|

市場調查報告書

商品編碼

1519895

氣霧劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Aerosol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

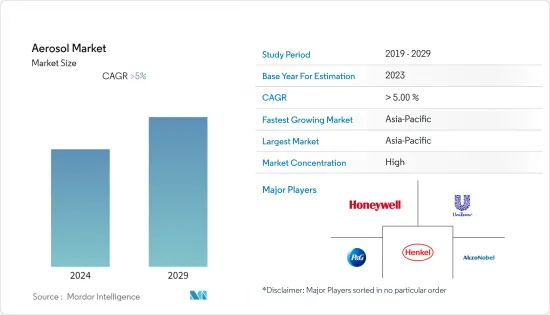

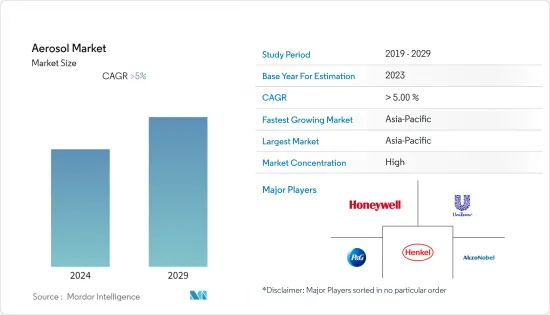

氣霧劑市場規模預計到 2024 年為 400.6 億美元,預計到 2029 年將達到 531.3 億美元,在預測期內(2024-2029 年)複合年成長率超過 5.5%。

2020年,COVID-19大流行擾亂了供應鏈並暫時停止了生產,阻礙了氣霧劑市場的整體成長。然而,個人保健產品氣霧劑消費量的增加推動了疫情後的產業成長。

主要亮點

- 推動該市場成長的主要因素是油漆和塗料行業對氣霧罐的需求不斷增加,以及衛生和個人護理意識的不斷提高。

- 與氣霧劑使用相關的嚴格法規可能會阻礙市場成長。

- 產品創新和醫療產業投資的增加預計將在未來幾年為市場創造機會。

- 歐洲主導市場,而亞太地區預計在預測期內複合年成長率最高。

氣霧劑市場趨勢

個人護理產業主導市場

- 氣溶膠在科學上被描述為空氣或其他氣體中的小固體顆粒或液滴的膠體。該定義包括人造產品和自然現象,例如霧。髮膠噴霧、乳霜、泡棉、啫哩、潔廁液等化妝品在當下的場景下變得更加實用和衛生。

- 氣霧劑產品可以非接觸式塗布,可以保護使用者免受感染疾病,並降低燒燙傷和割傷的風險。此外,密封包裝可防止產品污染。因此,個人護理市場對氣霧劑的需求激增。氣霧罐是整個個人護理和化妝品行業的最佳包裝選擇之一。由於氣霧罐的回收率很高,從永續性的角度來看,對氣霧罐的需求正在增加。

- 歐萊雅報告顯示,2025年全球美容及個人護理品銷售額預計將增加至7,846億美元。

- 日本擁有 3,000 多家美容相關企業,其中包括資生堂、花王、高絲和POLA Orbis 等全球品牌。日本的美容產業由種類繁多的化妝品支撐,其中護膚和彩妝的需求量很大。

- 根據國家統計局 (NBS) 的數據,2023 年中國化妝品市場將成長約 5.1%,達到 4,141.7 億元人民幣(約 586.1 億美元)。在經歷了經濟不確定性、大流行政策轉變和停工的艱難一年後,中國美容市場正在迅速復甦。然而,儘管銷售額下降,但不可否認的是,化妝品和美容產品繼續受到中國消費者的青睞。

- 印度品牌股權基金會 (IBEF) 表示,在中產階級可支配收入不斷成長以及對健康美好生活的渴望不斷增強的推動下,印度美容、化妝品和美容市場預計到 2025 年將成長 200 億日元。會成長為美元。

- 近年來,北美個人護理市場保持彈性。市場不斷創新並適應新的消費者需求,而不僅僅是品質、性能和創新。消費者在購買時尋找意義,包括美觀。

- Groupon 研究顯示,美國女性每年在各種美容產品和服務上花費近 3,700 美元,這表明她們在此類產品上的花費要高得多。

- 2023年,美國在全球美容及個人護理市場上創造了最多的收益,為978.1億美元,其次是中國,為671.8億美元,日本為459.6億美元。德國以超過200億美元位居歐洲國家之首。

- 個人護理產品市場由幾家主要企業主導,包括歐萊雅、寶潔、聯合利華和資生堂。

- 所有這些因素預計將在預測期內對個人護理行業氣霧劑市場做出貢獻。

亞太地區是一個快速成長的地區

- 由於個人保健產品需求增加、醫療產業投資增加以及該地區汽車產量增加,預計亞太地區氣霧劑需求將強勁成長。

- 在亞太地區,由於汽車行業的強勁需求以及建築和施工計劃的增加,預計中國的氣霧劑需求將在預測期內顯著成長,這很可能進一步增加對油漆和被覆劑的需求。

- 根據香港貿易發展局統計,中國是全球第二大化妝品消費市場。國家統計局資料顯示,2022年,我國化妝品銷售額與前一年同期比較成長14%。

- 根據歐萊雅的報告,2022年該國美容及個人護理市場規模將達553億美元。在經歷了因經濟不確定性、大量關閉和其他流行病政策變化而導致的放緩之後,該國的美容市場在 2022 年呈現出強勁復甦。

- 根據美國塗料協會統計,中國約佔亞太地區所有被覆劑的60%。這段時期的快速都市化刺激了國內油漆塗料產業的發展。

- 亞太地區的生產和銷售主要由中國、印度和日本等國家主導,這些國家擁有主要汽車製造商和大量生產基地。

- 根據中國工業協會統計,中國是全球最重要的汽車生產基地,2023年汽車產量達30,160,966輛,比去年的27,020,615輛增加11.6%。根據國際貿易管理局(ITA)預測,到2025年,國內汽車產量預計將達到3,500萬輛。

- 在中國,重點是擴大電動車的生產和銷售。為此,該公司設定了2025年每年生產700萬輛電動車的目標。目標是到2025年中國新車產量的20%是電動車。

- 根據國家投資促進和便利化局(Invest India)的數據,印度在美容和個人護理(BPC)市場中排名第八。意識的提高、獲取的便利性和生活方式的改變等因素正在推動市場的發展。 2023年,個人衛生市場預計將達到150億美元。

- 印度是該地區第二大汽車製造商。根據國際汽車製造商組織(OICA)的數據,2023年,印度汽車製造業生產了約5,851,507輛汽車,較2022年成長約7%。

- 日本化妝品工業聯合會於2023年4月由東京化妝品工業聯合會、日本化妝品工業聯合會、西日本化妝品工業聯合會、中部化妝品工業聯合會合併而成。

- 日本化妝品產業主要企業之一花王株式會社發布的報告顯示,2022年日本化妝品市場整體成長將超過3%,並且隨著市場復甦,未來幾年將繼續進一步成長。

- 日本擁有 3,000 多家洗護用品、美容和個人護理公司,其中包括資生堂、花王、高絲和POLA Orbis 等全球品牌。此外,資生堂、Mandom、歐萊雅、寶潔、聯合利華等都是主要企業。然而,人口萎縮正在對市場產生重大影響。

- 根據日本工業協會(JAMA)統計,2023年汽車產量成長14.84%,達到8,998,538輛。

- 因此,汽車、油漆塗料和家具行業的這種成長可能會增加未來幾年對氣霧劑產品的需求,並進一步推動氣霧劑市場的需求。

氣霧劑產業概況

氣霧劑市場已部分整合。該市場的主要企業(排名不分先後)包括廣東Theaoson Technology、Johnson &Son Inc.、Honeywell International Inc.、Toyo Seikan Group Holdings Ltd.和Reckitt Benckiser Group PLC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 塗料產業對氣霧罐的需求增加

- 提高衛生和個人護理意識

- 其他司機

- 抑制因素

- 關於氣霧劑使用的嚴格規定

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 按推進劑類型

- 二甲醚(DME)

- 氫氟碳化合物 (HFC)

- 氫氟烯烴 (HFO)

- 其他(氧化亞氮、二氧化碳等)

- 按罐類型

- 鋼

- 鋁

- 塑膠

- 其他(玻璃、錫)

- 按用途

- 車

- 個人護理

- 食品

- 農業

- 家庭用品

- 工業/技術

- 醫療保健

- 油漆/塗料

- 其他(清洗劑、噴霧等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ACT Aerosol Chemie Technik GmbH

- Beiersdorf

- Guangdong Theaoson Technology Co. Ltd

- Honeywell International Inc.

- Hydrokem Aerosols Limited

- Reckitt Benckiser Group PLC

- SC Johnson & Son Inc.

- Shenzhen Sunrise New Energy Co. Ltd

- Suhan Aerosol

- Toyo Seikan Group Holdings Ltd

第7章 市場機會及未來趨勢

- 加大醫療產業的產品創新與投資

- 其他機會

The Aerosol Market size is estimated at USD 40.06 billion in 2024, and is expected to reach USD 53.13 billion by 2029, growing at a CAGR of greater than 5.5% during the forecast period (2024-2029).

In 2020, the COVID-19 pandemic hindered the growth of the aerosol market as a whole because it messed up the supply chain and put a temporary stop to production. However, the rising consumption of aerosols in personal care products has propelled industry growth post-pandemic.

Key Highlights

- The major factors driving the growth of the market studied are the increasing demand for aerosol cans from the paint and coatings industry and rising awareness related to hygiene and personal care.

- Stringent regulations related to the use of aerosols are likely to hinder the growth of the market.

- Product innovation and increasing investments in the medical industry are expected to create opportunities for the market in the coming years.

- Europe is expected to dominate the market, while Asia-Pacific is likely to witness the highest CAGR during the forecast period.

Aerosol Market Trends

Personal Care Industry to Dominate the Market

- Aerosols are described scientifically as colloids of small, solid particles or liquid droplets in air or another gas. This definition encompasses man-made products and natural phenomena, such as fog. Cosmetic products, such as hair sprays, creams, foams and gels, toilette liquids, and others, are handled more practically and hygienically in the current scenario.

- Aerosol products can be applied without contact, protecting users from infections and reducing the risk of burns or lacerations. Furthermore, the sealed package prevents product contamination. As a result, the demand for aerosol has surged in the personal care market. Aerosol cans are one of the best choices for packaging across the personal care and cosmetics industry. Since aerosol cans hold high recycling rates, the demand for aerosol cans tends to rise in terms of sustainability.

- According to the reports by L'Oreal, the revenue of global beauty and personal care is anticipated to ascend to USD 784.6 billion in 2025.

- Japan is home to more than 3,000 beauty care companies, including global brands of Shiseido, Kao, Kose, and Pola Orbis. The Japanese beauty industry is carried by a wide range of cosmetic products, with skincare and makeup being in high demand.

- According to China's National Bureau of Statistics (NBS), the cosmetics market in China grew by around 5.1% in 2023, reaching CNY 414.17 billion (~USD 58.61 billion). The Chinese beauty market is rapidly recovering after a challenging year due to economic uncertainty, pandemic policy shifts, and lockdowns. However, despite the drop in sales, there is no denying that cosmetic and beauty products continue to gain traction among Chinese consumers.

- According to the Indian Brand Equity Foundation (IBEF), the Indian beauty, cosmetic, and and grooming market will grow to USD 20 billion by 2025, driven by the increasing disposable income of the middle class and the growing desire to live well and look good.

- The North American personal care market has remained resilient over the past years. The market continues to innovate and adapt to the new demands of consumers, who want more than just quality, performance, and innovation; they want meaning in their purchases, including beauty.

- According to a study by Groupon, American women spend nearly USD 3,700 on various beauty products and services yearly, signifying the considerably high expenditure on such products.

- The United States generated the most revenue from the global beauty and personal care market in 2023, with USD 97.81 billion, followed by China, generating a revenue of USD 67.18 billion, further followed by Japan, with a revenue of USD 45.96 billion. Germany ranked first among European nations, with over USD 20 billion.

- The market for personal care products is dominated by a few key players like L'Oreal, P&G, Unilever, and Shiseido.

- All such factors are expected to contribute to the aerosol market in the personal care industry during the forecast period.

Asia-Pacific to be the Fastest-growing Region

- Asia-Pacific is expected to witness strong growth in the demand for aerosol, driven by increasing demand for personal care products, increasing investments in the medical industry, and increasing automotive production in the region.

- In Asia-Pacific, China is expected to witness noticeable growth in the demand for aerosol during the forecast period, owing to the robust demand from the automotive industry and increasing construction and architectural projects, which is further likely to increase the demand for paints and coatings.

- According to the Hong Kong Trade Development Council, China is the world's second-largest consumer market for cosmetic products. In 2022, cosmetics sales in China increased by 14% compared to the year before, according to data from the National Bureau Of Statistics.

- According to a report by L'Oreal, the country generated USD 55.3 billion in the beauty and personal care market in 2022. The country's beauty market witnessed a strong rebound in 2022 after facing a slowdown due to economic uncertainties, numerous lockdowns, and other pandemic policy changes.

- China consists of around 60% of the entire coatings volume of Asia-Pacific, according to the American Coatings Association. Rapid urbanization during this period has spurred the domestic paints and coating industry.

- The production and sales in Asia-Pacific are primarily dominated by countries like China, India, and Japan, which consist of large automotive manufacturers and a vast number of production bases within the countries.

- According to the China Association of Automobile Manufacturers (CAAM), China has the most significant automotive production base in the world, accounting for a total vehicle production of 30,160,966 units in 2023, registering an increase of 11.6% compared to 27,020,615 units produced last year. As per the International Trade Administration (ITA), domestic automotive production is expected to reach 35 million units by 2025.

- In China, the main focus is to increase production and sales of electric vehicles. To this end, the country has set a target to produce 7 million electric vehicles per year by 2025. By 2025, the goal is to bring electric vehicles into 20 % of total new vehicle production in China.

- According to the National Investment Promotion and Facilitation Agency (Invest India), India stands eighth in the beauty and personal care (BPC) market. Factors such as growing awareness, easier access, and changing lifestyles are driving the market. In 2023, the personal hygiene market was expected to reach USD 15 billion.

- India has become the second-largest automotive vehicle manufacturer in the region. According to Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2023, Indian automotive manufacturing industry observed a growth of about 7% compared to 2022 and produced about 58,51,507 vehicles.

- The Japan Cosmetic Industry Association (JCIA) was established in April 2023 by integrating the Tokyo Cosmetic Industry Association, the Japan Cosmetic Industry Federation, the West Japan Cosmetic Industry Association, and the Chubu Cosmetic Industry Association.

- According to a report published by Kao Corporation, one of the key players in the Japanese cosmetic industry, the overall market in Japan grew by over 3% in 2022, with further growth anticipated in the next several years as the market recovers.

- Japan has over 3,000 toiletries, beauty, and personal care companies, including global brands like Shiseido, Kao, Kose, and Pola Orbis. Furthermore, its major players are Shiseido Company, Mandom Corporation, Loreal, Procter and Gamble, and Unilever. However, shrinking demographics is highly affecting the market.

- According to Japan Automobile Manufacturers Association (JAMA), the motor vehicles production of the country in 2023 grew by 14.84% and accounted for 8,998,538 units.

- Therefore, such growth in the automotive, paints and coatings, and furniture industries is likely to increase the demand for aerosol products in the coming years, further driving the demand in the aerosol market.

Aerosol Industry Overview

The aerosol market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include Guangdong Theaoson Technology Co. Ltd, Johnson & Son Inc., Honeywell International Inc., Toyo Seikan Group Holdings Ltd, and Reckitt Benckiser Group PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Aerosol Cans from Paints and Coatings Industry

- 4.1.2 Increasing Awareness Related to Hygiene and Personal Care

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Related to Use of Aerosol

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Propellant Type

- 5.1.1 Dimethyl Ether (DME)

- 5.1.2 Hyrdofluorocarbons (HFC)

- 5.1.3 Hydrofluoro Olefins (HFO)

- 5.1.4 Other Types (Nitrous Oxide, Carbon Dioxide, etc.)

- 5.2 By Can Type

- 5.2.1 Steel

- 5.2.2 Aluminum

- 5.2.3 Plastic

- 5.2.4 Other Can Types (Glass and Tin)

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Personal Care

- 5.3.3 Food Products

- 5.3.4 Agriculture

- 5.3.5 Household Products

- 5.3.6 Industrial and Technical

- 5.3.7 Medical

- 5.3.8 Paints and Coatings

- 5.3.9 Other Applications (Cleaning Products, Sprays, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACT Aerosol Chemie Technik GmbH

- 6.4.2 Beiersdorf

- 6.4.3 Guangdong Theaoson Technology Co. Ltd

- 6.4.4 Honeywell International Inc.

- 6.4.5 Hydrokem Aerosols Limited

- 6.4.6 Reckitt Benckiser Group PLC

- 6.4.7 S.C. Johnson & Son Inc.

- 6.4.8 Shenzhen Sunrise New Energy Co. Ltd

- 6.4.9 Suhan Aerosol

- 6.4.10 Toyo Seikan Group Holdings Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Product Innovation and Increasing Investments in Medical Industry

- 7.2 Other Opportunities