|

市場調查報告書

商品編碼

1687756

驅蟲劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Insect Repellent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

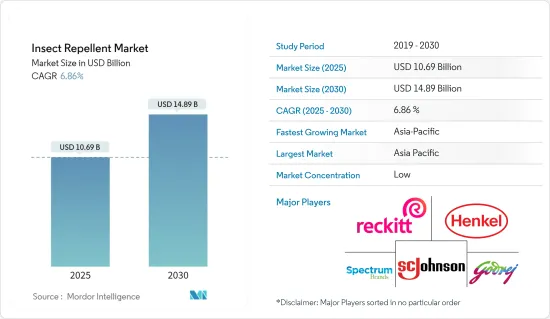

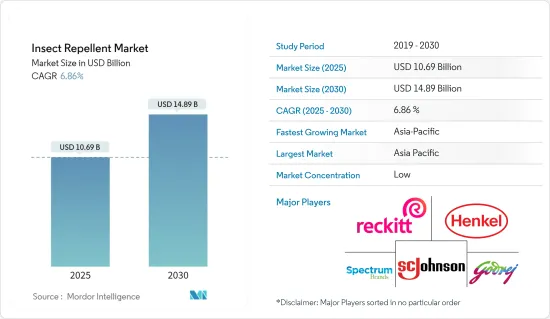

驅蟲劑市場規模預計在 2025 年為 106.9 億美元,預計到 2030 年將達到 148.9 億美元,預測期內(2025-2030 年)的複合年成長率為 6.86%。

預計預測期內,登革熱、瘧疾、基孔肯雅病、茲卡病毒和黃熱病等疾病威脅的加劇將增加對驅蟲劑的需求。政府加強疾病控制力度、人們健康意識增強以及驅蟲產品價格合理是推動全球驅蟲劑需求的主要因素。此外,驅蟲劑的價格分佈廣泛,使得許多消費者更容易獲得和負擔得起。採用天然成分驅蟲劑的人數正在增加。越來越多的消費者開始使用這類驅蟲劑,以避免皮疹和過敏等問題。

製造商推出了各種產品來減少驅蟲劑中避蚊胺的有害影響,預計這將在預測期內顯著促進驅蟲劑市場的成長。例如,2023年7月,Flora-scent Organics推出了一款創新驅蚊香。根據該公司介紹,這些熏香是由天然有機植物油混合物製成的,這種植物油以驅蟲特性而聞名,但不含香茅油。隨著這些化學驅蟲劑造成的健康危害增加,消費者的偏好開始轉向草藥驅蟲劑。現在,世界已開發地區的人們已經開始使用以印度楝為基礎的噴霧劑、乳霜、油、香茅油、樺樹皮和其他植物成分。該市場的主要企業包括 Dabur International、Reckitt Benckiser Group PLC、Godrej Consumer Products Limited、SC Johnson &Son Inc.、Jyothy Laboratories、Spectrum Brand Holdings Inc. 和 Genesis Group。市場上的公司正在採用新產品發布、協議、合作夥伴關係和收購等策略來在市場上站穩腳跟。

驅蟲劑市場趨勢

產品創新激增推動市場

驅蟲劑產品的創新源於對更有效、更持久、更易於使用的解決方案的需求,以及對更安全、更環保的選擇日益成長的需求。因此,製造商不斷改進驅蟲劑配方,以提高功效和安全性。這包括開發新的活性成分,如派卡瑞丁、IR3535和檸檬桉油(OLE),以及最佳化現有成分,如避蚊胺和Permethrin。例如,2023 年 5 月,消費品創新者 Grand Tongo 宣布推出 Town & Jungle Protection 驅蟲噴霧。該品牌聲稱,新系列推出了一種以避蚊胺為基礎的驅蟲劑,可以取代避蚊胺並驅趕蟲子。此外,該品牌表示,派卡瑞丁是一種溫和、不油膩、幾乎無味的活性成分,對於那些尋求有效防護而又不想有傳統避蚊胺驅蟲劑弊端的人來說,它是理想的選擇。

此外,消費者對天然和植物來源的驅蟲劑的需求日益成長,因為它們是合成化學品的更安全、更環保的替代品。採用植物抽取物、精油和草藥配製的創新產品可以有效防蟲,同時吸引環保意識的消費者。為了應對這種情況,製造商正在開發使用生物分解性成分和永續採購產品以減少對環境影響的驅蟲劑。例如,莊臣旗下公司 STEM 於 2022 年 6 月推出了創新的新型蟲害防治產品系列,包括 STEM Bug Spray 和 STEM Bug 擦拭巾。據該品牌聲明,STEM 驅蟲噴霧採用特殊配製的精油混合物製成,可驅蚊。此外,STEM驅蟲擦拭巾採用植物來源活性成分,適合兒童(6個月及以上)驅蚊。這種多功能性使這些擦拭巾成為個人使用或露營的理想選擇,可提供全面的驅蟲功效。

亞太地區對驅蟲劑的需求不斷增加

中國是亞太地區人口最多的國家,其消費者的可支配收入較高,意識不斷增強,生活水準不斷提高,導致驅蟲劑的使用率增加。所有這些因素結合起來會提高產品銷售。此外,蒼蠅、白蟻、臭蟲、螞蟻和蟑螂等家居昆蟲在中國也很常見。噴霧劑、蒸發器、粉筆和粉末等易於使用的驅蚊劑的使用,導致這些產品在中國家庭中的銷售量激增。

在印度,隨著健康意識和興趣的不斷增強,以及家庭收入的提高和驅蟲產品的普及,驅蟲劑正逐漸進入家庭。此外,各種廣告宣傳、政府措施和新產品創新也在推動市場研究。例如,2023年5月,利潔時家用驅蟲品牌Mortein與DENTSU CREATIVE India合作,在印度巴雷利發起了一項抗擊瘧疾的新舉措「Suraksha Ka Teeka」。發起這項宣傳計畫的目的是教育消費者透過使用「teeka」的日常做法來預防媒介傳播感染疾病。

此外,印度推出的「清潔印度」運動等各種項目提高了人們對衛生和清潔的重視,進一步促進了市場的成長。例如,蚊媒瘧疾的發生率已大大降低。卷狀驅蟲劑是該地區最受歡迎的產品,因為它們具有成本效益並且在所有零售通路均有銷售。便利商店等線下通路在亞太國家農村地區頗受歡迎。

驅蟲劑產業概況

由於全球和地區參與者眾多,驅蟲劑市場高度停滯且競爭激烈。市場的主要參與者包括 Spectrum Brands Inc.、Henkel AG &Co.KGaA、Reckitt Benckiser Group PLC、SC Johnson &Son Inc.、Godrej Group 等。 Godrej Consumer Products 是市場領導者,擁有廣泛的產品系列、全球影響力和持續的動力。在研究期間,該公司專注於產品創新,開發了四種創新產品並擴大產品系列和全球影響力。另一家市場領導(SC Johnson & Son) 在所研究的市場中也享受著銷售量的成長,這得益於消費者對包括所有產品類型(如避蚊胺產品以及天然和有機驅蟲劑)在內的更廣泛產品的偏好日益成長。因此,為了進一步鞏固市場地位,該公司正在大力投資擴大其旗艦產品的生產規模。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 產品創新激增

- 政府舉措不斷增加、市場主體大力推動

- 市場限制

- 使用驅蟲劑的安全問題

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 產品類型

- 身體驅蟲劑(乳霜、乳液、油)

- 其他驅蟲劑

- 線圈

- 液體蒸發器

- 噴霧/氣霧劑

- 餌

- 其他驅蟲劑

- 銷售管道

- 線下零售店

- 網路零售商

- 類別

- 天然驅蟲劑

- 傳統驅蟲劑

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 德國

- 西班牙

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 主要企業策略

- 市場佔有率分析

- 公司簡介

- Spectrum Brands Holdings Inc.

- Henkel AG & Co. KGaA

- Newell Brands Inc.

- Enesis Group

- SC Johnson & Son Inc.

- Quantum Health

- Reckitt Benckiser Group PLC

- Jyothy Labs Limited

- Dabur India Ltd

- Sawyer Products Inc.

- Kao Corporation

第7章 市場機會與未來趨勢

The Insect Repellent Market size is estimated at USD 10.69 billion in 2025, and is expected to reach USD 14.89 billion by 2030, at a CAGR of 6.86% during the forecast period (2025-2030).

The growing threat of diseases, such as dengue, malaria, chikungunya, Zika virus, and yellow fever, is expected to boost the demand for insect repellents during the forecast period. Government initiatives being increasingly undertaken for disease control, rising health awareness among people, and the affordable costs of these products are among the major factors propelling the demand for insect repellents across the world. Also, the wide range of insect repellents in different price ranges has made them more easily accessible and affordable for a large consumer base. There has been a rise in the adoption of insect repellents based on natural ingredients. The adoption of such insect repellents is increasing among consumers to avoid problems such as skin rashes and allergies, among others.

Manufacturers are coming up with various products that are reducing the harmful effects of repellents due to the content of DEET in them, which, in turn, is anticipated to boost the insect repellent market's growth significantly during the forecast period. For instance, in July 2023, Flora-scent Organics launched an innovative mosquito-repellent incense stick. As per the company, it is an all-natural product made using a blend of organic plant oils that are well-known for their insect-repellent qualities, but it contains no citronella. With the growing incidences of health hazards caused by such chemical-based insect repellents, consumer preferences have begun to switch toward herbal-based insect repellents. Presently, people in developed regions worldwide have started using neem-based sprays, creams, oils, citronella oil, birch tree bark, and other plant-based ingredients. Key players in the market include Dabur International, Reckitt Benckiser Group PLC, Godrej Consumer Products Limited, SC Johnson & Son Inc., Jyothy Laboratories, Spectrum Brand Holdings Inc., and Genesis Group. The players operating in the market have been adopting strategies, such as new product launches, agreements, collaborations, and acquisitions, to gain a stronger foothold in the market.

Insect Repellent Market Trends

Surge in Product Innovations Propelling the Market

Product innovation in insect repellents has been driven by the need for more effective, long-lasting, and user-friendly solutions, as well as increasing demand for safer and more environmentally friendly options. As a result, manufacturers are continually refining and improving the formulation of insect repellents to enhance their efficacy and safety. This includes the development of new active ingredients, such as picaridin, IR3535, and oil of lemon eucalyptus (OLE), as well as the optimization of existing ingredients like DEET and permethrin. For instance, in May 2023, Grand Tongo, an innovator in consumer products, unveiled the launch of Town & Jungle Protection insect repellent. As per the brand's claim, this new collection featured a DEET alternative, a picaridin-based insect repellent that repels bugs. In addition, the brand stated that picaridin is an active ingredient that is gentle on the skin, non-greasy, and virtually odorless, making it an ideal choice for those who want effective protection without the drawbacks associated with traditional DEET-based repellents.

Furthermore, there is growing consumer demand for insect repellents made from natural and plant-based ingredients, perceived as safer and more environmentally friendly alternatives to synthetic chemicals. Innovations in botanical extracts, essential oils, and herbal formulations offer effective protection against insects while appealing to eco-conscious consumers. In response, manufacturers are developing insect repellents with reduced environmental impact, using biodegradable ingredients and sustainable sourcing practices. For instance, in June 2022, STEM, owned by S.C. Johnson, introduced an innovative new line of pest control products, including STEM Bug Repellent Spray and STEM Bug Repellent Wipes. According to the brand's statement, the STEM Bug Repellent Spray is crafted with an essential oil blend specifically formulated to deter mosquitoes. Furthermore, the brand affirms that the STEM Bug Repellent Wipes utilize plant-derived active components and are suitable for children (aged six months and above) to fend off mosquitoes. This versatility makes these wipes ideal for personal use or use in camping settings, offering comprehensive protection against insects.

Increased Demand for Insect Repellents from Asia-Pacific

China represents the largest market for insect repellents among Asia-Pacific countries as it is the most populous regional country, and its consumers have high disposable incomes, growing awareness, and improved living standards, which, along with the affordable pricing of repellents, has increased their penetration among household goods. All these factors cumulatively augment the sales of the product. Moreover, household insects like flies, termites, bed bugs, ants, and cockroaches are very common in China. The use of insect repellants in usable forms like sprays, vaporizers, chalks, and powders has proliferated sales of these products in Chinese homes.

In India, people's growing awareness and rising health concerns, along with increased household incomes and affordable product pricing, have improved insect repellents' penetration in homes. Furthermore, various ad campaigns, government initiatives, and innovations in new products have been driving the market studied. For instance, in May 2023, Mortein, Reckitt's household insect-repellent brand, and DENTSU CREATIVE India collaborated to launch their new initiative, 'Suraksha Ka Teeka,' against malaria in Bareilly, India. The awareness program was launched to leverage the everyday habit of applying 'teeka' to educate consumers on protection from vector-borne diseases.

The launch of various programs like Swacch Bharat Abhiyaan in India has also increased the importance of hygiene and cleanliness among people, which further improved market growth. For instance, the incidences of malaria caused by mosquitoes have reduced significantly. Insect repellents in the coil form are the most popular products in the region because they are cost-effective and available across all retail channels. Among the rural areas of the Asia-Pacific countries, offline distribution channels such as convenience stores are more popular.

Insect Repellent Industry Overview

The insect repellent market is highly stagnant and competitive, with the presence of various global and regional players. The major players operating in the market include Spectrum Brands Inc., Henkel AG & Co. KGaA, Reckitt Benckiser Group PLC, S.C. Johnson & Son Inc., and Godrej Group. Its extensive product portfolio, global presence, and continuous activities have made Godrej Consumer Products a market leader. During the study period, the company's major focus remained on product innovations, and it developed four innovative products to extend its product portfolio and global presence. SC Johnson & Son, another market leader, is also enjoying higher sales volumes in the market studied, supported by growing consumer inclination toward its wider range of products, which includes all product types, including DEET products and natural and organic insect repellents. Accordingly, to further strengthen its position in the market, the company has been extensively investing to scale up the production of its core products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Surge in Product Innovation

- 4.1.2 Increasing Government Initiatives and Extensive Promotions by Market Players

- 4.2 Market Restraints

- 4.2.1 Safety Concerns Associated with the Usage of Insect Repellents

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Body Work Insect Repellents (Cream/Lotion and Oil)

- 5.1.2 Other Insect Repellents

- 5.1.2.1 Coil

- 5.1.2.2 Liquid Vaporizer

- 5.1.2.3 Spray/Aerosol

- 5.1.2.4 Bait

- 5.1.2.5 Other Insect Repellents

- 5.2 Distribution Channel

- 5.2.1 Offline Retail Stores

- 5.2.2 Online Retail Stores

- 5.3 Category

- 5.3.1 Natural Insect Repellent

- 5.3.2 Conventional Insect Repellent

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Spectrum Brands Holdings Inc.

- 6.3.2 Henkel AG & Co. KGaA

- 6.3.3 Newell Brands Inc.

- 6.3.4 Enesis Group

- 6.3.5 S.C. Johnson & Son Inc.

- 6.3.6 Quantum Health

- 6.3.7 Reckitt Benckiser Group PLC

- 6.3.8 Jyothy Labs Limited

- 6.3.9 Dabur India Ltd

- 6.3.10 Sawyer Products Inc.

- 6.3.11 Kao Corporation