|

市場調查報告書

商品編碼

1519907

全球膠衣市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Gelcoat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

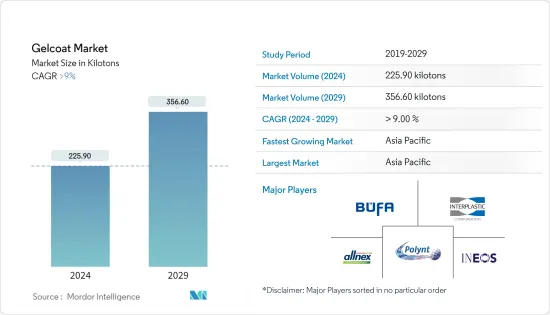

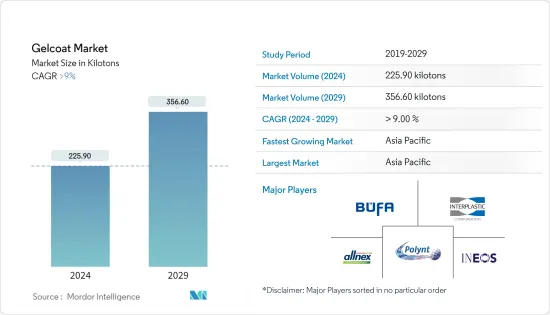

全球膠衣市場規模預計到2024年將達到225.90千噸,2029年達到356.60千噸,2024-2029年預測期間複合年成長率超過9%。

由於經濟和商業活動減少,預計 COVID-19 大流行將在 2020 年和 2021 年影響膠衣市場。由於建築業和工業生產下降,需求仍然較低,但隨著貿易和政府指南的復甦,預計需求將會復甦。

主要亮點

- 汽車和運輸業對膠衣的需求不斷成長將推動市場成長。由於汽車製造商根據政府指南,專注於使用複合材料生產輕型汽車,以提高燃油效率並減少二氧化碳(CO2)排放,因此預計該行業將主導膠衣市場。膠衣是改善這些複合材料零件美觀的關鍵。

- 聚酯膠衣廣泛應用於各行業,特別是在交通運輸和海洋領域。其在海洋工業中的受歡迎得益於其優異的防水、防紫外線、耐腐蝕等性能。對聚酯膠衣的需求不斷成長促進了市場的成長。

- 苯乙烯是聚酯樹脂基膠衣的主要單體,由於其廣泛使用而引發了安全和健康問題。因此,許多政府實施了嚴格的法規來減少膠衣和樹脂中的苯乙烯排放,這給市場擴張帶來了挑戰。

- 亞太地區在全球整體膠衣市場中佔據主導地位,其中印度、中國等國家的消費量最高。

膠衣市場趨勢

汽車和運輸(包括航太和船舶)產業引領市場

- 據OICA稱,全球汽車產業目前正在經歷顯著成長,2022年將比2021年成長6%。 2022年,全球各個已開發國家和開發中國家的汽車產量均增加,包括中國、德國、韓國、英國和義大利。 2022年,汽車產量超過8,500萬輛。

- 根據美國船舶製造商協會 (NMMA) 的報告,2022 年美國休閒船業的銷售額累計為 2,303 億美元。

- 據印度投資局稱,2021年1月期間,161個造價120億美元的海洋產業計劃已竣工,178個計劃正在實施。

- 根據國際航空運輸協會預測,2023年總收入預計將達到8,030億美元,與前一年同期比較增9.7%。這意味著該產業收益自2019年達到8,380億美元以來首次突破8,000億美元閾值。預計成本年增率將維持在8.1%。

- 所有這些因素都可能在預測期內快速推動市場。

亞太地區主導膠衣市場

- 亞太地區在全球市場佔有率佔據主導地位。航太、汽車、船舶和建築等最終用戶產業的投資和生產不斷增加,正在推動該地區的膠衣市場需求。

- 由東芝、日立、造船株式會社和 JFE 鋼鐵公司組成的聯盟在日本福島海岸建造世界上最大的離岸風力發電。該計劃將配備多達 143 台浮體式渦輪機,預計從 2025 年起投入運作,可能會增加對膠衣的需求。

- 此外,印度新能源和可再生能源部(MNRE)設定了2030年安裝30GW離岸風力發電容量的目標。風力發電機和潮汐渦輪機的葉輪以及葉片上的保護塗層經常需要使用模內穩定的凝膠塗層。

- 據勞埃德船級社稱,中國有望在 2030 年成為卓越的海洋強國。為了實現這一目標,中國計劃在此期間建造40艘郵輪,有些用於國內市場,有些則用於國際市場。

- 在 I2U2 峰會上,兩位領導人透露,阿拉伯聯合大公國將撥款 20 億美元,在印度各地建立一個全面的食品公園網路。此外,該集團也證實有意在印度古吉拉突邦開展混合可再生能源計劃。該計劃將產生 300 兆瓦 (MW) 的風能和太陽能,並透過電池儲存系統進行增強。

- 據印度投資局稱,到2025年,印度建築業預計將達到1.4兆美元,印度建築業跨越250子部門,透過跨行業協作和PMAY-U技術確定了超過54項全球創新建築技術。提交,相信印度建築業的新時代將開始。

- 此外,快速成長的建築業(主要在中國)是推動建築業膠衣需求的主要因素。

膠衣產業概述

膠衣市場是分散的。主要企業(排名不分先後)包括 Allnex GMBH、INEOS、Polynt SpA、Inter Plastic Corporation 和 BUFA Composite Systems GmbH & Co.KG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建築業快速成長

- 汽車和運輸業的需求不斷成長

- 聚酯基膠衣的高利用率

- 其他司機

- 抑制因素

- 政府對膠衣製造商的嚴格規定

- 過渡到封閉式成型工藝

- 膠衣開裂問題

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:數量)

- 樹脂型

- 聚酯纖維

- 環氧樹脂

- 乙烯基酯

- 其他

- 最終用戶產業

- 海洋

- 汽車/交通

- 建造

- 風力發電

- 衛生保健

- 食品與飲品

- 電力/電子

- 其他(航太、零售)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Akzo Nobel NV

- Allnex GMBH

- Ashland

- Atul Ltd

- Bang & Bonsomer

- BUFA Composite Systems GmbH & Co. KG

- Eastman Chemical Company

- GRP Factors Ltd

- Gurit Services AG

- HK Research Corporation

- INEOS

- Interplastic Corporation

- LyondellBasell Industries Holdings BV

- Poliya

- Polynt SpA

- Reichhold LLC

- Scott Bader Company Ltd.

- Seahawkpaints.com

- Sika AG

第7章 市場機會及未來趨勢

- 風力發電和航太需求不斷成長

- 塗料領域技術創新進展

The Gelcoat Market size is estimated at 225.90 kilotons in 2024, and is expected to reach 356.60 kilotons by 2029, growing at a CAGR of greater than 9% during the forecast period (2024-2029).

The COVID-19 pandemic is expected to impact the Gelcoat Market in 2020 and 2021, driven by reduced economic and commercial activities. Declines in construction and industrial output will keep demand low, but recovery is anticipated with revived trade and government guidelines.

Key Highlights

- Growing demand for gelcoat in the automotive and transportation industry is set to drive market growth. This sector dominated the gelcoat market due to automakers' efforts to produce lightweight vehicles with composites, aligning with government guidelines for improved fuel efficiency and reduced carbon dioxide (CO2) emissions. Gelcoats are key to enhancing the aesthetics of these composite components.

- Polyester Gelcoats are extensively used in various industries, particularly in the transportation and marine sectors. Their popularity in the marine industry is due to their excellent properties, including water resistance, UV protection, and corrosion resistance. This rising demand for polyester gelcoats contributes to market growth.

- Styrene, the predominant monomer in polyester resin-based gelcoats, has raised safety and health concerns due to its extensive use. This poses challenges for market expansion as many governments have implemented strict regulations to reduce styrene emissions from gelcoats and resins, consequently limiting market growth in the forecast period.

- Asia-Pacific dominated the Gelcoat Market across the globe with the largest consumption in a country such as India, China, etc.

Gelcoat Market Trends

Automotive and Transportation (including Aerospace and Marine) segment to lead the Market

- As per OICA, the Global Automotive Industry is currently growing at a substantial rate of 6% in 2022 over 2021. In 2022, various developed and developing countries across the world, including China, Germany, South Korea, Canada, the United Kingdom, and Italy, experienced an increase in automotive production. In 2022, over 85 Million Units of Motor vehicles were manufactured.

- The National Marine Manufacturers Association (NMMA) reports that the recreational boating industry in the U.S. generated an estimated US230.3 billion in sales in 2022.

- According to Invest India, during January 2021, a total of 161 projects in the marine industry, at a cost of US$12 billion, have been completed, and 178 projects at a cost of INR 1,96,578 Crores (US$ 26,595 million) are under implementation.

- As per IATA, it expects a year-over-year increase in total revenues of 9.7% to reach USD 803 Billion in 2023. This marks the first instance of industry revenues surpassing the USD 800 Billion threshold since 2019 when it reached USD 838 Billion. The growth in expenses is projected to be limited to an 8.1% annual rise.

- All these factors are likely to rapidly drive the market during the forecast period.

Asia-Pacific Region to Dominate the Gelcoat Market

- Asia-Pacific region dominated the global market share. The increasing investments and production in end-user industries, aerospace, automotive, marine, construction, etc, are driving the demand for Gelcoat Market in the region.

- A consortium involving Toshiba, Hitachi, Zosen Corp, and JFE Steel is set to construct the world's largest offshore wind farm off the Fukushima coast in Japan. This project, featuring as many as 143 floating turbines and expected to become operational after 2025, is likely to boost the demand for gelcoats.

- Moreover, the Indian Ministry of New and Renewable Energy (MNRE) has set targets for offshore wind installations, aiming for 30 GW by 2030. The use of an in-mold stable gelcoat is frequently required for the protective coating on blades, as well as wind and tidal turbine rotor blades

- According to Lloyd's Register, by 2030, China is poised to become a prominent maritime powerhouse in the shipping industry. To accomplish this, China plans to construct 40 cruise ships, with a portion intended for the domestic market and others for international markets, during this period.

- At the I2U2 Summit, the leaders disclosed that the UAE will allocate $2 billion for the establishment of a network of comprehensive food parks throughout India. Additionally, the group has confirmed its intention to move forward with a hybrid renewable energy project in India's Gujarat State. This initiative will encompass 300 megawatts (MW) of wind and solar capacity, enhanced by a battery energy storage system.

- As per Invest India, the construction industry in India is expected to reach USD 1.4 Trillion by 2025, and the construction industry in India works across 250 sub-sectors with linkages across sectors and over 54 global innovative construction technologies identified under a Technology Sub-Mission of PMAY-U to start a new era in Indian Construction Sectors.

- Furthermore, the rapidly growing construction industry, primarily in China, is a major factor driving the demand for gelcoat in the construction industry.

Gelcoat Industry Overview

The Gelcoat Market is fragmented in nature. The major players (not in any particular order) include Allnex GMBH, INEOS, Polynt S.p.A., Interplastic Corporation, and BUFA Composite Systems GmbH & Co. KG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surge in the Construction Industry

- 4.1.2 Increasing Demand in the Automotive and Transportation Industry

- 4.1.3 High Utilization of Polyester-Based Gelcoat

- 4.1.4 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations for Gelcoat Manufacturers

- 4.2.2 Transition to Closed Molding Processes

- 4.2.3 Cracking Issues in Gelcoat

- 4.2.4 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Resin Type

- 5.1.1 Polyester

- 5.1.2 Epoxy

- 5.1.3 Vinyl Ester

- 5.1.4 Others

- 5.2 End-User Industry

- 5.2.1 Marine

- 5.2.2 Automotive and Transportation

- 5.2.3 Construction

- 5.2.4 Wind Energy

- 5.2.5 Healthcare

- 5.2.6 Food and Beverage

- 5.2.7 Electrical and Electronics

- 5.2.8 Others (Aerospace. Retail)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Allnex GMBH

- 6.4.4 Ashland

- 6.4.5 Atul Ltd

- 6.4.6 Bang & Bonsomer

- 6.4.7 BUFA Composite Systems GmbH & Co. KG

- 6.4.8 Eastman Chemical Company

- 6.4.9 GRP Factors Ltd

- 6.4.10 Gurit Services AG

- 6.4.11 HK Research Corporation

- 6.4.12 INEOS

- 6.4.13 Interplastic Corporation

- 6.4.14 LyondellBasell Industries Holdings B.V.

- 6.4.15 Poliya

- 6.4.16 Polynt S.p.A.

- 6.4.17 Reichhold LLC

- 6.4.18 Scott Bader Company Ltd.

- 6.4.19 Seahawkpaints.com

- 6.4.20 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand in the Wind Energy and Aerospace Sectors

- 7.2 Increasing Innovations in the Coatings Sector