|

市場調查報告書

商品編碼

1519877

分子篩:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Molecular Sieves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

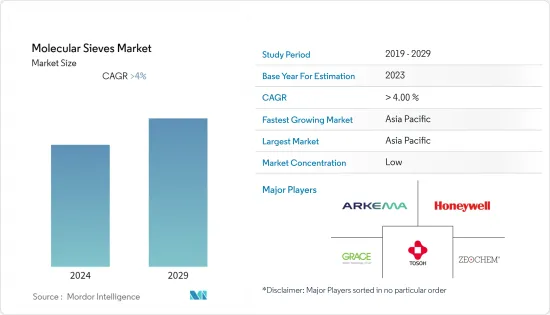

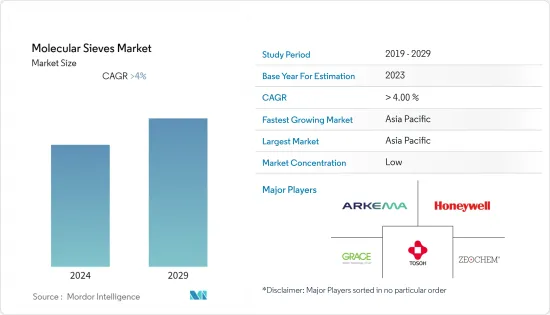

預計2024年分子篩市場規模將達40.2億美元,2029年將達到50.6億美元,在預測期間(2024-2029年)複合年成長率將超過4.5%。

2020 年市場受到 COVID-19 的負面影響。受疫情影響,許多分子篩製造商和原料製造商延長了其製造地的所有營運關閉時間。然而,大流行後產業已恢復速度,預計這一趨勢將在預測期內持續下去。

短期內,推動市場成長的主要因素包括人們對污水中有害有機物質處理的認知不斷提高以及在石油和石化產品中廣泛用作催化劑。

相反,化學合成物、酵素和其他替代品的威脅將阻礙市場成長。

抗菌沸石分子篩的發展似乎是個機會。

亞太地區主導全球市場,其中中國和印度等國家的消費量最高。

分子篩市場趨勢

精製和石化領域佔市場主導地位

- 分子篩廣泛應用於煉油精製。分子篩用於石化應用,例如乙烯、丙烯、丁二烯和其他原料的脫水和精製、裂解氣體和液體的脫水、石腦油進料的脫水以及乙炔轉換器的氫氣乾燥。

- 沸石用作將原油精製成石油產品的催化劑。由於其優異的選擇性,沸石催化劑通常是將煉油廠物流轉化為高辛烷值汽油混合原料的最有效和最具成本效益的技術。

- 根據BP《2022年世界能源統計年鑑》顯示,全球煉油廠總吞吐量約79,229,000桶/日,與前一年同期比較成長5%。美國的煉油廠吞吐量最高,每天 15,148,000 桶,其次是中國。

- 與上年相比,全球石油產量也出現小幅成長。根據BP全球能源統計年鑑,2022年全球精製量達近1.02億桶/日,2021年產量約42.21億噸。總體而言,全球煉油產能在過去 50 年中幾乎加倍,其中成長最快的時期出現在 1970 年代。

- 石油和天然氣工業的前景建議石油探勘的長期發展和分子篩的增加使用。

- 所有上述因素預計將在預測期內影響調查市場。

亞太地區主導市場

- 亞太地區在分子篩市場上佔據主導地位,並且由於其煉油和精製、汽車、製藥、工業氣體生產和水處理等各個行業的製造業務蓬勃發展,預計未來將繼續佔據主導地位。

- 根據中國國家統計局統計,截至2023年8月,中國每月生產塑膠製品約636萬噸。

- 中國也是化妝品的主要消費國之一。 2022年,中國批發和零售企業的化妝品零售額約為3,936億元人民幣(約570億美元)。然而,根據中國國家統計局的數據,這比上年略有下降,當時零售總額約為 4,026 億元人民幣(約 586 億美元)。

- 印度的化妝品和個人護理產業約佔該國快速消費品產業總量的51%。對產品的需求不斷成長,導致許多公司製定了在該國立足的策略,包括業務擴張和產品創新。例如,2022 年 7 月,Godrej Consumer Products 推出了印度首款混合沐浴乳Godrej Magic Body Wash,售價僅 45 印度盧比(0.57 美元)。

- 根據BP《2022年世界能源統計年鑑》顯示,中國石油總產量是亞太地區最高的,2021年產量接近2億噸,其次是印度,仍佔中國總產量的最大佔有率。

- 此外,根據BP統計審查,2022年天然氣產量佔有率為5.5%,而2021年為5.2%,成為亞太地區最高生產國,僅次於印度。

- 因此,預計全部區域各行業的投資和成長將在預測期內對分子篩市場產生正面影響。

分子篩產業概況

分子篩市場分散。主要企業(排名不分先後)包括 Honeywell International Inc.、Arkema、Zeochem AG、WR Grace & Co.-Conn. 和 Tosoh Corporation。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 提高污水中有害有機物處理的意識

- 作為石油和石化產品的催化劑有著廣泛的應用

- 其他司機

- 抑制因素

- 合成化學品、酵素和其他替代品的威脅

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 生產分析

- 價格分析

第5章市場區隔(基於以金額為準的市場規模)

- 形狀

- 顆粒

- 串珠的

- 粉末

- 尺寸

- 微孔的

- 介孔的

- 大孔的

- 產品類別

- 碳

- 黏土

- 多孔玻璃

- 矽膠

- 沸石

- 最終用戶產業

- 車

- 化妝品和清潔劑

- 油和氣

- 製藥

- 廢棄物和水處理

- 其他最終用戶產業(建築、化工)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲/紐西蘭

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arkema

- Axens

- BASF SE

- CarboTech

- Clariant

- Desicca Chemical Pvt. Ltd

- Hengye Inc.

- Honeywell International Inc.

- JIUZHOU CHEMICALS

- KNT Group

- Kuraray Co. Ltd

- Merck KGaA

- OMRON Healthcare Inc.

- Palmer Holland

- Resonac Holdings Corporation

- Sorbead India

- Tosoh Corporation

- WR Grace & Co.-Conn.

- Zeochem AG

- Zeolyst International

第7章 市場機會及未來趨勢

- 抗菌沸石分級篩的研製

- 醫用氧氣濃縮用奈米沸石分子篩

The Molecular Sieves Market size is estimated at USD 4.02 billion in 2024, and is expected to reach USD 5.06 billion by 2029, growing at a CAGR of greater than 4.5% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Due to the pandemic, many molecular sieve manufacturers and raw material manufacturers extended the closure of all their operations at their manufacturing locations. However, the industries picked up speed in the post-pandemic era and were expected to keep doing so during the forecast period.

Over the short term, major factors driving the market's growth include rising awareness for treating hazardous organic materials in wastewater and their extensive application as catalysts in petroleum and petrochemical products.

Conversely, the threat from chemical composites, enzymes, and other substitutes will hinder the market's growth.

Developing anti-microbial zeolite molecular sieves is likely to be an opportunity.

Asia-Pacific dominated the global market, with the largest consumption from countries such as China and India.

Molecular Sieves Market Trends

Petroleum Refining and Petrochemicals Segment to Dominate the Market

- The petroleum refining business makes extensive use of molecular sieves. They are utilized in petrochemical applications such as ethylene, propylene, butadiene, and other feedstock dehydration and purification, cracked gas and liquid dehydration, naphtha feed dehydration, and drying hydrogen gas for acetylene converters.

- Zeolites are used as catalysts to refine crude oil into finished petroleum products. Zeolite catalysts are often the most efficient and cost-effective technique for converting refinery streams into high-octane gasoline blending stock due to their excellent selectivity.

- According to the BP Statistical Review of World Energy 2022, total oil refinery throughput worldwide was roughly 79,229 thousand barrels per day, a 5% increase over the previous year. The United States had the largest oil refinery throughput, with 15,148 thousand barrels daily, followed by China.

- A modest volume gain was also when comparing world oil output to the previous year. According to the BP Statistical Review of Global Energy, the world's oil refinery capacity almost reached 102 million barrels per day in 2022, and approximately 4,221 million metric tonnes of volume were produced in 2021. Overall, global refinery capacity has nearly doubled in the past fifty years and experienced the largest growth during the 1970s.

- The prospectus for the future development of the oil and gas business recommends that oil exploration will proceed to develop in the long term and utilize molecular sieves.

- All the factors mentioned above, in turn, are expected to impact the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the molecular sieves market and is expected to continue doing so due to the region's extensive manufacturing operations for various industries such as petroleum refining and petrochemicals, automotive, pharmaceutical, industrial gas production, water treatment, and many more.

- According to the National Bureau of Statistics of China, as of August 2023, China produced roughly 6.36 million metric tons of plastic products every month.

- China is also one of the major consumers of cosmetics. In 2022, wholesale and retail companies' retail sales of cosmetics in China totaled about CNY 393.6 billion (~USD 57 billion). This, though, indicated a slight decrease compared to the previous year, which had a total retail sale of about CNY 402.6 billion (~USD 58.6 billion), as stated by the National Bureau of Statistics of China.

- India's cosmetics and personal care segment accounts for about 51% of the country's total FMCG sector. Due to the growing demand for the products, many companies have developed strategies to have a strong foothold in the country, including expansion and product innovation. For instance, in July 2022, Godrej Consumer Products unveiled Godrej Magic Bodywash, India's first ready-to-mix body wash, at just INR 45 (USD 0.57).

- According to the BP Statistical Review of World Energy 2022, the total oil production in China was the highest in the Asia-Pacific region, accounting for nearly 200 million tons of production in 2021, followed by India, which only produced a sixth of the total production in China.

- Moreover, in 2022, the natural gas production share was 5.5%, whereas in 2021, it was 5.2% and had the highest production in the Asia-Pacific region, followed by India, as stated by the BP statistical review.

- Therefore, with all the investments and the growth in the various industries across the region, a positive impact is expected on the molecular sieves market during the forecast period.

Molecular Sieves Industry Overview

The Molecular Sieves Market is fragmented in nature. The major players (not in any particular order) include Honeywell International Inc., Arkema, Zeochem AG, W. R. Grace & Co.-Conn., and Tosoh Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Awareness About Treatment of Hazardous Organic Materials in Wastewater

- 4.1.2 Extensive Application as a Catalyst in Petroleum and Petrochemical Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Threat from Chemical Composites, Enzymes, and Other Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Analysis

- 4.6 Price Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Shape

- 5.1.1 Pelleted

- 5.1.2 Beaded

- 5.1.3 Powdered

- 5.2 Size

- 5.2.1 Microporous

- 5.2.2 Mesoporous

- 5.2.3 Macroporous

- 5.3 Product Type

- 5.3.1 Carbon

- 5.3.2 Clay

- 5.3.3 Porous Glass

- 5.3.4 Silica Gel

- 5.3.5 Zeolite

- 5.4 End-user Industry

- 5.4.1 Automotive

- 5.4.2 Cosmetics and Detergent

- 5.4.3 Oil and Gas

- 5.4.4 Pharmaceutical

- 5.4.5 Waste and Water Treatment

- 5.4.6 Other End-user Industries ( Construction and Chemical)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Australia & New Zealand

- 5.5.1.6 Malaysia

- 5.5.1.7 Thailand

- 5.5.1.8 Indonesia

- 5.5.1.9 Vietnam

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.2.4 Rest of North America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Russia

- 5.5.3.6 Spain

- 5.5.3.7 NORDIC

- 5.5.3.8 Turkey

- 5.5.3.9 Russia

- 5.5.3.10 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Qatar

- 5.5.5.5 Egypt

- 5.5.5.6 UAE

- 5.5.5.7 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Axens

- 6.4.3 BASF SE

- 6.4.4 CarboTech

- 6.4.5 Clariant

- 6.4.6 Desicca Chemical Pvt. Ltd

- 6.4.7 Hengye Inc.

- 6.4.8 Honeywell International Inc.

- 6.4.9 JIUZHOU CHEMICALS

- 6.4.10 KNT Group

- 6.4.11 Kuraray Co. Ltd

- 6.4.12 Merck KGaA

- 6.4.13 OMRON Healthcare Inc.

- 6.4.14 Palmer Holland

- 6.4.15 Resonac Holdings Corporation

- 6.4.16 Sorbead India

- 6.4.17 Tosoh Corporation

- 6.4.18 W. R. Grace & Co.-Conn.

- 6.4.19 Zeochem AG

- 6.4.20 Zeolyst International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Anti-microbial Zeolite Molecular Sieves

- 7.2 Nano-size Zeolite Molecular Sieves for Medical Oxygen Concentration