|

市場調查報告書

商品編碼

1536874

氣霧塗料:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Aerosol Paints - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

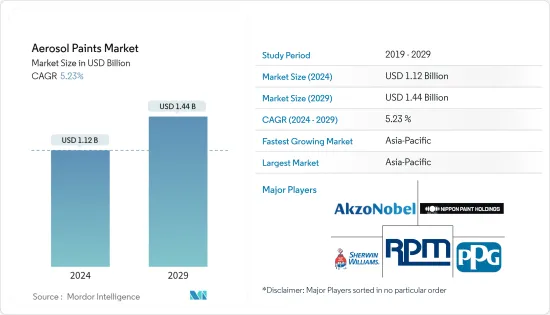

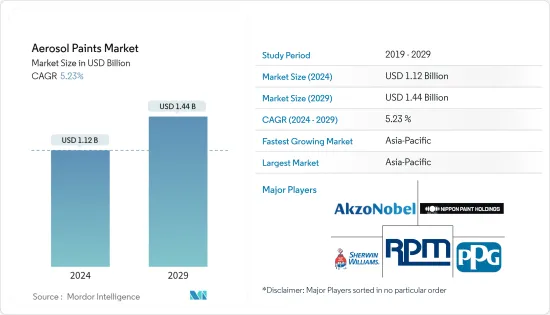

全球氣溶膠塗料市場規模預計將在2024年達到11.2億美元,並在2024-2029年預測期間以5.23%的複合年成長率成長,到2029年將達到14.4億美元。

受新冠肺炎 (COVID-19) 疫情影響,製造廠關閉、建設活動暫停和供應鏈中斷,氣溶膠塗料的需求下降。目前,市場已經從疫情中恢復過來,並呈現出強勁的成長動能。

在預測期內,住宅和商業房地產建設活動的增加以及 DIY 活動中氣溶膠塗料的使用增加可能會推動氣溶膠塗料市場的發展。

然而,嚴格的VOC法規可能會成為市場的限制因素。

也就是說,氣溶膠塗料的新技術預計將為市場帶來新的機會。

亞太地區在全球市場中佔據主導地位,中國需求強勁,其次是印度和日本。

氣溶膠塗料市場趨勢

建築業在市場上佔據主導地位。

- 建築領域主導了氣溶膠塗料市場的需求。氣溶膠塗料用於各種建築飾面應用,包括清漆、底漆、內外牆塗料以及著色劑。它們也用於住宅、商業和機構建築等建築工地。

- 氣溶膠塗料通常用於修補和修復建築表面,例如牆壁、天花板和裝飾。氣溶膠塗料可以幫助您獲得一致的飾面,特別是在傳統塗裝方法難以塗抹的區域。此外,氣溶膠塗料有多種顏色和飾面,允許建築設計中的客製化和創造力。

- 在亞太地區,印度、中國、菲律賓、越南和印尼等國家的住宅建設正在迅速成長。此外,在北美,由於移民的增加和核心家庭的趨勢,對住宅和維修工作的需求正在增加。

- 在東南亞,印尼是最大、成長最快的建築市場之一。印尼政府啟動了在全國建設約100萬套住宅的計劃,政府為此累計了約10億美元的預算。

- 此外,美國擁有世界上最大的建築業之一。美國人口普查局的數據顯示,2023年該國建築業價值達197.87億美元,較2022年成長超過7%。此外,2024年2月取得建築許可證的私人住宅單位數量為1,518,000個,較2023年同期增加2.4%。

- 德國擁有歐洲大陸最大的建築業。然而,近幾個月來,建築業卻呈現下滑趨勢。德國聯邦統計局數據顯示,2023年德國發放住宅建築許可證數量為260,100份,減少94,100份。此外,2023年德國公寓建築許可數量將下降27%,凸顯建築和房地產行業需求疲軟。

- 因此,預計建築建設活動的活性化將在預測期內主導氣溶膠塗料市場。

亞太地區主導市場

- 預計亞太地區將主導全球市場。由於中國、印度和日本等國家的汽車、建築、木材和包裝等行業的消費不斷成長,該地區氣溶膠塗料的使用量正在增加。

- 氣溶膠塗料在汽車領域用於塗覆汽車和汽車OEM零件的表面,以保護和增強美觀性。由於消費者和汽車愛好者廣泛採用氣溶膠塗料用於各種修補、客製化和細節用途,售後市場對氣溶膠塗料的需求高於生產用途。

- 根據OICA預測,2023年中國乘用車銷量為2,600萬輛,較2022年成長10%以上,商用車銷量為403萬輛,較2022年成長22%以上。

- 此外,2023年印度汽車總銷量將為507萬輛,較2022年成長7.5%以上。該國乘用車銷量為410萬輛,較2022年成長8.2%。

- 意識到小規模使用氣溶膠塗料的成本效益和美學效益,越來越多的架構在建築應用中使用氣溶膠塗料。氣溶膠塗料塗布表面,以提供光滑、均勻的表面效果並提高結構的美觀。氣溶膠塗料用於在牆壁和其他表面上創造複雜的設計、圖案和藝術品。

- 建築業是中國經濟持續發展的主要貢獻者。據住宅部預測,到2025年,中國建築業預計將維持GDP的6%。

- 此外,日本的住宅和建築業近年來經歷了名義成長。日本正在興建許多豪華公寓和多用戶住宅。例如,三菱地所正在建造日本最高的建築,由50套豪華公寓組成,每套月租金為43,000美元。該計劃正在東京車站附近建設,預計2027年完工。

- 因此,亞太地區汽車銷量的成長和建築施工的增加預計將在預測期內推動氣溶膠塗料的需求。

氣霧塗料產業概況

氣溶膠塗料市場分散。主要參與者(排名不分先後)包括 Sherwin Williams、AkzoNobel NV、Nippon Paint Holdings、RPM International、PPG Industries Inc.

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 住宅和商業建設活動增加

- 在 DIY 活動中增加氣溶膠塗料的使用

- 抑制因素

- 嚴格的VOC法規阻礙成長

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:金額)

- 樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 醇酸

- 其他樹脂

- 科技

- 溶劑型

- 水系統

- 最終用戶產業

- 車

- 建築學

- 木材/包裝

- 運輸

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟和協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Aeroaids Corporation

- Akzo Nobel NV

- BASF SE

- Kobra Paint

- Masco Corporation

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- Rusta LLC

- The Sherwin-Williams Company

第7章 市場機會及未來趨勢

- 創造成長機會的新技術

The Aerosol Paints Market size is estimated at USD 1.12 billion in 2024, and is expected to reach USD 1.44 billion by 2029, growing at a CAGR of 5.23% during the forecast period (2024-2029).

The demand for aerosol paints decreased due to COVID-19 owing to the shutdown of manufacturing units, a halt in construction activities, and disruption in the supply chain. Currently, the market has recovered from the pandemic and is growing at a significant rate.

Rising residential and commercial construction activities and increasing usage of aerosol paints in DIY activities are likely to drive the aerosol paints market during the forecast period.

However, stringent VOC regulations are likely to act as restraints for the market.

Nevertheless, emerging technologies for aerosol paints are expected to provide new opportunities for the market.

Asia-Pacific dominates the global market, with robust demand from China, followed by India and Japan.

Aerosol Paints Market Trends

Architectural Industry to Dominate the Market

- The architectural segment dominates the demand in the aerosol paints market. Aerosol paints are used in various architectural finishing applications, including varnishes, primers, interior and exterior paints, and stains. These are also utilized in architectural structure sites, including residential, commercial, or institutional structures.

- Aerosol paints are often employed for touch-up and repair work on architectural surfaces, such as walls, ceilings, and trims. They can help achieve a consistent finish, especially in areas that are challenging to access with traditional painting methods. Additionally, aerosol paints come in various colors and finishes, allowing for customization and creativity in architectural designs.

- Asia-Pacific has been witnessing strong growth in residential construction in countries such as India, China, the Philippines, Vietnam, and Indonesia. Besides, in North America, there has been a high housing and repair construction demand owing to increased immigrants and the trend of nuclear families.

- In Southeast Asia, Indonesia is one of the largest and fastest-growing architectural markets. The Indonesian government started a program to build about one million housing units across the country, for which the government has allocated about USD 1 billion in the budget.

- Additionally, the United States has one of the world's largest construction industries. According to the United States Census Bureau, in 2023, the construction value in the country reached USD 19,78,700 million, registering an increase of more than 7% compared to 2022. Moreover, in February 2024, privately owned housing units authorized by building permits stood at 1,518,000 units, registering an increase of 2.4% compared to the same period in 2023.

- Germany has the largest construction industry in the European continent. However, the country has been facing a downward trend in the construction industry for the past few months. According to the Federal Office of Statistics in Germany, in 2023, the construction of 260,100 dwellings was permitted in Germany, which was a decrease of 94,100 building permits. Furthermore, building permits for apartments in Germany fell by 27% in 2023, underscoring a downturn in construction and real estate industry demand.

- Hence, the rising architectural construction activities are expected to dominate the market for aerosol paints during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the global market. With growing consumption from industries such as automotive, architecture, wood, and packaging from countries such as China, India, and Japan, the usage of aerosol paints is increasing in the region.

- Aerosol paints are used in the automotive sector to coat the surfaces of vehicles and automotive OEM parts to protect the surface and enhance its aesthetic appearance. The aftermarket demand for aerosol coatings is higher than that for production usage owing to the diverse applications and widespread adoption of aerosol coatings for touch-up, customization, and detailing purposes by consumers and automotive enthusiasts.

- According to OICA, in 2023, the sales of passenger vehicles in China stood at 26 million units, registering an increase of more than 10% as compared to 2022, while those of commercial vehicles stood at 4.03 million units, registering an increase of more than 22% as compared to 2022.

- Furthermore, in 2023, the total sales of vehicles in India stood at 5.07 million units, registering an increase of more than 7.5% compared to 2022. The sales of passenger vehicles in the country stood at 4.1 million units, registering an increase of 8.2% compared to 2022.

- Manufacturers are increasingly using aerosol paints for architectural applications after realizing the cost benefits and aesthetic quality associated with aerosol paints when used on a small scale. Aerosol paints are applied on surfaces to provide a smooth and even finish, enhancing the aesthetics of structures. They are used to create intricate designs, patterns, and artworks on walls and other surfaces.

- The construction sector is a key contributor to China's continued economic development. As per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- In addition, the housing and construction industry has also witnessed nominal growth in Japan in the past couple of years. Many luxury apartments and residential complexes are under construction in Japan. For instance, Mitsubishi State is constructing Japan's tallest building, which comprises 50 luxury apartments, each generating USD 43,000 monthly rent. The project is being built near the Tokyo station and is likely to be completed by 2027.

- Hence, growing sales of automobiles and rising architectural construction in Asia-Pacific are expected to boost the demand for aerosol paints during the forecast period.

Aerosol Paints Industry Overview

The aerosol paints market is fragmented in nature. The major players (not in any particular order) include Sherwin Williams, AkzoNobel NV, Nippon Paint Holdings Co. Ltd, RPM International, and PPG Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Residential and Commercial Construction Activities

- 4.1.2 Increasing Usage of Aerosol Paints in DIY Activities

- 4.2 Restraints

- 4.2.1 Stringent VOC Regulations to Hinder the Growth

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Polyurethane

- 5.1.4 Alkyd

- 5.1.5 Other Resins (Polyester, Silicone, and Vinyl)

- 5.2 Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.3 End-User Industry

- 5.3.1 Automotive

- 5.3.2 Architectural

- 5.3.3 Wood and Packaging

- 5.3.4 Transportation

- 5.3.5 Other End-user Industries (Wall Graffiti, Metals, Plastics, Refrigerators, Bicycles, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aeroaids Corporation

- 6.4.2 Akzo Nobel NV

- 6.4.3 BASF SE

- 6.4.4 Kobra Paint

- 6.4.5 Masco Corporation

- 6.4.6 Nippon Paint Holdings Co. Ltd

- 6.4.7 PPG Industries Inc.

- 6.4.8 RPM International Inc.

- 6.4.9 Rusta LLC

- 6.4.10 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Technologies to Create Growth Opportunities