|

市場調查報告書

商品編碼

1439842

聚羥基烷酯(PHA):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Polyhydroxyalkanoate (PHA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

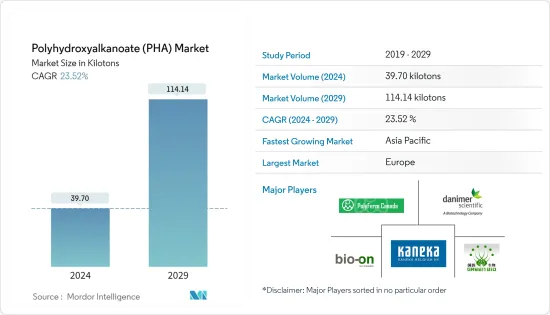

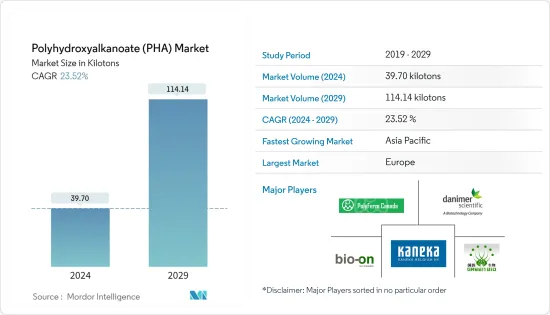

聚羥基烷酯(PHA)的市場規模預計到2024年為39,700噸,在預測期內(2024-2029年)預計到2029年將達到114,140噸,複合年成長率為23.52%。

推動所研究市場的主要因素是對環保材料的需求不斷成長。另一方面,與傳統聚合物相比,PHA 的高價格以及冠狀病毒感染疾病(COVID-19)爆發帶來的不利條件阻礙了市場成長。

預計包裝應用將在預測期內主導調查市場。

由於德國、法國和英國等國家消費量的增加,預計歐洲將主導全球 PHA 市場。

聚羥基烷酯(PHA)市場趨勢

包裝應用需求增加

- 聚羥基烷酯(PHA)被認為是用於包裝應用的有前途的材料。它有多種用途,包括塑膠袋、薄膜、盒子、床單以及一次性湯匙和叉子。

- 對生物分解性塑膠的需求不斷成長以及政府的舉措預計將推動包裝和食品服務應用中對 PHA 的需求。

- 包裝是製造公司考慮的關鍵因素之一,以確保其產品在視覺上對消費者有吸引力。隨著製造業、食品加工廠和工業生產數量的不斷增加,全球包裝產業正經歷強勁成長。

- 近年來,包裝產業經歷了一場變革,製造業和工業部門紛紛適應軟包裝。為此,全球包裝產業對軟包裝的需求正在迅速成長。

- 此外,由於電子零售企業和食品和飲料行業的需求,包裝要求近年來顯著增加。

- 因此,對包裝和食品服務的需求不斷成長預計將在未來幾年增加對 PHA 的需求。

歐洲地區主導市場

- 預計歐洲地區在預測期內將佔據聚羥基烷酯(PHA)市場的最大佔有率。

- 由於國內電子商務的大幅成長和海外出口的增加,德國包裝業正在快速成長。此外,對包裝食品和飲料日益成長的偏好也推動了其成長。

- 由於包裝行業的積極發展,德國對先進包裝的需求不斷增加,預計這將在未來幾年對調查市場的需求做出貢獻。

- 英國個人護理和食品飲料行業對小型優質包裝的需求不斷成長。該國正致力於提供更環保的包裝,這增加了國內包裝產業對 PHA 的需求。

- 在法國,食品製造業約佔法國製造業的20%。與其他產業相比,食品業的包裝設計創新率為 43%。這促進了該國食品包裝的需求。

- 因此,歐洲國家對 PHA 的需求預計在預測期內將會增加。

聚羥基烷酯產業概況

全球聚羥基烷酯(PHA)市場本質上是部分一體化的。主要企業包括 Bio-on SpA、PolyFerm Canada、Danimer Scientific、Tianjin GreenBio Materials 和 Kanika 公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對環保材料的需求不斷成長

- 其他司機

- 抑制因素

- 與傳統聚合物相比價格較高

- 由於COVID-19感染疾病的爆發,情況不利

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 類型

- 單體

- 共聚物

- 三元聚合物

- 目的

- 包裝

- 農業

- 生物醫學

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)/排名分析

- 主要企業採取的策略

- 公司簡介

- Bio-on SpA

- CJ CheilJedang Corp.

- Danimer Scientific

- Full Cycle Bioplastics

- Genecis Bioindustries Inc.

- Kaneka Corporation

- PolyFerm Canada

- RWDC Industries

- Tepha Inc.

- TerraVerdae Inc.

- Tianjin GreenBio Materials Co., Ltd.

第7章市場機會與未來趨勢

The Polyhydroxyalkanoate Market size is estimated at 39.70 kilotons in 2024, and is expected to reach 114.14 kilotons by 2029, growing at a CAGR of 23.52% during the forecast period (2024-2029).

The major factor driving the market studied is the growing demand for eco-friendly materials. On the flip side, the higher prices of PHA compared to the conventional polymers and unfavorable conditions arising due to the COVID-19 outbreak are hindering the growth of the market.

Packaging application is expected to dominate the market studied during the forecast period.

Europe is expected to dominate the global PHA market owing to the increasing consumption from countries such as Germany, France, and United Kingdom.

Polyhydroxyalkanoate Market Trends

Increasing demand from Packaging Application

- Polyhydroxyalkanoates (PHA) are considered as promising materials that are used for packaging applications. They are used in various applications such as plastic bags, films, boxes, sheets, disposable spoons and forks among others.

- Increasing demand for biodegradable plastics along with governments initiatives of various countries are expected to boost the demand for PHA from packaging and food services application.

- The packaging is one of the key aspects considered by the firms engaged in the manufacturing industry, to ensure aesthetic appeal to the consumers. With the growing number of manufacturing units, food processing plants, and increasing industrial production, the global packaging industry is witnessing robust growth.

- In the last few years, the packaging industry has been experiencing a transition, where the manufacturing and industrial sector has been adapting to flexible packaging. Owing to this, the demand for flexible packaging is rapidly growing in the global packaging industry.

- Additionally, the e-retail business and demand from the food and beverage industry are substantially increasing the packaging requirement in recent times.

- Therefore, the growing demand for packaging and food services is expected to boost the demand for PHA in coming years.

Europe Region to Dominate the Market

- Europe region is expected to account for the largest share of Polyhydroxyalkanoate (PHA) market during the forecast period.

- The packaging industry in Germany has been growing at a rapid pace, owing to the huge increases in domestic e-commerce and rising foreign exports. In addition, the increasing preference for packaged food and beverages has also aided its growth.

- Owing to the positive development in the packaging industry, the demand for advanced packaging has increased in Germany, which is expected to contribute to the demand for the market studied in the coming years.

- There is a growing demand for small size and premium packaging from the personal care and food and beverage sectors in the United Kingdom. The country has been focusing on offering more environmentally friendly packaging, which has increased the demand for PHA from the packaging sector in the country.

- In France, the food manufacturing industry represents about 20% of the French manufacturing industry. The packaging design innovation in the food industry is 43%, compared to other industrial sectors. This has been contributing to the demand for the food packaging in the country.

- Therefore, the demand for PHA in European countries is expected to grow during the forecast period.

Polyhydroxyalkanoate Industry Overview

The global Polyhydroxyalkanoate (PHA) market is partially consolidated in nature. The major companies are Bio-on SpA, PolyFerm Canada, Danimer Scientific, Tianjin GreenBio Materials Co., Ltd., and Kaneka Corporation among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Eco-Friendly Materials

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Price Compared to the Conventional Polymers

- 4.2.2 Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Monomers

- 5.1.2 Co-Polymers

- 5.1.3 Terpolymers

- 5.2 Application

- 5.2.1 Packaging

- 5.2.2 Agriculture

- 5.2.3 Biomedical

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Bio-on SpA

- 6.4.2 CJ CheilJedang Corp.

- 6.4.3 Danimer Scientific

- 6.4.4 Full Cycle Bioplastics

- 6.4.5 Genecis Bioindustries Inc.

- 6.4.6 Kaneka Corporation

- 6.4.7 PolyFerm Canada

- 6.4.8 RWDC Industries

- 6.4.9 Tepha Inc.

- 6.4.10 TerraVerdae Inc.

- 6.4.11 Tianjin GreenBio Materials Co., Ltd.