|

市場調查報告書

商品編碼

1851103

電訊領域API:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Telecom API - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

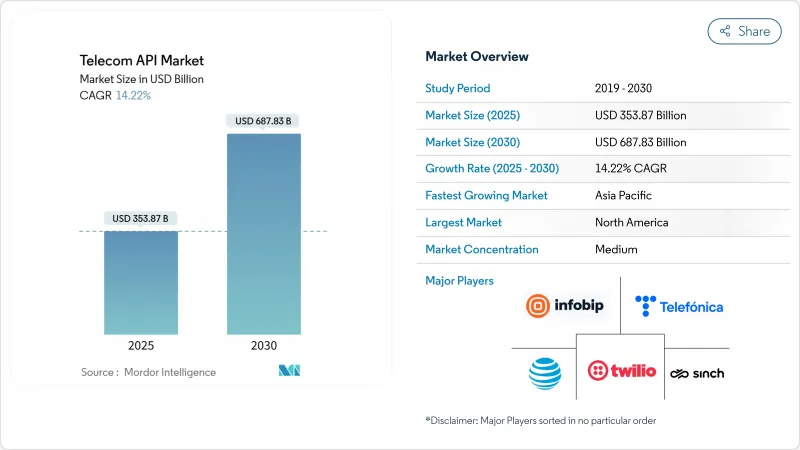

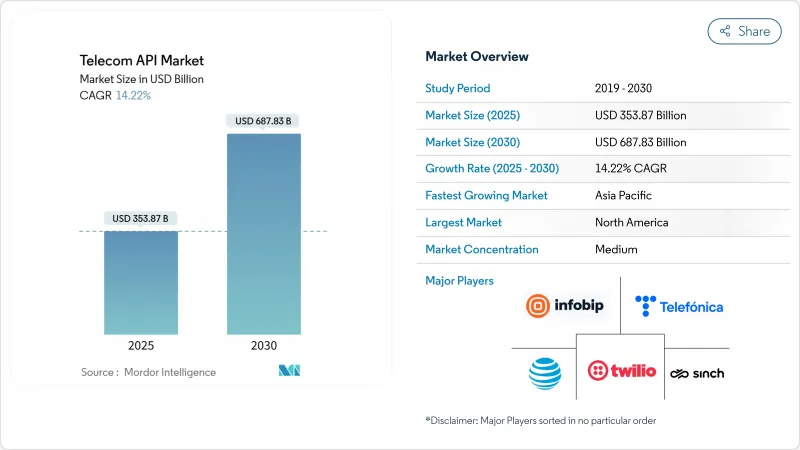

預計到 2025 年,電訊的 API 市場規模將達到 3,538.7 億美元,到 2030 年將達到 6,878.3 億美元,在預測期(2025-2030 年)內,複合年成長率將達到 14.22%。

這一成長反映了通訊業向可編程網路轉型、5G功能貨幣化以及通訊平台即服務 (CPaaS) 的快速普及。 GSMA 開放閘道器等標準化措施、5G 網路切片按需品質 API 的廣泛應用以及企業對嵌入式即時通訊的需求是推動成長的關鍵因素。日益激烈的競爭正在推動產業整合。設備供應商和通訊業者正在組建合資企業以共享網路 API,而 CPaaS 專家則透過收購策略擴大規模。混合雲端部署也為市場帶來益處,它平衡了雲端的敏捷性和資料主權要求,使營運商能夠快速向開發者生態系統開放網路功能。

全球電訊API市場趨勢與洞察

企業中CPaaS採用率快速成長

企業正持續將全通路通訊融入客戶工作流程,Twilio 2025 年第一季11.7 億美元的營收和超過 33.5 萬活躍客戶便印證了這一點。通訊業者也不斷提升內部效率:AT&T 以 MuleSoft 為基礎的專案將新用戶入職週期從一年縮短至六週,每年節省 200 萬工時。 API 重用帶來的經濟效益進一步強化了經營團隊對開發者體驗和持續整合管道的關注。人工智慧驅動的生成式編碼助理通訊了內部團隊的入門門檻,而個人化訊息則持續推動簡訊、RCS 和語音管道的流量成長。

透過開放閘道器和CAMARA實現網路API標準化

目前,已有 49 家營運商集團認可了 GSMA 開放閘道器,這表明業界已就設備檢驗、延遲控制和定位服務等功能的統一介面達成共識。西班牙電信的商業化應用使開發者能夠在保持隱私控制的同時,將通訊功能整合到金融科技和串流媒體應用中。 T-Mobile 符合 CAMARA 標準的按需品質 API 則支援在醫療保健、物流和零售等行業實現低延遲部署。標準化降低了軟體公司的整合成本,並加快了網路應用的上市速度。

API安全漏洞和詐欺性訊號傳輸的嚴重程度日益加劇

預計到2024年,API呼叫量將激增167%,這將使平檯面臨更多攻擊風險,導致戴爾、GitHub和TracFone等公司遭受資料洩露,其中TracFone被罰款1,600萬美元。調查顯示,95%的組織都曾遭遇API安全事件,23%的組織遭受資料遺失。由於用戶身分和信令系統跨越多個網域,電訊仍然是高風險目標。有效的緩解策略包括零信任策略、持續運行時保護以及通訊業者和雲端提供者之間的威脅情報共用。

細分市場分析

到2024年,通訊API將維持35.67%的電訊API市場佔有率,這主要得益於企業A2P流量的成長,該流量已達到2.2兆條訊息。隨著企業優先使用簡訊、彩信和進階通訊服務進行身份驗證和推廣,通訊電訊API市場規模預計將穩定成長。 RCS的成長動能強勁:Infobip預測,到2029年,A2P RCS營收將達到42億美元。同時,支付API的成長速度最快,複合年成長率(CAGR)高達17.45%,這得益於嵌入式金融模式將用戶的覆蓋範圍與金融科技能力結合。隨著企業將多模態支援整合到客戶經驗平台中,語音、IVR和WebRTC API仍然具有重要意義。開發人員也正在通訊業者識別和詐騙偵測API來增強行動交易的安全性。

需求模式持續轉變為增值功能。生成式人工智慧聊天機器人推動情境化通訊,而基於位置的API則協助智慧城市部署中的超當地語系化行銷。反垃圾郵件監管的加強促使業者對經過認證的寄件者ID收取額外費用,從而實現收入多元化。與雲端客服中心供應商的深度合作,使得通訊API成為醫療保健、銀行、零售等產業企業轉型策略的核心。

混合部署將實現最高成長,到2024年將佔據49.85%的市場佔有率,複合年成長率(CAGR)為15.45%。隨著網路核心仍保留在本地,而收費、分析和對外服務等微服務遷移到公共雲端,混合電訊部署中的API市場規模預計將會成長。營運商案例包括VIVA Bahrain的混合雲端核心和PCCW Global面向批發API的多重雲端策略。在亞太地區,本地資料儲存的監管要求正在推動混合部署的進一步普及。

業者傾向採用與雲端平台無關的容器編排管理,以避免廠商鎖定,並動態調整工作負載以最佳化成本。邊緣節點擴展了混合拓撲結構,為人工智慧推理和電腦視覺任務提供毫秒延遲。純公共雲端模式仍然適用於待開發區虛擬網路營運商 (MVNO),但整合複雜性和不可預測的出口流量費用限制了其在頂級營運商中的廣泛應用。純本地部署策略適用於對安全性要求較高的政府網路,但缺乏大規模 API 經濟所需的彈性。

電訊API 市場報告按服務類型(通訊/簡訊-彩信-RCS API、語音/IVR 和語音控制 API、其他)、部署類型(混合式、多重雲端、其他部署模式)、最終用戶(企業開發人員、內部通訊開發人員、合作夥伴開發人員、長尾開發人員)、經營模式(直接面向營運商、聚合商主導的CPS、平台進行細分服務 [PaaS、平台、PaaS]。

區域分析

北美地區將佔2024年總收入的34.06%,反映出CPaaS(通訊平台即服務)的高普及率和5G網路的廣泛覆蓋範圍。 AT&T、T-Mobile和Verizon與Aduna Ventures的合作,為金融科技和醫療保健應用提供統一的號碼認證和SIM卡交換API訪問,從而增強安全性。 Twilio 2024年44.6億美元的營收凸顯了企業對可程式通訊的強勁投資。政府鼓勵技術沙箱的框架支持電訊API市場的持續實驗。

預計到2030年,亞太地區將以17.51%的複合年成長率實現最快成長,這主要得益於其行動優先的經濟模式推動了5G的普及和數位服務的廣泛應用。預計到2024年第二季度,亞太地區通訊業者的總合收入將達到1,477億美元,其中72%的營運商實現了正成長。中國的5G用戶普及率預計到2028年將達到88%,而澳洲、日本和韓國在推廣按需高品質API所做的努力,都預示著該地區電信市場將積極擴張。政府對智慧製造和電子政府的推動,正在驅動對低延遲和安全功能的需求,使得電訊API市場成為該地區數位化進程的支柱。

隨著符合GDPR標準的各項安全措施提升了客戶對API服務的信任度,歐洲市場呈現穩定成長態勢。德國電信的AI手機藍圖表明,區域通訊業者對設備、人工智慧和通訊能力的融合表現出濃厚的興趣。歐洲通訊業者與超大規模資料中心業者的合作計劃加速了邊緣部署和CAMARA API的標準化進程。中東、非洲和拉丁美洲等新興市場也正經歷類似的成長,這得益於網路現代化投資和雲端夥伴關係策略,從而加快了數位服務上市的速度。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 企業中CPaaS採用率快速成長

- 透過開放閘道器和CAMARA實現網路API標準化

- 5G貨幣化壓力推動按需服務品質API的發展

- 邊緣運算工作負載需要低延遲切片 API

- 不斷成長的物聯網設備需要身分和收費API

- Gen-AI 支援降低准入門檻的開發工具

- 市場限制

- API安全漏洞和訊號詐騙的嚴重程度日益加劇

- 傳統OSS/BSS升級瓶頸

- OTT CPaaS 競賽壓縮利潤空間

- 與超大規模資料中心業者採用不透明的收入分成模式

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 宏觀經濟影響分析

- 電訊的API應用案例

第5章 市場規模與成長預測

- 按服務類型

- 通訊/簡訊-彩信-RCS API

- 語音/IVR 和語音控制 API

- 支付 API

- WebRTC API

- 位置和地圖 API

- 用戶身分管理和 SSO API

- 其他服務

- 依部署類型

- 混合

- 多重雲端

- 其他部署模式

- 最終用戶

- 企業開發人員

- 內部通訊開發人員

- 合作夥伴開發商

- 長尾開發者

- 按經營模式

- 直接連接通訊業者

- 聚合器主導的CPaaS

- 平台即服務 (PaaS)

- API市場/交易平台

- 按地區

- 北美洲

- 南美洲

- 歐洲

- 亞太地區

- 中東和非洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 供應商能力矩陣

- 主要供應商的關鍵案例研究

- 公司簡介

- ATandT Inc.

- Telefonica SA

- Twilio Inc.

- Infobip Ltd.

- Sinch AB

- Verizon Communications Inc.

- Orange SA

- Deutsche Telekom AG

- Ribbon Communications

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Cisco Systems Inc.

- Google LLC(Apigee)

- Vodafone Group Plc

- Nokia Corp.

- Vonage Holdings Corp.

- MessageBird BV

- Bandwidth Inc.

- Telnyx LLC

- Syniverse Technologies LLC

第7章 市場機會與未來展望

The Telecom API Market size is estimated at USD 353.87 billion in 2025, and is expected to reach USD 687.83 billion by 2030, at a CAGR of 14.22% during the forecast period (2025-2030).

Uptake reflects the telecom sector's pivot to programmable networks, monetization of 5G capabilities, and the rapid spread of Communications Platform as a Service (CPaaS). Key forces behind growth include standardization efforts such as GSMA Open Gateway, the proliferation of quality-on-demand APIs for 5G network slicing, and enterprise demand for embedded real-time communications. Competitive intensity has prompted consolidation: equipment vendors and carriers have formed joint ventures to pool network APIs, while CPaaS specialists scale through enterprise acquisition strategies. The market also benefits from hybrid cloud deployments that balance cloud agility with data-sovereignty requirements, positioning operators to quickly expose network functions to developer ecosystems.

Global Telecom API Market Trends and Insights

Surge in CPaaS adoption among enterprises

Enterprises continue embedding omnichannel communications into customer workflows, illustrated by Twilio's Q1 2025 revenue of USD 1.17 billion and an active customer base exceeding 335,000. Operators improve internal efficiency as well: AT&T's MuleSoft-centered program cut onboarding cycles from one year to six weeks and saved 2 million work hours annually. The economic payoff from API reuse reinforces management's focus on developer experience and continuous integration pipelines. Generative-AI-powered coding assistants lower entry barriers for in-house teams, and personalized messaging fuels sustained traffic on SMS, RCS, and voice channels.

Open Gateway and CAMARA standardization of network APIs

Forty-nine operator groups now back GSMA Open Gateway, signaling an industry consensus on unified interfaces for capabilities such as device verification, latency control, and location services. Telefonica's commercial launch shows developers integrating telecom features into fintech and streaming apps while retaining privacy controls. T-Mobile's CAMARA-compliant Quality-on-Demand APIs enable low-latency deployments in healthcare, logistics, and retail. Standardization lowers integration costs for software firms and accelerates time-to-market for network-aware applications.

Escalating API-security breaches and signaling fraud

API call volumes leapt 167% in 2024, exposing platforms to attack vectors that resulted in breaches at Dell, GitHub, and TracFone, the latter paying USD 16 million in penalties. Research shows 95% of organizations faced API security incidents, with 23% suffering data loss. Telecom players remain high-value targets because subscriber identity and signaling systems traverse multiple domains. Effective mitigations include zero-trust policies, continuous runtime protection, and threat-intelligence sharing between carriers and cloud providers.

Other drivers and restraints analyzed in the detailed report include:

- Monetization pressure on 5G driving QoS-on-demand APIs

- Edge-computing workloads need low-latency slicing APIs

- Legacy OSS/BSS upgrade bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Messaging APIs retained 35.67% Telecom API market share in 2024, anchored by enterprise A2P traffic that reached 2.2 trillion messages. The Telecom API market size for messaging is forecast to expand steadily as businesses prioritize SMS, MMS, and Rich Communication Services for authentication and promotions. RCS growth is striking: Infobip projects A2P RCS revenue climbing to USD 4.2 billion by 2029. Meanwhile, Payment APIs are scaling fastest at 17.45% CAGR because embedded finance models blend telecom reach with fintech capabilities. Voice, IVR, and WebRTC APIs retain relevance as enterprises integrate multi-modal support into customer-experience platforms. Developers also leverage subscriber-identity and fraud-detection APIs to boost security for mobile transactions.

Demand patterns continue shifting toward value-added functionality. Generative-AI chatbots drive contextual messaging, and location-based APIs enable hyperlocal marketing in smart-city rollouts. As regulation tightens against spam, operators charge premiums for verified sender IDs, reinforcing revenue diversification. Close collaboration with cloud contact-center vendors keeps messaging APIs central to enterprise transformation agendas across healthcare, banking, and retail.

Hybrid environments captured 49.85% market share in 2024 and delivered the highest growth trajectory at 15.45% CAGR, underscoring operator priorities around sovereignty and latency. Telecom API market size for hybrid deployments is projected to expand as network cores stay on-premises while microservices for billing, analytics, and exposure layers move to public cloud. Operator examples include VIVA Bahrain's hybrid cloud core and PCCW Global's multi-cloud strategy for wholesale APIs. Regulatory mandates for local data storage in APAC further sustain hybrid uptake.

Operators favor cloud-agnostic container orchestration to avoid vendor lock-in and to dynamically shift workloads for cost optimization. Edge nodes extend hybrid topologies, offering developers single-digit-millisecond latency for AI inference and computer-vision tasks. Pure public-cloud models remain suitable for greenfield MVNOs, but integration complexity and unpredictable egress fees limit broad adoption for tier-one operators. On-premises-only strategies persist for security-sensitive government networks yet lack the elasticity required for large-scale API economies.

The Telecom API Market Report is Segmented by Service Type (Messaging/SMS-MMS-RCS API, Voice/IVR & Voice Control API, and More), Deployment Type (Hybrid, Multi-Cloud, and Other Deployment Modes), End-User (Enterprise Developer, Internal Telecom Developer, Partner Developer, and Long-Tail Developer), Business Model (Direct Carrier Exposure, Aggregator-Led CPaaS, Platform-As-A-Service [PaaS], and More), and Geography.

Geography Analysis

North America accounted for 34.06% of 2024 revenue, reflecting high CPaaS penetration and extensive 5G coverage. Collaboration among AT&T, T-Mobile, and Verizon in the Aduna venture allows unified access to Number Verification and SIM Swap APIs that raise security for fintech and healthcare applications. Twilio's USD 4.46 billion 2024 revenue underscores robust enterprise spending on programmable communications, while developer-first cultures spur quick uptake of new network features. Government frameworks that encourage technology sandboxes support continuous experimentation in the Telecom API market.

Asia-Pacific is forecast to register the fastest 17.51% CAGR through 2030 as mobile-first economies escalate 5G rollouts and digital-services adoption. Combined regional telco revenue hit USD 147.7 billion in Q2 2024, with 72% of operators reporting positive growth. China's projected 88% 5G subscription rate by 2028 and initiatives in Australia, Japan, and South Korea to expose quality-on-demand APIs illustrate aggressive expansion. Government mandates for smart manufacturing and e-governance increase demand for low-latency and security features, making the Telecom API market the backbone of regional digital agendas.

Europe shows steady growth because GDPR-aligned security practices elevate customer trust in API services. Deutsche Telekom's AI-phone roadmap demonstrates regional operator interest in converging devices, AI, and telecom capabilities. Collaborative projects among European carriers and hyperscalers accelerate edge deployments and standardized CAMARA APIs. Emerging markets in the Middle East, Africa, and Latin America ride similar trajectories, backed by network-modernization investments and cloud-partnership strategies that lower time-to-market for digital-service launches.

- ATandT Inc.

- Telefonica SA

- Twilio Inc.

- Infobip Ltd.

- Sinch AB

- Verizon Communications Inc.

- Orange SA

- Deutsche Telekom AG

- Ribbon Communications

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Cisco Systems Inc.

- Google LLC (Apigee)

- Vodafone Group Plc

- Nokia Corp.

- Vonage Holdings Corp.

- MessageBird B.V.

- Bandwidth Inc.

- Telnyx LLC

- Syniverse Technologies LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in CPaaS adoption among enterprises

- 4.2.2 Open Gateway and CAMARA standardisation of network APIs

- 4.2.3 Monetisation pressure on 5G driving QoS-on-demand APIs

- 4.2.4 Edge-computing workloads need low-latency slicing APIs

- 4.2.5 IoT fleet expansion demanding ID and billing APIs

- 4.2.6 Gen-AI-assisted dev-tools lowering entry barriers

- 4.3 Market Restraints

- 4.3.1 Escalating API-security breaches and signalling fraud

- 4.3.2 Legacy OSS/BSS upgrade bottlenecks

- 4.3.3 Margin compression from OTT CPaaS competitors

- 4.3.4 Unclear revenue-share models with hyperscalers

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Macroeconomic Impact Analysis

- 4.9 API Use Cases in Telecom Industry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Messaging/SMS-MMS-RCS API

- 5.1.2 Voice/IVR and Voice Control API

- 5.1.3 Payment API

- 5.1.4 WebRTC API

- 5.1.5 Location and Mapping API

- 5.1.6 Subscriber ID Mgmt and SSO API

- 5.1.7 Other Services

- 5.2 By Deployment Type

- 5.2.1 Hybrid

- 5.2.2 Multi-cloud

- 5.2.3 Other Deployment Modes

- 5.3 By End-User

- 5.3.1 Enterprise Developer

- 5.3.2 Internal Telecom Developer

- 5.3.3 Partner Developer

- 5.3.4 Long-tail Developer

- 5.4 By Business Model

- 5.4.1 Direct Carrier Exposure

- 5.4.2 Aggregator-led CPaaS

- 5.4.3 Platform-as-a-Service (PaaS)

- 5.4.4 API Marketplace/Exchange

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 South America

- 5.5.3 Europe

- 5.5.4 Asia Pacific

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Vendor Capability Matrix

- 6.5 Key Case Studies of Major Vendors

- 6.6 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.6.1 ATandT Inc.

- 6.6.2 Telefonica SA

- 6.6.3 Twilio Inc.

- 6.6.4 Infobip Ltd.

- 6.6.5 Sinch AB

- 6.6.6 Verizon Communications Inc.

- 6.6.7 Orange SA

- 6.6.8 Deutsche Telekom AG

- 6.6.9 Ribbon Communications

- 6.6.10 Huawei Technologies Co. Ltd.

- 6.6.11 Telefonaktiebolaget LM Ericsson

- 6.6.12 Cisco Systems Inc.

- 6.6.13 Google LLC (Apigee)

- 6.6.14 Vodafone Group Plc

- 6.6.15 Nokia Corp.

- 6.6.16 Vonage Holdings Corp.

- 6.6.17 MessageBird B.V.

- 6.6.18 Bandwidth Inc.

- 6.6.19 Telnyx LLC

- 6.6.20 Syniverse Technologies LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment