|

市場調查報告書

商品編碼

1604917

倉庫自動駕駛搬送機器人(AMR)的全球市場 - 2024年版Warehouse Autonomous Mobile Robot (AMR) Market - Edition 2024 |

||||||

價格

簡介目錄

樣品view

- 在新冠肺炎 (COVID-19) 疫情期間和之後,自動化在倉儲行業中佔據主導地位。

- 倉庫中的 AMR 市場是一個快速成長的產業,其推動因素是倉庫營運自動化需求的不斷增長以及對經濟高效的解決方案的需求。

- 自 2023 年起,技術投資大幅成長,主要得益於關鍵市場被壓抑的需求和經濟復甦。

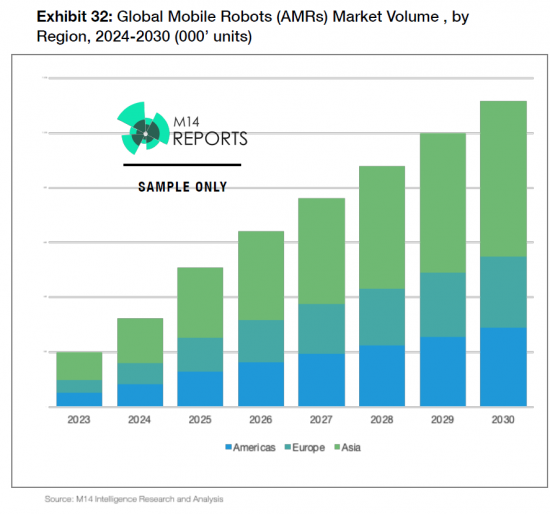

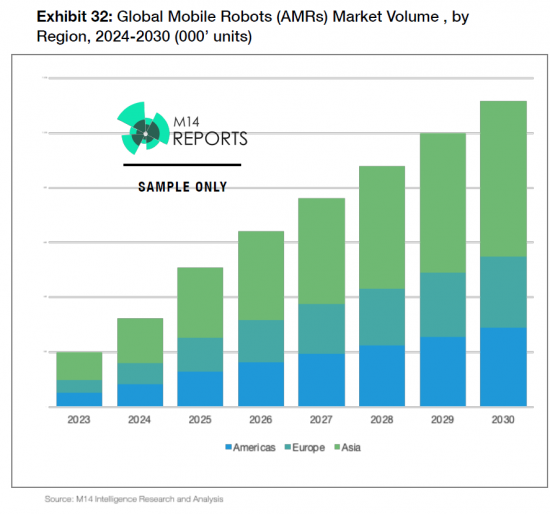

- 美洲和歐洲市場預計將佔據重要的市場佔有率,並且預計在 2023 年至 2030 年的預測期內銷量將逐漸增加。

信息圖形

- 亞洲正迅速採用自主運輸機器人 (AMR),特別是在中國、日本和韓國等國家。

- 由於製造業和物流業的蓬勃發展以及機器人自動化的廣泛採用,東協預計將成為關鍵的成長市場,這相當於 GDP 成長約 5%。

- 倉庫 AMR 市場高度分散,市場上有多個利益相關者,包括 OEM、技術公司、軟體和人工智慧公司、地圖和在地化提供者、系統整合商和服務提供者。

- 人工智慧有潛力影響自主運輸機器人 (AMR) 的性能和功能,擴展其適應和學習能力。倉庫防火牆後面的專用 5G 網路提供安全性、資料控制和卓越效能,實現快速、低延遲、即時移動和避障。

- 倉儲領域 AMR 市場的主要驅動力包括倉儲營運中擴大採用自動化、對經濟高效的解決方案的需求以及對電子商務和線上零售的需求不斷增長。

- 工業 4.0 的日益普及、智慧工廠的趨勢以及互聯物流的興起也正在推動市場成長。

- AMR 解決方案的高成本和市場缺乏標準化是 AMR 在倉庫中發展的一些主要課題。

- 機器人即服務 (RaaS) 為機器人客戶提供即用即付選項和全方位服務體驗,使採用更易於管理。這種商業模式預計將大幅成長,到 2030 年將達到 35% 的市場收入佔有率。

本報告調查分析了全球倉庫自主移動機器人(AMR)市場,考察了倉庫行業自主移動機器人(AMR)的市場滲透潛力、感測技術的創新以及各地區主要整車廠的情況並提供創業競賽等資訊。

目錄

第1章 調查範圍與前提條件

第2章 調查手法 - 資料的分析與預測

第3章 倉庫產業的自動化的現狀

- 到 2030 年,超過 51% 的倉庫將實現某種形式的自動化

- 從 2023 年到 2030 年,自動化倉庫數量將以 17.5% 的複合年增長率增長

第4章 倉庫自動化市場

第5章 倉庫自動化的明細:各解決方案

第6章 倉庫和物流的機器人的種類

第7章 倉庫產業上自動化

- 在配送中心使用 AMR 預計可將營運成本降低 40%

第8章 自動駕駛搬送機器人(AMR)市場分析,出貨台數和金額

第9章 自動駕駛搬送機器人(AMR)的零組件佔有率:硬體設備·軟體

第10章 自動駕駛搬送機器人(AMR)的收益佔有率:不同商業模式 - RaaS模式和直銷模式

第11章 倉庫的自動駕駛搬送機器人(AMR)的種類 - 市場銷售額(出貨台數和金額)

- 庫存運輸機器人:市場銷售額(出貨台數和金額)

- GTP機器人:市場銷售額(出貨台數和金額)

- 分類機器人:市場銷售額(出貨台數和金額)

- 庫存管理無人機:市場銷售額(出貨台數和金額)

第12章 與AMR的自規則感測技術選擇

- AMR感測系統:市場分析與預測

- 光達市場規模及預測

- 相機市場規模及預測

- 雷達市場規模及預測

- AMR 中人工智慧和專用 5G 網路的數量

第13章 自動駕駛搬送機器人(AMR)市場:各地區

- 地區的明細:市場規模與預測

- 倉庫產業上AMR的國家的分析

第14章 產業動態

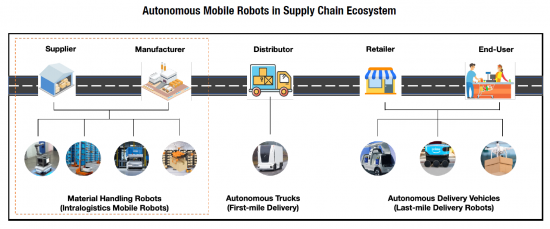

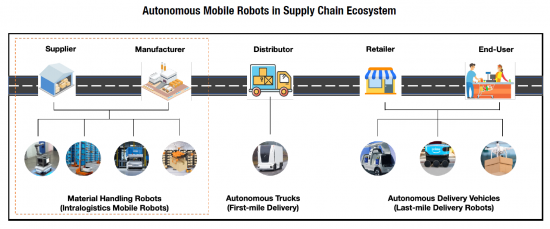

- AMR 有助於加強和優化倉庫供應鏈

- 營運支出的全新 RaaS b 模型

- 2024年倉庫AMR投資分析

- 投資分析:按組成部分和地區劃分

- 投資分析:依主要公司分類

- 自主運輸機器人領域的重大收購(2022 年至 2024 年 8 月)

第15章 AMR的價格設定的分析

- 主要零組件和那個相關成本的整體明細

第16章 競爭的評估

- AMR市場企業的簡介

- Geek+

- Locus Robotics

- Vecna Robotics

- GreyOrange

- ForwardX Robotics

- Symbotic (Acquired by Walmart)

- Seegrid Corporation

- Ocado

- AutoStore

- Fetch Robotics (Acquired by Zebra Technologies)

- 6 River Systems (Acquired by Shopify)

- MiR (Acquired by Teradyne)

- AutoGuide (Acquired by Teradyne)

- Gideon Brothers

- Syrius Robotics

- Guozi Robotics

- Bright Machines

- Youibot

- inVia Robotics

- Flexxbotics

- Balyo

- BlueBotics (Acquired by ZF Group)

- BrainCorp

- ATi Motors

- GrayMatter Robotics

- SVT Robotics

- InOrbit

簡介目錄

Executive Summary

With the ACES mobility research and analysis platform, M14 Intelligence is bringing the most in-depth analysis of autonomous, connected, electric, and shared mobility industry.

SAMPLE VIEW

This report plays a part in assisting stakeholders in understanding the possible Autonomous Mobile Robot's (AMR) market penetration in warehousing industry, technology innovations in sensing technologies and competition among the leading OEMs and start-ups across the geographies.

- Automation has recorded higher penetration in the warehousing industry during and after the covid-19 breakout.

- The AMR market in warehousing is a rapidly growing industry, driven by the increasing demand for automation in warehouse operations and the need for cost-effective and efficient solutions.

- Post 2023, the technology investments has rose sharply, majorly driven by the pent-up demand and economic recovery for the key markets.

- American and European markets are expected to hold significant market share and will witness gradual volume growth during the forecasted years of 2023-2030

INFOGRAPHICS

- The adoption of autonomous mobile robots (AMRs) in Asia is accelerating rapidly, particularly in countries like China, Japan, and South Korea

- ASEAN is expected to be a key growth market, owing to the boom in the manufacturing and logistics industries and the thrive to adopt of robotics automation to match the GDP growth of around 5%

- The AMR market in warehousing is highly fragmented, with several stakeholders operating in the market including OEMs, technology players, software and AI companies, mapping and localization providers, system integrators, and service providers

- AI impacts both the performance and functionality of autonomous mobile robots (AMR), potentially extending their capabilities in terms of adaptation and learning. While Private 5G network behind a warehouse firewall offers security, data control, and better performance and enables real-time mobility and obstacle avoidance with high speed and low-latency

- The major factors driving the AMR market in warehousing include the increasing adoption of automation in warehouse operations, the need for cost-effective and efficient solutions, and the growing demand for e-commerce and online retail

- The increasing adoption of Industry 4.0, the trend towards the smart factory and the growing trend of connected logistics are also propelling the growth of the market

- The high cost of AMR solutions and the lack of standardization in the market are some of the major challenges for growth of AMRs in warehousing

- Robot-as-a-Service (RaaS) allows robotics customers a pay-as-you-go option and gives them a full-service experience, making adoption more manageable. This business model is expected to grow dramatically reaching the market revenue share of 35% in 2030.

Report in numbers:

- 60+ pages of analysis on AMR market penetration and forecast

- More than 50 leading and emerging players analyzed

- More than 20 software and technology companies analyzed

- 20+ data tables and infographics on AMR analysis

- Interviews with 30+ stakeholders

- Analysis of top markets including US, China, Japan, Germany, France, and ASEAN countries

Countries covered:

Global (ASEAN countries, US, Canada, Germany, France, U.K., Japan, China, Others).

Companies mentioned:

|

|

TABLE OF CONTENTS

1. SCOPE OF RESEARCH AND ASSUMPTIONS

2. RESEARCH METHODOLOGY - DATA ANALYSIS AND FORECAST

3. Status of Automation in Warehousing Industry

- 3.1. Over 51 percent warehouses will have some form of automation installed by 2030

- 3.2. 17.5% CAGR growth in the number of automated warehouses from 2023 to 2030

4. Warehouse Automation Market

5. Warehouse Automation Breakdown by Solutions

6. Types of Robots in Warehousing and Logistics

7. Automation in Warehousing Industry

- 7.1. 40 percent reduction in operating cost is expected with the use of AMRs in DCs

8. Autonomous Mobile Robots (AMRs) Market Analysis Shipment and Value

9. Component Share in Autonomous Mobile Robots (AMRs): Hardware & Software

10. Revenue Share of Autonomous Mobile Robots (AMRs) by Business Model - RaaS Model and Direct Sales Model

11. Type of Autonomous Mobile Robots (AMRs) in Warehouses- Market Sale (Shipment & Value)

- 11.1. Inventory Transportation Robots: Market Sales (Shipment and Value)

- 11.2. Goods-to-Person Robots: Market Sales (Shipment and Value)

- 11.3. Sorting Robots: Market Sales (Shipment and Value)

- 11.4. Drones for Inventory Management: Market Sales (Shipment and Value)

12. Autonomous Sensing Technologies and Choices in AMRs

- 12.1. Sensing Systems in AMRs: Market Analysis and Forecast

- 12.2. LiDAR Market Size and Forecast

- 12.3. Camera Market Size and Forecast

- 12.4. Radar Market Size and Forecast

- 12.5. Artificial Intelligence and Private 5G Network Penetration in AMRs

13. Autonomous Mobile Robots (AMR) Market by Region

- 13.1. Regional Breakdown: Market Volume and Forecast

- 13.2. Country analysis of AMRs in Warehousing Industry

14. Industry Dynamics

- 14.1. AMRs are augmenting and optimizing the warehousing supply chain

- 14.1.1. Better cost efficiency and quick ROI

- 14.2. Emerging OpEx-oriented robots-as-a-service (RaaS) b-model

- 14.3. 2024 Investment Analysis of AMRs in Warehousing

- 14.4. Investment Analysis by Component and Region

- 14.5. Investment Analysis by Leading Players

- 14.6. Notable acquisitions in Autonomous Mobile Robots, 2022- Aug 2024

15. Pricing Analysis of AMRs

- 15.1. General breakdown of the key components and their associated costs

16. Competition Assessment

- 16.1. Profiles of companies in AMR Market

- 16.1.1. Geek+

- 16.1.2. Locus Robotics

- 16.1.3. Vecna Robotics

- 16.1.4. GreyOrange

- 16.1.5. ForwardX Robotics

- 16.1.6. Symbotic (Acquired by Walmart)

- 16.1.7. Seegrid Corporation

- 16.1.8. Ocado

- 16.1.9. AutoStore

- 16.1.10. Fetch Robotics (Acquired by Zebra Technologies)

- 16.1.11. 6 River Systems (Acquired by Shopify)

- 16.1.12. MiR (Acquired by Teradyne)

- 16.1.13. AutoGuide (Acquired by Teradyne)

- 16.1.14. Gideon Brothers

- 16.1.15. Syrius Robotics

- 16.1.16. Guozi Robotics

- 16.1.17. Bright Machines

- 16.1.18. Youibot

- 16.1.19. inVia Robotics

- 16.1.20. Flexxbotics

- 16.1.21. Balyo

- 16.1.22. BlueBotics (Acquired by ZF Group)

- 16.1.23. BrainCorp

- 16.1.24. ATi Motors

- 16.1.25. GrayMatter Robotics

- 16.1.26. SVT Robotics

- 16.1.27. InOrbit

02-2729-4219

+886-2-2729-4219