|

市場調查報告書

商品編碼

1519892

第三方付款:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Third Party Payment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

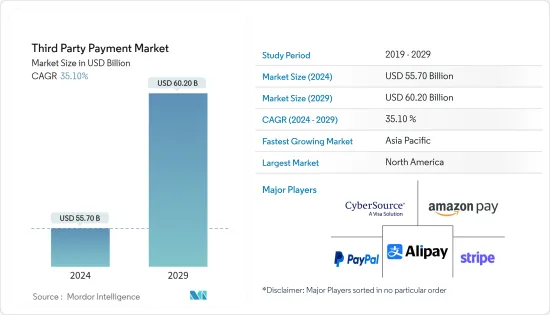

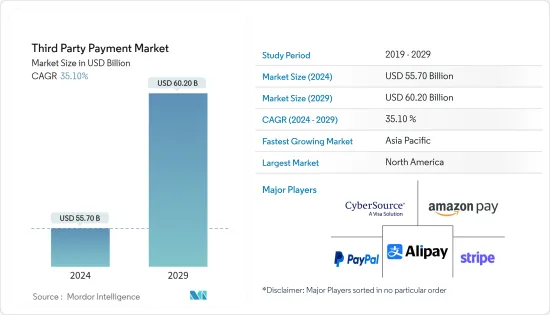

第三方付款市場規模預計到2024年為557億美元,預計到2029年將達到602億美元,在預測期內(2024-2029年)複合年成長率預計將成長35.10%。

預計 2024 年至 2029 年第三方支付市場將大幅成長。科技的進步改變了數位時代用戶互動和交易的方式,導致更多的人和企業透過線上付款管道參與第三方交易。例如,在零售交易中,PayPal 是一個充當第三方的線上付款門戶,賣家和買家在此進行交易,並使用 PayPal 閘道器進行付款。

主要亮點

- 各行業的企業擴大採用數位付款,尤其是小型企業對企業交易。第三方參與交易因其便利性和相對簡單性而成為必不可少的要素。

- 隨著越來越多的公司將付款整合到其產品中,付款格局正在改變。企業代表客戶轉移資金的第三方支付比傳統的應付帳款帳款、應收帳款和第一方付款更為普遍。

- 此外,與傳統商家帳戶相比,第三方支付處理商通常會對每筆交易申請更高的費用,而且客戶身分也被混淆。安全威脅和技術整合因素也可能阻礙市場成長。

- 儘管第三方支付市場競爭激烈,但由於競爭後的全球復甦趨勢明顯,市場成長前景樂觀,投資者對此持樂觀態度。因此,我們預計未來幾年該領域的投資將會增加。

第三方支付市場趨勢

POS(銷售點)領域預計將推動市場發展

- 現金交易仍然在付款處理系統領域佔據主導地位,對無現金未來的預測不太可能很快實現。然而,該細分市場仍在急劇轉向電子錢包,並大幅遠離現金。

- 此外,世界各地的商店和服務機構正在迅速採用和整合 PayPal、Samsung Pay、支付寶、Apple Pay 和微信支付等行動付款應用程式來接受付款。由於生活方式和消費者習慣的變化以及PayPal第三方支付的快速成長,這一趨勢很可能從2024年持續到2029年。

- 亞太地區和歐洲、中東和非洲等高成長地區將推動第三方支付市場的成長,預計未來 POS 的現金使用量也將出現兩位數下降。

- 行動 POS(銷售點)設備的日益普及也是該細分市場成長的一個促成因素。據 Mobile Payments Today 最近發布的部落格稱,行業專家預測,到 2023 年,行動 POS 交易數量將增加兩倍。

- 此外,Google等公司正在為智慧型手機用戶提供便利的非接觸式付款。這些技術在相容的智慧型手機和智慧型手錶中利用近場通訊(NFC) 技術。用戶必須將信用卡或簽帳金融卡資訊保存在 Android Pay 帳戶中,並在支付商品和服務費用時將智慧型手機或手錶放在零售銷售點終端附近。

亞太地區市場可望實現顯著成長

- 就行動付款而言,付款領域的創新主要由亞洲推動。亞洲市場的消費者在網路生活的各個方面都要求同等或更高的舒適度和安全性,特別是在付款和購物方面。

- 隨著數位交易變得越來越普遍,該地區的企業迅速採用電子付款系統來促進安全、便利的交易。同時,政府和知名組織正在積極倡導無現金交易,作為更廣泛的數位化舉措的一部分,進一步推動 POS(銷售點)系統在市場上的採用。因此,監管機構正在帶頭推動數位化工作,以促進無現金付款並加速 POS 市場的成長。

- 政府支持數位付款的努力也是推動亞太地區已開發市場的因素。因此,影響亞太第三方付款市場的三個主要因素是:電子商務、POS滲透率和政府措施。

- 在全部區域,消費者將受益於更有效率、更便利的付款流程,以及更短的排隊時間、無現金問題和更快的排隊速度等便利性。

- 隨著中國和印度等國家透過行動電子錢包採用數位付款,亞太市場預計將大幅成長。無處不在的行動裝置、先進的數位基礎設施以及不斷成長的應用程式使用量正在推動亞太地區數位和行動錢包的快速成長。

第三方支付產業概況

第三方支付市場競爭激烈。市場上的一些參與者已經營運了相當長一段時間。從那時起,許多新興企業紛紛湧現,抓住了這個市場提供的巨大機會。有些玩家只在某些地區活躍。主要參與者包括 PayPal Holdings Inc.、Stripe Inc.、Alipay.com 和 Amazon Payments Inc.。近期市場趨勢如下:

- 2023 年 6 月,Stripe Inc. 宣布與 Google Workspace 合作,支援使用 Google 日曆進行付費預約。這項新功能可讓企業連接他們的 Stripe 帳戶、設定價格,然後讓客戶能夠在 Google 日曆中預訂和支付服務。

- 2023 年 4 月 - PayPal Holdings Inc. 宣佈為其小型企業付款解決方案推出新功能。這些解決方案允許小型企業接受各種付款方式,包括 PayPal Venmo 和 PayPal Pay Later 產品,透過為客戶提供更多付款方式選擇來加快結帳速度。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 網路的普及導致數位付款的普及

- 由於基於雲端基礎的系統,B2B 銷售成長,POS 領域銷售增加

- 世界高成長地區電子商務的成長

- 市場限制因素

- 安全和隱私問題抑制市場

第6章 市場細分

- 按類型

- 線上

- 移動的

- 銷售點管理

- 按最終用戶

- BFSI

- 零售

- 電子商務

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- PayPal Holdings Inc.

- Stripe Inc.

- Alipay.com Co. Ltd

- Amazon Payments Inc.

- Authorize.Net(CyberSource Corporation)

- WePay Inc.(JPMorgan Chase & Co.)

- 2checkout.Com Inc.(Avangate BV)

- Adyen NV

- First Data Corporation(Fiserv Inc.)

- One 97 Communications Limited

第8章投資分析

第9章 市場機會及未來趨勢

The Third Party Payment Market size is estimated at USD 55.70 billion in 2024, and is expected to reach USD 60.20 billion by 2029, growing at a CAGR of 35.10% during the forecast period (2024-2029).

The third party payment market is expected to rise at a considerable rate between 2024 and 2029. More people and businesses are taking part in third-party transactions via online payment platforms due to the development of technology that has changed how users interact and conduct transactions in the digital age. For example, in a retail transaction, PayPal is an online payment portal that acts as a third party, where the seller and the buyer can perform the transaction, and the payment is made using the PayPal gateway.

Key Highlights

- Enterprises across sectors have made a major effort to accept digital payments, particularly in small business-to-business transactions. Third-party involvement in transactions has been an essential factor owing to its convenience and relatively simple nature.

- The flow of payments has changed as more companies incorporate payments into their products. Third-party payments, where businesses move money for their customers, have become more prevalent than traditional accounts payable and receivable or first-party payments.

- Moreover, third-party payment processors often charge higher per-transaction fees compared to traditional merchant accounts, and customer identity is obfuscated. Security threats and technical integration factors might hamper the market's growth.

- Although the third party payment market is highly competitive, the market is expected to grow as the global recovery trend post-COVID is clear, and investors are optimistic as the market growth looks promising. Therefore, it is expected that there will be more investment in this field in the coming years.

Third Party Payment Market Trends

The Point of Sale Segment is Expected to Drive the Market

- Cash transactions continue to dominate the payment processing system segment, and it is unlikely that future predictions of a cashless state will be realized anytime soon. However, this segment is still witnessing a radical shift toward eWallets because of the dramatic change from cash.

- Moreover, stores and services across the world have been rapidly adopting and integrating mobile payment applications, such as PayPal, Samsung Pay, AliPay, Apple Pay, and WeChat Pay, to accept payments. This trend will be maintained between 2024 and 2029 due to changes in lifestyles and consumer habits, as well as the rapid growth of PayPal third-party payments.

- High-growth regions, like APAC and EMEA, are expected to drive the growth of the third party payment market and are also projected to witness a double-digit reduction in the use of cash at point of sale in the future.

- The growing adoption of mobile point of sale (POS) devices is also a factor contributing to this segment's growth. Industry experts predicted the number of mobile point-of-sale transactions to triple by 2023, according to a recent blog from Mobile Payments Today.

- Moreover, companies such as Google have made it convenient for smartphone users to make contactless payments. These technologies make use of near-field communication (NFC) technology on supported smartphones and smartwatches. A user stores his/her credit or debit card information on the Android Pay account, and when the user wants to pay for an item or service, the phone or watch should be placed near the retailer's point-of-sale terminal.

Asia-Pacific is Expected to Register a Major Growth in the Market

- Innovation in the field of payments is being driven mainly by Asia with regard to Mobile Payments. Consumers in Asian markets, especially with regard to payments and shopping, are more than willing to take equal measures of comfort and security for all aspects of their online lives.

- The increasing prevalence of digital transactions has spurred businesses in the region to swiftly embrace electronic payment systems, facilitating secure and convenient transactions. Concurrently, governments and prominent organizations are actively advocating for cashless transactions as part of broader digitalization initiatives, further propelling the adoption of point-of-sale (PoS) systems in the market. Consequently, regulatory bodies are promoting cashless payments and spearheading digitization endeavors to foster the growth of the point-of-sale market.

- Government initiatives to support digital payments are another factor driving an advanced market in Asia-Pacific. Thus, the three main factors impacting the third-party payment market in Asia-Pacific are e-commerce, PoS proliferation, and government initiatives.

- In addition to the convenience of shorter lines, elimination of cash-on-hand issues, and fast-moving queues throughout the region, consumers are able to benefit from a more efficient and convenient payment process.

- As countries such as China and India are adopting a digital payment option through mobile wallets, the Asia-Pacific market has been expected to grow significantly. The ubiquitous mobile devices, advanced digital infrastructure, and the growing usage of apps drive digital/mobile wallets, which are growing rapidly in Asia-Pacific.

Third Party Payment Industry Overview

The third party payment market is highly competitive. It has some players who have been in the business for quite some time. Subsequently, many startups are coming up to seize the huge opportunity this market offers. Some players have a presence only in a particular geography. The major players include PayPal Holdings Inc., Stripe Inc., Alipay.com Co. Ltd, and Amazon Payments Inc. The recent developments in the market are as follows:

- June 2023: Stripe Inc. announced a partnership with Google Workspace to power paid appointment bookings with Google Calendar. With this new feature, businesses can connect their Stripe account, set a price, and then offer their clients the ability to book and pay for services in Google Calendar.

- April 2023 - PayPal Holdings Inc. announced the addition of new features to complete its payment small business solutions. These solutions allow small businesses to accept a range of payments, including PayPal Venmo and PayPal Pay Later Products, giving customers more choices as to how they can pay can help drive checkout.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Penetration of Internet Leading to Proliferation of Digital Payments

- 5.1.2 Cloud Based Systems Leading to Growth of B2B Sales and also Higher Sales in the POS Segment

- 5.1.3 Growth of E-Commerce Across the High Growth Regions of the World

- 5.2 Market Restraints

- 5.2.1 Security and Privacy Concerns to Restrain the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Online

- 6.1.2 Mobile

- 6.1.3 Point of Sale

- 6.2 By End User

- 6.2.1 BFSI

- 6.2.2 Retail

- 6.2.3 E-Commerce

- 6.2.4 Other End User

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 PayPal Holdings Inc.

- 7.1.2 Stripe Inc.

- 7.1.3 Alipay.com Co. Ltd

- 7.1.4 Amazon Payments Inc.

- 7.1.5 Authorize.Net (CyberSource Corporation)

- 7.1.6 WePay Inc. (JPMorgan Chase & Co.)

- 7.1.7 2checkout.Com Inc. (Avangate BV)

- 7.1.8 Adyen NV

- 7.1.9 First Data Corporation (Fiserv Inc.)

- 7.1.10 One 97 Communications Limited