|

市場調查報告書

商品編碼

1443913

旅居車:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Motorhome - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

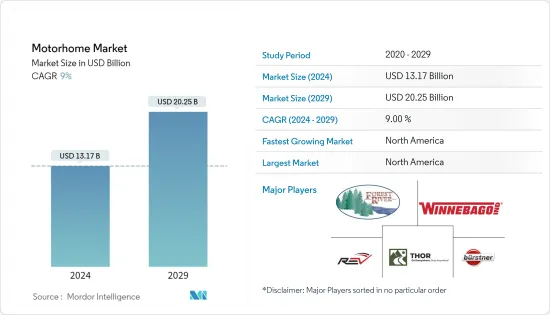

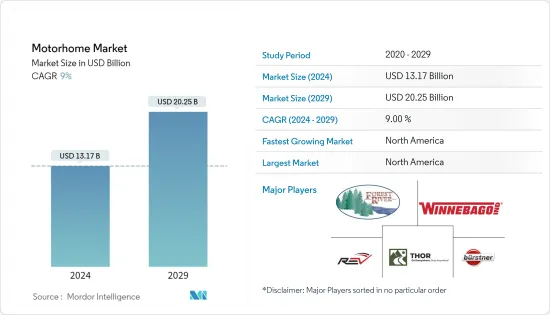

旅居車市場規模預計2024年為131.7億美元,預計到2029年將達到202.5億美元,在預測期內(2024-2029年)年複合成長率為9%成長。

COVID-19 的爆發對旅居車產業產生了多種影響。在旅居車中露營被認為是大流行期間和之後最安全的假期之一,因為它允許獨立旅行,提供與在家中類似的居住、睡眠、烹飪和衛生選擇。馬蘇。此外,旅居車製造商還為客戶提供舒適、豪華的車輛和最佳的能源效率。因此,旅居車旅居車已經開始成長動力,隨著房車開始青睞更安全的旅居車度假,預計未來幾年將繼續成長。例如,2022年1月,Entegra Coach推出了基於賓士Sprinter 4X4平台打造的Entegra B級旅居車。

從長遠來看,大型旅客群體對舒適旅行和住宿的需求迅速成長,將推動旅居車在世界各地的採用。消費者偏好從傳統度假套餐轉向公路旅行正在推動市場對牽引式電動休閒車的需求。此外,更嚴格的汽車排放法規的實施將鼓勵消費者轉換電動車和混合房車,擴大市場規模。例如,計劃於 2022 年 8 月上市的最新車型是 Crosscamp Flex,它是基於歐寶 Zafira-e Life 開發的。它在 2022 年德國杜塞爾多夫 Caravan Salon 上首次亮相,預計於 2023 年開始銷售。電動Crosscamp Flex 配備 75 千瓦時電池,WLTP 續航里程為 200 英里。

與其他常見的度假活動相比,旅居車還具有旅行成本較低的額外優勢。由於上述優點,近年來市場對旅居車的興趣有所增加,並且這種情況在未來可能會持續下去。另一方面,旅居車的高租金成本預計將限制市場成長。

由於該地區擁有旅居車的家庭(主要是千禧世代)數量不斷增加以及旅居車租賃需求不斷成長,預計北美將在 2021 年佔據全球旅居車市場的重要佔有率。

旅居車市場趨勢

日益成長的富裕程度和千禧世代

勞動人口的增加對人均所得的增加有顯著貢獻。因此,許多 HNWI(高淨值人士)正在全球增加旅行和露營等娛樂活動的支出。

美國是世界上最大的經濟體,也是大多數富人的家園。中國擁有世界上最多的人口,加上不斷成長的經濟和巨大的商機,是中國富人數量不斷成長的一個主要因素。 2022年11月,傳統和電動車以及中重型商用車全自動變速箱的領先設計和製造商艾里遜變速箱宣布,旅居車已與一列列車成功合作。超過10個中國房車新品牌因採用慶鈴700P輕卡底盤和艾里遜變速箱而受到青睞。

根據《世界財富報告》,2020年澳洲億萬富豪增加了4%。這是由於採礦業的增加,佔該國 GDP 的 7%。儘管印度的億萬富翁數量不多,但該國被譽為「成長引擎」。它為個人百萬富翁提供了成長和為經濟做出貢獻的巨大機會。

人均收入的增加和富人數量的增加正在增加全球旅行和露營等休閒的平均支出。露營和旅行正成為千禧世代越來越受歡迎的休閒活動。

此外,在德國,買家更重視舒適性和功能性。顯示油箱中的水位和汽油水平以及電池容量等詳細資訊的車輛連接行動應用程式變得越來越流行。根據歐洲房車聯合會的數據,2021 年德國註冊了 82,017 輛新房旅居車。此外,德國還擁有廣泛的露營地網路。所有這些因素都將導致旅居車未來的成長。

北美地區可望在市場中發揮重要作用

由於該地區擁有旅居車的家庭(主要是千禧世代)數量不斷增加以及旅居車租賃需求不斷成長,北美在預測期內佔據了很大的佔有率。美國是世界主要房車製造地之一。根據房車行業協會委託的一項研究,美國房車的擁有量正在迅速增加。

- 根據房車產業協會 2021 年 12 月對製造商進行的調查,2021 年房車總出貨出貨創紀錄的 600,240 輛,與 2017 年的 504,599 輛總出貨相比增加了 19%。

- 2021 年房車總出貨出貨2020 年的 430,412 輛成長 39.5%。以傳統旅行拖車為首的牽引式房車,截至 2021 年批發出貨為 544,028 輛,較 2020 年成長 39.6%。截至今年底,旅居車與前一年同期比較增加了 37.8%。售出 56,212 套。截至2020年,公園型房車出貨為3,923輛,較2020年成長5.7%。

旅居車在美國已成為度假、車尾聚會、帶寵物旅行、商務以及戶外運動和其他休閒活動的交通途徑。該國露營地數量的增加反映了人們對旅居車休閒旅遊的日益偏好。因此,領先公司正在開發新產品並專注於電動旅居車。 2022 年 1 月,Thor 推出了一款續航里程為 300 英里的概念電動旅居車。該公司表示,消費者對電動車和卡車的偏好的變化也可能描繪旅居車的成長軌跡。

此外,賣家還為合格的借款人提供新房旅居車車型以及二手車和融資選擇的優惠交易和優惠。對這些車輛的需求激增激起了知名金融相關人員的興趣,他們希望抓住這個機會並壟斷市場。

年輕一代擴大採用旅居車、由於技術進步而引入旅居車以及健康的經濟預計將在預測期內對市場成長做出重大貢獻。

旅居車產業概況

大公司希望透過削減成本來加強銷售,而小公司則專注於新產品的推出和擴展。市場領導正在尋求收購規模較小的公司。 2022 年 1 月,房車製造商 Winnebago Industries 推出了首款「全電動零排放旅居車」概念。至此,該公司加入了越來越多希望進軍電動旅居車市場的汽車製造商行列。

旅居車市場的一些主要企業包括 Thor Industries, Inc.、Winnebago Industries, Inc. 和 Forest River, Inc.。近年來,由於對節能汽車的需求不斷增加,製造商之間的競爭加劇。梅賽德斯-奔馳於2021年8月宣布,將在杜塞爾多夫房車沙龍上首次發布新款小型貨車「New Citan」。該展位還將展示基於 Le Voyageur、Kabe、Eura Mobil 和 Alphavan 的梅賽德斯-奔馳 Sprinter 打造的旅居車,以及梅賽德斯-奔馳 Marco Polo旅居車車車型。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 按類型

- A級

- B級

- C級

- 按最終用戶

- 車隊車主

- 直接購買者

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Thor Industries, Inc.

- Winnebago Industries, Inc.

- Dethleffs GmbH &Co. KG

- Hymer GmbH &Co. KG

- Forest River Inc.

- Rapido Motorhomes

- The Swift Group

- Tiffin Motorhomes Inc.

- Triple E Recreational Vehicles

- BURSTNER GMBH &CO. KG

第7章市場機會與未來趨勢

The Motorhome Market size is estimated at USD 13.17 billion in 2024, and is expected to reach USD 20.25 billion by 2029, growing at a CAGR of 9% during the forecast period (2024-2029).

The COVID-19 outbreak had a mixed effect on the motorhome industry. Camping in motorhomes can be seen as one of the safest vacations during and post-pandemic period as one can travel independently with living, sleeping, cooking, and sanitary options, which is similar to living at home. Moreover, motorhome manufacturers provide comfort, luxury, and optimal energy efficiency in the vehicles for the customers. Therefore, the motorhome market began to gain traction as campers began to prefer safer motorhome vacations, and growth is expected to continue in the coming years. For instance,

Key Highlights

- In January 2022, Entegra coach launched the Entegra Class B motorhome built on the Mercedes Benz Sprinter 4X4 platform.

Over the long term, rapidly increasing demand for comfortable travel and accommodation of large passenger groups will fuel the adoption of Motorhomes across the globe. The shift in consumer preference from conventional holiday packages to road trips drives the market demand for towable and motorized recreational vehicles. Further, implementing stringent vehicle emission regulations encourages consumers to switch to electric and hybrid recreational vehicles, augmenting the market size. For instance,

Key Highlights

- In August 2022, The Crosscamp Flex, which is based on an Opel Zafira-e Life, was the most recent model on the horizon. It debuted at the Caravan Salon 2022 in Dusseldorf, Germany, and sales will begin in 2023. The electric Crosscamp Flex is powered by a 75-kilowatt-hour battery and has a WLTP driving range of 200 miles.

Motorhomes have the added benefit of lowering excursion costs when compared to other common get-away activities. The previously mentioned benefits have been driving market interest in motorhomes in recent years, and this is likely to continue in the future. The high rental cost of motorhomes, on the other hand, is expected to limit the market growth.

North America will hold a significant share of the global motorhome market in 2021, owing to an increasing number of motorhome-owning households (mostly millennials) and rising demand for motorhome rentals in the region.

Key Highlights

- In March 2021, Rev Recreation Group (RRG) introduced the new diesel-powered luxury motor coach 2021 American Dream 39RK to add the luxury factor into recreational vehicles.

Motorhome Market Trends

Increasing Nmber of HNWI and Millennials

The growing working population is a significant contributor to rising per capita income. As a result, many HNWI (High Net Worth Individuals) spending on recreational activities, such as traveling and camping, is increasing globally.

The United States has the world's largest economy and is home to most HNWI. China's population as the world's largest, combined with the country's continuously growing economy and tremendous business opportunities, are huge factors for the country's larger number of HNWI. For instance,

- In November 2022, Allison Transmission, a leading designer and manufacturer of conventional and electric vehicles and fully automatic transmissions for medium and heavy commercial vehicles, successfully collaborated with Qingling Motors Co., Ltd to gain traction in the Chinese motorhome market.

- More than ten new Chinese RV brands have gained popularity due to their use of the Qingling 700P light truck chassis and Allison transmission.

According to the world wealth report, Australia's millionaires increased by 4% in 2020, owing to increased mining operations, which contributed 7% of the country's GDP. Although India has fewer millionaires, the country is known as the "engine of growth." It offers enormous opportunities for individual millionaires to grow and contribute to the economy.

With rising per capita income and an increase in the number of HNWI, average spending on recreational activities, such as traveling and camping, is increasing globally. Camping and travel are becoming increasingly popular recreational activities among millennials.

Further, in Germany, buyers are placing value on more comfort and features. Mobile applications linked to the vehicle, with details like water and gas levels in tanks and battery capacity, are becoming popular. According to the European Caravan Federation, in 2021, 82,017 new motorhomes were registered in Germany . Moreover, Germany also has an extensive network of campsites. All these factors are leading to the growth of motorhomes in the upcoming time period.

North America Region Expected to Play Key role in the Market

North America accounted for a sizable share during the forecast period, owing to an increasing number of motorhome-owning households (the majority of which are millennials) and rising demand for motorhome rentals in the region. The United States is one of the world's major RV manufacturing hubs. According to a study commissioned by the Recreation Vehicle Industry Association, RV ownership in the United States is rapidly increasing.

- According to the RV Industry Association's December 2021 survey of manufacturers, total RV shipments for 2021 ended with a record 600,240 wholesale shipments, a 19% increase over the 2017 total of 504,599 shipments.

- Total RV shipments in 2021 are up 39.5% from 430,412 units shipped in 2020. Towable RVs, led by conventional travel trailers, ended 2021 with 544,028 wholesale shipments, a 39.6% increase over 2020. Motorhomes finished up 37.8% from the previous year, with 56,212 units sold. With 3,923 units shipped, Park Model RV completed the year with a 5.7% increase over 2020.

Motorhomes are popular in the United States for vacationing and tailgating, traveling with pets, doing business, and as a preferred mode of transportation for outdoor sports and other leisure activities. The growing number of campgrounds in the country reflects the ever-increasing preference for recreational travel in motorhomes. As a result, major players are developing new products and focusing on EV motorhomes. For instance,

- In January 2022, Thor unveiled a concept EV motorhome with 300 miles range. The company stated that shifting consumer preferences in electric cars and trucks may also portray growth paths for motorhomes.

Furthermore, sellers are offering lucrative deals and benefits not only on new motorhome models but also on pre-owned units and accessible financing options for qualified borrowers. The surge in demand for these vehicles has piqued the interest of prominent financial players who want to seize the opportunity and dominate the market.

Additionally, the younger generation's increasing adoption of motorhomes, the introduction of motorhomes with technological advancements, and a healthy economy are expected to significantly contribute to the market's growth during the forecast period.

Motorhome Industry Overview

Major players are trying to consolidate their sales by cutting costs, while smaller players focus on new product launches and expansions. Market leaders are trying to acquire smaller players. For instance,

- In January 2022, Winnebago Industries, the RV manufacturer, unveiled its concept for an "all-electric zero-emission motorhome," the first of its kind. With it, the company joins a growing list of automakers looking to expand into the electric campervan market.

Some major players in the motorhome market are Thor Industries, Inc., Winnebago Industries, Inc., and Forest River, Inc. The competition among manufacturers has increased over the past few years due to the growing demand for fuel-efficient vehicles.

- In August 2021, Mercedes-Benz announced that its new small van, "the new Citan," will be unveiled at the Caravan Salon in Dusseldorf. The stand will also feature motorhomes based on the Mercedes-Benz Sprinter from Le Voyageur, Kabe, Eura Mobil, and Alphavan, as well as Mercedes-Benz Marco Polo camper van models. The new Citan is an entirely new design.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size Value in USD Billion)

- 5.1 By Type

- 5.1.1 Class A

- 5.1.2 Class B

- 5.1.3 Class C

- 5.2 By End-User

- 5.2.1 Fleet Owners

- 5.2.2 Direct Buyers

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thor Industries, Inc.

- 6.2.2 Winnebago Industries, Inc.

- 6.2.3 Dethleffs GmbH & Co. KG

- 6.2.4 Hymer GmbH & Co. KG

- 6.2.5 Forest River Inc.

- 6.2.6 Rapido Motorhomes

- 6.2.7 The Swift Group

- 6.2.8 Tiffin Motorhomes Inc.

- 6.2.9 Triple E Recreational Vehicles

- 6.2.10 BURSTNER GMBH & CO. KG