|

市場調查報告書

商品編碼

1645033

德國醫藥倉儲:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Germany Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

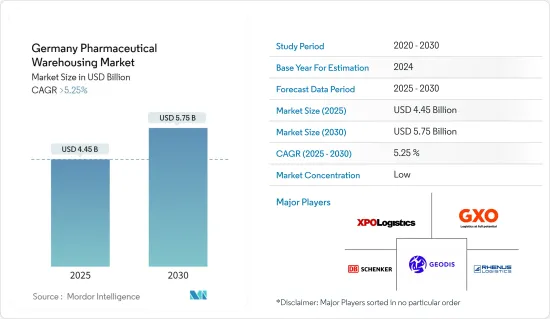

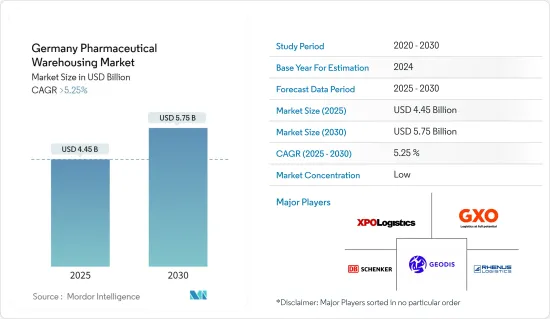

德國醫藥倉儲市場規模在 2025 年估計為 44.5 億美元,預計到 2030 年將達到 57.5 億美元,預測期內(2025-2030 年)的複合年成長率將超過 5.25%。

德國醫藥倉儲產業在該國醫藥物流網路中發揮著至關重要的作用。特別是疫苗和生技藥品等溫度敏感物品的專用倉庫的需求激增。 2024年,低溫運輸市場預計將快速擴張,與前一年同期比較成長率接近6%。根據德國貿易投資署 (GTAI) 的報告,這一成長將包括溫控儲存和冷藏運輸網路等設施。這一成長得益於德國強大的物流基礎設施,該基礎設施滿足國內和國際需求,特別是滿足歐盟嚴格的 GDP 標準所需的設施。

自動化和人工智慧等技術進步正在改變德國的藥品儲存。機器人和自動化系統的整合不僅使業務更加高效,而且更具成本效益。根據德國物流協會的報告,藥品需求的不斷成長預計將導致從 2024 年起藥品倉庫的自動化採用率每年增加 15%。此外,人們正在進行大量投資來提高倉儲業務的速度和一致性,主要物流中心正在利用尖端技術為該行業提供更好的服務。

德國醫藥倉儲的監管狀況是市場擴張的重要催化劑。政府執行嚴格的標準,如德國藥品法 (Arzneimittelgesetz) 和 GDP 等歐盟法規所規定。這些規定強調藥品安全、嚴密的溫度控制和強大的可追溯性。遵守低溫運輸已成為一項重大挑戰,特別是因為預計到 2024 年,對溫度敏感的藥品將佔倉庫總容量的 20% 以上。由於對疫苗和生技藥品溫度控制的要求越來越嚴格,對此類專業設施的需求預計每年將增加 8%。

德國醫藥倉儲市場趨勢

醫藥倉庫採用自動化和人工智慧

醫藥倉儲產業正在經歷自動化和人工智慧的採用激增,成為該行業的一個突出趨勢。同時,醫藥供應鏈日益複雜,對高效能精準營運的需求不斷增加,促使德國物流企業大力投資機器人和人工智慧技術。這些進步不僅降低了人事費用,而且還增強了庫存管理、訂單履行和法規合規性。

現在,許多大型醫藥倉庫使用 AGV 和機械臂進行分類和挑選任務,從而縮短週轉時間並提高訂單準確性。許多德國領先的醫藥物流公司已承諾投資旨在最佳化其倉庫的人工智慧系統,特別注重庫存追蹤和預測性維護。

在德國的醫藥倉儲領域,人工智慧近年來一直在重塑業務。 2024 年 1 月:勃林格殷格翰正在使用機器學習演算法來預測需求、簡化庫存管理並減少浪費,尤其是對溫度敏感的藥物。同樣,2024 年初,默克公司採用了人工智慧主導的預測分析,透過提供即時庫存監控和儲存預測來確保遵守藥品法規並降低營運費用。這些發展凸顯了人工智慧在提高德國醫藥供應鏈效率和確保法規遵循方面日益重要的作用。

嚴格的監管要求,尤其是對疫苗和生技藥品等溫度敏感產品的要求,是自動化的主要驅動力。人工智慧和自動化透過精確控制儲存條件以及即時監控溫度和濕度等環境因素,在確保合規性方面發揮關鍵作用。此外,透過最大限度地減少人為錯誤,這些技術確保了藥品的正確處理和運輸。據業內人士透露,由於德國企業擴大採用這些先進技術,自動化藥品倉庫每年的擴張速度達到 15%。隨著對高效業務的需求不斷增加,預計這一趨勢將會持續下去。

藥品低溫運輸物流的成長

低溫運輸物流正成為德國醫藥倉儲領域的關鍵趨勢。生技藥品、疫苗和其他對溫度敏感的藥物的需求激增,凸顯了對專門倉儲設施的迫切需求。到2024年,低溫運輸倉儲將佔德國醫藥倉庫總容量的20%以上,而該產業正快速成長。這種快速成長的關鍵促進因素是疫苗和生技藥品數量的增加,這兩者都需要嚴格的溫度控制。有些疫苗需要在極低的溫度下儲存,低至-80°C,但大多數生技藥品都保存在2至8°C之間。

這一趨勢不僅將持續到 2024 年,而且還將因新生技藥品和更多溫度敏感產品的推出而得到加強。低溫運輸物流的擴張受到現行監理環境的極大影響。例如,歐盟的《良好分銷規範》和德國的《藥品法》要求製藥公司確保溫度敏感貨物的安全儲存和運輸。

2023年下半年,Kuhne+Nagel將在法蘭克福開設新的溫控倉庫,增強其在德國的低溫運輸物流能力。該設施將滿足對溫度敏感藥物(特別是疫苗和生技藥品)日益成長的需求。此次擴建符合德國對歐盟良好分銷規範(GDP)指南的承諾,並確保了這些必需產品的安全儲存和運輸。這項舉措凸顯了德國對加強其在醫藥物流領域專業知識的重視。

為了滿足嚴格的標準,德國醫藥倉庫營運商正在投資具有即時溫度監控和資料記錄功能的先進低溫運輸設施。物流公司正在增加冷藏能力以滿足日益成長的需求。

德國醫藥倉儲產業概況

德國的醫藥倉儲市場是一個分散的市場,由全球公司和本地公司混合組成。大部分進出口產品在冷藏運送過程中都需要監控。供應商正在實施各種策略來擴大其市場影響力,包括策略聯盟、夥伴關係、併購、地理擴張和產品/服務發布。主要參與者包括 XPO Logistics Inc.、CDS Hackner GmbH、GXO Logistics 和 Wagner Group GmbH。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 製藥業越來越重視品質和產品敏感性

- 倉庫自動化提高效率和準確性

- 市場限制

- 缺乏高效率的物流支持

- 技術純熟勞工短缺

- 市場機會

- 政府措施加強藥品倉庫建設

- 加強醫藥創新與發展

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 地緣政治與疫情將如何影響市場

第5章 市場區隔

- 按類型

- 低溫運輸倉庫

- 非低溫運輸倉庫

- 按應用

- 藥廠

- 藥局

- 醫院

- 其他

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Nippon Express

- Bio Pharma Logistics

- Rhenus SE and Co. KG

- ADAllen Pharma

- DB Schenker

- FedEx Corp.

- GEODIS SA

- CEVA Logistics

- Hellmann Worldwide Logistics SE and Co KG

- CDS Hackner GmbH

- Pfenning Logistics

- GXO Logistics

- Wagner Group GmbH

- Kuehne Nagel Management AG

- United Parcel Service Inc.

- XPO Logistics Inc.

- 其他公司

第7章:市場的未來

第 8 章 附錄

- 宏觀經濟指標(GDP分佈,依活動分類)

- 經濟統計 - 運輸及倉儲業對經濟的貢獻

- 對外貿易統計 - 按商品、目的地和原產國分類的進出口數據

The Germany Pharmaceutical Warehousing Market size is estimated at USD 4.45 billion in 2025, and is expected to reach USD 5.75 billion by 2030, at a CAGR of greater than 5.25% during the forecast period (2025-2030).

Germany's pharmaceutical warehousing industry plays a pivotal role in the nation's pharmaceutical logistics network. The demand for specialized warehouses, particularly for temperature-sensitive items like vaccines and biologics, has surged. In 2024, the cold chain market is expanding swiftly, with an average year-on-year growth rate nearing 6%. This growth encompasses facilities like temperature-controlled storage units and refrigerated transportation networks, as highlighted in a report by Germany Trade & Invest (GTAI). This growth is bolstered by Germany's robust logistics infrastructure, which caters to both domestic and international demands, especially with facilities meeting stringent EU GDP standards.

Technological advancements, including automation and artificial intelligence, are transforming pharmaceutical storage in Germany. The integration of robotics and automated systems not only boosts operational efficiency but also enhances cost-effectiveness. The German Logistics Association reports that, in response to increasing demand for medicines, pharmaceutical warehouses are projected to see a 15% annual rise in automation adoption, beginning in 2024. Furthermore, significant investments are being channeled to enhance the speed and consistency of warehouse operations, with major logistics centers leveraging state-of-the-art technologies to better cater to the sector.

Germany's regulatory landscape for pharmaceutical warehousing is a crucial catalyst for market expansion. The government enforces stringent standards, as delineated in the German Medicines Act (Arzneimittelgesetz) and EU regulations like GDP. These regulations emphasize the safety of pharmaceutical products, meticulous temperature control, and robust traceability. Cold chain compliance poses a significant challenge, especially with temperature-sensitive pharmaceuticals projected to occupy over 20% of total warehouse capacity by 2024. Given the heightened temperature control mandates for vaccines and biologics, the demand for such specialized facilities is anticipated to grow by 8% annually.

Germany Pharmaceutical Warehousing Market Trends

Adoption of Automation and AI in Pharmaceutical Warehousing

The pharmaceutical warehouse sector witnessed a significant surge in the adoption of automation and AI, marking it as a prominent trend in the industry. At the same time, the rising intricacies of pharmaceutical supply chains, coupled with a heightened demand for efficient and precise operations, are prompting German logistics firms to invest heavily in robotics and AI technologies. These advancements not only curtail labor costs but also enhance stock management, order fulfillment, and adherence to regulations.

Many leading pharmaceutical warehouses now utilize AGVs and robotic arms for sorting and picking tasks, leading to quicker turnaround times and heightened order accuracy. Numerous major pharmaceutical logistics firms in Germany have pledged investments in AI systems aimed at warehouse optimization, particularly emphasizing inventory tracking and predictive maintenance.

In Germany's pharmaceutical warehousing sector, AI has been reshaping operations in recent years. In January 2024, Boehringer Ingelheim harnessed machine learning algorithms to forecast demand, streamline inventory management, and curtail wastage, especially for temperature-sensitive medications. Likewise, in early 2024, Merck KGaA employed AI-driven predictive analytics for immediate stock oversight and storage predictions, guaranteeing adherence to pharmaceutical regulations and cutting down operational expenses. These developments highlight AI's expanding influence in boosting efficiency and ensuring regulatory compliance in Germany's pharmaceutical supply chain.

Stringent regulatory requirements, especially concerning temperature-sensitive products like vaccines and biologics, significantly drive the push for automation. AI and automation play a pivotal role in ensuring compliance by providing precise control over storage conditions and real-time monitoring of environmental factors such as temperature and humidity. Moreover, by minimizing human error, these technologies ensure the proper handling and transportation of medications. Industry sources indicate that automated pharmaceutical warehouses are expanding at an annual rate of 15%, driven by the increasing adoption of these advanced technologies by German firms. Given the escalating demand for high-efficiency operations, this trend is expected to persist.

Growth in Cold Chain Logistics for Pharmaceuticals

Cold chain logistics emerges as a pivotal trend in Germany's pharmaceutical storage landscape. The surging demand for biologic pharmaceuticals, vaccines, and other temperature-sensitive medications underscores the urgent need for specialized cold storage facilities. By 2024, cold chain storage has claimed over 20% of Germany's total pharmaceutical warehouse capacity, with the sector witnessing rapid growth. This surge is predominantly fueled by the increasing volume of vaccines and biologics, both of which demand stringent temperature controls. While certain vaccines necessitate storage at a frigid -80°C, the majority of biologics are maintained within a 2 to 8°C range.

The urgency for these facilities was amplified by the pressing demands of COVID-19 vaccine distribution, a trend that has not only persisted into 2024 but has also been bolstered by the introduction of new biologics and even more temperature-sensitive products. The expansion of cold chain logistics is heavily influenced by the prevailing regulatory landscape. For instance, both the European Union's Good Distribution Practice standards and Germany's Arzneimittelgesetz mandate that pharmaceutical companies ensure the safe storage and transport of temperature-sensitive goods.

In late 2023, Kuehne + Nagel strengthened its cold chain logistics capabilities in Germany by opening a new temperature-controlled warehouse in Frankfurt. This facility addresses the rising demand for temperature-sensitive pharmaceuticals, notably vaccines and biologics. The expansion aligns with Germany's commitment to the EU Good Distribution Practice (GDP) guidelines, ensuring the secure storage and transportation of these essential products. This initiative highlights Germany's focus on bolstering its pharmaceutical logistics expertise.

German pharmaceutical warehouse providers are investing in advanced cold chain facilities with real-time temperature monitoring and data recording to meet stringent standards. Logistics companies are increasing cold storage capacities to meet rising demand.

Germany Pharmaceutical Warehousing Industry Overview

The Germany Pharmaceutical Warehousing market is fragmented in nature, with a mix of global and local players. Most of the imports and exports products need to be monitored in refrigerated transports. Vendors are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. Major players include XPO Logistics Inc., CDS Hackner GmbH, GXO Logistics, and Wagner Group GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased focus on quality and product sensitivity in the pharma industry

- 4.2.2 Automation at warehouses to increase efficiency and accuracy

- 4.3 Market Restraints

- 4.3.1 Lack of efficient logistics support

- 4.3.2 Shortage of skilled labor

- 4.4 Market Opportunities

- 4.4.1 Rise in government initiatives to enhance Pharmaceutical Warehousing

- 4.4.2 Increasing Pharmaceutical product innovation and Development

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Cold Chain Warehouse

- 5.1.2 Non-Cold Chain Warehouse

- 5.2 By Application

- 5.2.1 Pharmaceutical Factory

- 5.2.2 Pharmacy

- 5.2.3 Hospital

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Nippon Express

- 6.2.2 Bio Pharma Logistics

- 6.2.3 Rhenus SE and Co. KG

- 6.2.4 ADAllen Pharma

- 6.2.5 DB Schenker

- 6.2.6 FedEx Corp.

- 6.2.7 GEODIS SA

- 6.2.8 CEVA Logistics

- 6.2.9 Hellmann Worldwide Logistics SE and Co KG

- 6.2.10 CDS Hackner GmbH

- 6.2.11 Pfenning Logistics

- 6.2.12 GXO Logistics

- 6.2.13 Wagner Group GmbH

- 6.2.14 Kuehne Nagel Management AG

- 6.2.15 United Parcel Service Inc.

- 6.2.16 XPO Logistics Inc.*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin