|

市場調查報告書

商品編碼

1641922

互聯農業-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Connected Agriculture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

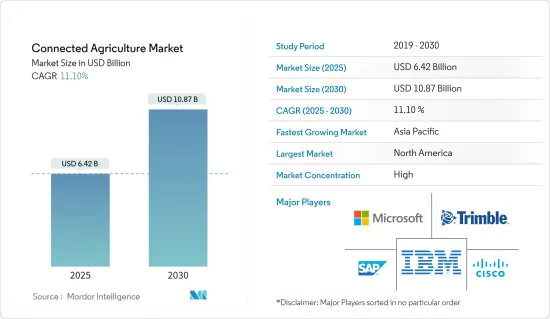

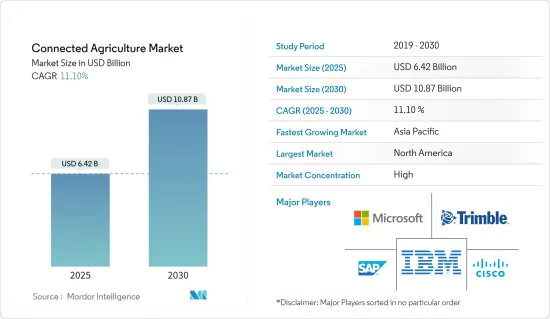

2025 年互聯農業市場規模預估為 64.2 億美元,預計到 2030 年將達到 108.7 億美元,預測期內(2025-2030 年)的複合年成長率為 11.1%。

對先進農業技術的需求可以最佳化作物產量,同時最大限度地減少水、肥料和種子等資源的消耗,這是推動互聯農業市場成長的關鍵因素。透過實施各種相互關聯的農業技術,農民和企業可以更有效地管理農業時間,同時使用更少的資源。

關鍵亮點

- 農業水資源管理對於提高農業產量、降低成本和促進環境穩定至關重要。農業相關人員關注水資源短缺問題並致力於加強農業用水管理。互動式農業水資源管理解決方案結合了物聯網 (IoT)、行動應用程式、巨量資料分析和決策支援系統,有助於為不斷成長的人口生產環保且最佳的農產品。

- 互聯農業使農民能夠最大限度地利用作物,同時減少傳統耕作方法帶來的成本和勞動力。互聯農業將使農民能夠以專業的方式投資正確的時間和資源組合,以更準確地評估最佳播種密度、估算肥料並預測作物產量。農民現在依賴最新的農業進步,例如使用行動電話和其他連網設備。低功耗廣域網路 (LPWA)、Zigbee、WiFi 等先進的連接通訊以及新的無線感測器技術正在幫助農民管理各種農業任務,包括採購物資、管理庫存以及及時播種和收穫,並協助規劃和執行。

- 資料收集是精密農業的第一階段,因此也是研究最多的階段。這主要透過確定土壤肥力(從田地、多邊形或區域獲取一個樣本)來實現。這些區域是利用航空和衛星影像分類的,並以多年拍攝的同一作物的產量地圖和照片為基礎。這樣做最終是為了提高產量。一公頃多邊形網格是最常用的土壤測試方法。這個網格維度足以了解該場的變化以及其中發生的情況。最後,根據土壤掃描結果,建立精準施肥和施用石灰的任務圖。

- 人們對連網農場技術缺乏了解,而且安裝成本過高。這些是預期時限內該技術的限制。世界各地的農民大多都是小規模農民,買不起如此昂貴的設備。這項技術需要農民有熟練的技術和知識,需要大量的前期投資和有效的農具,而且農民不願意使用這項技術來收集資訊。由於成本較高,它只適合大型工業化農場。

- 新冠疫情引發了人們對人工智慧(AI)應用的更多關注。人工智慧和機器學習模型將即時使用資料來產生見解,例如何時播種、選擇哪種作物以及選擇哪種雜交品種以獲得更高的產量。精密農業通常被稱為有助於提高收穫的整體品質和準確性的人工智慧系統。人工智慧技術有助於檢測農場中的害蟲、植物疾病和營養缺陷。人工智慧(AI)感測器可以在決定使用哪種除草劑之前識別並瞄準雜草。

互聯農業市場趨勢

從應用角度來看,智慧灌溉預計將實現顯著成長。

- 分析顯示,智慧灌溉應用在預測期內將顯著成長。智慧水管理的應用日益廣泛,進一步擴大了互聯農業在智慧灌溉中的應用,智慧水資源管理是解決水資源管理挑戰的一個組成部分。智慧系統在水資源管理的潛在應用非常廣泛,包括水質、水量和高效灌溉的解決方案。

- 此外,聯合國的一份報告稱,到 2025 年,水資源短缺可能直接影響近 20% 的人類,並間接影響地球上其他居民。智慧水系統是物聯網、巨量資料和人工智慧技術的結合,可以幫助挫敗這些預測並扭轉因不合理使用水資源而造成的損害。

- 此外,智慧灌溉也為重大社會挑戰提供了解決方案,例如支持全球糧食安全和節約水資源。大規模農民對灌溉先進技術和即時資料存取的認知不斷提高,這是智慧灌溉領域互聯農業解決方案和服務的一些應用。這些發展將進一步促進該領域的成長。

- 根據國際能源總署預測,到2040年需要取水總量將達到4.35兆立方公尺。近幾十年來,水消費量的成長是人口成長的兩倍多。龐大的水資源消耗和取用將為智慧灌溉領域的互聯農業解決方案和服務應用創造機會。

亞太地區將經歷最高成長

- 根據分析,由於市場供應商數量的眾多、新時代農業科技新興企業的出現以及先進技術在農業領域的應用不斷增加,預測期內亞太地區的互聯農業市場將顯著成長。此外,該地區政府還推出了多項措施支持智慧農業,預計將在未來幾年為市場供應商提供成長機會。

- 日本的農業生產成本高於其他國家,原因是化肥、農機等農業投入成本較高。根據日本農林水產省統計,去年日本主要農產品米的種植總投入成本平均為每60公斤9180日圓。其中13%為化肥成本,其餘32%為農業機械及其安裝成本。因此,減少肥料浪費和降低機械成本的聯網農業的進步可能會極大地造福日本農民。

- 此外,菲律賓農業部 (DA) 正在評估無人機改變種子種植、施肥和施用農藥以及作物監測方式的潛力。此外,日本農林水產省也設定目標,到2022年將日本約一半的稻米、小麥和大豆種植區引進農業無人機。

- 在印度,馬哈拉斯特拉邦拉邦政府在 2022 年 10 月批准使用無人機噴灑農藥後尚未制定任何政策。國家行政部門正在等待明確的答复,然後核准對中心核准的無人機購買計劃的補貼。無人機正被推廣為解決勞動力危機和提高農業機械化程度的一種方式。國際農藥公司先正達週一表示,其兩種殺菌劑配方已獲得負責監管噴灑的中央農藥委員會的批准,可使用無人機噴灑。

互聯農業行業概況

隨著多家參與企業的加入,互聯農業市場也不斷整合。市場參與企業正在採用產品創新、併購等策略來擴大產品系列、增加其地理覆蓋範圍,並主要為了保持市場競爭力。

2023 年 1 月,阿斯頓大學將透過知識轉移夥伴關係(KTP) 與工程公司 Solagen Technologies (SGT) 和內羅畢大學合作,利用太陽能和風力發電全年灌溉肯亞的土地。提高作物產量。 SGT 是肯亞最大的能源、水和灌溉解決方案和服務提供者。我們與非政府組織、政府和人民合作,為東非農村和受衝突影響地區的社區提供客製化的能源、水和糧食安全解決方案。

2022 年 11 月 Trimble Agriculture 和 xFarm Technologies 今天宣布了新的合作。 Trimble 是精密農業技術領域的全球參與企業,現在透過與科技公司 xFarm Technologies 開發的 xFarm 應用程式的整合,能夠為農民提供更有價值、更有效率的解決方案。 xFarm Technologies 利用其數位平台支援和簡化 100 多個國家/地區 170 萬公頃土地上的 12 萬個農場的工作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 產業價值鏈分析

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- BYOD(自帶無人機)在互聯農業中的出現

- 智慧水資源管理系統需求激增

- 市場限制

- 互聯農業的深度學習曲線

第6章 市場細分

- 按組件

- 解決方案

- 網管

- 農業資產管理

- 監督管理

- 服務

- 解決方案

- 按應用

- 智慧物流

- 智慧灌溉

- 農業規劃與管理

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- IBM Corporation

- SAP SE

- Trimble Navigation Ltd

- Microsoft Corporation

- Vodafone Group PLC

- Accenture PLC

- SWIIM System

- Orange Business Services

- Link Labs LLC

第8章投資分析

第9章 市場機會與未來趨勢

The Connected Agriculture Market size is estimated at USD 6.42 billion in 2025, and is expected to reach USD 10.87 billion by 2030, at a CAGR of 11.1% during the forecast period (2025-2030).

The demand for advanced agricultural techniques to optimize crop yields while using the least amount of resources, such as water, fertilizer, and seeds, is the key factor driving the growth of the connected agriculture market. Farmers and businesses will be able to manage their time more effectively on the farm while using fewer resources by putting various linked agricultural technologies into practice.

Key Highlights

- Water management in agriculture is critical for increasing agricultural yields while decreasing costs and contributing to environmental stability. Agriculture officials are concerned about water scarcity and are working to enhance agricultural water management. Water management solutions in linked agriculture, which incorporate the Internet of Things (IoT), mobile applications, Big Data analytics, and decision support systems, are assisting in the production of environmentally friendly and optimum agricultural outputs for a growing population.

- Connected agriculture enables farmers to maximize crop cultivation while reducing expenses and effort associated with traditional agricultural methods. Connected agriculture boosts production by allowing farmers to expertly invest time and resources in the right combination to more precisely evaluate optimum sowing density, estimate fertilizers, and predict crop yields. Farmers currently rely on the most recent agricultural advancements, such as the usage of cell phones and other linked equipment. Sophisticated connected technologies such as low power wide area (LPWA), Zigbee, WiFi, and new wireless sensor technologies aid farmers in the planning and execution of various agricultural operations such as purchasing supplies, inventory control, timely planting and harvesting, and so on.

- Data collection is the first stage of precision agriculture and, thus, the most researched. This is accomplished mostly through the determination of soil fertility (one sample from the field, a polygon, or a zone). Zones are created using aerial or satellite imagery and are based on yield maps or photographs of the same crop over numerous years. It is done to boost yields eventually. A one-hectare polygon grid is the most often used soil testing method. This grid dimension is adequate for understanding the field's variability and what is going on in it. Finally, based on the soil scan, task maps are created for precise fertilizer and liming applications.

- There is a lack of understanding of connected farm technology, and installation is prohibitively expensive. These are the technology's constraints over the anticipated timeframe. The majority of farmers worldwide are small-scale farmers who cannot afford such costly equipment. This technique necessitates competent and knowledgeable farmers, large initial investments, and effective farming instruments, making farmers unwilling to gather information from it. Because of its high cost, it is only suitable for large and industrialized farms.

- The COVID-19 pandemic brought attention to using artificial intelligence (AI). Data is used in real-time by artificial intelligence and machine learning models to get insightful knowledge, such as when to plant seeds, which crops to choose, which hybrid seeds to select for higher yields, and other things. Precision agriculture, often known as artificial intelligence systems, is assisting in enhancing the overall quality and accuracy of harvests. AI technology aids in the detection of pests, plant diseases, and undernutrition in farms. Artificial intelligence (AI) sensors can identify and target weeds before deciding which herbicide to use.

Connected Agriculture Market Trends

By Application, Smart Irrigation is Analyzed to Witness Substantial Growth

- The smart irrigation application is analyzed to witness significant growth over the forecast period. The application of connected agriculture in smart irrigation is further amplified by the growing use of Smart water management, which is an integral part of the solution for water management challenges. The potential application of smart systems in water management is vast and includes solutions for water quality, water quantity, and efficient irrigation.

- Moeover, water scarcity may directly affect nearly 20% of the human population by 2025, UN reports state, and indirectly influence the rest of the planet's inhabitants. Smart water systems based on the combination of the IoT, big data, and AI technologies may help stop these predictions and undo the damage the imprudent usage of water resources has already caused.

- Further, Smart irrigation provides solutions to society's critical challenges, such as supporting global food security and protecting water resources. Rising awareness regarding advanced technologies in irrigation and real-time data access to farms among large-scale farmers are some of the applications of connected agriculture solutions and services in the smart irrigation landscape. Such developments further foster the growth of the segment.

- According to IEA, by 2040, it is predicted that the total amount of water that will need to be withdrawn will be 4,350 billion cubic meters. The increase in water consumption in recent decades has outpaced population growth by a factor of two. Such huge water consumption and withdrawal would create an opportunity for connected agriculture solutions and services application in smart irrigation.

Asia Pacific to Witness the Highest Growth

- The Asia Pacific region is analyzed to witness significant growth in the connected agriculture market over the forecast period, owing to presence of significant number of market vendors, emergence of new age agri-tech startups coupled with growing use of advanced technologies in farming. In addition, various government initiatives to support smart agriculture in the region is analyzed to create growth opportunities for market vendors in the coming years.

- Japan's agricultural production expenses are high in comparison to other countries, owing to the high cost of agricultural inputs such as fertilizers and agricultural gear. According to the Ministry of Agriculture, Forestry, and Fisheries, rice cultivation, Japan's principal agricultural commodity, costs, on average, JPY 9,180 in total input costs for every 60kg of rice produced last year. Fertilizer expenditures account for 13% of this total, with agricultural machinery and implementation accounting for the remaining 32%. As a result, advancements in connected agriculture that reduce fertilizer waste or lower machinery costs will tremendously benefit Japanese farmers.

- Further, the Department of Agriculture (DA) in the Philippines is evaluating the potential of drones to change the way seeds are planted, the way fertilizers and pesticides are applied, and the way crops are monitored. Moreover, the Ministry of Japan set a goal to introduce agricultural drones for about half of the land planted with rice, wheat, and soy across Japan by 2022.

- In India, the Maharashtra government has yet to develop a policy following the Center's clearance of the use of drones to spray pesticides in October 2022. Before approving subsidies under the Center-approved drone purchase program, the state administration is awaiting clarifications. Drones are being promoted as a way to combat the labor crisis and advance agricultural mechanization. International agrochemical company Syngenta said on Monday that two of its fungicide formulations had been given the go-ahead for drone spraying by the central pesticide board, the organization in charge of spraying regulations.

Connected Agriculture Industry Overview

The connected agriculture market is consolidated owing to the presence of multiple players. The players in the market are adopting strategies like product innovation, mergers, and acquisitions in order to expand their product portfolio and expand their geographic reach and primarily to stay competitive in the market.

In January 2023, through a Knowledge Transfer Partnership (KTP), Aston University collaborated with engineering firm Solargen Technologies (SGT) and the University of Nairobi to develop a smart irrigation system that uses solar and wind energy to provide year-round watering of land and improve crop production in Kenya. SGT is Kenya's largest provider of energy, water, and irrigation solutions and services. They collaborate with non-governmental organizations, governments, and people to provide customized energy, water, and food security solutions to communities in rural and conflict-affected areas of Eastern Africa.

In November 2022, Trimble Agriculture and xFarm Technologies today announced a new collaboration. Trimble, the global player in precision farming technology, can now provide farmers with more valuable and efficient solutions through integration with the xFarm app developed by tech company xFarm Technologies, which uses its digital platform to support and simplify the work of 120,000 farms spread across 1.7 million hectares in over 100 countries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.3.1 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of BYOD (Bring Your Own Drone) in Connected Agriculture

- 5.1.2 Upsurge in Demand for Smart Water Management Systems

- 5.2 Market Restraints

- 5.2.1 Steep Learning Curve Regarding Connected Agriculture

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.1.1 Network Management

- 6.1.1.2 Agriculture Asset Management

- 6.1.1.3 Supervisory Control

- 6.1.2 Service

- 6.1.1 Solution

- 6.2 By Application

- 6.2.1 Smart Logistics

- 6.2.2 Smart Irrigation

- 6.2.3 Farming Planning and Management

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 IBM Corporation

- 7.1.3 SAP SE

- 7.1.4 Trimble Navigation Ltd

- 7.1.5 Microsoft Corporation

- 7.1.6 Vodafone Group PLC

- 7.1.7 Accenture PLC

- 7.1.8 SWIIM System

- 7.1.9 Orange Business Services

- 7.1.10 Link Labs LLC