|

市場調查報告書

商品編碼

1645035

中國醫藥倉儲:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

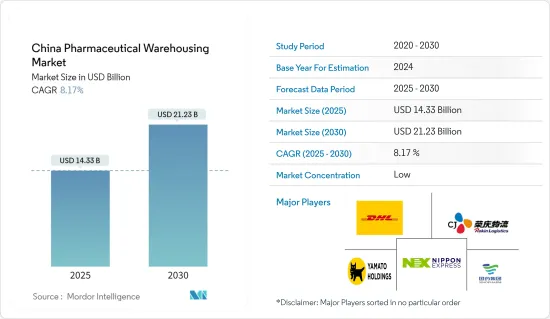

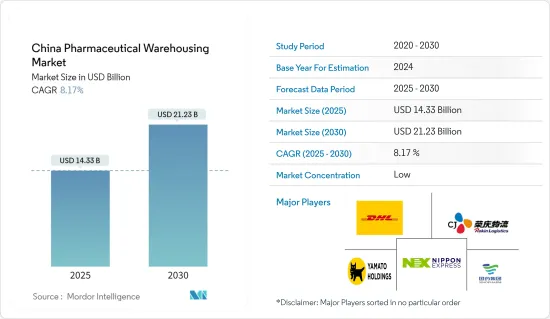

2025年中國醫藥倉儲市場規模預估為143.3億美元,預計2030年將達212.3億美元,預測期間(2025-2030年)複合年成長率為8.17%。

在生物技術和創新藥物發展的推動下,中國醫藥市場正經歷重大轉型。這項變革很大程度上受到中國政府戰略舉措的推動,特別是旨在加強公共衛生和促進科技創新的「健康中國2030」計畫。

由於大量研發投入和有利的監管環境,中國生技產業正快速成長。該市場擁有一個充滿活力的生態系統,生物技術新興企業、大型製藥公司和學術機構齊心協力,不斷突破醫學研究的界限並開拓新的治療方法。

中國生物技術領域的一個顯著趨勢是將人工智慧(AI)和巨量資料分析引入藥物開發。藥明康德等公司正在利用人工智慧來改善藥物研發、簡化臨床測試並推動精準醫療策略。借助主導平台,藥明康德不僅加快了有前景的候選藥物的識別,還提高了研發效率。

此外,中國的監管改革,特別是創新藥物的快速核准程序,為突破性治療方法更快地進入市場鋪平了道路,營造了鼓勵持續創新的環境。生物相似藥和生物製劑不僅提供具有成本效益的替代療法,而且還擴大了獲得尖端治療的機會。

中國政府正在採取措施支持數位健康技術的發展。此外,透過國家醫療資訊化發展規劃等舉措,我們正在努力建立統一的醫療資訊系統,無縫整合來自不同數位健康平台的資料,並增強資料互通性和護理協調性。

2023 年 6 月,FDA 正在考慮允許線上藥局分發處方箋藥。這一潛在的變化可能為阿里巴巴和京東等電子商務巨頭進入這個快速成長的市場鋪平道路。該措施的討論自去年年中開始,一旦核准,將開放一個規模超過 1 兆元(約 1,610 億美元)的市場。此舉不僅將使銷售從傳統醫院轉向線上藥局,還將挑戰國有醫院和經銷商長期以來在市場上的主導地位。

中國醫藥市場的轉型也正在延伸至倉儲業。製藥業的快速成長導致對先進倉儲解決方案的需求增加,以確保藥品的有效儲存和分配。

中國的醫藥倉儲市場正在透過採用自動儲存和搜尋系統 (AS/RS)、溫控環境和即時庫存管理系統等最尖端科技來滿足這些需求。

這些進步對於維持整個供應鏈中藥品的完整性和品質至關重要。隨著市場不斷擴大,完善的倉儲基礎設施的發展將對支持中國醫藥產業的整體成長和效率發揮至關重要的作用。

中國醫藥倉儲市場趨勢

加大低溫運輸倉庫建設

2024年上半年低溫運輸物流量達2.2億噸,成長4.4%。同時,低溫運輸物流收益達到2,779億元人民幣(389億美元),較去年同期成長3.4%。

至2024年6月,我國冷資料儲存容量將擴大至2.37億立方米,年增7.73%。今年以來,我國冷庫容量新增942萬立方公尺。 2024年上半年,全國冷庫租賃量預計將超過2,900萬立方米,年增8%以上。

生技藥品、疫苗和特殊藥物等溫度敏感物品的生產和消費不斷增加,增加了對大型冷藏倉庫的需求。生技藥品與傳統藥物不同,它是來自生物實體(包括人類和動物)的複雜物質。這些生技藥品涵蓋頻譜廣泛,從疫苗到血液成分。

生技藥品經常用於先進的治療方法,對物理環境中的微小變化都高度敏感。因此,為了滿足這些產品需求的突然成長,製藥和醫療保健公司必須重視快速可靠的供應鏈解決方案。

2024年10月,中國國家藥品監督管理局(NMPA)宣布了一項檢查舉措,允許生技藥品的非端到端製造。此前,國家藥監局要求生技藥品必須在單一製造地進行端到端生產。

本質上,這意味著理想情況下原料藥及其相應的產品都在同一家工廠生產。然而,國內生物製藥界一直呼籲放寬這項規定,特別是考慮到外國生物製藥製造商自由裁量權在不同地點生產原料藥和成品。

低溫運輸倉儲建設的大幅成長,凸顯了高效醫藥倉儲在中國日益成長的重要性。隨著對溫度敏感產品的需求不斷增加,冷資料儲存設施的擴建將在確保這些關鍵產品的完整性和可用性方面發揮關鍵作用。這一趨勢凸顯了對低溫運輸物流持續投資和創新的必要性,以支持製藥業不斷變化的需求。

藥廠加大開發力度

中國政策制定者正積極尋求透過放鬆管制來促進創新,以吸引外資。這與先前對跨境研發施加限制的立場不同。值得注意的是,今年政府首次將聚焦在「創新藥物」。光是2023年,創新藥物許可和合作交易就將超過220項,價值2,660億元人民幣(約370億美元)。

中國政府已推出多項舉措加強醫療衛生領域發展並促進國際合作。參與企業CGT 領域的國際企業正尋求透過投資、成立新業務、合併、收購甚至遷至四個指定的 FTZ 來抓住機會。這些企業涵蓋了廣泛的 CGT 相關領域,從 iPSC 和 CAR-T 到 mRNA、基因序列測定和體外診斷 (IVD/LDT)。

根據新《通知》,中國生物製藥公司現在可以直接吸引外國投資。透過在這些自由貿易區內設立或遷移子公司,公司可以避免先前要求的可變利益營業單位(VIE)結構。

作為一項重要舉措,這家總部位於印地安那波里斯的公司計劃在 2024 年 11 月投資 2.12 億美元擴建其蘇州工廠。此次擴建使蘇州自1996年以來的累積投資金額達到150億元人民幣(21億美元)。此前,該公司的主要減重藥物 Zepbound 已於 2024 年 7 月在中國核准。此後不久,拜耳在北京開設了醫療研發中心,並宣布計劃在美國以外建立首個創新培養箱Gateway Labs。

2024年9月,德國製藥巨頭拜耳在上海開設生命科學培養箱,稱讚中國的創新能力「位居世界前兩位」。就在一個月前,瑞士巨頭羅氏診斷公司的一個部門宣布了一項價值 4.2 億美元的巨額計劃,以加強其在蘇州的生產工廠,這是迄今為止其最大的投資。

此類戰略投資凸顯了中國市場的獨特機會。儘管面臨經濟放緩、國內競爭激烈和地緣政治緊張等挑戰,製藥業仍然是一個亮點,而從高科技到汽車等各個領域都出現了猶豫。許多外國公司仍在尋找與本土生物技術公司進行有利可圖且富有成效的合作的途徑。

北京方面推動醫療衛生領域自由化的舉措部分是出於讓老齡人口能夠獲得全球頂尖藥品的願望。這項自由化措施也刺激了製藥生產設施的快速發展,對中國的醫藥倉儲市場產生了重大影響。

中國醫藥倉儲產業概況

中國醫藥倉儲市場是全球競爭最激烈、成長最快的市場之一。這是在該國醫療保健產業不斷發展、藥品生產不斷擴大和分銷策略不斷變化背景下發生的。隨著中國製藥業的持續成長,能夠提供無縫倉儲、高效物流和先進解決方案的公司將在這個競爭激烈的市場中佔據優勢。市場高度分散,有許多本地和國際參與企業,包括國藥物流、DHL和CJ榮慶物流。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況(當前市場和經濟的市場狀況)

- 政府法規和舉措

- 科技趨勢

- 市場動態

- 市場促進因素

- 快速發展的製藥業

- 人口成長是倉儲市場的主要驅動力之一

- 市場限制/挑戰

- 供應鏈中斷

- 溫度和低溫運輸管理

- 市場機會

- 技術創新

- 市場促進因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 地緣政治與疫情將如何影響市場

第5章 市場區隔

- 按服務類型

- 貯存

- 分配

- 庫存管理

- 包裝

- 其他

- 按模式

- 低溫運輸倉庫

- 非低溫運輸倉庫

- 按最終用戶

- 製藥公司

- 醫院和診所

- 研究和政府組織

- 其他

第6章 競爭格局

- 公司簡介

- Sinopharm Logistics

- SF Express

- Kerry Logistics

- Yunda Holding

- CJ Rokin Logistics

- DHL Supply Chain

- DB Schenker

- Nippon Express

- Yamato Holdings

- CJ Rokin Logistics

- SF Express

- JD Logistics*

- 其他公司

第7章:市場的未來

第 8 章 附錄

- 宏觀經濟指標(GDP分佈,依活動分類)

- 經濟統計 - 運輸及倉儲業對經濟的貢獻

- 相關藥品進出口統計

The China Pharmaceutical Warehousing Market size is estimated at USD 14.33 billion in 2025, and is expected to reach USD 21.23 billion by 2030, at a CAGR of 8.17% during the forecast period (2025-2030).

Driven by biotechnology and innovative drug development, the Chinese pharmaceutical market is undergoing a significant transformation. This shift is largely propelled by strategic initiatives from the Chinese government, notably the "Healthy China 2030" plan, which seeks to bolster public health and champion scientific innovation.

China's biotechnology sector is on a rapid ascent, buoyed by hefty investments in research and development (R&D) and a supportive regulatory landscape. The market boasts a vibrant ecosystem where biotech startups, major pharmaceutical firms, and academic institutions collaborate, pushing the boundaries of medical research and pioneering new therapies.

A notable trend in China's biotechnology landscape is the infusion of artificial intelligence (AI) and big data analytics into drug development. Companies such as WuXi AppTec harness AI to refine drug discovery, streamline clinical trials, and bolster precision medicine strategies. Thanks to AI-driven platforms, WuXi AppTec has not only sped up the identification of promising drug candidates but also heightened the efficiency of its R&D endeavors.

Moreover, China's regulatory reforms, notably the expedited approval process for innovative drugs, have paved the way for swifter market entry of groundbreaking therapies, fostering an environment ripe for continuous innovation. The market is increasingly gravitating towards biosimilars and biopharmaceuticals, which not only provide cost-effective treatment alternatives but also broaden access to cutting-edge therapeutics.

Policies backing the expansion of digital health technologies have been rolled out by the Chinese government. Furthermore, initiatives such as the National Health Informatization Development Plan are working towards a unified health information system, seamlessly integrating data from diverse digital health platforms to boost data interoperability and healthcare coordination.

In June 2023, the FDA was contemplating a move to allow online pharmacies to dispense prescription drugs. This potential shift could pave the way for e-commerce giants like Alibaba and JD to tap into a burgeoning market. Discussions about this policy have been circulating since mid-last year, and its approval could unlock a market exceeding CNY 1 trillion (approximately USD 161 billion). Such a move would not only divert sales from traditional hospitals to online pharmacies but also challenge the longstanding dominance of state-run hospitals and distributors in the market.

The transformation of the Chinese pharmaceutical market also extends to the warehousing sector. With the rapid growth of the pharmaceutical industry, there is an increasing demand for advanced warehousing solutions to ensure the efficient storage and distribution of pharmaceutical products.

The Chinese pharmaceutical warehousing market is evolving to meet these needs, incorporating state-of-the-art technologies such as automated storage and retrieval systems (AS/RS), temperature-controlled environments, and real-time inventory management systems.

These advancements are crucial for maintaining the integrity and quality of pharmaceutical products throughout the supply chain. As the market continues to expand, the development of sophisticated warehousing infrastructure will play a pivotal role in supporting the overall growth and efficiency of the Chinese pharmaceutical industry.

China Pharmaceutical Warehousing Market Trends

Increase In Cold Chain Warehouse Development

In the first half of 2024, the volume of cold chain logistics hit 220 million tons, a rise of 4.4%. Concurrently, revenue from cold chain logistics climbed to CNY 277.9 billion (USD 38.9 billion), reflecting a 3.4% uptick compared to the same timeframe last year.

By June 2024, China's cold storage capacity expanded to 237 million cubic meters, showcasing a year-on-year growth of 7.73%. This year alone saw the addition of 9.42 million cubic meters in new cold storage capacity. In the first half of 2024, the leasing volume for cold storage across the nation surpassed 29 million cubic meters, marking an increase of over 8%.

The rising production and consumption of temperature-sensitive items, such as biologics, vaccines, and specialty drugs, underscore the need for expansive cold storage facilities. Biologics, unlike conventional drugs, are intricate substances sourced from biological entities, including humans and animals. These biological products encompass a wide spectrum, from vaccines to blood components.

Frequently utilized in advanced treatments, biologics exhibit heightened sensitivity to even minor fluctuations in their physical environment. Consequently, to cater to the surging demand for these products, pharmaceutical and healthcare firms must emphasize swift and dependable supply chain solutions.

In October 2024, the China National Medical Products Administration (NMPA) unveiled a pilot initiative permitting non-end-to-end manufacturing of biologics. Historically, the NMPA mandated that biologics undergo end-to-end production at a singular manufacturing site.

Essentially, this means both the drug substance and its corresponding product should ideally be produced within the same facility. However, the domestic biopharmaceutical sector has been pushing for a relaxation of this rule, particularly in light of the fact that foreign biologics manufacturers have been granted the leeway to produce the drug substance and its product at distinct locations.

The significant increase in cold chain warehouse development highlights the growing importance of efficient pharmaceutical warehousing in China. As the demand for temperature-sensitive products continues to rise, the expansion of cold storage facilities will play a crucial role in ensuring the integrity and availability of these critical products. This trend underscores the need for ongoing investment and innovation in cold chain logistics to support the pharmaceutical industry's evolving requirements.

Increase in Development of Pharmaceutical Manufactures

Chinese policymakers are actively working to attract foreign investment by relaxing regulations, a move aimed at fostering innovation. This marks a departure from their previous stance, which imposed restrictions on cross-border research and development. Notably, the government spotlighted "innovative drugs" in its work report for the first time this year. In 2023 alone, there were over 220 licensing and partnership deals for innovative drugs, amounting to a substantial RMB 266 billion (approximately USD 37 billion).

The Chinese government has rolled out several initiatives to bolster the healthcare sector and promote international collaboration. International players in the CGT arena are eyeing opportunities and considering actions like investments, establishing new entities, mergers, and acquisitions, or even relocating to four designated FTZs. These ventures span a wide array of CGT-related domains, from iPSCs and CAR-T to mRNA, gene sequencing, and in vitro diagnostics (IVD/LDT).

Thanks to the new Circular, biopharmaceutical firms in China can now directly draw foreign investments. By setting up or moving subsidiaries to the four FTZs, they sidestep the previously mandatory variable interest entity (VIE) structure.

In a significant move, an Indianapolis-based firm is set to invest a whopping USD 212 million in November 2024, expanding its Suzhou plant. This expansion will elevate its cumulative investment in Suzhou since 1996 to a staggering 15 billion yuan (USD 2.1 billion). This decision follows China's green light for its major weight loss drug, Zepbound, in July 2024. Shortly after, the firm launched a medical innovation center in Beijing and announced plans for a Gateway Labs, marking its inaugural innovation incubator outside the U.S.

In September 2024, Bayer, the German pharmaceutical giant, inaugurated a life science incubator in Shanghai, lauding China's innovation prowess as "among the world's top two." Just a month earlier, Roche Diagnostics, a Swiss behemoth's division, unveiled a massive USD 420 million project - its largest investment to date - to enhance its manufacturing facility in Suzhou.

These strategic investments shine a light on a unique opportunity within the Chinese market. Despite challenges like an economic slowdown, stiff domestic competition, and geopolitical strains causing hesitance in sectors from tech to automotive, the pharmaceutical realm remains a beacon. Many foreign entities still perceive avenues for profit and fruitful collaborations with local biotechs.

Part of Beijing's initiative to liberalize the healthcare sector is driven by a desire to ensure its aging populace has access to premier global medicines. This liberalization has also spurred an increase in the development of pharmaceutical manufacturing facilities, significantly impacting the Chinese pharmaceutical warehousing market.

China Pharmaceutical Warehousing Industry Overview

China's pharmaceutical warehousing market is one of the most competitive and fastest-growing in the world. It is due to the country's growing healthcare sector, growing pharmaceutical manufacturing, and changing distribution strategies. As the pharmaceutical industry in China continues to grow, companies that can provide seamless warehousing, effective distribution, and cutting-edge solutions will gain a competitive advantage in this highly competitive market. The market is highly fragmented, with many local and International players operating in the market, such as Sinopharm Logistics, DHL, CJ Rokin Logistics, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview (Current Market Scenario of Market and Economy)

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends

- 4.4 Market Dynamics

- 4.4.1 Market Drivers

- 4.4.1.1 Rapidly Expanding Pharmaceutical Industry

- 4.4.1.2 Population Growth is one of the main drivers for the warehousing market

- 4.4.2 Market Restraints/ Challenges

- 4.4.2.1 Supply Chain Disruptions

- 4.4.2.2 Temperature Controlled and Cold Chain Management

- 4.4.3 Market Opportunities

- 4.4.3.1 Technological Innovations

- 4.4.1 Market Drivers

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Powers of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Storage

- 5.1.2 Distribution

- 5.1.3 Inventory Management

- 5.1.4 Packaging

- 5.1.5 Others

- 5.2 By Mode

- 5.2.1 Cold Chain Warehouse

- 5.2.2 Non-Cold Chain Warehouse

- 5.3 By End User

- 5.3.1 Pharmaceutical Companies

- 5.3.2 Hospital and Clinics

- 5.3.3 Research Institiutes and Government Agencies

- 5.3.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 Sinopharm Logistics

- 6.2.2 SF Express

- 6.2.3 Kerry Logistics

- 6.2.4 Yunda Holding

- 6.2.5 CJ Rokin Logistics

- 6.2.6 DHL Supply Chain

- 6.2.7 DB Schenker

- 6.2.8 Nippon Express

- 6.2.9 Yamato Holdings

- 6.2.10 CJ Rokin Logistics

- 6.2.11 SF Express

- 6.2.12 JD Logistics*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, By Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 Export and Import Statistics of Related Pharmaceutical Products