|

市場調查報告書

商品編碼

1850046

汽車網路安全:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Cybersecurity For Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

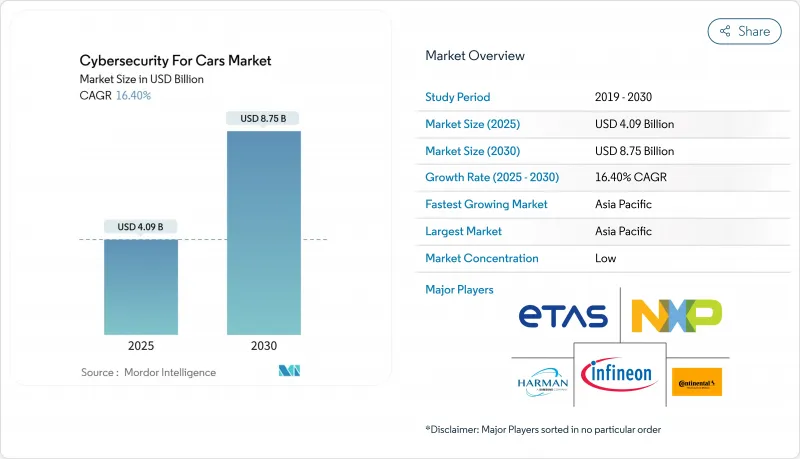

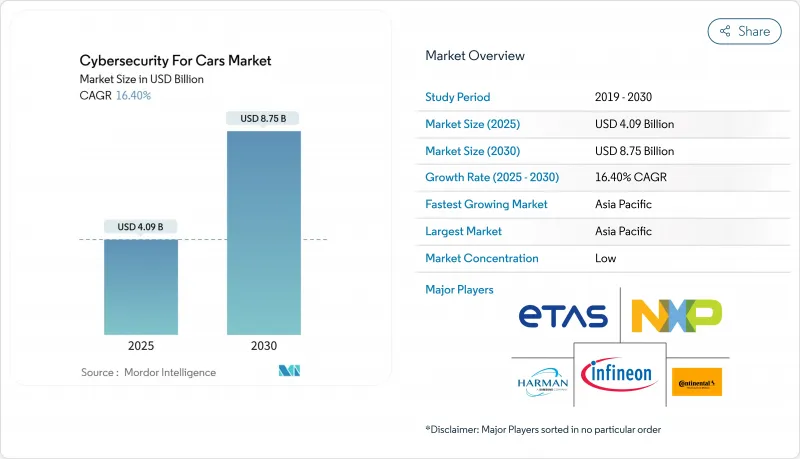

據估計,汽車網路安全市場規模將在 2025 年達到 40.9 億美元,到 2030 年達到 87.5 億美元,在預測期(2025-2030 年)內複合年成長率將達到 16.40%。

汽車的快速數位化、日益嚴格的監管審查以及5G/V2X技術的廣泛部署正在重塑競爭策略,並開闢新的服務主導收入來源。製造商正競相在UNECE R155/R156審核前完成網路安全管理系統的認證,而隨著軟體定義車輛對持續保護的需求不斷成長,雲端原生安全平台也日益受到青睞。同時,電動車的普及、雙向充電以及配備豐富感測器的ADAS功能的出現,正在擴大攻擊面,吸引那些承諾提供即時威脅情報和自動化回應的專業解決方案供應商。原始設備製造商(OEM)也在尋求透過空中下載安全更新和基於使用量的保險計劃來實現盈利,這些計劃獎勵經過認證的網路安全加固措施,從而部分抵消高昂的整合成本。

全球汽車網路安全市場趨勢與洞察

更嚴格的監管將推動根本變革。

全球認證的關鍵在於證明端到端的安全性。光是聯合國歐洲經濟委員會R155一項標準,到2030年就將創造21億美元的合規機會,因為原始設備製造商(OEM)必須證明他們能夠追蹤69種攻擊途徑,並在車輛的整個生命週期內持續監控這些途徑。 ISO/SAE 21434標準將網路安全工程硬性納入概念設計和退役階段,促使汽車製造商擴充其專業團隊。類似的規則正在日本和美國湧現,從而消除先發劣勢,並建立全球標準化的基準。

聯網汽車的興起擴大了攻擊面

現代車輛最多可搭載 150 個電子控制單元 (ECU) 和 1 億行代碼,到 2030 年這一數字可能會成長三倍,這將給傳統防禦系統帶來巨大壓力。後端伺服器已佔安全事件的 43%,95% 的攻擊源自遠端。基於 5G 的車聯網 (V2X) 通訊增加了一個高頻寬的攻擊途徑,揭露了遠端資訊處理閘道器,而針對經銷商 IT 系統的勒索軟體攻擊則凸顯了車輛邊界之外的供應鏈漏洞。

傳統架構整合成本阻礙了其廣泛應用。

在傳統平台上改裝超過150個ECU可能會使車輛開發預算增加15%至20%。大陸集團2022年的違規行為暴露了其供應商網路,並迫使其進行代價高昂的架構改造。這種財務拖累會減緩大眾市場品牌的上市速度,即便合規期限將近。

細分市場分析

到了2024年,以軟體為基礎的平台將佔總收入的41.2%,凸顯其在軟體定義汽車時代的核心地位。在這個時代,嵌入式防火牆、安全韌體和運行時入侵偵測正在融合。同時,差距分析、威脅建模、審核準備等工作外包給專家顧問,主導服務預計將以19.8%的複合年成長率成長。汽車網路安全市場越來越青睞那些能夠將持續監控與UNECE R155文件支援結合的供應商,例如哈曼的端對端WP.29軟體套件。

當硬體安全模組、PKI 套件和雲端 SOC 平台必須在緊迫的開發時間內實現互通時,專業服務還能協調多供應商整合。這種跨學科的協調使服務提供者成為合規藍圖的關鍵安全隔離網閘,並將收入轉向定期評估和託管檢測合約。因此,汽車網路安全市場正在出現包含服務保留條款的合作關係,以幫助軟體授權人確保終身利潤。

到2024年,端點防禦仍將維持30.1%的市場佔有率,因為加密金鑰、安全啟動和ECU級防火牆仍然是基礎。然而,隨著汽車製造商將資料湖、OTA編配和車隊分析等功能遷移到雲端,雲端防禦將以21.3%的複合年成長率領先。在Upstream與Google雲端等合作專案的推動下,雲端保護在汽車網路安全市場的規模正逐季成長。 2024年大眾汽車資料外洩事件的教訓表明,遙測資料加密不足會導致連鎖聲譽損害。

網路層分段和TLS v1.3升級與雲端運算的快速發展相輔相成,而隨著汽車每週下載微服務,以應用為中心的安全加固變得至關重要。無線安全是保護5G鏈路的最後一公里,這些鏈路支撐著車隊編組和V2I信令通訊。隨著虛擬ECU將任務卸載到邊緣,結合車載安全措施和遠端AI輔助分析的混合架構正在為汽車網路安全市場建立新的藍圖。

汽車網路安全市場按解決方案類型(軟體解決方案、硬體解決方案及其他)、安全類型(網路安全、應用安全及其他)、車輛類型(乘用車、輕型商用車及其他)、應用領域(資訊娛樂、遠端資訊處理、連網互通及其他)、模式(車載模式、外部雲端服務)和地區進行細分。市場預測以美元計價。

區域分析

預計到2024年,亞太地區汽車網路安全市場營收將成長35.6%,複合年成長率達20.2%,成為該市場成長最快的地區。中國互聯電動車產量的擴張正在推動對支援V2G功能的PKI和ECU加固套件的大規模採購。韓國的5G網路建設推動了對即時空中修補技術的需求,而印度新興的出口雄心則推動了對ISO 21434合規工具的投資。這些趨勢正促使該地區的供應商提供託管在資料居住合規區域內的低延遲雲端SOC服務。

北美是一個日趨成熟但仍在不斷發展的市場,高階汽車和健全的保險生態系統正在推動網路安全的商業化。美國的連網汽車法規將於2025年3月生效,這將迫使汽車製造商對其供應鏈進行審核,確保零件符合規定,並轉向採購國產晶片組和安全模組。加拿大的一級供應商正利用其接近性和監管一致性來整合安全的乙太網路骨幹網,而墨西哥的組裝廠則正在採用託管安全服務來應對針對即時物流的勒索軟體攻擊。

歐洲仍然是監管趨勢的領導者和研發中心。德國擁有博世ETAS和大陸集團等主要供應商,後者先前曾遭遇安全漏洞,凸顯了其集中式架構的脆弱性。法國和英國正將公共津貼用於量子安全汽車密碼技術,而ENX VCS審核框架則以ISO 21434為基礎,實現了供應商評估的標準化。東歐的工程中心為企業提供了具有競爭力的人才,但與戰爭相關的網路制裁正在重塑籌資策略。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 監管要求(UNECE R155/R156、ISO 21434)合規性浪潮

- 聯網汽車快速成長及5G/V2X部署

- ADAS/自動駕駛功能的普及增加了網路風險

- 車網互動(V2G)充電創造了一個新的攻擊面

- 與認證網路安全加固措施一致的基於使用量的保險折扣

- 軟體定義汽車中 OTA 安全更新的 OEM 獲利模式

- 市場限制

- 高昂的整合成本和傳統的電子電氣架構

- 標準碎片化和認證超負荷

- 汽車業網路安全人才嚴重短缺

- 對長壽命車輛保固期後責任的擔憂

- 產業價值鏈分析

- 監管環境

- 技術展望

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 影響市場的宏觀經濟因素

第5章 市場規模與成長預測

- 按解決方案類型

- 基於軟體

- 基於硬體

- 專業服務

- 一體化

- 其他解決方案

- 按安全類型

- 網路安全

- 應用程式安全

- 雲端安全

- 端點安全

- 無線安全

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 大型商用車輛

- 電動車(純電動車/油電混合車/插電式油電混合車)

- 透過使用

- 資訊娛樂

- 車載資訊系統和連接

- 動力傳動系統/推進控制

- ADAS及安全性

- 充電基礎設施和V2G

- 依表單類型

- 車載(嵌入式)

- 外部雲端服務

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 新加坡

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Continental AG

- Harman International(Samsung)

- Bosch ETAS GmbH

- Infineon Technologies AG

- NXP Semiconductors NV

- Cisco Systems Inc.

- DENSO Corporation

- Visteon Corporation

- Delphi Technologies plc

- Honeywell International Inc.

- Argus Cyber Security Ltd.

- Karamba Security Ltd.

- Arilou Technologies Ltd.

- Escrypt GmbH

- Secunet Security Networks AG

- Upstream Security Ltd.

- VicOne Inc.(Trend Micro)

- GuardKnox Cyber-Technologies Ltd.

- BlackBerry QNX

- SafeRide Technologies Ltd.

- Cybellum Technologies Ltd.

- Trillium Secure Inc.

- Vector Informatik GmbH

- Comsec Automotive Ltd.

- GuardSquare NV

- AutoCrypt Co. Ltd.

第7章 市場機會與未來趨勢

The Cybersecurity For Cars Market size is estimated at USD 4.09 billion in 2025, and is expected to reach USD 8.75 billion by 2030, at a CAGR of 16.40% during the forecast period (2025-2030).

Rapid vehicle digitalization, growing regulatory scrutiny, and wider 5G/V2X roll-outs are reshaping competitive strategies and opening new service-led revenue pools. Manufacturers race to certify Cybersecurity Management Systems before UNECE R155/R156 audits, while cloud-native security platforms gain traction as software-defined vehicles demand continuous protection. Simultaneously, electric-vehicle adoption, bidirectional charging, and sensor-rich ADAS features multiply the attack surface, attracting specialized solution vendors that promise real-time threat intelligence and automated response. OEMs also eye monetization of over-the-air security updates and usage-based insurance programs that reward certified cyber-hardening, partially offsetting high integration costs.

Global Cybersecurity For Cars Market Trends and Insights

Regulatory mandates drive fundamental change

Global homologation now hinges on demonstrating end-to-end security. UNECE R155 alone creates a USD 2.1 billion compliance opportunity by 2030 as OEMs must track 69 attack vectors and prove continuous monitoring throughout vehicle lifecycles. ISO/SAE 21434 hardcodes cybersecurity engineering into concept and decommission phases, prompting carmakers to expand specialist teams. Similar rules emerge in Japan and the United States, eliminating first-mover disadvantages and standardizing baselines worldwide.

Connected-vehicle fleet expansion multiplies attack surfaces

Modern cars host up to 150 ECUs and 100 million lines of code-volumes that could triple by 2030, stressing legacy defenses. Backend servers already account for 43% of incidents, and 95% of attacks originate remotely. 5G-based V2X exchanges add high-bandwidth vectors exposing telematics gateways, while ransomware targeting dealership IT highlights supply-chain vulnerabilities beyond the vehicle perimeter.

Legacy architecture integration costs constrain adoption

Retrofitting 150-plus ECUs in legacy platforms can add 15-20% to vehicle development budgets. Continental's 2022 breach illustrated supplier-network exposure and forced expensive architecture reviews. Such financial drag delays roll-outs among volume brands, even as compliance deadlines loom.

Other drivers and restraints analyzed in the detailed report include:

- ADAS proliferation elevates safety-critical risks

- Vehicle-to-Grid integration creates bidirectional pathways

- Automotive cybersecurity talent shortage limits execution

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software-based platforms held 41.2% of 2024 revenue, underscoring their centrality in a software-defined vehicle era where embedded firewalls, secure firmware, and runtime intrusion detection converge. Consulting-led offerings, however, are on a 19.8% CAGR ascent as OEMs outsource gap analyses, threat modeling, and audit preparation to specialist advisors. The cybersecurity for cars market increasingly rewards vendors capable of bundling continuous monitoring with UNECE R155 documentation support, a capability visible in HARMAN's end-to-end WP.29 packages.

Professional services also orchestrate multi-vendor integration when hardware security modules, PKI suites, and cloud SOC platforms must interoperate inside tight development timelines. Such cross-domain coordination positions service providers as primary gatekeepers of compliance roadmaps, shifting revenue toward recurring assessment and managed-detection contracts. Consequently, the cybersecurity for cars market is witnessing alliances where software licensors embed service retainer clauses to secure lifetime margins.

Endpoint controls retained a 30.1% share in 2024 because cryptographic keys, secure boot, and ECU-level firewalls remain foundational. Yet cloud defenses are racing ahead at 21.3% CAGR as automakers shift data lakes, OTA orchestration, and fleet analytics off-board. The cybersecurity for cars market size for cloud protection is swelling each quarter, buoyed by collaborations such as Upstream's tie-up with Google Cloud. Incident lessons from the 2024 Volkswagen data breach showed that insufficient encryption of telemetry can cascade into reputational damage.

Network-layer segmentation and TLS v1.3 upgrades ride parallel with cloud growth, while application-centric hardening becomes imperative as vehicles download microservices weekly. Wireless security remains the final mile, guarding 5G links that now underpin platooning and V2I signalling. As virtual ECUs offload tasks to the edge, hybrid architectures combining in-vehicle enforcement with remote AI-assisted analytics form the emerging blueprint across the cybersecurity for cars market.

Cybersecurity for Cars Market is Segmented by Solution Type (Software-Based, Hardware-Based, and More), Security Type (Network Security, Application Security, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Application (Infotainment, Telematics and Connectivity, and More), Form Type (In-Vehicle and External Cloud Services), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 35.6% revenue in 2024 and is projected to grow at 20.2% CAGR, making it the fastest-advancing geography within the cybersecurity for cars market. China's scaling of connected-EV production fuels large-scale procurement of V2G-ready PKI and ECU hardening suites, while Japan's early alignment with UNECE rules accelerates supplier certification programs. South Korea's 5G highways amplify demand for real-time over-the-air patching technologies, and India's emergent export ambitions trigger investments in ISO 21434 compliance tooling. Collectively, these dynamics push regional vendors to deliver low-latency cloud SOC services hosted within data-residency-compliant zones.

North America represents a mature yet evolving arena where premium vehicle trims and robust insurance ecosystems encourage cybersecurity monetization. The United States Connected Vehicles Rule, effective March 2025, forces OEMs to audit supply chains for sanctioned components, redirecting procurement toward domestic chipsets and security modules. Canada's tier-one suppliers leverage proximity and regulatory alignment to integrate secure Ethernet backbones, while Mexico's assembly plants adopt managed-security services to counter rising ransomware aimed at just-in-time logistics.

Europe remains a regulatory trendsetter and R&D hub. Germany hosts flagship suppliers such as Bosch ETAS and Continental, although the latter's prior breach highlighted vulnerabilities in centralized architecture. France and the United Kingdom channel public grants into quantum-safe automotive cryptography, while the ENX VCS audit framework overlays ISO 21434 to standardize supplier assessments. Eastern European engineering hubs contribute competitive talent, though war-related cyber sanctions reshape sourcing strategies.

- Continental AG

- Harman International (Samsung)

- Bosch ETAS GmbH

- Infineon Technologies AG

- NXP Semiconductors NV

- Cisco Systems Inc.

- DENSO Corporation

- Visteon Corporation

- Delphi Technologies plc

- Honeywell International Inc.

- Argus Cyber Security Ltd.

- Karamba Security Ltd.

- Arilou Technologies Ltd.

- Escrypt GmbH

- Secunet Security Networks AG

- Upstream Security Ltd.

- VicOne Inc. (Trend Micro)

- GuardKnox Cyber-Technologies Ltd.

- BlackBerry QNX

- SafeRide Technologies Ltd.

- Cybellum Technologies Ltd.

- Trillium Secure Inc.

- Vector Informatik GmbH

- Comsec Automotive Ltd.

- GuardSquare NV

- AutoCrypt Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory mandates (UNECE R155/R156, ISO 21434) compliance wave

- 4.2.2 Rapid growth in connected-vehicle fleet and 5G/V2X roll-outs

- 4.2.3 ADAS/autonomous feature proliferation elevating cyber-risk

- 4.2.4 Vehicle-to-Grid (V2G) bidirectional charging introduces new attack surface

- 4.2.5 Usage-based-insurance discounts tied to certified cyber-hardening

- 4.2.6 OEM monetisation of OTA security updates in software-defined cars

- 4.3 Market Restraints

- 4.3.1 High integration cost and legacy E/E architectures

- 4.3.2 Fragmented standards and certification overload

- 4.3.3 Acute shortage of automotive-grade cyber-talent

- 4.3.4 Post-warranty liability concerns for long-life vehicles

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Solution Type

- 5.1.1 Software-Based

- 5.1.2 Hardware-Based

- 5.1.3 Professional Services

- 5.1.4 Integration

- 5.1.5 Other Solutions

- 5.2 By Security Type

- 5.2.1 Network Security

- 5.2.2 Application Security

- 5.2.3 Cloud Security

- 5.2.4 Endpoint Security

- 5.2.5 Wireless Security

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.3.4 Electric Vehicles (BEV/HEV/PHEV)

- 5.4 By Application

- 5.4.1 Infotainment

- 5.4.2 Telematics and Connectivity

- 5.4.3 Powertrain/Propulsion Control

- 5.4.4 ADAS and Safety

- 5.4.5 Charging Infrastructure and V2G

- 5.5 By Form Type

- 5.5.1 In-Vehicle (Embedded)

- 5.5.2 External Cloud Services

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 Harman International (Samsung)

- 6.4.3 Bosch ETAS GmbH

- 6.4.4 Infineon Technologies AG

- 6.4.5 NXP Semiconductors NV

- 6.4.6 Cisco Systems Inc.

- 6.4.7 DENSO Corporation

- 6.4.8 Visteon Corporation

- 6.4.9 Delphi Technologies plc

- 6.4.10 Honeywell International Inc.

- 6.4.11 Argus Cyber Security Ltd.

- 6.4.12 Karamba Security Ltd.

- 6.4.13 Arilou Technologies Ltd.

- 6.4.14 Escrypt GmbH

- 6.4.15 Secunet Security Networks AG

- 6.4.16 Upstream Security Ltd.

- 6.4.17 VicOne Inc. (Trend Micro)

- 6.4.18 GuardKnox Cyber-Technologies Ltd.

- 6.4.19 BlackBerry QNX

- 6.4.20 SafeRide Technologies Ltd.

- 6.4.21 Cybellum Technologies Ltd.

- 6.4.22 Trillium Secure Inc.

- 6.4.23 Vector Informatik GmbH

- 6.4.24 Comsec Automotive Ltd.

- 6.4.25 GuardSquare NV

- 6.4.26 AutoCrypt Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment