|

市場調查報告書

商品編碼

1493834

智慧建築新創企業展望(2024):新創企業格局概覽,誰最受關注?The Smart Building Startup Landscape 2024 - Overview of the Startup Landscape. Who is Gaining Traction? |

||||||

本報告是評估智慧建築新創公司狀況的最新(2024 年)權威資源。

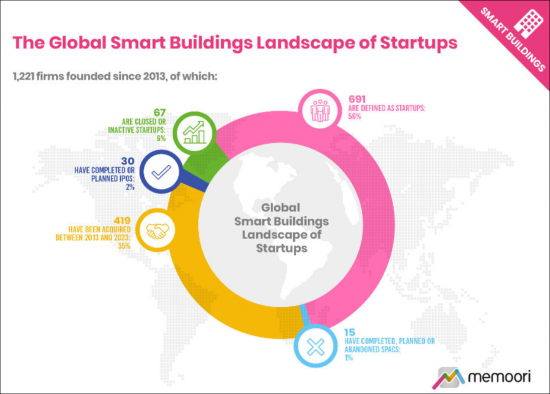

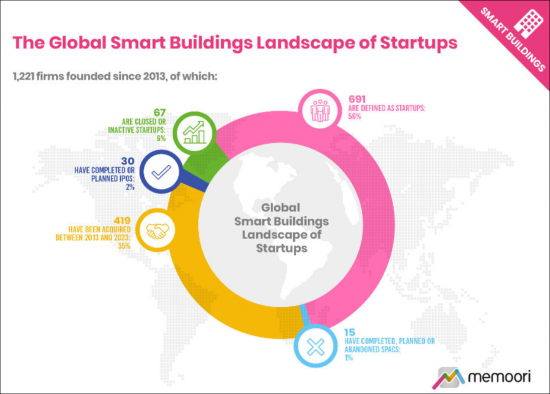

全球智慧商業樓宇市場自2013年以來成立的1,221家家處於管理和營運階段的公司中,691家公司處於活躍狀態,符合新創公司的定義。 在這份報告中,我們從主要細分領域中挑選了100家去年備受關注的新創公司(共16類)進行了詳細分析。

新創公司的定義是 "成立不到10年的私人公司,專門從事商業和工業建築市場,不是大公司的子公司或收購,而是風險投資或私人公司這是一家獲得大量股權融資的公司。

此報告包括一個列出所有領先新創公司的電子錶格和一個簡報文件,其中包含報告中的高解析度圖表和圖表,無需額外付費。 該報告也包含在我們最新版本(2024 年)的高級訂閱服務中。

本報告的調查詳情

- 本報告重點介紹了過去兩年在智慧建築領域關鍵 16 領域獲得關注的 100 家新創公司。其中60%是新進者,尚未在我們先前的報告中被列為駕駛者。

- 這100家公司約佔 2013 年以來智慧建築領域新創公司的 14.5%。

- 本報告涵蓋不再經營、不再活躍或已關閉的新創公司(約佔所有新創企業的 6%)。我們也確定了過去一年因裁員而失去吸引力的關鍵新創公司。

本報告中的資訊是基於對智慧建築市場的嚴格分析,並基於過去的研究:人工智慧、住宅分析、工作體驗應用、物聯網、 視訊監控,存取控制。

本報告分為兩部分,旨在幫助所有利害關係人和投資者評估新創公司在不斷增長的行業中的影響和範圍。我們也分析了為什麼與其他高科技產業相比,商業建築的營運和維護階段的市場擾亂速度較慢。

這份報告由121 頁和42 簡報幻燈片組成,列出了所有關鍵事實並得出結論,以便2024 年瞭解2018 年初創企業的狀況以及如何這些公司正在塑造房地產科技的未來。

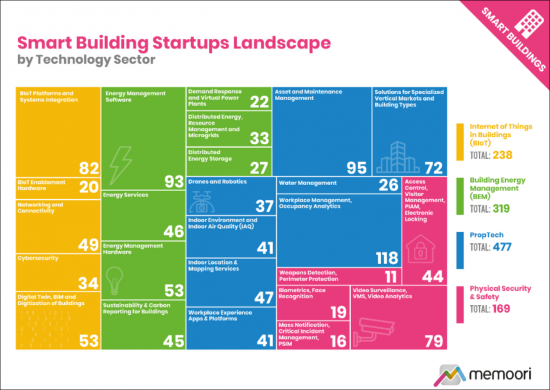

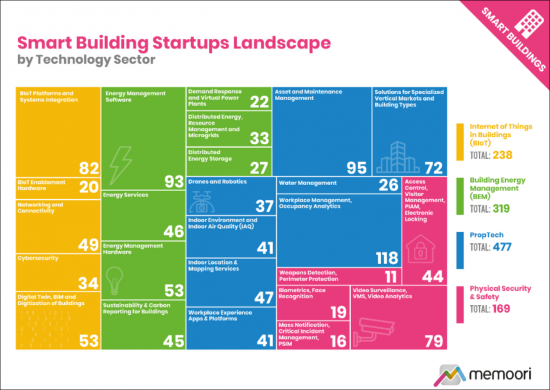

物聯網 (IoT) 正在滲透到智慧建築領域,並且是許多受訪的新創公司的關鍵技術驅動力。 BIoT 類別有 238 家公司,佔總數的 19%,所有四個細分市場的新創公司都為物聯網技術提供專門的用例,以提高建築營運效能並增強用戶體驗,這是一個值得注意的舉措。

目錄

前言

調查範圍與方法

執行摘要

第一章全球智慧建築新創公司狀況

- 智慧建築新創公司:2015 年以來投資額達 370 億美元-市場顛覆在哪裡?

- 智慧建築新創公司:依科技領域劃分

- 新創公司分佈:依地區劃分

第 2 章增加智慧建築新創公司的吸引力

- BIoT(建築物物聯網)

- 建構物聯網平台

- 數位孿生解決方案

- 建築能源管理

- 能源管理軟體

- 永續發展與碳管理

- 能源服務

- 能源管理硬體

- 能源儲存

- 房地產科技

- 資產管理/維護

- 工作場所管理與工作經驗

- 室內測繪與定位服務

- 無人機和機器人

- 室內空氣品質 (IAQ)

- 飯店業

- 物理安全

- 門禁/訪客管理

- 影片分析/電腦視覺

- 武器探測/周界防禦

第三章關閉啟動

- 暫停運轉期間的啟動和關閉

- 對大型新創公司的興趣下降

第四章智慧建築新創企業的未來前景

附錄

This Report is a New 2024 Definitive Resource for Evaluating the Smart Building Startup Landscape.

Of the 1,221 companies founded since 2013 in the management and operations phase of the global smart commercial buildings space, 691 are active and fit our definition of a startup. This report selects 100 startups for further analysis that have gained traction in the last year across 16 major segments.

Our definition of a Startup is "a private company formed for no more than 10 years, that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company, and is often financed by venture capital or private equity funding."

The report INCLUDES at no extra cost, a spreadsheet listing all the startups gaining traction, and a presentation file with high-resolution charts from the report. This report is also included in our 2024 Premium Subscription Service.

What does this Startup Report tell You?

- It highlights 100 startups that have gained traction in the last two years across 16 major segments in the smart buildings space. 60% of these firms are new entrants, in the sense that they have not been listed before as gaining traction in our previous reports.

- These 100 companies account for around 14.5% of the startups founded since 2013 in the smart buildings space.

- It reviews non-operational or inactive startups and closures, which account for around 6% of the startup landscape. We also identify the major startups that have lost traction through headcount reduction in the last year.

The information in this report is based on a rigorous analysis of the smart building market and builds on our previous research into artificial intelligence, occupancy analytics, workplace experience apps, the Internet of Things, video surveillance, and access control.

This report, the second in a 2-part series, will help all stakeholders and investors to assess the impact and range of startups in growth sectors. It also provides some analysis on why market disruption has been slower in the operation and maintenance phases of commercial buildings compared to other tech industries.

Within its 121 Pages and 42 Presentation Slides, The Report Sieves out all the Key Facts and Draws Conclusions, so you can understand what the StartUp Landscape looks like in 2024 and how these Companies are Shaping the Future of PropTech.

The Internet of Things pervades the smart buildings space and is the major technology driver for many of the startups identified. While the BIoT category accounted for 238 or 19% of the total number of companies, it should be noted that startups are using IoT technology in specialized use cases across all four segments to deliver improved operational performance of buildings and enhanced user experiences.

This report provides valuable information for all stakeholders and investors to assess the impact and range of companies in all growth sectors of the smart buildings space.

Who Should Buy This Report?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in smart building companies around the world. In particular, those wishing to invest in or acquire startup companies will find it particularly useful. Want to know more?

Table of Contents

Preface

Research Scope and Methodology

Executive Summary

1. The Global Smart Buildings Landscape of Startups

- 1.1. With $37Bn Invested in Smart Building Startups Since 2015, Where is the Market Disruption?

- 1.2. Smart Buildings Startups by Technology Sector

- 1.3. Regional Distribution of Startups

2. Smart Building Startups Gaining Traction

- 2.1. Internet of Things in Buildings (BIoT)

- 2.1.1. Building IoT Platforms

- 2.1.2. Digital Twin Solutions

- 2.2. Building Energy Management

- 2.2.1. Energy Management Software

- 2.2.2. Sustainability and Carbon Management

- 2.2.3. Energy Services

- 2.2.4. Energy Management Hardware

- 2.2.5. Energy Storage

- 2.3. PropTech

- 2.3.1. Asset Management and Maintenance

- 2.3.2. Workplace Management and Workplace Experience

- 2.3.3. Indoor Mapping and Location Services

- 2.3.4. Drones and Robotics

- 2.3.5. Indoor Air Quality (IAQ)

- 2.3.6. Hospitality Sector

- 2.4. Physical Security

- 2.4.1. Access Control and Visitor Management

- 2.4.2. Video Analytics and Computer Vision

- 2.4.3. Weapons Detection and Perimeter Protection

3. Startup Closures

- 3.1. Non-Operational Startups and Closures

- 3.2. Major Startups Losing Traction

4. The Future Outlook for Smart Building Startups

Appendix

- A1 Smart Building Startups Gaining Traction

List of Charts and Figures

- The Global Smart Building Landscape of Startups

- Smart Building Startups Landscape by Technology Sector

- Regional Distribution of Startups

- Internet of Things in Buildings (BIoT)

- Startups Landscape for IoT Platforms in Buildings

- BIoT Platforms Gaining Traction

- Digital Twin Solutions in Buildings Landscape

- Digital Twin Startups Gaining Traction

- Building Energy Management

- Building Energy Management Software Startups Landscape

- Energy Management Software Startups Gaining Traction

- Sustainability and Carbon Management Startups Landscape

- Sustainability and Carbon Management Startups Gaining Traction

- Energy Services Startups Landscape

- Energy Services Startups Gaining Traction

- Energy Management Hardware Startups Landscape

- Energy Management Hardware Startups Gaining Traction

- Distributed Energy Storage Startups Landscape

- Energy Storage Startups Gaining Traction

- PropTech

- Asset Management & Maintenance Startups Landscape

- Asset Management & Maintenance Startups Gaining Traction

- Workplace Management Startups Landscape

- Workplace Management Startups Gaining Traction

- Indoor Mapping & Location Services Startups Landscape

- Indoor Mapping Startups Gaining Traction

- Drones & Robotics Startups Landscape

- Drones & Robotics Startups Gaining Traction

- Indoor Air Quality Startups Landscape

- Indoor Air Quality Startups Gaining Traction

- Hospitality Sector Startups in Buildings Landscape

- Hospitality Sector Startups Gaining Traction

- Physical Security in Buildings

- Access Control, Locking, Visitor Management Startups Landscape

- Access Control Startups Gaining Traction

- Video Surveillance, Analytics & Computer Vision Startups Landscape

- Video Analytics Startups Gaining Traction

- Weapons Detection & Perimeter Protection Startups Landscape

- Weapons Detection Startups Gaining Traction

- Closed or Bankrupt Startups in 2023

- Major Startups Losing Traction in the Smart Buildings Space