|

市場調查報告書

商品編碼

1690848

露營拖車和旅居車:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Caravan And Motorhome - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

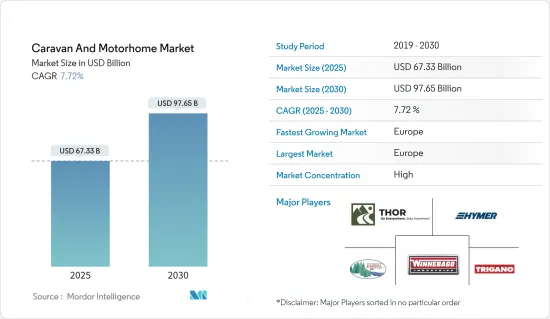

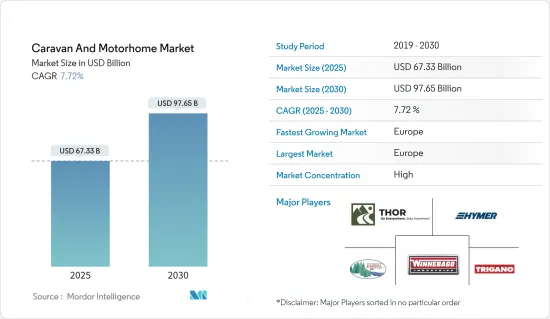

露營拖車和旅居車市場規模預計在 2025 年為 673.3 億美元,預計到 2030 年將達到 976.5 億美元,預測期內(2025-2030 年)的複合年成長率為 7.72%。

近年來,露營拖車和旅居車市場經歷了顯著的成長和發展,反映了消費者偏好和生活方式趨勢的變化。一個顯著的趨勢是,乘坐露營拖車或旅居車出行越來越受到人們的青睞,成為假日旅行的首選方式。消費者希望這些休閒車能提供自由和靈活性,讓他們能夠以自己的步調探索不同的目的地。旅行偏好的變化,加上人們對戶外和自然體驗日益成長的興趣,促進了露營拖車和旅居車市場的擴張。

在產品多樣性方面,製造商為了滿足日益成長的需求,推出了各種各樣的露營拖車和旅居車型號,以滿足不同的偏好和要求。現代設計通常採用創新功能、技術進步和改進的設施,以增強整體旅行體驗。此外,該行業非常重視永續性和環保實踐,製造商採用更節能的系統和材料,以適應消費者日益增強的環境責任意識。

迷你露營拖車因其緊湊的設計而日益流行,其通常具有流線型車身和較小的佔地面積。儘管體積小,製造商仍致力於最大限度地利用內部空間並配備必要的設施。迷你露營拖車通常配備舒適的睡眠空間、基本的廚房設施和巧妙的收納解決方案。它注重功能性和空間的有效利用,以緊湊的設置提供舒適的露營體驗。

迷你露營拖車,也稱為層級拖車、微型露營拖車或折疊露營車,比大型拖車更實惠。入門級選配起價約為 5,000 歐元,而配置更齊全的車型售價在 15,000 歐元至 20,000 歐元之間。這種價格優勢吸引了注重預算的旅客和首次購買露營拖車的車主。

截至 2023 年 3 月的一個季度,旅客數量大幅增加,澳洲境內個人旅行人數達到 450 萬人次,成長了 24%。此外,人們也喜歡旅行大篷車和露營,在這些車輛中度過的夜晚共計1800萬個,大幅增加了22%。旅遊和休閒的激增促成了全年1,550萬人次出遊、6,230萬人次住宿和112億美元的旅遊消費。值得注意的是,這些數字超過了疫情前的1400萬人次旅行和5900萬人次過夜的統計數據。

旅居車在世界各地越來越受歡迎,尤其是在歐洲。越來越多的高淨值人士(HNWI)和充足的房車停車選擇使得房車在北美和歐洲越來越受歡迎。

露營拖車和旅居車的市場趨勢

預計未來幾年旅居車將變得更加受歡迎。

露營和旅行已經成為千禧世代越來越受歡迎的休閒。 C 型旅居車比 A 型和 B 型旅居車更節省燃料。許多休閒車製造商正在推出基於福特和賓士底盤的 C 型車。

小型廂式(B 型)旅居車的需求正在不斷成長,尤其是在德國市場,許多新興企業和新參與企業提供將OEM庫存車輛或現有廂型車改裝成露營車的服務。

- 2023 年 3 月,專門從事貨車改裝的公司 Krug Expedition 推出了旅居車。 Rhino XL 是一款堅固的越野旅居車,能夠承受最惡劣的條件。

- 2024年2月,Goboonie與瑞士再保險子公司iptiQ合作推出了旅居車保險解決方案。

預計 A、B 和 C 型旅居車的發展將在未來幾年促進整體市場的成長。

預計歐洲將在市場中發揮關鍵作用

歐洲在露營拖車和旅居車市場中發揮著至關重要的作用。

- 露營拖車和旅居車深植於歐洲文化。幾十年來,乘坐露營拖車旅行和探索不同目的地的概念一直被人們所接受,反映了人們對移動生活和戶外探險的文化親和性。這種文化接受度創造了對露營拖車和旅居車的持續需求,它們已成為歐洲旅行和休閒活動不可或缺的一部分。

- 歐洲擁有豐富多彩的風景和旅遊目的地,從風景如畫的鄉村到充滿活力的城市。這種地理多樣性鼓勵旅行者探索不同的地方,而露營拖車和旅居車提供了理想的交通方式。這些車輛所提供的自由和靈活性符合尋求個人化和沈浸式旅行體驗的歐洲旅行者的偏好。

到 2022年終,歐洲註冊的露營拖車和旅居車將超過 630 萬輛,較五年前的 520 萬輛有顯著增加。在此期間,露營拖車佔所有露營設備的近三分之二。然而,露營車的數量明顯增加,歐洲旅居車數量達到 280 萬輛,與 2017 年相比增加了 50%。因此,露營拖車和旅居車的比例為 56%,而前者為 44%。在過去五年中,露營拖車公園的數量增加了 5% 多一點,這意味著旅居車超過露營拖車數量的情況即將出現。在荷蘭,露營車的數量預計將從 2017 年的 105,000 輛成長到 2022年終的近 180,000 輛,而露營拖車的數量仍為 424,000 輛,因此這種轉變仍然遙遙無期。去年,KCI 報告稱,荷蘭的露營拖車和房車總合已超過 60 萬輛,案例首個里程碑。在歐洲國家中,荷蘭的旅居車和露營持有數量最多,其次是德國(約 160 萬輛)、法國(115 萬輛)和英國(83.5 萬輛)。

露營拖車和旅居車產業概況

露營拖車和旅居車市場正在高度整合,多家製造商提供具有先進功能的產品。企業正在透過併購、聯盟、合作等策略擴大市場佔有率。例如

- 2023 年 10 月,Mink Campers 推出了其露營車系列的最新成員:MINK-E。 MINK-E 是一款環保全電動汽車,專為穿越戶外景觀中具有挑戰性和不可預測的地形而設計。 13.5 英尺(4.1 公尺)長的 Mink Camper 保留了經典的動態層級造型,重量僅為 1,150 磅(520 公斤),體積小巧。

- ARB Earth Camper 將於 2023 年 7 月推出,這將有力地證明探險家可以選擇更輕的旅行拖車,而無需犧牲露營拖車生活方式的刺激。

- 2022 年 1 月,Ford-Werke GmbH 與 Erwin Hymer Group (EHG) 簽署了一項框架協議,以交付Ford Transit 和 Ford Transit Custom 作為客戶級休閒車和旅居車的基礎。該協議將允許兩家公司在不斷成長的休閒車市場中佔有股權。供應協議包括福特 Transit 廂型車和骨架底盤駕駛室車型,以及福特 Transit Custom Combi 自訂 ,用於改裝成 EHG 品牌下的露營車、半整合式和凹室旅居車。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 產品類型

- 露營拖車

- 旅行拖車

- 第五輪拖車

- 折疊露營拖車

- 卡車露營

- 旅居車

- A型

- B型

- C型

- 按最終用戶

- 直接買家

- 車隊車主

- 露營拖車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Thor Industries Inc.

- Swift Group

- Forest River Inc.

- Winnebago Industries Inc.

- Burstner GmbH & Co. KG

- Triple E Recreational Vehicles

- Hymer GmbH & Co. KG

- Jayco Inc.

- Dethleffs GmbH & Co. KG

- Knaus Tabbert AG

- Trigano SA

第7章 市場機會與未來趨勢

The Caravan And Motorhome Market size is estimated at USD 67.33 billion in 2025, and is expected to reach USD 97.65 billion by 2030, at a CAGR of 7.72% during the forecast period (2025-2030).

The caravan and motorhome market has witnessed significant growth and evolution in recent years, reflecting changing consumer preferences and lifestyle trends. One notable trend is the increasing popularity of caravan and motorhome travel as a preferred mode of vacationing. Consumers are seeking the freedom and flexibility that these recreational vehicles provide, allowing them to explore diverse destinations at their own pace. This shift in travel preferences, coupled with a growing interest in outdoor and nature-based experiences, has contributed to the expansion of the caravan and motorhome market.

In terms of product diversity, manufacturers have responded to the rising demand by introducing a wide range of caravan and motorhome models, catering to various preferences and requirements. Modern designs often incorporate innovative features, technological advancements, and improved amenities to enhance the overall travel experience. Additionally, there is a notable emphasis on sustainability and eco-friendly practices within the industry, with manufacturers incorporating energy-efficient systems and materials to align with the growing awareness of environmental responsibility among consumers.

The trend of mini caravans is picking up pace as they are characterized by their compact design, typically featuring a streamlined body with a reduced footprint. Despite their smaller size, manufacturers focus on maximizing interior space to include essential amenities. Mini caravans often come equipped with a cozy sleeping area, basic kitchen facilities, and clever storage solutions. The emphasis is on functionality and efficient use of space to provide a comfortable camping experience within a compact setup.

Mini caravans, also known as teardrop trailers, micro caravans, or folding campers, offer affordability compared to larger models. Entry-level options start around EUR 5,000, with well-equipped versions reaching EUR 15,000 - EUR 20,000. This price advantage attracts budget-conscious travelers and first-time caravanners.

In the quarter spanning March 2023, there was a substantial rise in travel figures, with individuals undertaking 4.5 million trips, marking a 24% increase across Australia. Additionally, the delights of caravanning and camping were savored, with 18 million nights spent, reflecting a substantial 22% surge. This surge in travel and leisure activities contributes to an annual rolling total of 15.5 million trips, 62.3 million nights, and an impressive USD 11.2 billion in visitor expenditure. Notably, these figures surpass the pre-pandemic statistics, which stood at 14 million trips and 59 million nights.

Motorhomes are becoming increasingly popular around the world, particularly in Europe. The rising number of high-net-worth individuals (HNWI), combined with the availability of ample RV parking, is driving its adoption in North America and Europe.

Caravan And Motorhome Market Trends

Motorhomes are Anticipated to Gain Prominence Over the Coming Years

Camping and travel are becoming increasingly popular recreational activities among millennials. Type C motorhomes outperform type A and B motorhomes in terms of fuel efficiency. Many recreational vehicle manufacturers are introducing type C vehicles based on Ford and Mercedes-Benz chassis.

With the increasing demand for small van (type B) motorhomes, especially in the German market, many new companies and start-ups are offering services to convert stock OEM vehicles and existing vans into campervans.

- In March 2023, Krug Expedition, a company specializing in van conversions, revealed its motorhome referred to as the "Rhinoceros on Wheels. The Rhino XL is a robust off-road motorhome built to withstand extreme conditions.

- In February 2024, Goboony collaborated with iptiQ, a subsidiary of Swiss Re, to introduce a motorhome insurance solution.

Such developments across type A, B, and C motorhomes are expected to contribute to the overall growth of the market in the coming years.

Europe is Likely to Play a Key Role in the Market

Europe plays a pivotal role in the market of caravans and motorhomes due to several factors that contribute to the region's prominence in this industry.

- Caravanning and motorhoming have deep cultural roots in Europe. The concept of touring and exploring different destinations using caravans has been embraced for decades, reflecting a cultural affinity for mobile living and outdoor adventures. This cultural acceptance has created a sustained demand for caravans and motorhomes, making them an integral part of travel and leisure activities in Europe.

- Europe boasts diverse landscapes and destinations, ranging from picturesque countryside to vibrant cities. This geographical diversity encourages travelers to explore various locations, and caravans and motorhomes offer an ideal means for this. The freedom and flexibility provided by these vehicles align with the preferences of European travelers who seek personalized and immersive travel experiences.

By the end of 2022, Europe witnessed registrations of over 6.3 million caravans and motorhomes, a notable increase from 5.2 million five years prior. During that period, caravans constituted almost two-thirds of all camping equipment. However, the remarkable surge in campers is evident, with the count of motorhomes reaching 2.8 million in Europe, marking a 50% rise compared to the figures recorded in 2017. Consequently, the proportion between caravans and motorhomes now stands at 56% compared to 44%. Over the past five years, the caravan park has experienced a growth of slightly over 5%, suggesting an impending scenario where motorhomes may surpass caravans in numbers. While this shift is still a distant prospect in the Netherlands, where the camper count rose from 105,000 in 2017 to nearly 180,000 by the end of 2022, there are still 424,000 caravans in the country. Last year, KCI reported a combined count of over 600,000 caravans and campers in the Netherlands, marking the first instance of such a milestone. Among European countries, the Netherlands boasts the highest ownership of motorhomes and caravans, following Germany with almost 1.6 million units, France with 1.15 million, and Great Britain with 835,000.

Caravan And Motorhome Industry Overview

The caravan and motorhomes market is intensely consolidated, with several manufacturers offering products with advanced features. Companies are increasing their market share through strategies such as mergers and acquisitions, partnerships, and collaborations. For instance,

- In October 2023, Mink Campers revealed the latest iteration of its camper series with the MINK-E, an environmentally friendly, fully electric version designed for navigating the challenging and unpredictable terrains of outdoor landscapes. The Mink Camper, measuring 13.5 ft (4.1 meters), maintains its classic and aerodynamic teardrop shape, ensuring a compact size with a weight of 1,150 lbs (520 kg).

- In July 2023, the introduction of the ARB Earth Camper serves as compelling evidence that adventure seekers can opt for a lighter travel trailer without sacrificing the thrill of the caravanning lifestyle.

- In January 2022, Ford-Werke GmbH and Erwin Hymer Group (EHG) signed a framework agreement for the delivery of Ford Transit and Ford Transit Custom as the foundation for customer-ready recreational vehicles and motorhomes. The agreement will allow both companies to capitalize on the growing leisure vehicle market. The supply agreement includes Ford Transit panel van and skeletal chassis cab models, as well as Ford Transit Custom kombi vans, for conversion into camper vans, semi-integrated motorhomes, and alcove motorhomes by EHG brands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market size in value USD Billion)

- 5.1 Product Type

- 5.1.1 Caravan

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth-wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhome

- 5.1.2.1 Type A

- 5.1.2.2 Type B

- 5.1.2.3 Type C

- 5.1.3 By End User

- 5.1.3.1 Direct Buyers

- 5.1.3.2 Fleet Owners

- 5.1.1 Caravan

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thor Industries Inc.

- 6.2.2 Swift Group

- 6.2.3 Forest River Inc.

- 6.2.4 Winnebago Industries Inc.

- 6.2.5 Burstner GmbH & Co. KG

- 6.2.6 Triple E Recreational Vehicles

- 6.2.7 Hymer GmbH & Co. KG

- 6.2.8 Jayco Inc.

- 6.2.9 Dethleffs GmbH & Co. KG

- 6.2.10 Knaus Tabbert AG

- 6.2.11 Trigano SA