|

市場調查報告書

商品編碼

1641980

持續交付:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Continuous Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

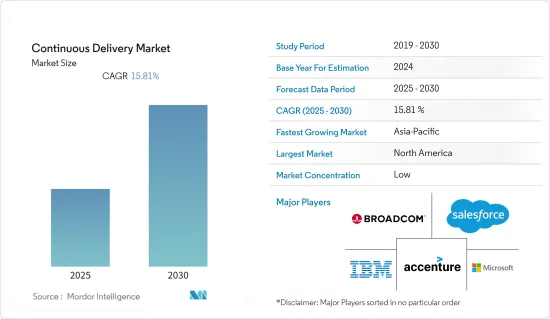

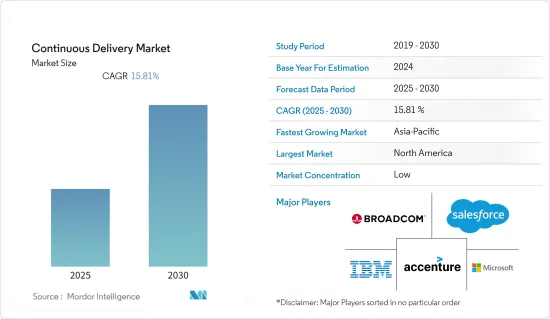

預測期內,持續交付市場預計將以 15.81% 的複合年成長率成長。

據美國軟體開發公司 Perforce Software, Inc. 稱,65% 的經理、軟體開發人員和高階主管報告稱,他們的組織已經開始使用持續交付。

主要亮點

- 持續交付市場正在迅速擴張,主要受人工智慧 (AI) 和機器學習 (ML) 成長的推動。隨著互聯基礎設施的快速部署和數位設備自主性的不斷提高,人工智慧/機器學習技術正在改變軟體開發過程。這些技術可以實現自我複製系統、自動化測試、預測部署結果、改進發布計劃並提供智慧監控和警報。

- 此外,敏捷開發方法也越來越受到支持,因為它們能夠更快、更靈活地交付軟體。持續交付非常符合敏捷原則,以小增量而不是定期的大規模發布來更新軟體。據澳洲軟體公司 Atlassian Corporation 稱,美國至少有 71% 的組織採用敏捷方法。此外,敏捷舉措的成功率為 64%,而瀑布計劃的成功率為 49%。敏捷計劃的成功率比瀑布計劃高出 1.5 倍。

- 雲端處理和基礎設施即程式碼的日益普及使得基礎設施管理擴充性和適應性。持續交付使公司能夠使用雲端平台和基礎設施即程式碼工具在雲端配置中快速部署和管理應用程式。持續交付 CI/CD 管道是一種自動化流程,使公司和組織能夠快速可靠地建置、測試和部署軟體。雲端基礎設施為運行這些流程提供了一個靈活、可擴展的平台,使企業能夠適應不斷變化的需求並最佳化資源使用。這些工具透過多種重要方式幫助組織實現更高的業務敏捷性:

- 然而,開放原始碼持續交付計劃和工具將主導商業持續交付工具領域,並推動服務持續交付市場的成長。持續交付市場正在幫助公司和企業改變其提供服務的方式,並以更高的準確性、成本節約和生產力來經營業務。它還會產生大量有用的資訊,幫助您做出更好、更快的決策。這些資訊可以最佳化當前流程和操作,或預測何時、何地以及如何最好地提供產品和服務。

- 然而,由於公司不願意接受改變並將新技術融入現有流程和工具鏈中,持續的市場擴張可能需要改進。許多企業需要支援以採用全自動化技術來使用 DevOps 和持續交付解決方案。

持續交付市場趨勢

雲端技術在持續交付市場的應用日益廣泛

- 在雲端上實施持續交付工具可提供高度的擴充性、靈活性以及以定義的權限共用的能力。那些建立持續交付工具的人正在抓住機會搶佔市場佔有率。

- 持續交付工具提供 DevOps 功能,讓團隊在雲端的一個地方協作、開發、測試、部署和管理軟體。這使得最終用戶可以訪問雲端上的任何內容並建立新的應用程式。

- 隨著大多數企業將資料轉移到雲端,各行各業正在開發雲端基礎的解決方案並釋放市場機會。預計這將推動未來幾年的市場成長。

- 谷歌宣布推出 Cloud Build,這是一個完全託管的持續交付和整合平台,可協助企業快速大規模地建置、測試和部署軟體。此外,企業對雲端處理的投資不斷增加,預計這將在未來幾年推動市場成長。

- 例如,今年亞馬遜公司的雲端處理部門亞馬遜網路服務(AWS)宣布了在印度進行重大投資的計畫。該公司今年計劃投資金額1.6 兆印度盧比(130 億美元)。印度對雲端服務的需求不斷成長,推動了大規模投資。此項投資將主要用於擴大和加強 AWS 在全國範圍內的雲端基礎設施。

- 公共雲端使業務能夠根據市場變化更快、更有效地適應和運作。該技術變得更容易使用。現在,我們可以用以前從未想像過的方式創造極具吸引力的消費者體驗。

- 雲端運算的採用促使人們和組織改變其行為,並使某些業務線能夠透過克服技術限制來完成工作。雲端趨勢將影響組織如何規劃投資、如何做出數位業務決策、如何選擇供應商以及他們選擇什麼技術。

- 持續交付市場的一個突出趨勢是發布管理、規劃和發布自動化工具,這些工具使 DevOps 應用程式和工具能夠促進軟體部署到公共雲端雲和私有雲端。例如,發布自動化工具可以讓員工輕鬆設定部署配置模板,從而節省時間。

北美佔據主要市場佔有率

- 由於美國是雲端基礎技術和物聯網的早期採用者,預計北美的需求將成長最高。然而,提高靈活性、敏捷性和實施新應用程式的能力等好處至關重要。

- 此外,北美的企業正在採用雲端基礎的應用程式,估計美國35% 的中小型企業已經採用雲端解決方案。北美正在掀起一股併購熱潮,以利用這個機會。例如,Steltix 與 Autodeploy 合作,將其持續部署和交付軟體套件推向歐洲市場。

- 機器學習 (ML)、人工智慧 (AI)、預測分析和規範分析等新技術的興起,以及這些新技術與持續交付模型、規則、自學、資料和推理引擎的整合,您的組織將能夠運行得更順暢。

- 這些投資的主要驅動力是新技術的不斷發展,以利用以前被認為是非商業性的數量。由於這些投資,零售、醫療保健、通訊和製造應用預計將在北美佔據相當大的市場佔有率。

持續交付行業概覽

持續交付市場是分散的。隨著新技術的採用,許多參與者透過技術創新和市場發展進入市場,加劇了市場競爭。主要參與者包括 IBM 公司、微軟公司、埃森哲公司、Salesforce Inc.、Wipro Limited、CA Technologies(博通公司)、XebiaLabs(DIGITAL.AI)、Electric Cloud Inc.(CloudBees Inc.)和 Red Hat Inc.。 Atlassian 等

2024 年 5 月 Octopus Deploy 是公認的持續交付 (CD) 行業標準,它宣布了旨在簡化大型企業 Kubernetes CD 的功能。透過引入新的 Kubernetes 代理、容器鏡像和 Helm 的外部饋送觸發器,Octopus Deploy 可以輕鬆地大規模部署到 Kubernetes,從而無需複雜且昂貴的持續整合 (CI) 腳本。

2024 年 3 月,CircleCI 透過引入發布編配功能增強了其 CI/CD 平台,使開發人員能夠更好地控制其應用程式部署。此附加功能使開發團隊能夠將其程式碼的特定子集部署到生產中,並立即收到有關程式碼執行情況的回饋。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 整個業務流程自動化的需求不斷增加

- 雲端技術的採用日益廣泛

- 市場限制

- 維護資料安全和隱私

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場區隔

- 依部署類型

- 雲

- 本地

- 按組織規模

- 大型企業

- 中小企業

- 按最終用戶產業

- BFSI

- 通訊和 IT

- 零售和消費品

- 醫療保健和生命科學

- 製造業

- 政府和國防

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- XebiaLabs(DIGITAL.AI)

- Broadcom Inc.(CA Technologie)

- IBM Corporation(Red Hata Inc.)

- Electric Cloud Inc.(CloudBees Inc.)

- Atlassian Corporation PLC

- Microsoft Corporation

- Accenture PLC

- Wipro Limited

- Salesforce Inc.

- Flexagon LLC

- Clarive Software Inc.

第7章投資分析

第 8 章:市場的未來

The Continuous Delivery Market is expected to register a CAGR of 15.81% during the forecast period.

According to Perforce Software, Inc., an American software developer, 65% of managers, software developers, and executives report that their organizations have started using continuous delivery.

Key Highlights

- The market for continuous delivery is expanding rapidly, owing primarily to the growth of artificial intelligence (AI) and machine learning (ML). AI/ML-powered technologies are transforming the software development process due to the rapid deployment of connected infrastructure and the rising autonomy of digital devices. These technologies enable self-regeneration systems, automate testing, forecast deployment results, improve release schedules, and provide smart monitoring and alarms.

- Moreover, Agile development approaches have grown in favor due to their ability to deliver software more quickly and flexibly. Continuous delivery aligns well with Agile principles, giving the software minor incremental updates rather than significant, periodic releases. According to Atlassian Corporation, an Australian software company, at least 71% of United States organizations use Agile. Further, Agile initiatives have a 64% success rate, while waterfall projects have a 49% success rate. Agile projects are 1.5X more successful than waterfall projects.

- The rising adoption of cloud computing and Infrastructure as Code has improved scaling and adaptability in infrastructure management. Continuous delivery swiftly allows enterprises to deploy and manage their applications in cloud configurations with cloud platforms and Infrastructure as Code tools. Continuous delivery CI/CD pipelines are automated processes enabling businesses and organizations to build, test, and deploy software quickly and reliably. Cloud infrastructure provides a flexible and scalable platform for running these processes, allowing companies to adapt to changing demands and optimize resource usage. These tools help organizations achieve greater business agility in several vital ways.

- However, open-source continuous delivery projects and tools are set to dominate the commercial straight delivery tools segment, driving the growth of the service steady delivery market. The constant delivery market helps businesses or enterprises change how they deliver services and run their businesses to be more accurate, save money, and be more productive. Also, it creates a lot of helpful information that helps people make better and faster decisions. This information can optimize current processes and operations or predict when, where, and how to offer the best products and services.

- However, the continuous market expansion may need to be improved due to businesses' reluctance to embrace change and integrate new technologies into their existing processes and toolchains. Many companies require support in adopting completely automated techniques for using DevOps and continuous delivery solutions.

Continuous Delivery Market Trends

Increasing Adoption of Cloud Technology in the Continuous Delivery Market

- Implementing continuous delivery tools on the cloud provides high scalability, flexibility, and sharing capabilities with defined authority. The people who make constant delivery tools are taking advantage of the chance to get a piece of the market.

- Continuous delivery tools provide DevOps capabilities that allow teams to collaborate, develop, test, deploy, and manage software on the cloud in one place. This helps end users access everything and build new applications on the cloud.

- Most companies are moving their data to the cloud, so industry players are developing cloud-based solutions to exploit the market opportunity. This is likely to boost market growth over the next few years.

- Google announced Cloud Build, which helps fully manage continuous delivery and integration platforms, helping build, test, and deploy software quickly and at scale. Also, companies are investing in cloud computing, which is expected to help the market grow over the next few years.

- For instance, in the current year, Amazon Web Services (AWS), a cloud computing division of Amazon.com Inc., has announced a significant investment plan for India. The company intends to invest a staggering INR 1.06 trillion (USD 13 billion) in the current year. The increasing demand for cloud services in India drives substantial financial commitment. The investment will primarily focus on expanding and strengthening AWS's cloud infrastructure nationwide.

- With the public cloud, businesses can make changes and run their operations more quickly and effectively in response to changes in the market. It improves the user-friendliness of technology. It has made building incredibly engaging consumer experiences in previously unthinkable ways possible.

- Due to cloud adoption, people and organizations have modified their behavior, and several business lines have gotten things done by getting past technological restrictions. Cloud trends affect how organizations plan to invest, how they make decisions about their digital businesses, how they choose vendors, and what technologies they choose.

- One of the prominent trends in the continuous delivery market is release management, planning, and release automation tools, which make it easier for DevOps applications and tools to deploy software to public or private clouds. Release automation tools, for example, can save time by making it easy for the staff to set up templates for deployment configurations.

North America to Occupy Significant Market Share

- The North American region is projected to have the most significant growth in demand due to the early adoption of cloud-based technologies and IoT by the United States. However, advantages such as increased flexibility and agility and the ability to implement new applications are essential.

- Additionally, companies are adopting cloud-based applications in the North American region, and it was estimated that nearly 35% of SMBs in the United States have already deployed cloud solutions. There have been a series of mergers, collaborations, and acquisitions in North America to take advantage of this opportunity. Steltix, for example, has collaborated with Autodeploy to bring a continuous deployment and delivery software suite to European markets.

- The rise of new technologies like machine learning (ML), artificial intelligence (AI), and predictive and prescriptive analytics, and integrating these new technologies with continuous delivery models, rules, self-learning, data sets, and inference engines will help organizations run more smoothly.

- The primary driver behind these investments has been the continuous evolution of new technologies to utilize previously considered non-commercial volumes. With these investments, North America's retail, healthcare, communications, and manufacturing applications are expected to hold a significant market share.

Continuous Delivery Industry Overview

The continuous delivery market is fragmented. With the adoption of new technologies, many players are entering the market with innovation and development, making the market competitive. Some of the key players include IBM Corporation, Microsoft Corporation, Accenture PLC, Salesforce Inc., Wipro Limited, CA Technologies (Broadcom Company), XebiaLabs (DIGITAL.AI), Electric Cloud Inc. (CloudBees Inc.), Red Hat Inc., and Atlassian, among others.

May 2024: Octopus Deploy, recognized as the industry standard for Continuous Delivery (CD), has unveiled features aimed at streamlining Kubernetes CD for large enterprises. With the introduction of a new Kubernetes agent and external feed triggers for container images and Helm, Octopus Deploy facilitates large-scale deployments to Kubernetes, doing away with the necessity for intricate and costly continuous integration (CI) scripts.

March 2024: CircleCI enhanced its CI/CD platform by introducing a release orchestration feature, empowering developers with greater control over application deployments. This addition allows development teams to deploy a specific subset of code to a live production environment, enabling them to receive immediate feedback on the code's performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand For Automation Across Business Processes

- 4.2.2 Increasing Adoption Of Cloud Technology

- 4.3 Market Restraints

- 4.3.1 Maintaining Data Security And Privacy

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 impact on the industry

5 MARKET SEGMENTATION

- 5.1 Deployment Type

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium-sized Enterprises

- 5.3 End User Industry

- 5.3.1 BFSI

- 5.3.2 Telecom and IT

- 5.3.3 Retail and Consumer Goods

- 5.3.4 Healthcare and Life Sciences

- 5.3.5 Manufacturing

- 5.3.6 Government and Defense

- 5.3.7 Other End User Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 XebiaLabs (DIGITAL.AI)

- 6.1.2 Broadcom Inc. (CA Technologie)

- 6.1.3 IBM Corporation (Red Hata Inc.)

- 6.1.4 Electric Cloud Inc. (CloudBees Inc.)

- 6.1.5 Atlassian Corporation PLC

- 6.1.6 Microsoft Corporation

- 6.1.7 Accenture PLC

- 6.1.8 Wipro Limited

- 6.1.9 Salesforce Inc.

- 6.1.10 Flexagon LLC

- 6.1.11 Clarive Software Inc.