|

市場調查報告書

商品編碼

1519883

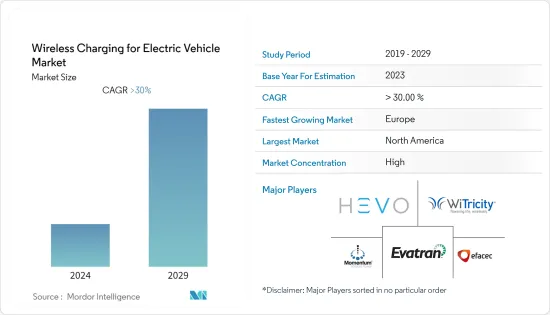

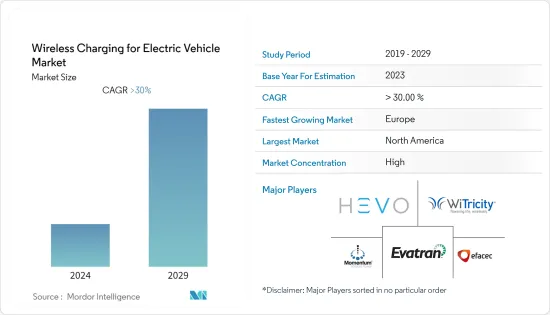

電動車無線充電:市場佔有率分析、產業趨勢與成長預測(2024-2029)Wireless Charging For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

電動車無線充電市場規模預計到 2024 年為 1.523 億美元,預計到 2029 年將達到 7.625 億美元,預測期內(2024-2029 年)複合年成長率為 38.40%。

無線電動汽車 (EV) 充電是一項創新技術,無需車輛與充電站之間的實體連接即可實現電動車充電。與傳統的有線充電相比,無線電動汽車充電具有多種優勢。首先,它消除了對繁瑣且耗時的電纜和連接器的需求。其次,降低了因電纜損壞或連接不當而導致觸電或火災的風險。最後,服務商提供了更簡化和方便用戶使用的充電體驗,因為您只需將汽車停在充電墊片,充電過程就會自動開始。

*無線充電是目前正在開發的最新技術之一,將推動電動車產業的發展。

*在都市區安裝充電站和充電器時,確保土地通常是一個問題。隨著無線充電的推出,隨著挑戰的緩解,充電器業者的銷售表現也有所改善。

*儘管無線充電是電動車的必需品,但也存在一些缺點需要考慮,例如充電過程中的能量損失、缺乏適當的充電基礎設施以及高成本。

*隨著電動車在世界各地普及,無線充電站的需求預計將會增加。世界各國政府正在向英國、挪威、日本和美國等國家以及中國等新興經濟體的買家提供獎勵。

*少數國家正在致力於電動車無線充電。例如,2022年9月,一家日本建設公司宣布與Denso公司合作,協助建造道路路面,到年終將為電動車提供無線充電點。這是由於認知到需要建造合適的車站(包括土地)的結果。

電動車無線充電市場趨勢

乘用車銷售成長帶動市場成長

隨著越來越多的人意識到傳統汽油車對環境的影響,對電動車的興趣與日俱增。此外,燃油價格上漲正在減緩汽車產業電動車的採用,這在刺激充電站需求方面發揮著重要作用。

這迫使汽車製造商增加電動車研發支出,最終使他們能夠在未來銷售電動車。這項策略對人們產生了強烈影響,他們的購買模式發生了很大變化,從傳統內燃機汽車轉向電動車。這項變革在不減少內燃機汽車銷售的情況下,為現在和未來的電動車創造了一個充滿希望的市場。

全球整體,2022年電動車銷量較2021年成長約55.5%,雖然車輛銷量低於上年,但首次突破1,000萬輛。因此,根據國際能源總署 (IEA) 的數據,到 2022 年,全球購買的七分之一的乘用車將是電動車。

此外,叫車和汽車共享市場預計將增加對充電站的需求。與私家車相比,叫車和汽車共享車輛的使用時間通常更長,利用率更高。這意味著它們需要更頻繁地充電,從而增加了對充電站的需求。

現在,電動車在性能、維護和初始購買成本方面與內燃機汽車相當(有時甚至超過)。

搭乘用電動車的成長預計將增加對充電設備和無線充電的需求,據稱這將減少充電所需的勞動力。無線充電預計將在不久的將來普及,市場規模將會擴大。

歐洲是一個快速成長的市場

歐洲是最大的製造地,預計將成為無線充電站的最大市場。這種成長歸因於支持電動車銷售的可行基礎設施的可用性。電動車被認為是汽車購買者的可行選擇。過去五年來,歐洲的電動車銷量一直在成長。隨著銷量的預期成長,電動車無線充電基礎設施等技術的機會正在出現。

德國、英國和法國由於規模經濟、高所得和汽車製造中心的結合,可能成為最大的無線充電市場。在比利時和英國等國家,研究顯示貨車、公車和計程車更有可能接受無線充電。

此外,2023 年 3 月,ABT e-Line 和 WiTricity 宣布計劃在歐洲提供售後無線電動汽車充電服務。 ABT e-Line 最初計劃升級 VW ID.4 以支援 WiTricity 無線充電,目標發布日期為 2024 年初。之後,我們計劃擴展到其他電動車款。

無線充電的市場基礎已經顯現,德國、荷蘭、英國等歐洲國家的電動車銷售量逐年成長。

電動車無線充電產業概況

高通、WiTricity、Momentum Dynamics、Hevo、Primove(龐巴迪)和大陸集團等領先公司在市場上獲得了相當大的佔有率。這些領先公司專注於合作夥伴關係、新產品發布以及研發,以滲透當地市場。例如

*2023 年 11 月,Electron 宣布與密西根州交通部合作,將無線充電引入公共道路。採用 Electron 技術,感應式充電線圈將安裝在底特律 Marantette 街和 Dalzell 街之間的第 14 街,為配備 Electron接收器的電動車在路上行駛時充電。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 電動車的擴張

- 政府支持和獎勵

- 市場限制因素

- 高成本可能阻礙市場成長

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按車型分類

- 客車

- 商用車

- 按應用程式類型

- 住宅

- 商業的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 世界其他地區

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Hella Aglaia Mobile Vision

- Witricity Corporation

- Momentum Dynamics Corporation

- Elix Wireless Inc.

- Mojo Mobility

- EFACEC

- ZTE Corporation

- Evatran Group Inc.

- HEVO Inc.

- Tgood Electric Co

- Continental AG

- Robert Bosch GmbH

- Hella Kgaa Hueck & Co.

- Toyota Motor Corporation

- Toshiba Corporation

第7章 市場機會及未來趨勢

- 協作與夥伴關係

- 技術進步

The Wireless Charging For Electric Vehicle Market size is estimated at USD 152.30 million in 2024, and is expected to reach USD 762.5 million by 2029, growing at a CAGR of 38.40% during the forecast period (2024-2029).

Wireless electric vehicle (EV) charging is an innovative technology that enables EVs to be charged without needing a physical connection between the vehicle and the charging station. Wireless EV charging has several advantages over traditional wired charging. Firstly, it eliminates the need for cables and connectors, which can be inconvenient and time-consuming to handle. Secondly, it reduces the risk of electric shock or fire hazards caused by damaged cables or improper connections. Finally, it offers a more streamlined and user-friendly charging experience, as drivers can simply park their vehicle over the charging pad, and the charging process begins automatically.

* Wireless vehicle charging is one of the latest technologies that is being significantly developed, and it is also likely to boost the electric car industry.

* Setting up a charging station and chargers often increases land availability challenges in urban areas. With the inception of wireless charging, the challenges have been eased, and thus, charger operators have witnessed improved sales bars.

* Even though wireless charging is a must-have for electric vehicles, a few drawbacks need to be considered, like energy loss while charging, lack of availability of proper charging infrastructure, and high cost.

* The increase in the sale of electric vehicles across the globe is anticipated to drive the demand for wireless charging stations. Governments across the world, in countries like the United Kingdom, Norway, Japan, and the United States, as well as in developing countries like China, are providing purchasers with incentives.

* A limited number of countries are working on wireless charging for electric vehicles. For instance, in September 2022, a Japanese construction company announced the joining of cooperation with Denso Corporation to help build road pavement offering wireless EV charging points by the end of 2025. This came after realizing the necessity of constructing a proper station that includes the land.

Wireless Charging For Electric Vehicle Market Trends

Increasing Passenger Car Sales To Propel The Market Growth

As more people become aware of the environmental impacts of traditional gasoline-powered cars, there is a growing interest in electric cars. Additionally, rising fuel prices have slowed the penetration of electric vehicles in the automobile industry, which plays a significant role in stimulating the demand for charging stations.

This has forced automakers to increase their expenditure on R&D of electric vehicles, which eventually allowed them to market electric vehicles in the future. This strategy strongly impacted people, as there was a considerable change in the purchase pattern from conventional IC engine vehicles to electric vehicles. The change has not decreased the sales of IC engine vehicles but created a promising market for electric vehicles in the present and future.

Globally, the sales of electric cars increased by around 55.5% in 2022 compared to 2021, crossing 10 million for the first time, even though car sales were less than the previous year. As a result, 1 in every 7 passenger cars bought globally in 2022 was an EV, according to the International Energy Agency (IEA).

Further, the ride-hailing and car-sharing markets are expected to increase the demand for charging stations. Ride-hailing and car-sharing vehicles are typically used for longer periods and experience higher utilization rates than privately owned vehicles. This means that they need to be charged more frequently, which increases the demand for charging stations.

Electric vehicles have reached par (sometimes surpassed) with IC engine vehicles in terms of performance, maintenance, and the initial cost of purchase.

The growth of passenger electric vehicles is anticipated to increase the need for charging equipment and wireless charging, which claims to reduce the effort put into charging the vehicle. Wireless charging is expected to gain popularity and have a growing market in the near future.

Europe is the Fastest Growing region in the Market

Europe is expected to be the largest manufacturing hub and the largest market for wireless charging stations. This growth owes to the availability of viable infrastructures to support electric vehicle sales. Electric vehicles are considered a viable option for customers who purchase a vehicle. The sales of electric cars in the European region have been on the rise for the last five years. The sales are forecasted to increase, thereby opening opportunities for technologies like wireless charging infrastructure for electric vehicles.

Germany, the United Kingdom, and France will be the biggest markets for wireless charging due to a combination of economies of scale, high levels of income, and being an automotive manufacturing hub. In countries like Belgium and the United Kingdom, surveys have demonstrated that vans, buses, and taxis are more likely to accept wireless charging of vehicles, as these particular segments require a high range with convenient charging methods.

Moreover, in March 2023, ABT e-Line and WiTricity had announced plans to deliver aftermarket wireless EV charging in Europe. ABT e-Line plans to initially upgrade the VW ID.4 to support wireless charging from WiTricity, with the availability targeted for early 2024. The company plans to expand to additional EV models thereafter.

The foundation for the market for wireless charging is already visible from the yearly increasing sales of electric vehicles in European countries, like Germany, the Netherlands, and the United Kingdom, among many others.

Wireless Charging For Electric Vehicle Industry Overview

Some of the major players, like Qualcomm, WiTricity, Momentum Dynamics, Hevo, Primove (Bombardier), Continental, etc., have captured significant shares in the market. These major players focus on partnerships, the launching of new products, and R&D to achieve a higher penetration into the regional markets. For instance,

* In November 2023, Electron, in partnership with the Michigan Department of Transportation, announced the deployment of a wireless-charging public roadway. Using technology from Electreon, Detroit's 14th Street is now equipped with inductive-charging coils between Marantette and Dalzelle streets that will charge electric vehicles equipped with Electreon receivers as they drive on the road.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Adoption Of Electric Vehicles

- 4.1.2 Government Support And Incentives

- 4.2 Market Restraints

- 4.2.1 Higher Cost May hinder the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Application Type

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 Australia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Hella Aglaia Mobile Vision

- 6.2.2 Witricity Corporation

- 6.2.3 Momentum Dynamics Corporation

- 6.2.4 Elix Wireless Inc.

- 6.2.5 Mojo Mobility

- 6.2.6 EFACEC

- 6.2.7 ZTE Corporation

- 6.2.8 Evatran Group Inc.

- 6.2.9 HEVO Inc.

- 6.2.10 Tgood Electric Co

- 6.2.11 Continental AG

- 6.2.12 Robert Bosch GmbH

- 6.2.13 Hella Kgaa Hueck & Co.

- 6.2.14 Toyota Motor Corporation

- 6.2.15 Toshiba Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Collaboration And Partnerships

- 7.1.1 Technological Advancements