|

市場調查報告書

商品編碼

1406575

人工智慧-市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Artificial Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

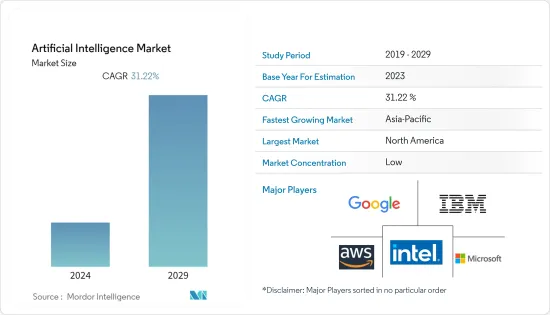

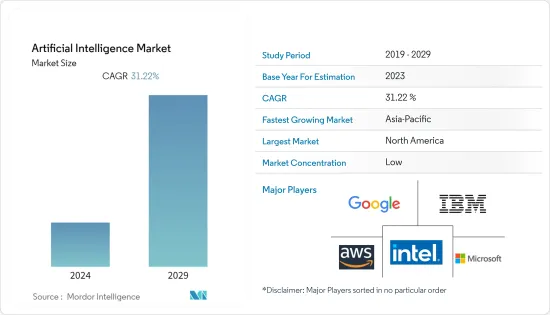

預計人工智慧市場在預測期內的複合年成長率將達到31.22%。

主要亮點

- 人工智慧 (AI),特別是電腦視覺和機器學習 (ML),正在徹底改變產業形勢。隨著深度學習和資料驅動人工智慧的突破,人工智慧市場正在全球擴張,而機器人獲得自主權以在全球市場競爭的需求正在推動對人工智慧產品和服務的需求,預計採用將會加速。

- 近年來,數位科技和網路的使用不斷擴大,大大促進了全球人工智慧產業的擴張。各產業的技術突破不斷受到高科技巨頭大規模研發投入的推動。

- 基於人工智慧的機器學習技術的預測分析解決方案的擴展預計將在預測期內推動人工智慧市場的發展。世界各地的許多最終用戶公司利用預測模型進行工業規劃和成長。

- 隨著網際網路的普及和新技術的擴散,全球創建的資料量正在急劇增加。物聯網、工業4.0和5G等技術正在推動人工智慧的發展。巨量資料是技術突破所產生的資料大幅增加的結果。

- COVID-19 對市場產生了重大影響。雖然一些行業的人工智慧採用率有所增加,但其他行業的採用率卻有所下降。 COVID-19 的災難為企業高管提供了有關數位轉型的重要見解。最引人注目的收穫之一是資料分析和人工智慧可以為業務帶來的潛力。

- 例如,人工智慧使公共部門能夠將流程、人員和服務帶到網路上,促使地方、區域和國家政府採用人工智慧。在短短幾個月內,世界各國政府已經學會將人工智慧作為抗病毒的武器。這包括公共教育和患者篩檢,以追蹤和追蹤接觸者。

- 無論是 IT 問題、人力資源請求還是有關公司支出政策的問題,員工都需要立即獲得幫助,以便透過「在任何地方工作」的能力來提高工作效率。傳統服務台不再具備為混合員工提供 24/7 即時協助的規模或速度。服務台通常平均需要三個工作天才能解決員工問題,從而降低了參與度和工作效率。為了解決這些問題,2022 年 7 月,塔塔諮詢服務公司 (TCS) 宣布與 MoveWorks 建立合作夥伴關係。該人工智慧平台透過隨時查詢員工的需求,提供無縫的多語言支援。此類措施預計將提振數位轉型的需求,並有助於後 COVID-19 場景下的市場成長。

人工智慧市場趨勢

擴大採用雲端基礎的應用程式和服務來推動市場成長

- 雲端基礎的解決方案是當今數位環境的重要組成部分。多重雲端營運的成長趨勢以及對雲端基礎的智慧服務不斷成長的需求正在推動所研究市場的需求。現代人工智慧(AI)技術正在為雲端處理付加獨特的價值並不斷提升其價值。方面對於提高整體製程可行性和採用新技術是必要的。

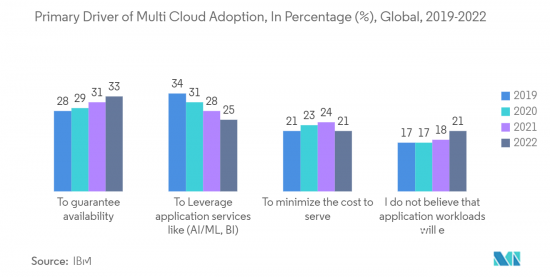

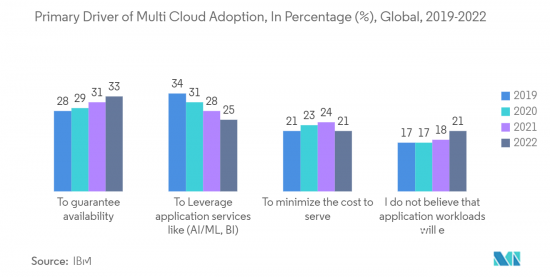

- 人工智慧軟體還可以幫助彌合雲端處理和最新突破之間的差距。它還有助於滿足新企業和新興企業的需求。據 IBM 稱,到 2022 年,25% 的受訪者將使用多重雲端來利用各種應用服務,包括 AI/ML、巨量資料分析、商業智慧和物聯網。

- 持續營運和基礎設施需求正在推動對混合運算模型的需求,這些模型可實現長期成本節約、安全性和可擴展性。為了擴展和管理 IT,企業擴大投資於跨越私有、公有和邊緣環境的混合雲端部署模式。例如,2023年2月,Oracle宣布將在沙烏地阿拉伯建立第三個公共雲端,以滿足快速成長的雲端服務需求。位於利雅德的新雲端區域是Oracle 15 億美元投資計畫的一部分,該計畫旨在增強其在該國的雲端基礎設施能力。

- 分析先驅 SAS 與 Moro Hub 合作,利用 Moro Hub 領先的雲端服務為杜拜企業提供基於人工智慧的解決方案,並加速其數位轉型之旅。 2022 年 7 月,SAS 宣布與 Moro Hub 合作,Moro Hub 是杜拜水電局數位部門 Digital Dewa 的一個部門。作為新安排的一部分,SAS 將在單一平台上採用 Moro Hub 的多種雲端服務,使其資料管理產品更加敏捷、擴充性和安全。

- 此外,由於擴充性、提高生產力和降低成本等優勢,雲端方法在金融服務、電子商務和工業等各個行業中越來越受歡迎。

- 雲端運算在外包 3D 原型、組件和產品的 3D 列印等應用中的使用正在迅速擴大。 3D 列印製造商的新平台也在推動雲端擴展。金屬和碳纖維 3D 列印機製造商 Markforged 最近發布了工業 3D 列印軟體平台 Digital Forge。該平台旨在連接目前全球運作的數千個 Markforged 系統。

北美佔最大市場佔有率

- 美國擁有來自世界各地的頂尖科學家和企業家,擁有加速北美人工智慧(AI)發展的著名研究中心,以及聯邦政府對最尖端科技的戰略投資。支持性創新生態系統。

- 該產業預計將受益於美國政府多項與人工智慧相關的舉措。例如,2022年12月,美國國家科學基金會宣布,美國農業部(USDA)、美國國防安全保障部科技局(US DHSTD)、美國國家標準與技術研究院(NIST)、美國國家標準技術研究院(美國)美國食品與農業研究所 (NIFA) 與美國國防部 (US DoD) 研究與技術副部長辦公室合作啟動了「透過第二部分進行能力建設和擴展人工智慧創新」計劃。透過能力建構計劃以及 NSF主導的國家人工智慧研究機構生態系統內的合作,ExpandAIseeks 將增加為人工智慧教育、研究和勞動力發展領域服務於代表性不足群體的機構的參與度。我們的目標是顯著增加這一點。

- 此外,美國正在努力正式製定國家人工智慧(AI)舉措,該計劃將促進可信賴的人工智慧、加強人工智慧創新、利用新技術加強現有基礎設施、透過人工智慧改善教育和培訓,重點是六大戰略支柱:開發新的機會,加速人工智慧在私營和聯邦部門的使用,以改善現有系統,並培育支持人工智慧進一步發展的全球環境。

- 此外,2022年4月,美國商務部和國家標準研究院(NIST)將開展首次國家人工智慧諮詢,任務是就如何推進國家人工智慧管治工作向拜登政府提供建議。 (NAIAC)已宣布。

- 此外,公共和私營部門參與多個行業人工智慧技術的開發和使用預計將支持加拿大對人工智慧不斷成長的需求。例如,2022 年 4 月,一家總部位於渥太華的公司透過人工智慧驅動的類人會議助理提高了虛擬會議的效率。 Uncanny Lab Ltd. 的 Blue Cap 技術改善了主持人和嘉賓的會議。該公司整合的音訊會議平台包括 Google Meets 和 Zoom。自動會議錄音、回顧影片和簡潔的會議摘要是會議助理的一些基本功能。

- 由於加拿大頂尖的研究人員、充滿活力的新興企業、開放的移民規則、慷慨的研發稅收補貼以及進入國際市場的機會,像Google、Facebook 和Uber 這樣的大公司在加拿大大量營運。我們建立了核心實驗室,與世界上的機構。加拿大政府透過加拿大高等研究院 (CIFAR) 正在資助多項舉措,以展示加拿大在人工智慧領域的領導地位。

人工智慧產業概況

人工智慧市場高度分散,主要參與者包括 IBM 公司、英特爾公司、微軟公司、Google有限責任公司(Alphabet Inc.)和亞馬遜網路服務公司等。市場參與者正在採取合作夥伴關係、創新、併購和收購等策略來增強產品供應並獲得永續的競爭優勢。

2022 年 7 月 NBFC 主要 HDFC 週二宣布與領先的客戶關係管理 (CRM) 平台銷售團隊建立合作夥伴關係,以支持其發展重點。 HDFC 表示,Mulesoft 創新的 API主導整合方法和低程式碼整合功能透過連接系統實現快速創新,協助創造新體驗。

2022 年 7 月,SAS 和 Basserah 合作,為沙烏地阿拉伯的企業提供尖端的資料分析和人工智慧解決方案。透過這種合作關係,兩家公司都專注於資料和機器人流程自動化,以便在沙烏地阿拉伯王國尋求成長機會。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 機器學習

- 電腦視覺

- 自然語言處理(NLP)

- 上下文感知計算和其他技術

第5章市場動態

- 市場促進因素

- 對預測分析解決方案的需求不斷成長

- 由於技術進步,資料生成顯著增加

- 擴大採用雲端基礎的應用程式和服務

- 改善消費者體驗的需求不斷成長

- 市場挑戰

- 對高初始成本和勞動替代的擔憂

- 缺乏熟練的人工智慧工程師

- 資料隱私問題

- 主要使用案例/應用

- 銷售和行銷

- 物流管理

- 自動化客戶服務

- 威脅情報自動化

- IT自動化等

- COVID-19 對市場的影響

第6章市場區隔

- 按成分

- 硬體

- 軟體和服務

- 按最終用戶產業

- BFSI

- 時尚/零售

- 醫療保健/生命科學

- 製造業

- 車

- 航太/國防

- 建造

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Google LLC(Alphabet Inc.)

- Amazon Web Services Inc.(amazon.com Inc.)

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Cisco Systems Inc.

- Siemens AG

- Nvidia Corporation

- Hewlett Packard Enterprise

第8章投資分析

第9章 市場機會及未來趨勢

The artificial intelligence market is expected to register a CAGR of 31.22% during the forecast period.

Key Highlights

- Artificial intelligence (AI), particularly computer vision and machine learning (ML), is transforming the landscape of industries. The artificial intelligence market is expanding globally due to breakthroughs in deep learning and data-driven AI, and the necessity to acquire robotic autonomy to compete in a global market is projected to promote the adoption of AI products and services.

- In recent years, the growing use of digital technologies and the Internet considerably aided the expansion of the worldwide AI industry. Technology breakthroughs in a variety of industries are constantly being fueled by the large research and development investments made by tech giants.

- The expansion of predictive analytics solutions based on AI-based ML technology is expected to boost the artificial intelligence market over the forecast period. Many end-user firms are using predictive modeling worldwide for industry planning and growth.

- With increased Internet penetration and new technology, there is a tremendous increase in the amount of data created globally. AI is being encouraged by technologies such as the Internet of Things, Industry 4.0, 5G, and others. Big data is the outcome of a massive increase in data created due to technological breakthroughs.

- COVID-19 significantly impacted the market. While certain industries witnessed an increase in AI adoption, others witnessed a decline. The Covid-19 debacle provided critical insights about digital transformation for company executives. One of the most compelling takeaways was the potential that data analytics and AI bring to a business.

- For example, AI enables the public sector to bring processes, people, and services online and encourages local, regional, and national governments to adopt AI. In only a few months, governments throughout the globe have learned to employ artificial intelligence as a weapon in combating the virus. This includes educating the public and screening patients to track and trace contacts.

- Employees need rapid assistance to be productive with the move to "work from anywhere," whether they have an IT problem, an HR request, or a question regarding the company's expenditure policy. Due to a lack of size or speed, traditional service desks can no longer provide round-the-clock assistance in real time to a hybrid workforce. Service desks often resolve employee issues in an average of three working days, which lowers engagement and productivity. To address these problems, in July 2022, Tata Consultancy Services (TCS) announced a partnership with Moveworks. This AI platform offers employees seamless multilingual support by querying their needs at any moment. Such initiatives are projected to boost the demand for digital transformation and help market growth in the post-COVID-19 scenario.

Artificial Intelligence Market Trends

Growth in Adoption of Cloud-based Applications and Services Drives the Market Growth

- Cloud-based solutions are an essential component of today's digital environment. The expanding trend of multi-cloud operation and the growing need for cloud-based intelligence services drive the demand in the market under study. The latest artificial intelligence (AI) technologies add unique and increased value to cloud computing. This aspect improves overall process viability and is necessary for incorporating new technology.

- AI software can also help bridge the gap between cloud computing and modern breakthroughs. It also assists in satisfying the needs of new enterprises and startups. According to IBM, In 2022, 25 percent of respondents said they were using multi-cloud to leverage different application services like AI/ML, big data analytics, business intelligence, IoT, etc.

- The continuous operations and infrastructure requirement raises the demand for hybrid computing models to reduce long-term costs, security, and scalability. To extend and manage IT, investment in hybrid public cloud deployment models that span private, public, and edge environments has flourished. For example, in February 2023, Oracle announced it would establish a third public cloud in Saudi Arabia to address the fast-expanding demand for its cloud services. The new cloud region, located in Riyadh, is part of Oracle's projected USD 1.5 billion investment to increase cloud infrastructure capabilities in the country.

- SAS, a pioneer in analytics, entered into an arrangement with Moro Hub to leverage Moro Hub's superior cloud services to strengthen its AI-based solutions for businesses in Dubai and accelerate its journey toward digital transformation. SAS announced cooperation with Moro Hub, a branch of Dubai Electricity and Water Authority's digital arm, Digital Dewa, in July 2022 to accomplish this. As part of the new arrangement, SAS will employ Moro Hub's multiple cloud services on a single platform to increase its data management products' agility, scalability, and security.

- Furthermore, due to its benefits, such as scalability, increased productivity, and cost reduction, the cloud method is gaining popularity in a variety of industries, such as financial services, e-commerce, industrial, and others.

- The use of cloud computing to power applications, such as 3D printing for outsourcing 3D prototypes, components, and products, is rapidly expanding. New platforms from 3D printing makers are also assisting cloud expansion. Markforged, a metal and carbon fiber 3D printer maker, recently introduced Digital Forge, an industrial 3D printing software platform. The platform is intended to connect all of the Markforged systems now in operation worldwide, which number in the thousands.

North America Holds Largest Market Share

- The United States has a robust innovation ecosystem supported by strategic federal investments in cutting-edge technology, in addition to the presence of forward-thinking scientists and entrepreneurs who come together from around the world and renowned research centers that have accelerated the development of artificial intelligence (AI) in the North American region.

- The industry is anticipated to benefit from many US government initiatives related to AI. For instance, the Expanding AI Innovation through Capacity Building and Part II program was launched by the US National Science Foundation in December 2022 in coordination with the US Department of Agriculture (USDA), the US Department of Homeland Security, the Science and Technology Directorate (US DHSTD), the National Institute of Standards and Technology (NIST), National Institute of Food and Agriculture (NIFA), and the US Department of Defense (US DoD), Office of the Under Secretary of Defense for Research and Engineering. Through capacity-building projects and collaboration within the NSF-led National AI Research Institutes ecosystem, ExpandAIseeks to significantly increase the participation of institutions that serve underrepresented groups in artificial intelligence education, research, and workforce development.

- Moreover, the United States has been working to formalize the National Artificial Intelligence (AI) Initiative, which concentrates on six strategic pillars: advancing trustworthy AI, enhancing AI innovation, enhancing current infrastructure through new technologies, developing new opportunities for education and training through AI, facilitating private and federal sector utilization of AI to improve current systems, and fostering an international environment that supports further advancements in AI.

- Further, in April 2022, the US Department of Commerce and the National Institute on Standards (NIST) announced members of the inaugural National Artificial Intelligence Advisory Committee (NAIAC) tasked with advising the Biden administration on how to proceed with the national AI governance efforts.

- The inclusion of the public and private sectors in the development and use of AI technology across several industries is also anticipated to support Canada's expanding need for AI. For example, in April 2022, an Ottawa-based business enhanced the effectiveness of virtual meetings with its AI-powered, human-like meeting assistant. Uncanny Lab Ltd.'s bluecap technology improves meetings for hosts and guests. Platforms for teleconferencing that the firm integrates with include Google Meets and Zoom. Automatic meeting transcriptions, review films, and succinct meeting summaries are among its fundamental capabilities that serve as a meeting assistant.

- Major corporations like Google, Facebook, and Uber have established core research laboratories that work with numerous institutions all over Canada thanks to the country's top researchers, vibrant start-ups, open immigration rules, considerable tax subsidies for R&D, and access to international markets. The Canadian government finances several initiatives to demonstrate Canada's leadership in AI through the Canadian Institute for Advanced Research (CIFAR).

Artificial Intelligence Industry Overview

The artificial intelligence market is highly fragmented, with the presence of major players like IBM Corporation, Intel Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), and Amazon Web Services Inc. Players in the market are adopting strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In July 2022, NBFC-giant HDFC on Tuesday announced its partnership with the leading customer relationship management (CRM) platform, Salesforce, to support its growth priorities. HDFC stated that Mulesoft's innovative API-led integration approach and low code integration capabilities would help the company innovate quickly around connecting systems and help create new experiences.

In July 2022, SAS and Basserah partnered to deliver leading data analytics and AI solutions to Saudi businesses. With this partnership, both companies are focusing on data and robotics process automation for growth opportunities in the Kingdom of Saudi Arabia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.3.1 Machine Learning

- 4.3.2 Computer Vision

- 4.3.3 Natural Language Processing (NLP)

- 4.3.4 Context-aware Computing and Other Technologies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Predictive Analytics Solutions

- 5.1.2 Massive Growth in Data Generation due to Technological Advancements

- 5.1.3 Growth in Adoption of Cloud-based Applications and Services

- 5.1.4 Rising Demand for Enhanced Consumer Experience

- 5.2 Market Challenges

- 5.2.1 High Initial Costs and Concerns over Replacement of Human Workforce

- 5.2.2 Lack of Skilled and Expert AI Technicians

- 5.2.3 Concerns Regarding Data Privacy

- 5.3 Key Use-cases/Applications

- 5.3.1 Sales and Marketing

- 5.3.2 Logistics Management

- 5.3.3 Automated Customer Service

- 5.3.4 Automated Threat Intelligence

- 5.3.5 IT Automation, Among Others

- 5.4 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Components

- 6.1.1 Hardware

- 6.1.2 Software and Services

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 Fashion and Retail

- 6.2.3 Healthcare and Lifesciences

- 6.2.4 Manufacturing

- 6.2.5 Automotive

- 6.2.6 Aerospace and Defense

- 6.2.7 Construction

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Intel Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Google LLC (Alphabet Inc.)

- 7.1.5 Amazon Web Services Inc. (amazon.com Inc.)

- 7.1.6 Oracle Corporation

- 7.1.7 Salesforce Inc.

- 7.1.8 SAP SE

- 7.1.9 SAS Institute Inc.

- 7.1.10 Cisco Systems Inc.

- 7.1.11 Siemens AG

- 7.1.12 Nvidia Corporation

- 7.1.13 Hewlett Packard Enterprise