|

市場調查報告書

商品編碼

1640460

拉丁美洲塑膠瓶和容器:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)LA Plastic Bottles/Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

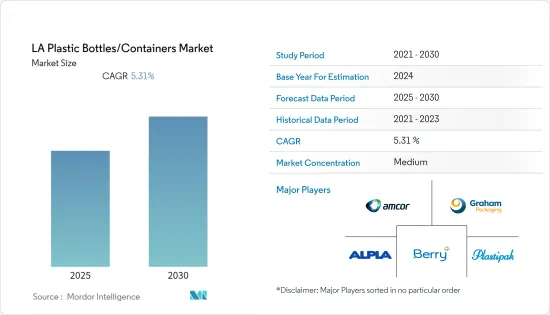

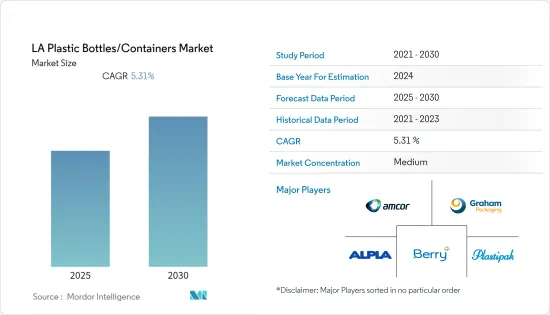

預計預測期內拉丁美洲塑膠瓶和容器市場的複合年成長率將達到 5.31%。

主要亮點

- 塑膠包裝由於重量輕、易於處理,比其他產品更受消費者的青睞。各種創新、經濟高效且永續的包裝解決方案正在進入市場,塑膠在該地區仍然被廣泛接受。這就是為什麼像 Amcor 這樣的領先公司正在該領域推出新的發展。在巴西,著名乳製品品牌 Letti 與 Amcor PLC 合作,推出透明的一公升寶特瓶來盛裝其乳製品。與 NewAge 合作,Amcor 最近在巴西推出了薩爾斯堡精釀啤酒的 PET。

- 拉丁美洲的 PET 市場由食品和飲料行業主導,因為生產軟性飲料和其他飲料的瓶子對 PET 樹脂的需求很大。巴西是世界第三大啤酒市場,每年生產140億公升啤酒。喜力對麒麟的收購可能會進一步推動拉丁美洲 PET 市場的發展。

- 拉丁美洲的塑膠回收再利用趨勢傾向於使用 100% 消費後樹脂製成且無標籤的瓶子。這些瓶子在當地的回收系統下可以完全回收,進一步促進循環經濟。 PET 容器可重複利用,這對所有相關人員來說是一個巨大的成就,也是拉丁美洲該行業的重大轉折點。

- 由於塑膠和塑膠製品可能對環境產生負面影響,許多拉丁美洲消費者開始轉向環保產品。這是因為許多國家的政府對此項業務實施了嚴格的法律法規。因此,其成長速度明顯慢於使用其他材料的其他產業。預計大多數地區國家的回收率較低將對塑膠瓶/容器業務產生重大影響。根據巴西塑膠組織 Fundacao Instituto de Administracao委託的研究,巴西只有 25.8% 的塑膠被回收。

- 快速的都市化(尤其是在新興國家)、不斷成長的可支配收入以及忙碌的消費者生活方式使得消費者選擇隨時隨地的飲料。這有助於擴大該地區的寶特瓶業務。然而,國家和地方都有法律禁止或限制生產和使用袋子、瓶子、杯子和吸管等一次性塑膠製品,這些製品經常被用作海洋垃圾。這些規定可能會限制市場擴張。

- 預計 COVID-19 對塑膠瓶/容器市場的影響將是巨大的,因為它支持飲料、食品和製藥等終端用戶行業,這些行業屬於基本服務,即使在封鎖規定期間也不會停止。限度。然而,2020年前四個月造成的供應鏈中斷已導致整個供應鏈的訂單延遲和前置作業時間。

拉丁美洲塑膠瓶市場的趨勢

擴大採用輕量化包裝方法

- 與玻璃相比,使用 PET 可使重量減輕高達 90%,從而實現更經濟的運輸過程。目前,PET塑膠瓶已被廣泛應用,取代了笨重且易碎的玻璃瓶,為礦泉水和其他飲料提供了可重複使用的包裝。此外,它們具有比 PE 和 PP 瓶更好的機械性能,從而減輕了重量。

- PET 使我們能夠生產出所有塑膠中最輕的瓶子和容器。根據 PETRA 介紹,PET 是一種透明、耐用、輕質的塑膠,廣泛用於包裝方便裝的軟性飲料、果汁和水。該地區銷售的幾乎所有單份和兩公升汽水和水都是用 PET 製成的。

- 根據 Amcor PLC 的一項研究,拉丁美洲消費者越來越喜歡傳達新鮮和奢華感的透明乳製品包裝。因此,Amcor 為 Letti 設計了一款 1 公升半透明寶特瓶,具有保護功能,以最佳化產品新鮮度。瓶子壁很厚,可以避免變形,瓶口直徑為 38 毫米,還配有紫外線阻隔劑,可以保護每個瓶子中的物品。

- 該地區的 PET 使用量正在增加,短期內主要原因之一是 PET 樹脂價格下跌。美國貿易戰導致PET樹脂價格下跌。拉丁美洲除墨西哥、阿根廷和巴西外,幾乎所有主要經濟體都是淨進口國,預計將壓低PET瓶片樹脂的價格並大幅降低生產成本。

- 此外,根據國際貿易委員會的數據,去年拉丁美洲和加勒比地區乙烯基聚合物的進口額約為 95.1 億美元,較 2020 年(約 53.5 億美元)增加 77.75%。進口量的成長反映了對乙烯聚合物等輕質材料的需求,其中 PET 是瓶子和容器的主要貢獻者。

墨西哥預計將佔據較大市場佔有率

- 墨西哥城周邊的大都會圈人口超過2,200萬,面臨確保供水安全的困境。其供水主要依賴從附近流域的進口,而過度抽取地下水已造成地層下陷等問題,引發人們永續性的質疑。墨西哥城缺水問題的影響在整個大都會圈出奇地不均衡,在低收入的近郊地區尤其嚴重。

- 低收入族群因無法持續獲得乾淨水源而遭受多種後果。水傳播感染疾病風險的增加和不良的健康影響與水質不良有直接關係。對許多家庭來說,從屋外取水需要花費時間和精力。墨西哥城大多數低收入家庭的用水需求是透過水車和瓶裝水來滿足。

- 另一方面,水罐車運送的成本高於透過公共配水系統定期供水的成本。與由供需關係決定價格的瓶裝水和私人供水車服務相比,公共供水系統獲得了大量補貼。整體而言,由於水罐車成本高昂,瓶裝水的需求急遽增加。

- 根據墨西哥都會自治大學伊斯塔帕拉帕分校的報告,80%的墨西哥人對公共供水較不信任,因此經常使用公共供水。八成墨西哥人和九成墨西哥城居民經常使用瓶裝水,這使得墨西哥成為世界上人均消費量最大的國家。

- 在墨西哥城,每人平均每年喝 390 公升水,比以瓶裝水為主的法國還多。根據自治市大學伊斯塔帕拉帕分校介紹,這個區是墨西哥城最貧困的地區之一,這裡的居民在寶特瓶水上的花費最多,佔其消費量的 90%。

- 據ITC稱,去年乙烯聚合物進口額約為32.5億美元,較2020年(約16.6億美元)成長95.78%。進口量的激增表明該國對塑膠瓶/容器的需求增加。

拉丁美洲塑膠瓶產業概況

拉丁美洲的塑膠瓶/容器市場相當分散。主要參與者包括 Amcor PLC、Graham Packaging Company、Plastipak Holdings Inc. 和 ALPLA Group。食品和飲料需求增加等因素可能為塑膠瓶和容器市場提供巨大的成長機會。這就是為什麼許多公司將這個市場視為新興市場。

2022 年 6 月:Amcor 與 Minderoo 基金會合作建造塑膠回收設施。分類和回收設施的建設將透過名為「看見未來」的合作項目獲得資金。前三個樞紐將位於印尼、荷蘭和巴西。 Minderoo (STF) 打算在未來兩年內開始建造其首個分類和回收設施。首批三家回收中心將吸引約 3 億美元的全球塑膠回收設施新投資,每年可產生約 15 萬噸再生塑膠,並將 20 萬噸塑膠垃圾從垃圾掩埋場掩埋。 。

2022 年 1 月:ALPLA 和墨西哥飲料公司 Coca-Cola FEMSA 在墨西哥塔巴斯科州昆杜阿坎市建造了一座回收設施。該回收設施名為「塔巴斯科新生態工廠」(PLANETA),耗資 6,000 萬美元興建。該新技術將每年處理5萬噸聚對苯二甲酸乙二醇酯(寶特瓶。 PLANETA 回收設施將每年生產 35,000 噸可立即使用的再生 PET 材料。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 對永續和創新食品包裝產品的需求不斷增加

- 擴大採用輕量化包裝方法

- 市場挑戰

- 關於塑膠使用的環境問題

- 人們對替代包裝形式的認知不斷提高

- COVID-19 市場影響評估

第6章 市場細分

- 按原料

- PET

- PP

- LDPE

- HDPE

- 其他成分

- 按行業

- 飲料

- 食物

- 化妝品

- 藥品

- 家居用品

- 其他行業

- 按國家

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲國家

第7章 競爭格局

- 公司簡介

- ALPLA Group

- Amcor PLC

- Plastipak Holdings Inc.

- Graham Packaging Company

- Berry Global Group Inc.

- Altium Packaging LLC

- Alpha Packaging

- Gerresheimer AG

- Container Corporation of Canada Ltd

- Greiner Packaging GmbH

- Comar LLC

第8章投資分析

第9章:市場的未來

The LA Plastic Bottles/Containers Market is expected to register a CAGR of 5.31% during the forecast period.

Key Highlights

- Plastic packaging has been witnessing an increasing inclination from consumers over other products, as plastic packages are lightweight and easier to handle. A wide variety of innovative, cost-effective, and sustainable packaging solutions is emerging in the market, and plastic, as a product, is still widely accepted in the region. It has led to significant players, like Amcor, introducing new developments in the area. In Brazil, a prominent dairy brand, Letti, collaborated with Amcor PLC to introduce transparent one-liter PET bottles for its milk products. In partnership with New Age, Amcor recently launched PET for its Salzburg Craft Beer in Brazil.

- The food and beverage industry dominated the Latin American PET market due to massive demand for PET resins to manufacture bottles for soft drinks and other beverages. The Brazilian beer market is the third largest globally and produces 14 billion liters annually. The acquisition of Kirin by Heineken will further drive the Latin American PET market.

- The trends of plastic recycling in Latin America are inclined towards using 100% post-consumer resin and a label-free bottle. The bottle is completely recyclable in the region's recycling system, which promotes the circular economy even more. The fact that the containers are recycled repeatedly because of PET is a massive achievement for everyone concerned and a significant turning point for the Latin American industry.

- Many consumers in Latin America are beginning to utilize eco-friendly items as plastic and plastic products can potentially have adverse environmental effects. Due to the stringent laws and regulations many governments in these nations imposed on the business. As a result, it grew significantly more slowly than other industries using other materials. The poor recycling rates of most areas countries have been predicted to substantially impact the plastic bottle and container business. Only 25.8% of plastics in Brazil were recycled, according to research commissioned by Fundacao Instituto de Administracao, a plastic organization in Brazil.

- Consumers have been influenced to pick on-the-go beverages by fast urbanization, particularly in emerging nations, rising disposable incomes, and consumers' busy lives. It is driving the expansion of the PET bottle business in the area. However, legislation is enacted at the national and sub-national levels to prohibit or limit the manufacture and use of single-use plastic goods like bags, bottles, cups, and straws, frequently found in marine debris. Such regulations may restrict market expansion.

- The impact of COVID-19 on the plastic bottles/containers market is minimal as it supports the end-user industries, such as beverages, food, pharmaceutical, etc., which come under essential services and are not discontinued even amidst the lockdown restrictions. However, the supply chain disruptions caused in the first four months of 2020 resulted in order delays and lead time across the supply chain.

Latin America Plastic Bottle Market Trends

Increasing Adoption of Lightweight Packaging Methods

- Adoption of PET can lead to up to 90% weight reduction compared to glass, allowing a more economical transportation process. Currently, plastic bottles made from PET are widely replacing heavy and fragile glass bottles, as they offer reusable packaging for mineral water and other beverages. Additionally, better mechanical qualities reduce weight compared to PE and PP bottles.

- Using PET will help manufacture the lightest bottle and containers among all types of plastic. According to PETRA, PET is a clear, durable, lightweight plastic widely used to package convenience-sized soft drinks, juices, and water. Virtually all single-serving and 2-liter carbonated soft drinks and water sold in the region are made from PET.

- In research, Amcor PLC found that Latin American consumers are increasingly attracted to transparent dairy packaging, which conveys freshness and premium quality. So, Amcor designed a one-liter translucent PET bottle for Letti that has some protective features to optimize the freshness of products. It includes a thicker wall to avoid deformation, a 38-mm finish, and an ultraviolet blocker to protect the contents of each bottle.

- There has been a rise in the use of PET in the region, one of the primary reasons in the short run is the falling prices of PET resins. Due to the US-China trade war, the prices of PET resins have been continually falling. With almost all major economies of Latin America, apart from Mexico, Argentina, and Brazil, being net importing countries, this is expected to bring down the prices of bottle-grade PET resins, thereby significantly reducing production costs.

- Moreover, according to ITC, last year, the imports of polymers of ethylene in Latin America and the Caribbean were valued at around USD 9.51 billion, a 77.75% rise in imports from the previous year, 2020, which was valued at about USD 5.35 billion. The growth in import value represents the demand for lightweight materials such as ethylene polymers, where PET is one of the significant contributors to bottles and containers.

Mexico is Expected to Hold a Significant Market Share

- The metropolitan region around Mexico City has a population of over 22 million and has been struggling to ensure water security. Its supply primarily depends on imports from nearby basins and an overdraft of groundwater, which causes issues like subsidence and raises questions about sustainability. The effects of this water stress in Mexico City are incredibly uneven across the metropolitan region and are particularly bad in low-income peri-urban areas.

- Low-income populations suffer several effects due to unreliable access to clean water. An increased risk of waterborne infections and adverse health effects are directly related to poor water quality. Carrying water from outside the house takes time and energy for many households. The majority of the domestic water demand for low-income homes in Mexico City is often met by water trucks and bottled water.

- On the other hand, the cost of water truck delivery is higher than the cost of ordinary water supply provided by the public distribution system. Compared to bottled water and private water truck service, which are priced according to supply and demand, the public water system's water price is heavily subsidized. Overall, the need for bottled water has dramatically grown due to the higher cost of the water truck.

- Autonomous Metropolitan University Iztapalapa Unit reports that 80% of Mexicans are frequent customers since they have little faith in the public water system. Eight out of ten Mexicans and nine out of ten people living in Mexico City frequently use bottled water, making Mexico the world's largest per-capita product consumer nation.

- In Mexico City, every person drinks an average of 390 liters a year, more than in France, where there is a tradition of drinking bottled water. Citizens of the Borough, one of the poorest in Mexico City, spend the most on bottled water, accounting for 90% of water consumption, according to the Autonomous Metropolitan University Iztapalapa Unit.

- According to the ITC, imported ethylene polymers, last year were valued at around USD 3.25 billion, a 95.78% rise in imports from the previous year, 2020, valued at about USD 1.66 billion. The import surge indicates the increased demand for plastic bottles and containers in the country.

Latin America Plastic Bottle Industry Overview

The Latin American plastic bottle and container market are moderately fragmented in nature. Some major players are Amcor PLC, Graham Packaging Company, Plastipak Holdings Inc., and ALPLA Group. Factors, such as the increasing demand for food and beverages will provide considerable growth opportunities in the plastic bottles and containers market. Therefore, many companies are seeing this market as an emerging one.

June 2022: Amcor and the Minderoo Foundation partner to create plastic recycling facilities. The construction of sorting and recycling facilities will be funded by the collaboration known as Sea The Future. The first three hubs will be Indonesia, the Netherlands, and Brazil. Minderoo (STF) intends to start building the first sorting and recycling facilities within two years. The first three recycling centers want to attract roughly USD 300 million in new investments in plastic recycling facilities worldwide, create about 150,000 metric tons of recycled plastic annually, and stop 200,000 metric tons of plastic trash from being landfilled.

January 2022: A recycling facility was built in the Cunduacan municipality of Mexico's Tabasco state by ALPLA and the Mexican beverage company Coca-Cola FEMSA. The recycling facility, known as Planta Nueva Ecologa de Tabasco (PLANETA), is being developed with an expenditure of USD 60 million. It will have new technology and an annual processing capacity of 50,000 tonnes of PET bottles made of polyethylene terephthalate. The PLANETA recycling facility will produce 35,000 tonnes of ready-to-use recycled PET material annually.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Sustainable and Innovative Food Packaging Products

- 5.1.2 Increasing Adoption of Lightweight Packaging Methods

- 5.2 Market Challenges

- 5.2.1 Environmental Concerns Regarding Use of Plastics

- 5.2.2 Increasing Awareness about Alternative Forms of Packaging

- 5.3 Assessment of the Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Raw Materials

- 6.1.1 PET

- 6.1.2 PP

- 6.1.3 LDPE

- 6.1.4 HDPE

- 6.1.5 Other Raw Materials

- 6.2 By End-User Vertical

- 6.2.1 Beverages

- 6.2.2 Food

- 6.2.3 Cosmetics

- 6.2.4 Pharmaceuticals

- 6.2.5 Household Care

- 6.2.6 Other End-User Verticals

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Argentina

- 6.3.3 Mexico

- 6.3.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ALPLA Group

- 7.1.2 Amcor PLC

- 7.1.3 Plastipak Holdings Inc.

- 7.1.4 Graham Packaging Company

- 7.1.5 Berry Global Group Inc.

- 7.1.6 Altium Packaging LLC

- 7.1.7 Alpha Packaging

- 7.1.8 Gerresheimer AG

- 7.1.9 Container Corporation of Canada Ltd

- 7.1.10 Greiner Packaging GmbH

- 7.1.11 Comar LLC