|

市場調查報告書

商品編碼

1521567

家庭食品儲存容器:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Home Food Storage Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

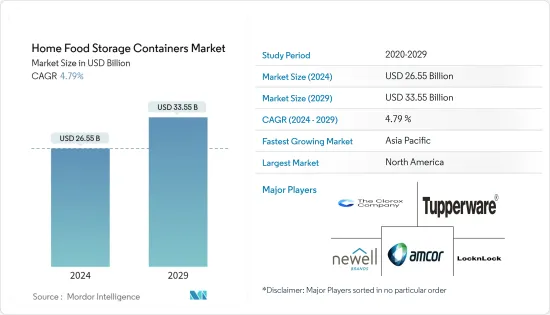

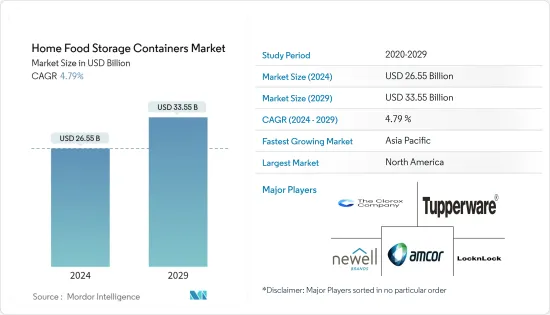

家庭食品儲存容器市場規模預計到2024年為265.5億美元,到2029年達到335.5億美元,在預測期內(2024-2029年)複合年成長率為4.79%。

由於人們對永續性問題和環境挑戰的認知不斷增強,食品儲存容器市場在全球範圍內不斷成長。製造商專注於食品容器的美觀和創新,為客戶提供各種創新的食品包裝,以擴大市場成長。

隨著世界繼續應對氣候變遷的影響,消費者正在改變偏好,以推廣環保和永續的包裝產品。市場上的重要參與者正在改變其包裝材料以滿足客戶的要求。例如,具有環保意識的Z世代正在推動食品儲存容器等環保包裝產品,這正在創造市場機會。

隨著對儲存已調理食品的食品容器的需求增加,製造商正在增加產量。都市化的加速、生活方式的改變以及對包裝食品的需求增加將支持食品儲存容器的未來成長。

家用食品儲存容器的市場趨勢

食品容器提供的便利性正在推動市場發展。

對家用食品容器的需求增加,因為它們變得更方便攜帶和包裝。製造商已適應不斷變化的消費者生活方式。推動家庭食品容器需求的因素之一是包裝食品和加工食品消費的增加。袋子和小袋因其視覺吸引力、保鮮性、便利性和便攜性而受到消費者的歡迎。這些特性正在推動對家庭食品儲存容器的需求。

北美市場佔據主導地位

由於家庭食品儲存容器的需求不斷成長以及電子商務領域的市場開拓不斷加快,北美在市場上佔據主導地位。此外,零售業對可重複使用的家用食品儲存容器的需求不斷增加,也促進了市場的成長。隨著北美消費者意識到一次性塑膠容器和可重複使用的替代品對環境的影響,該地區對由永續和環保產品製成的家庭食品儲存容器的需求不斷增加。這家北美製造商生產無BPA且食品安全的家用食品儲存容器。因此,製造商的這些產品創新增加了北美對家用食品容器的需求。

家用食品儲存容器產業概況

家庭食品儲存容器市場分散。市場上的主要企業正在投資研發以擴大其產品線。市場參與者也採取各種策略,透過巨額投資、新產品發布、併購和收購來擴大其全球足跡。主要參與者包括高樂氏公司 (The Clorox Company)、特百惠 (Tupperware)、Newell Brands、Amcor PLC、樂扣樂扣 (LocknLock Co.)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 人們越來越偏好家常飯菜

- 食品廢棄物和永續性意識

- 市場限制因素

- 市場競爭與物流挑戰

- 對環境造成的影響

- 市場機會

- 家庭食品儲存容器市場的技術進步

- 更多轉向生態包裝產品

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 對市場創新的見解

- COVID-19 對市場的影響

第5章市場區隔

- 按類型

- 難的

- 軟質的

- 按材質

- 塑膠

- 紙

- 金屬

- 玻璃

- 依產品

- 包包

- 小袋

- 容器

- 按用途

- 水果和蔬菜

- 肉品

- 糖果/糖果零食

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 義大利

- 其他歐洲國家

- 中東/非洲

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲

第6章 競爭狀況

- 市場集中度概況

- 公司簡介

- The Clorox Company

- Tupperware

- Newell Brands

- Amcor plc

- LocknLock Co.

- Prepara

- Thermos LLC

- Freshware

- Oneida

- Glasslock*

第7章 市場趨勢

第 8 章 免責聲明與出版商訊息

The Home Food Storage Containers Market size is estimated at USD 26.55 billion in 2024, and is expected to reach USD 33.55 billion by 2029, growing at a CAGR of 4.79% during the forecast period (2024-2029).

The food storage containers market is growing globally due to the increased awareness regarding sustainability issues and environmental challenges. Manufacturers focus on the aesthetics and innovation of food containers to provide customers with different innovative food packaging, expanding the market's growth.

Consumers are changing their preferences to promote environmentally friendly and sustainable packaging products because the world continues to fight against the effects of weather change. Significant players in the market are changing the packaging materials to meet customers' requirements. For instance, the environmentally conscious Z generation promotes eco-friendly packaging products, such as food storage containers, which creates opportunities for the market.

Manufacturers are increasing production levels with the rise in demand for food containers to store ready-to-eat meals. Rising urbanization, changing lifestyles, and increased demand for packaged food support the growth of food storage containers in the future.

Home Food Storage Containers Market Trends

The Convenience Offered by Food Containers is Driving the Market

The demand for home food containers increased because of the convenience of carrying and packaging. Manufacturers have adapted to the changing lifestyles of consumers. One of the factors that is increasing the demand for home food containers is that consumption of packaged and processed food is increasing. Bags and pouches became popular among consumers because they provide visual appeal, preservation of freshness, convenience, and portability. These qualities increase the demand for home food storage containers.

North America Dominates the Market

North America dominates the market due to the region's rising demand for home food storage containers and increased development in the e-commerce sector. Moreover, increasing demand for reusable home food storage containers in the retail sector increased the market growth. Consumers in North America are conscious of the environmental impact of disposable plastic containers and reusable alternatives; therefore, the demand for home food storage containers made of sustainable and eco-friendly products has increased in the region. Manufacturers in North America make home food storage containers made of BPA-free and food-safe. Thus, these product innovations made by the manufacturers increased the demand for home food containers in North America.

Home Food Storage Containers Industry Overview

The home food storage container market is fragmented. Major players in the market are investing in research and development to expand the product line. Market players are also taking various strategies to expand their global footprint through huge investments, new product launches, mergers, and acquisitions. The major players are The Clorox Company, Tupperware, Newell Brands, Amcor PLC, and LocknLock Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Preference Toward Home Cooked Meals

- 4.2.2 Awareness on Food Waste and Sustainability

- 4.3 Market Restraints

- 4.3.1 Market Competition and Logistics Challenges

- 4.3.2 Environmental Impact

- 4.4 Market Opportunities

- 4.4.1 Technological Advancements in the Home Food Storage Containers Market

- 4.4.2 Increasing Shift Toward Environmentally Packaging Products

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porters' Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technology Innovation in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Rigid

- 5.1.2 Flexible

- 5.2 By Material

- 5.2.1 Plastic

- 5.2.2 Paper

- 5.2.3 Metal

- 5.2.4 Glass

- 5.3 By Product

- 5.3.1 Bag

- 5.3.2 Pouch

- 5.3.3 Containers

- 5.4 By Application

- 5.4.1 Fruits and Vegetables

- 5.4.2 Meat Products

- 5.4.3 Candy and Confections

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 United States

- 5.5.3 Canada

- 5.5.4 Mexico

- 5.5.5 Rest of North America

- 5.6 Asia-Pacific

- 5.6.1 India

- 5.6.2 China

- 5.6.3 Japan

- 5.6.4 Australia

- 5.6.5 Rest of Asia-Pacific

- 5.7 South America

- 5.7.1 Brazil

- 5.7.2 Argentina

- 5.7.3 Rest of South America

- 5.8 Europe

- 5.8.1 UK

- 5.8.2 Germany

- 5.8.3 Italy

- 5.8.4 Rest of Europe

- 5.9 Middle East & Africa

- 5.9.1 South Africa

- 5.9.2 UAE

- 5.9.3 Rest of Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 The Clorox Company

- 6.2.2 Tupperware

- 6.2.3 Newell Brands

- 6.2.4 Amcor plc

- 6.2.5 LocknLock Co.

- 6.2.6 Prepara

- 6.2.7 Thermos L.L.C.

- 6.2.8 Freshware

- 6.2.9 Oneida

- 6.2.10 Glasslock*