stablecoins Methodology

- Figure 1.3: B2B Domestic CBDCs/Stablecoins Methodology

- Figure 1.4: B2B Cross-border CBDCs/Stablecoins Methodology

2. Forecast Summary

- 2.1. Total Volume of CBDC and Stablecoin Transactions

- Figure & Table 2.1: Total Number of Transactions Using Stablecoins and CBDCs (m), Split by Stablecoins and CBDCs, 2024-2031

- 2.2. Total Value of Stablecoin & CBDC Transactions

- Figure & Table 2.2: Total Value of Stablecoin and CBDC Transactions ($bn), Split by 8 Key Regions, 2024-2031

- 2.3. Potential Savings from CBDC and Stablecoin Use

- Figure & Table 2.3: Total Savings Achieved Using Stablecoins and CBDCs ($m), Split by 8 Key Regions, 2024-2031

3. CBDCs: Market Forecast

- 3.1. Total Number of CBDC Transactions

- Figure & Table 3.1: Total Number of Transactions Using CBDC (m), Split by 8 Key Regions, 2024-2031

- 3.2. Total Number of CBDC Transactions

- Figure & Table 3.2: Total Number of CBDC Transactions (m), Split by Segment, 2024-2031

- 3.3. Total Value of CBDC Transactions

- Figure & Table 3.3: Total Value of CBDC Transactions ($bn), Split by 8 Key Regions, 2024-2031

- 3.4. Total Value of CBDC Transactions

- Figure & Table 3.4: Total Value of CBDC Transactions, ($bn), Split by Segment, 2024-2031

- 3.5. Total Potential Savings Achieved Using CBDCs ($m)

- Figure & Table 3.5: Total Savings Achieved Using CBDCs ($m), Split by 8 Key Regions, 2024-2031

- 3.6. Total Potential Savings Achieved Using CBDCs

- Figure & Table 3.6: Total Savings Achieved Using CBDCs ($m), Split by Segment, 2024-2031

4. Stablecoins: Market Forecast

- 4.1. Total Number of Stablecoin Transactions

- Figure & Table 4.1: Total Number of Transactions Using Stablecoins (m), Split 8 Key Regions, 2024-2031

- 4.2. Total Number of Stablecoin Transactions

- Figure & Table 4.2: Total Number of Transactions Using Stablecoins (m), Split Segment, 2024-2031

- 4.3. Total Value of Stablecoin Transactions

- Figure & Table 4.3: Total Value of Stablecoin Transactions ($bn), Split by 8 Key Regions, 2024-2031

- 4.4. Total Value of Stablecoin Transactions

- Figure & Table 4.4: Total Value of Stablecoin Transactions, ($m), Split by Segment, 2024-2031

- 4.5. Total Potential Savings Achieved Using Stablecoins ($m)

- Figure & Table 4.5: Total Savings Achieved Using Stablecoins ($m), Split by 8 Key Regions, 2024-2031

- 4.6. Total Potential Savings Achieved Using Stablecoins ($m)

- Figure & Table 4.6: Total Savings Achieved Using Stablecoins ($m), Split by Segment, 2024-2031